Enlarge image

Userid: CPM Schema: Leadpct: 100% Pt. size: 10 Draft Ok to Print

instrx

AH XSL/XML Fileid: … r-form-940/2024/a/xml/cycle05/source (Init. & Date) _______

Page 1 of 15 10:57 - 14-Nov-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2024

Instructions for Form 940

Employer's Annual Federal Unemployment (FUTA) Tax Return

Section references are to the Internal Revenue Code establish a voluntary certification program for PEOs.

unless otherwise noted. PEOs handle various payroll administration and tax

reporting responsibilities for their business clients and are

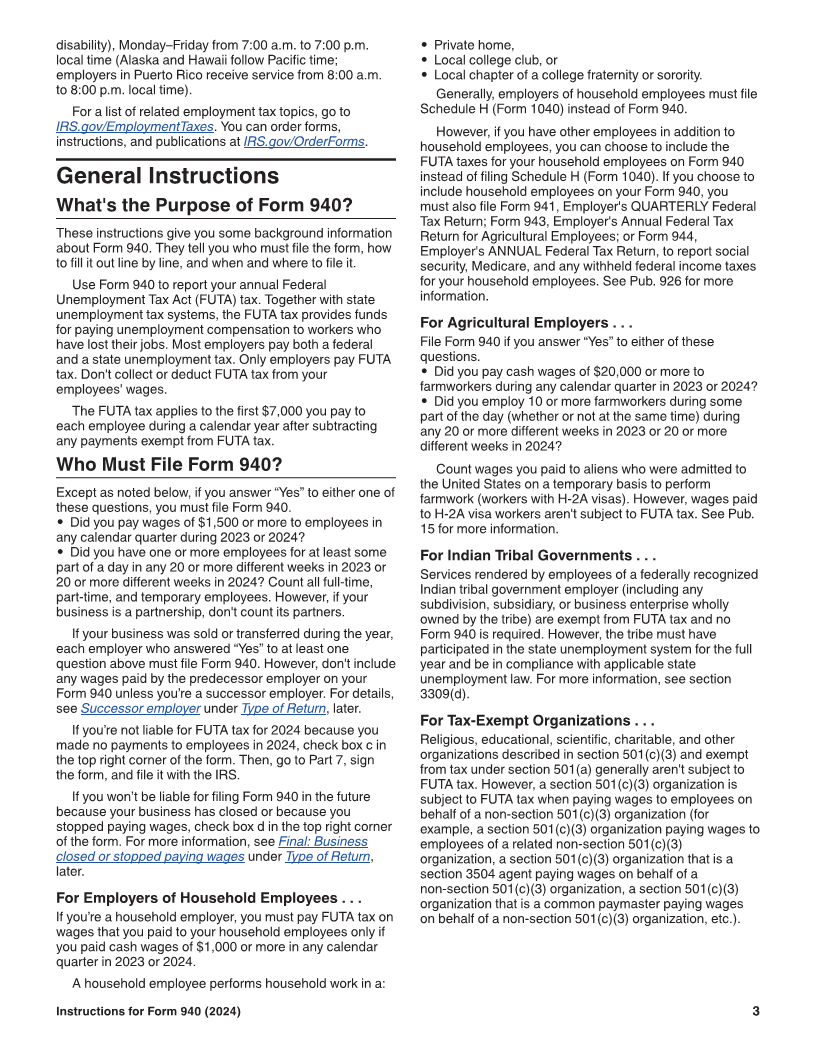

Future Developments typically paid a fee based on payroll costs. To become and

remain certified under the certification program, certified

For the latest information about developments related to professional employer organizations (CPEOs) must meet

Form 940 and its instructions, such as legislation enacted various requirements described in sections 3511 and

after they were published, go to IRS.gov/Form940. 7705 and related published guidance. Certification as a

CPEO may affect the employment tax liabilities of both the

CPEO and its customers. A CPEO is generally treated for

What's New

employment tax purposes as the employer of any

Electronically filing an amended Form 940. The IRS individual who performs services for a customer of the

now offers filing an amended Form 940 as part of CPEO and is covered by a contract described in section

