Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 8.5 Draft Ok to Print

AH XSL/XML Fileid: … orm-8862/202410/a/xml/cycle07/source (Init. & Date) _______

Page 1 of 3 17:21 - 29-Oct-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Instructions for Form 8862

(Rev. October 2024)

Information To Claim Certain Credits After Disallowance

Section references are to the Internal Revenue Code unless cannot claim the CTC, RCTC, ACTC, or ODC on either your original

otherwise noted. or amended return.

American opportunity tax credit (AOTC). You must have an

Future Developments SSN or ITIN to claim the AOTC. If you haven’t been issued an SSN

For the latest information about developments related to Form 8862 or ITIN on or before the due date of your return (including

and its instructions, such as legislation enacted after they were extensions), you cannot claim the AOTC on either your original or

published, go to IRS.gov/Form8862. amended return. Also, the AOTC is not allowed on either your

original or amended return for a student who hasn’t been issued an

What’s New SSN, ITIN, or ATIN on or before the due date of your return

(including extensions).

How to appeal the disallowance period. If you want to appeal the See your tax return instructions for more information.

2- or 10-year disallowance period preventing you from taking the

EIC, CTC, RCTC, ACTC, ODC, or AOTC, see How to appeal the

disallowance period, later.

General Instructions

Removal of Part V. Effective beginning tax year 2024, Part

V—Qualifying Child of More Than One Person has been removed Purpose of Form

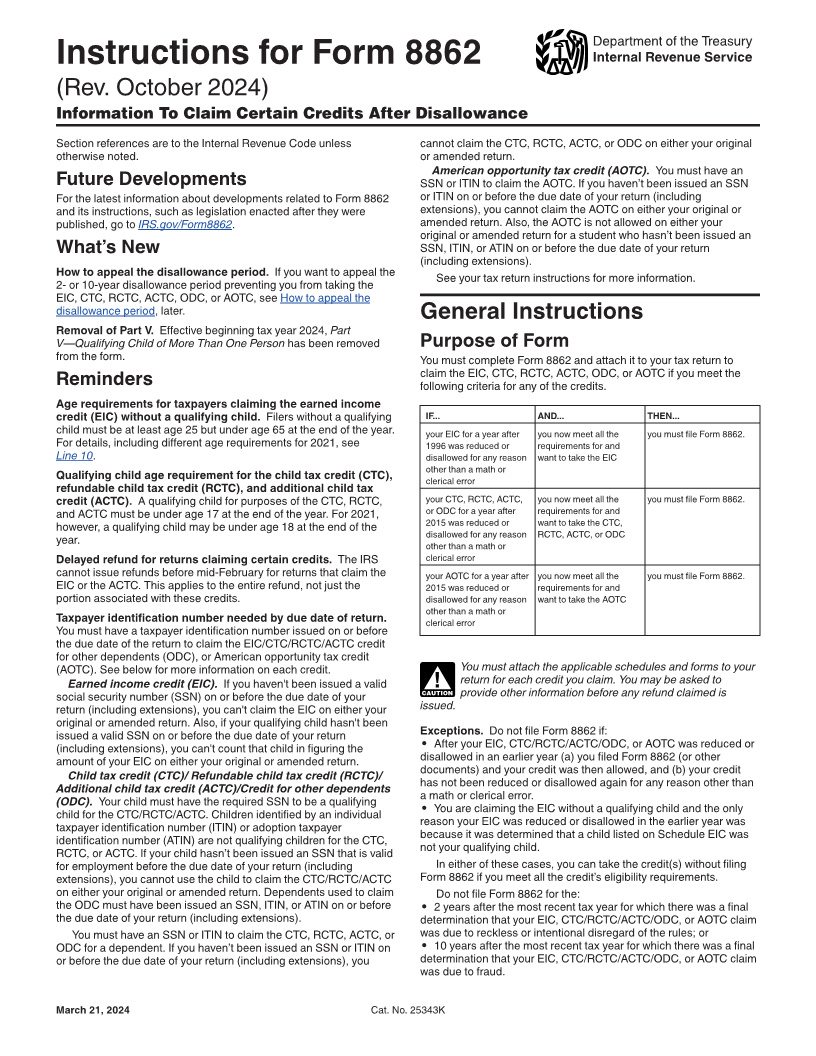

from the form. You must complete Form 8862 and attach it to your tax return to

claim the EIC, CTC, RCTC, ACTC, ODC, or AOTC if you meet the

Reminders following criteria for any of the credits.

