Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 9 Draft Ok to Print

AH XSL/XML Fileid: … form-w-7/202412/a/xml/cycle06/source (Init. & Date) _______

Page 1 of 16 6:50 - 12-Dec-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

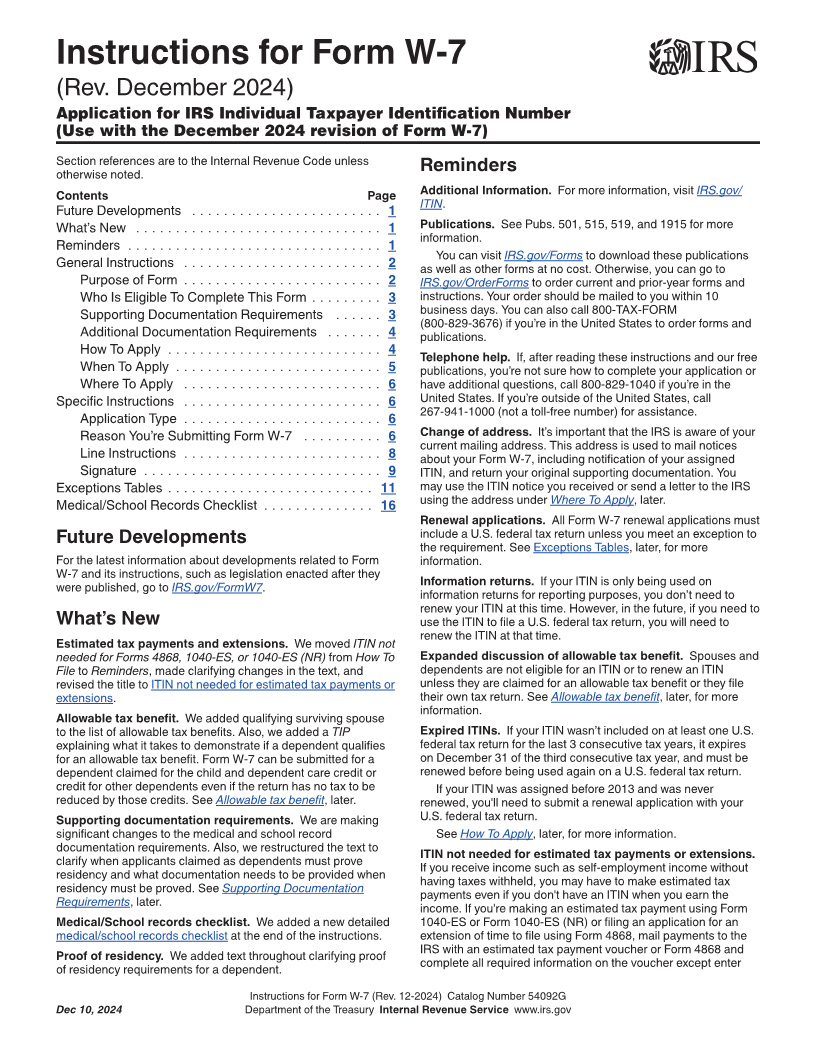

Instructions for Form W-7

(Rev. December 2024)

Application for IRS Individual Taxpayer Identification Number

(Use with the December 2024 revision of Form W-7)

Section references are to the Internal Revenue Code unless

otherwise noted. Reminders

Contents Page Additional Information. For more information, visit IRS.gov/

ITIN.

Future Developments . . . . . . . . . . . . . . . . . . . . . . . . 1

What’s New . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 Publications. See Pubs. 501, 515, 519, and 1915 for more

information.

Reminders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

You can visit IRS.gov/Forms to download these publications

General Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 2 as well as other forms at no cost. Otherwise, you can go to

Purpose of Form . . . . . . . . . . . . . . . . . . . . . . . . . 2 IRS.gov/OrderForms to order current and prior-year forms and

Who Is Eligible To Complete This Form . . . . . . . . . 3 instructions. Your order should be mailed to you within 10