Modernized e-File (MeF). For more information on 7705(e)(2) between the CPEO and the customer (CPEO

electronic filing, go to IRS.gov/EmploymentEfile. contract), but only for wages and other compensation paid

to the individual by the CPEO. To become a CPEO, the

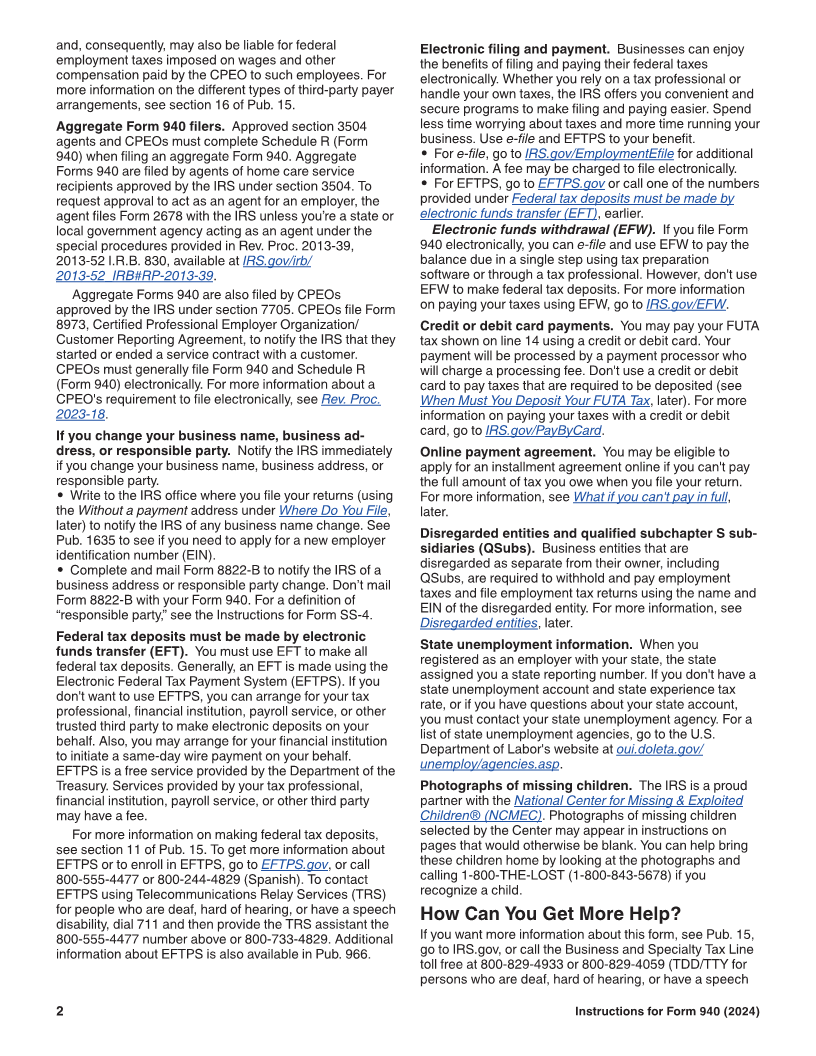

Credit reduction state. A state that hasn't repaid money

organization must apply through the IRS Online

it borrowed from the federal government to pay

Registration System. For more information or to apply to

unemployment benefits is called a credit reduction state.

become a CPEO, go to IRS.gov/CPEO.

