Enlarge image

Userid: CPM Schema: Leadpct: 100% Pt. size: 10 Draft Ok to Print

instrx

AH XSL/XML Fileid: … orm-8915-d/2024/a/xml/cycle04/source (Init. & Date) _______

Page 1 of 6 6:49 - 22-Nov-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2024

Instructions for Form 8915-D

Qualified 2019 Disaster Retirement Plan Distributions and Repayments

Section references are to the Internal Revenue Code The timing of your repayments will determine whether

unless otherwise noted. you need to file an amended return to claim them. See

Amending Form 8915-D, later.

General Instructions Qualified 2019 Disaster Distribution

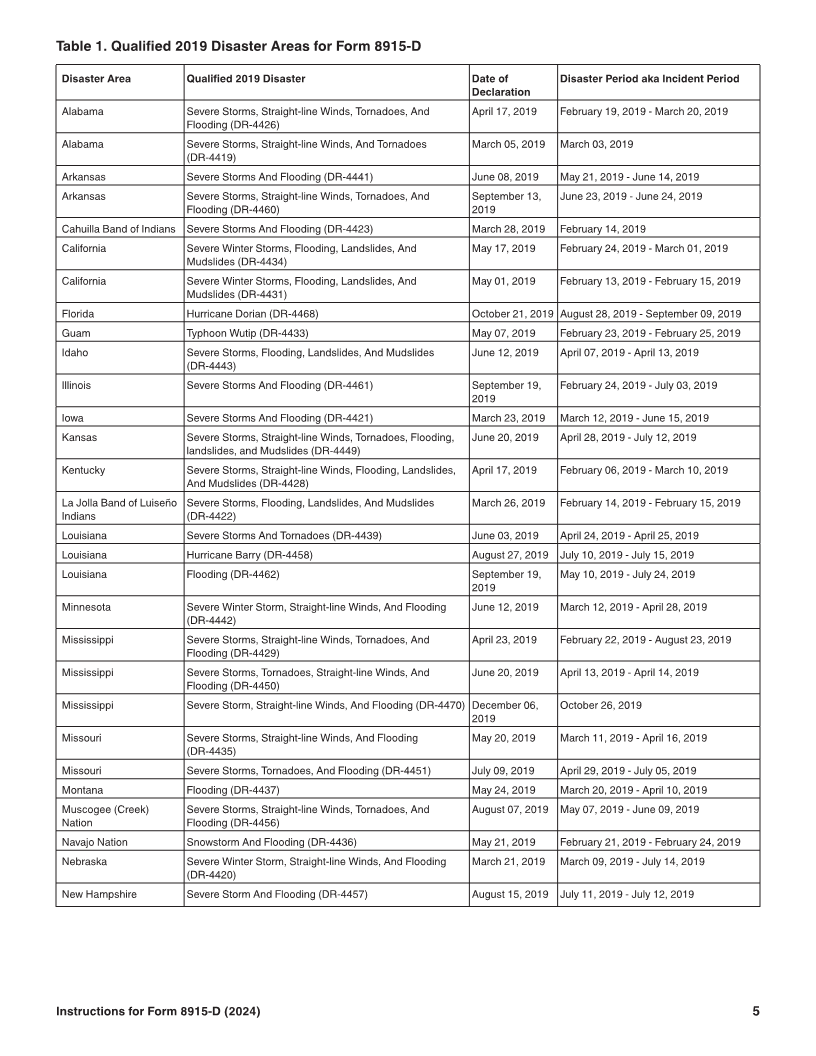

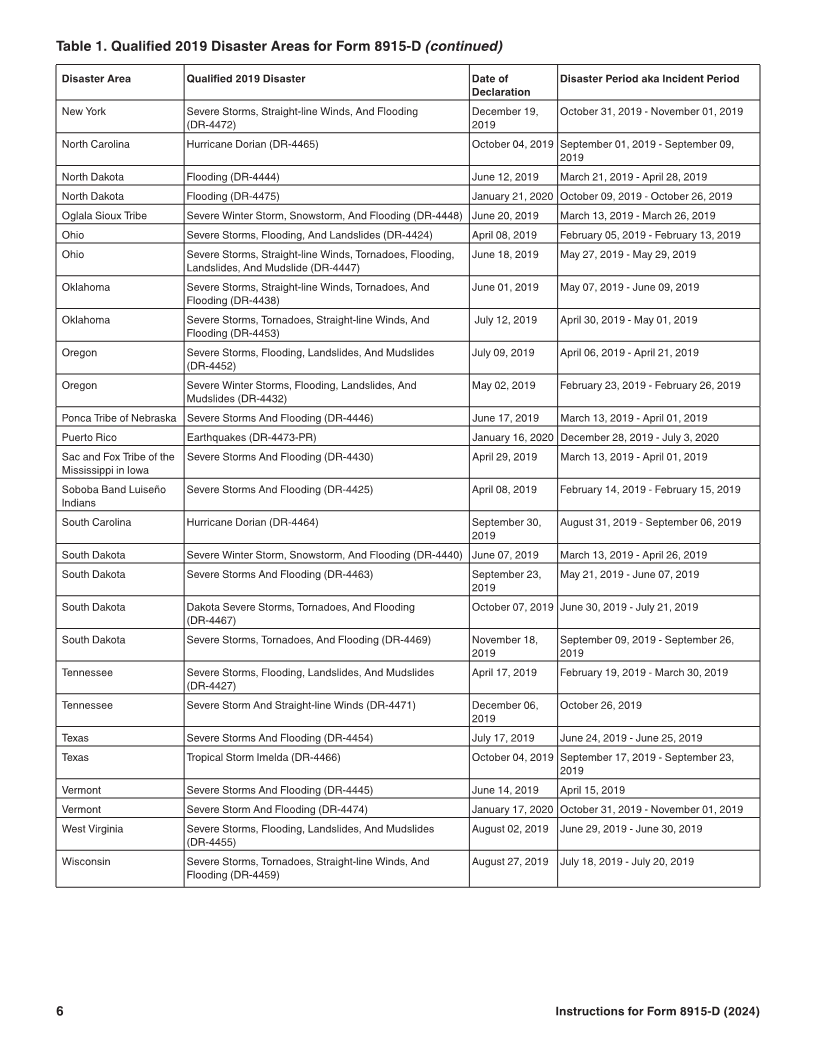

Future Developments What 2019 Disasters Are Covered?

For the latest information about developments related to In order to have a qualified 2019 disaster distribution for

Form 8915-D and its instructions, such as legislation which you are reporting repayments on a 2024 Form

enacted after they were published, go to IRS.gov/ 8915-D, you must have been adversely affected by the

Form8915D. 2019 Puerto Rico Earthquakes (DR-4473-PR) disaster

listed in Table 1 at the end of these instructions.

What’s New

Repayments. The repayment period for a qualified 2019 How Is a Qualified Disaster Distribution for the

disaster distribution ends 3 years and 1 day after the 2019 Puerto Rico Earthquakes (DR-4473-PR)

distribution was received. The only qualified 2019 disaster Disaster Taxed?

distributions for which you could make repayments in Generally, a qualified disaster distribution for the 2019

2024 are those made in 2021 for the 2019 Puerto Rico Puerto Rico Earthquakes (DR-4473-PR) disaster is

Earthquakes (DR-4473-PR) disaster. Repayments included in your income in equal amounts over 3 years.

reported on 2024 Form 8915-D can be used to reduce the However, if you elected, you could have included the

income reportable on your 2021, 2022, or 2023 tax return, entire distribution in your income in the year of the

as applicable, for qualified disaster distributions for that distribution. If more than one distribution was made during

disaster. If you have already filed your tax return for the the year, you must have treated all distributions for that

year in question, you will need to amend that return. year the same way. Any repayments made before you file

your return, by the due date (including extensions), and

Coronavirus-Related Distributions

within the 3-year period for making the repayment reduce

