Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 9 Draft Ok to Print

AH XSL/XML Fileid: … -form-8863/2024/a/xml/cycle05/source (Init. & Date) _______

Page 1 of 8 10:10 - 28-Oct-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

2024

Instructions for Form 8863

Education Credits (American Opportunity and Lifetime Learning Credits)

Section references are to the Internal Revenue Code unless may claim an education tax credit. You may include qualified

otherwise noted. tuition and related expenses that are not reported on Form

1098-T when claiming one of the related credits if you can

substantiate payment of these expenses. You may not include

Future Developments expenses paid on the Form 1098-T that have been paid by

For the latest information about developments related to Form qualified scholarships, including those that were not processed

8863 and its instructions, such as legislation enacted after they by the universities.

were published, go to IRS.gov/Form8863. To claim the American opportunity credit, you must

provide the educational institution’s employer

Reminders CAUTION! identification number (EIN) on your Form 8863. You

should be able to get this information from Form 1098-T or the

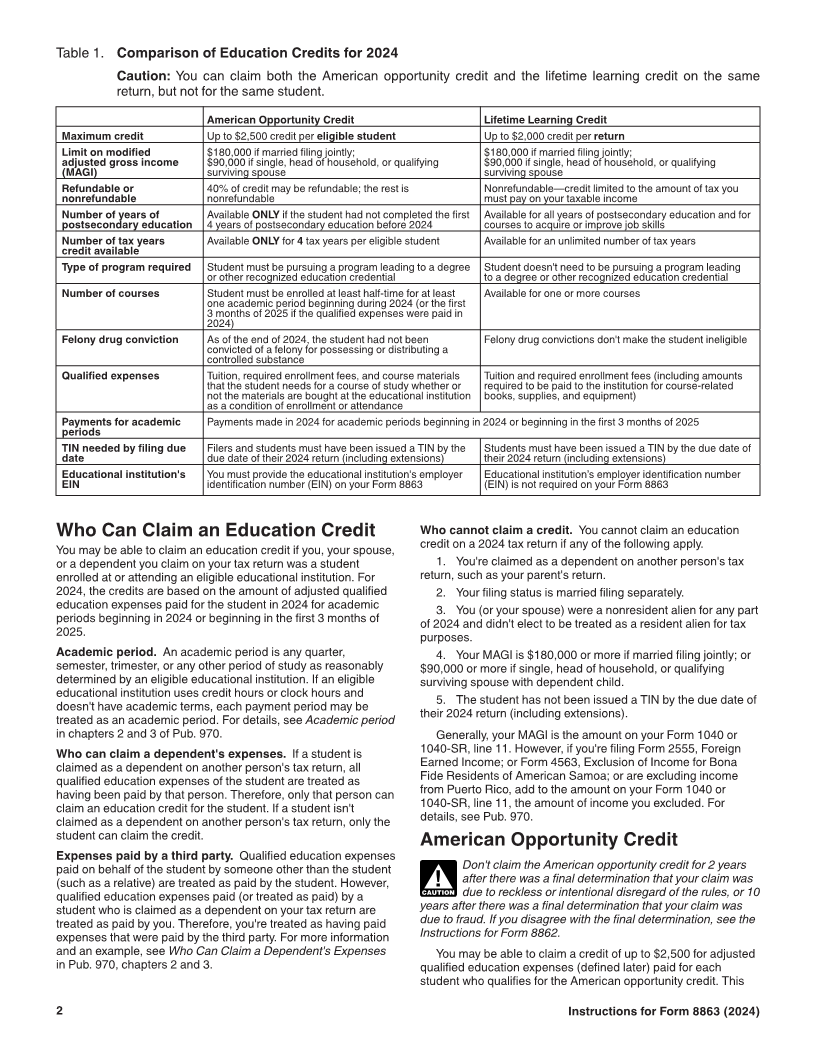

Limits on modified adjusted gross income (MAGI). The educational institution.

lifetime learning credit and the American opportunity credit MAGI

limits are $180,000 if you're married filing jointly ($90,000 if Ban on claiming the American opportunity credit. If you

you're filing single, head of household, or qualifying surviving claim the American opportunity credit even though you're not

spouse). See Table 1 and the instructions for line 3 or line 14. eligible, you may be banned from claiming the credit depending

Form 1098-T requirement. To be eligible to claim the on your conduct. See the Caution statement under American

American opportunity credit or the lifetime learning credit, the law Opportunity Credit, later.

requires a taxpayer (or a dependent) to have received Form Taxpayer identification number (TIN) needed by due date

1098-T, Tuition Statement, from an eligible educational of return. If you haven’t been issued a TIN by the due date of

institution, whether domestic or foreign. your 2024 return (including extensions), you can’t claim the

However, you may claim one of these education benefits if the American opportunity credit on either your original or an

student doesn't receive a Form 1098-T because the student’s amended 2024 return. Also, the American opportunity credit isn’t

educational institution isn't required to furnish a Form 1098-T to allowed on either your original or an amended 2024 return for a

the student under existing rules (for example, if the student is a student who hasn’t been issued a TIN by the due date of your

qualified nonresident alien, has certain qualified education 2024 return (including extensions).

expenses paid entirely with scholarships, has certain qualified Form 8862 may be required. If your American opportunity

education expenses paid under a formal billing arrangement, or credit was denied or reduced for any reason other than a math or

is enrolled only in courses for which no academic credit is clerical error for any tax year beginning after 2015, you must

awarded). If a student’s educational institution isn't required to attach a completed Form 8862, Information To Claim Certain

provide a Form 1098-T to the student, you may claim one of Credits After Disallowance, to your tax return for the next tax year

these education benefits without a Form 1098-T if you otherwise for which you claim the credit. See Form 8862 and its

qualify, can demonstrate that you (or a dependent) were enrolled instructions for details.

at an eligible educational institution, and can substantiate the

payment of qualified tuition and related expenses.

You may also claim one of these educational benefits if the General Instructions

student attended an eligible educational institution required to

furnish Form 1098-T but the student doesn't receive Form Purpose of Form

1098-T before you file your tax return (for example, if the Use Form 8863 to figure and claim your education credits, which

institution is otherwise required to furnish the Form 1098-T and are based on adjusted qualified education expenses paid to an

doesn't furnish it or refuses to do so) and you take the following eligible educational institution (postsecondary). For 2024, there

required steps: After January 31, 2025, but before you file the are two education credits.

return, you or the student must request that the educational • The American opportunity credit, part of which may be

institution furnish a Form 1098-T. You must fully cooperate with refundable.

the educational institution's efforts to gather the information • The lifetime learning credit, which is nonrefundable.

needed to furnish the Form 1098-T. You must also otherwise

qualify for the benefit, be able to demonstrate that you (or a A refundable credit can give you a refund when the credit is

dependent) were enrolled at an eligible educational institution, more than the tax you owe, even if you aren’t required to file a tax

and substantiate the payment of qualified tuition and related return. A nonrefundable credit can reduce your tax, but any

expenses. excess isn't refunded to you.

The amount of qualified tuition and related expenses reported Both of these credits have different rules that can affect your

on Form 1098-T may not reflect the total amount of the qualified eligibility to claim a specific credit. These differences are shown

tuition and related expenses paid during the year for which you in Table 1.

Oct 28, 2024 Cat. No. 53002G