The U.S. Department of Labor determines these states. If

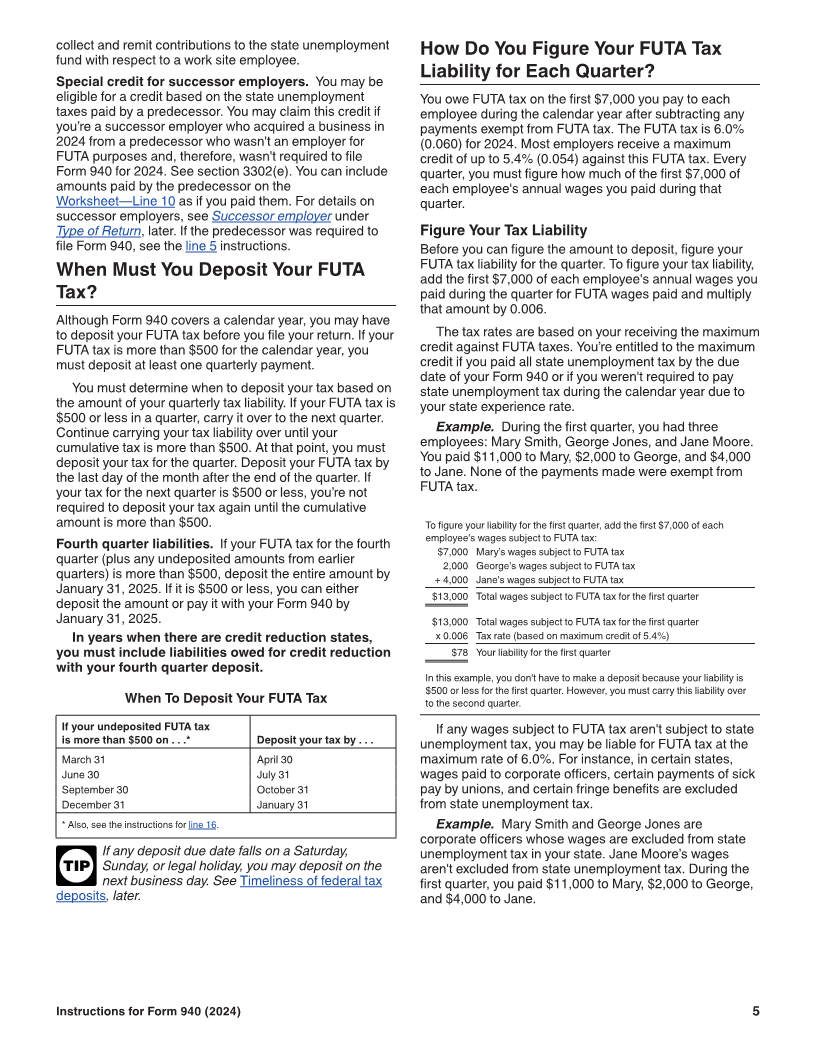

an employer pays wages that are subject to the For wages paid to a work site employee, a CPEO is

unemployment tax laws of a credit reduction state, that eligible for the credit for state unemployment tax paid to a

employer must pay additional federal unemployment tax state unemployment fund, whether the CPEO or a

when filing its Form 940. customer of the CPEO made the contribution. In addition,