2023 was the last year in which a coronavirus-related the amount of the distribution included in your income.

distribution could be repaid. Repayments were reported

on Form 8915-F, Qualified Disaster Retirement Plan Also, qualified disaster distributions for the 2019 Puerto

Distributions and Repayments. Rico Earthquakes (DR-4473-PR) disaster aren’t subject to

the additional 10% tax (or the 25% additional tax for

Purpose of Form certain distributions from SIMPLE IRAs) on early

Use 2024 Form 8915-D to report repayments in 2024 of distributions.

qualified disaster distributions for the 2019 Puerto Rico

Earthquakes (DR-4473-PR) disaster. Repayment of a Qualified 2019 Disaster

Distribution

For repayments of distributions for qualified 2021 and

later disasters, see Form 8915-F and its instructions. An amount paid more than 3 years and 1 day after

the distribution was received cannot be treated as

Note. Repayments of distributions from retirement plans CAUTION! a repayment. For example, if your qualified

(other than IRAs) are reported in Part I, and repayments of disaster distribution for the 2019 Puerto Rico Earthquakes

distributions from IRAs are reported in Part II. (DR-4473-PR) disaster was received on May 25, 2021,

and you choose to repay the distribution, the repayment

Who Must File must be made before May 26, 2024.

File 2024 Form 8915-D if you made a repayment in 2024

If you choose, you can generally repay to an eligible

of a qualified disaster distribution for the 2019 Puerto Rico

retirement plan any portion of a qualified disaster

Earthquakes (DR-4473-PR) disaster.

distribution for the 2019 Puerto Rico Earthquakes

When and Where To File (DR-4473-PR) disaster that is eligible for tax-free rollover

treatment. Also, you can repay a qualified disaster

File 2024 Form 8915-D with your 2024 Form 1040,

distribution for the 2019 Puerto Rico Earthquakes

1040-SR, or 1040-NR. If you are not required to file an

(DR-4473-PR) disaster made from a retirement plan on

income tax return but are required to file 2024 Form

account of hardship. However, see Exceptions, later, for

8915-D, fill in the address information on page 1 of Form

distributions you can’t repay.

8915-D, sign the Form 8915-D, and send it to the IRS at

the same time and place you would otherwise file 2024 You have 3 years from the day after the date you

Form 1040, 1040-SR, or 1040-NR. received the distribution to make a repayment. The

Instructions for Form 8915-D (2024) Catalog Number 73788N

Jul 25, 2024 Department of the Treasury Internal Revenue Service www.irs.gov