Age requirements for taxpayers claiming the earned income

credit (EIC) without a qualifying child. Filers without a qualifying IF... AND... THEN...

child must be at least age 25 but under age 65 at the end of the year. your EIC for a year after you now meet all the you must file Form 8862.

For details, including different age requirements for 2021, see 1996 was reduced or requirements for and

Line 10. disallowed for any reason want to take the EIC

other than a math or

Qualifying child age requirement for the child tax credit (CTC), clerical error

refundable child tax credit (RCTC), and additional child tax

credit (ACTC). A qualifying child for purposes of the CTC, RCTC, your CTC, RCTC, ACTC, you now meet all the you must file Form 8862.

and ACTC must be under age 17 at the end of the year. For 2021, or ODC for a year after requirements for and

however, a qualifying child may be under age 18 at the end of the 2015 was reduced or want to take the CTC,

disallowed for any reason RCTC, ACTC, or ODC

year. other than a math or

Delayed refund for returns claiming certain credits. The IRS clerical error

cannot issue refunds before mid-February for returns that claim the your AOTC for a year after you now meet all the you must file Form 8862.

EIC or the ACTC. This applies to the entire refund, not just the 2015 was reduced or requirements for and

portion associated with these credits. disallowed for any reason want to take the AOTC

other than a math or

Taxpayer identification number needed by due date of return. clerical error

You must have a taxpayer identification number issued on or before

the due date of the return to claim the EIC/CTC/RCTC/ACTC credit

for other dependents (ODC), or American opportunity tax credit

(AOTC). See below for more information on each credit. You must attach the applicable schedules and forms to your

Earned income credit (EIC). If you haven't been issued a valid ! return for each credit you claim. You may be asked to

social security number (SSN) on or before the due date of your CAUTION provide other information before any refund claimed is

return (including extensions), you can't claim the EIC on either your issued.

original or amended return. Also, if your qualifying child hasn't been

issued a valid SSN on or before the due date of your return Exceptions. Do not file Form 8862 if:

(including extensions), you can't count that child in figuring the • After your EIC, CTC/RCTC/ACTC/ODC, or AOTC was reduced or

amount of your EIC on either your original or amended return. disallowed in an earlier year (a) you filed Form 8862 (or other

Child tax credit (CTC)/ Refundable child tax credit (RCTC)/ documents) and your credit was then allowed, and (b) your credit

Additional child tax credit (ACTC)/Credit for other dependents has not been reduced or disallowed again for any reason other than

(ODC). Your child must have the required SSN to be a qualifying a math or clerical error.

child for the CTC/RCTC/ACTC. Children identified by an individual • You are claiming the EIC without a qualifying child and the only

taxpayer identification number (ITIN) or adoption taxpayer reason your EIC was reduced or disallowed in the earlier year was

identification number (ATIN) are not qualifying children for the CTC, because it was determined that a child listed on Schedule EIC was

RCTC, or ACTC. If your child hasn’t been issued an SSN that is valid not your qualifying child.

for employment before the due date of your return (including In either of these cases, you can take the credit(s) without filing

extensions), you cannot use the child to claim the CTC/RCTC/ACTC Form 8862 if you meet all the credit’s eligibility requirements.

on either your original or amended return. Dependents used to claim Do not file Form 8862 for the:

the ODC must have been issued an SSN, ITIN, or ATIN on or before • 2 years after the most recent tax year for which there was a final

the due date of your return (including extensions). determination that your EIC, CTC/RCTC/ACTC/ODC, or AOTC claim

You must have an SSN or ITIN to claim the CTC, RCTC, ACTC, or was due to reckless or intentional disregard of the rules; or

ODC for a dependent. If you haven’t been issued an SSN or ITIN on • 10 years after the most recent tax year for which there was a final

or before the due date of your return (including extensions), you determination that your EIC, CTC/RCTC/ACTC/ODC, or AOTC claim

was due to fraud.

March 21, 2024 Cat. No. 25343K