a CPEO is allowed the additional credit if the CPEO is

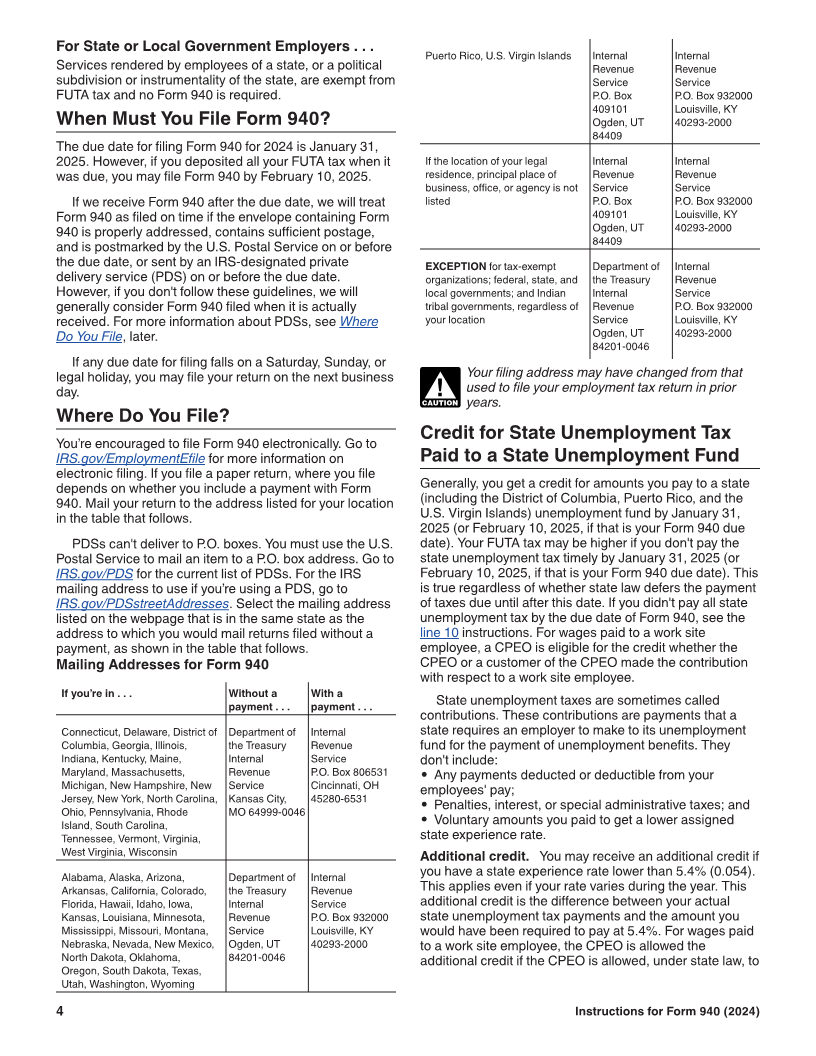

For 2024, there are credit reduction states. If you paid

permitted, under state law, to collect and remit

any wages that are subject to the unemployment

contributions to the state unemployment fund with respect

compensation laws of a credit reduction state, your credit

to a work site employee. For more information on the

against federal unemployment tax will be reduced based

credit, see Credit for State Unemployment Tax Paid to a

on the credit reduction rate for that credit reduction state.

State Unemployment Fund, later.

Use Schedule A (Form 940) to figure the credit reduction.

For more information, see the Schedule A (Form 940) CPEOs must generally file Form 940 and Schedule R

instructions or go to IRS.gov. (Form 940), Allocation Schedule for Aggregate Form 940

Filers, electronically. For more information about a CPEO’s

Reminders requirement to file electronically, see Rev. Proc. 2023-18,

2023-13 I.R.B 605, available at IRS.gov/irb/

Form 940 (sp) available in Spanish. All employers, 2023-13_IRB#REV-PROC-2023-18.

including employers in Puerto Rico and the U.S. Virgin

Islands, have the option to file Form 940 (sp). Outsourcing payroll duties. Generally, as an employer,

you're responsible to ensure that tax returns are filed and

Moving expense and bicycle commuting reimburse- deposits and payments are made, even if you contract

ments are subject to FUTA tax. The Tax Cuts and Jobs with a third party to perform these acts. You remain

Act (P.L. 115-97) suspends the exclusion for qualified responsible if the third party fails to perform any required

moving expense reimbursements from your employee's action. Before you choose to outsource any of your payroll

income under section 132 and the deduction from the and related tax duties (that is, withholding, reporting, and

employee's income under section 217, as well as the paying over social security, Medicare, FUTA, and income

exclusion for qualified bicycle commuting reimbursements taxes) to a third-party payer, such as a payroll service

from your employee's income under section 132, provider or reporting agent, go to IRS.gov/

beginning after 2017 and before 2026. Therefore, moving OutsourcingPayrollDuties for helpful information on this

expense and bicycle commuting reimbursements aren't topic. If a CPEO pays wages and other compensation to

exempt from FUTA tax during this period. Don't include an individual performing services for you, and the services

moving expense or bicycle commuting reimbursements on are covered by a CPEO contract, then the CPEO is

Form 940, line 4. For more information about fringe generally treated for employment tax purposes as the

benefits, see Pub. 15-B. employer, but only for wages and other compensation

Certification program for professional employer or- paid to the individual by the CPEO. However, with respect

ganizations (PEOs). The Stephen Beck, Jr., Achieving a to certain employees covered by a CPEO contract, you

Better Life Experience Act of 2014 required the IRS to may also be treated as an employer of the employees

Instructions for Form 940 (2024) Catalog Number 13660I

Nov 14, 2024 Department of the Treasury Internal Revenue Service www.irs.gov