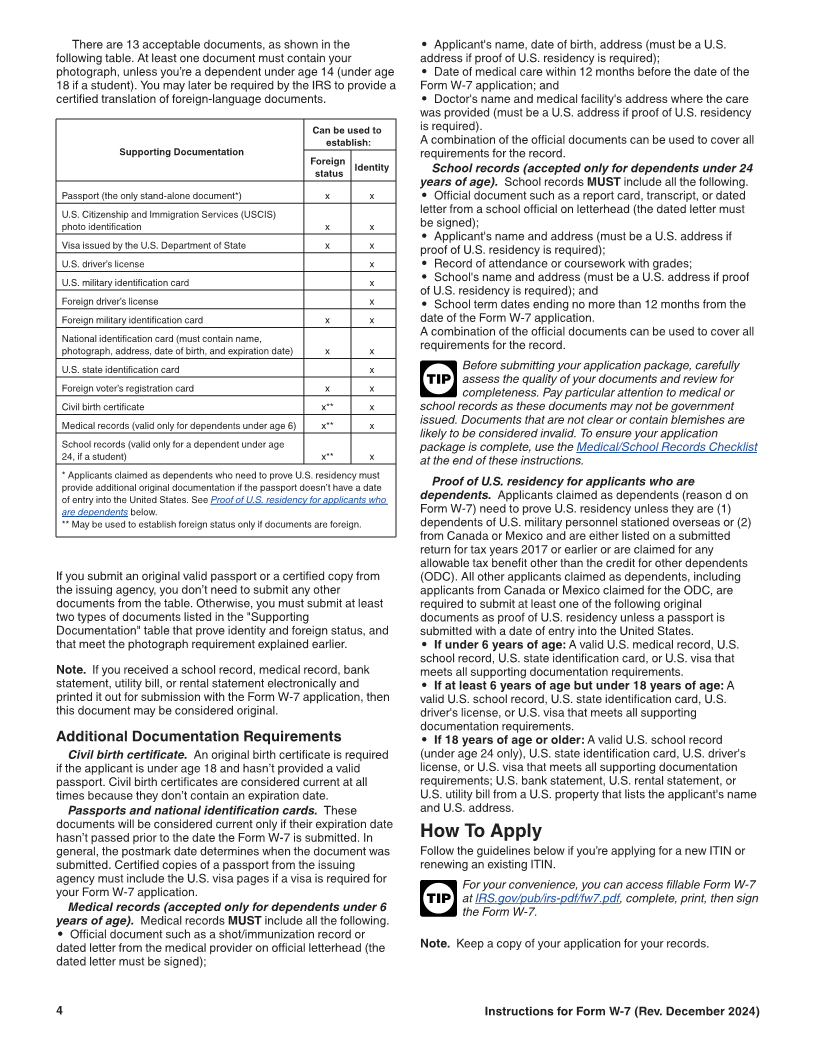

Supporting Documentation Requirements . . . . . . 3 business days. You can also call 800-TAX-FORM

(800-829-3676) if you’re in the United States to order forms and

Additional Documentation Requirements . . . . . . . 4 publications.

How To Apply . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Telephone help. If, after reading these instructions and our free

When To Apply . . . . . . . . . . . . . . . . . . . . . . . . . . 5 publications, you’re not sure how to complete your application or

Where To Apply . . . . . . . . . . . . . . . . . . . . . . . . . 6 have additional questions, call 800-829-1040 if you’re in the

Specific Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 6 United States. If you’re outside of the United States, call

267-941-1000 (not a toll-free number) for assistance.

Application Type . . . . . . . . . . . . . . . . . . . . . . . . . 6

Reason You’re Submitting Form W-7 . . . . . . . . . . 6 Change of address. It’s important that the IRS is aware of your

current mailing address. This address is used to mail notices

Line Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 8 about your Form W-7, including notification of your assigned

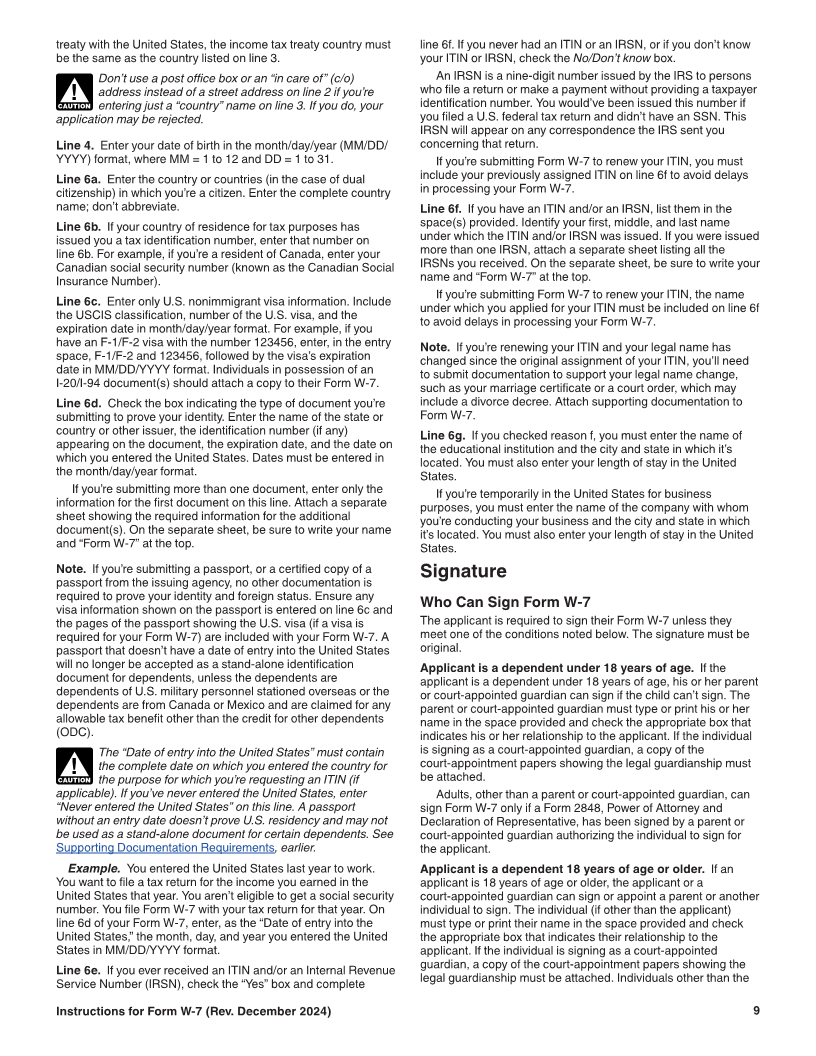

Signature . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 ITIN, and return your original supporting documentation. You

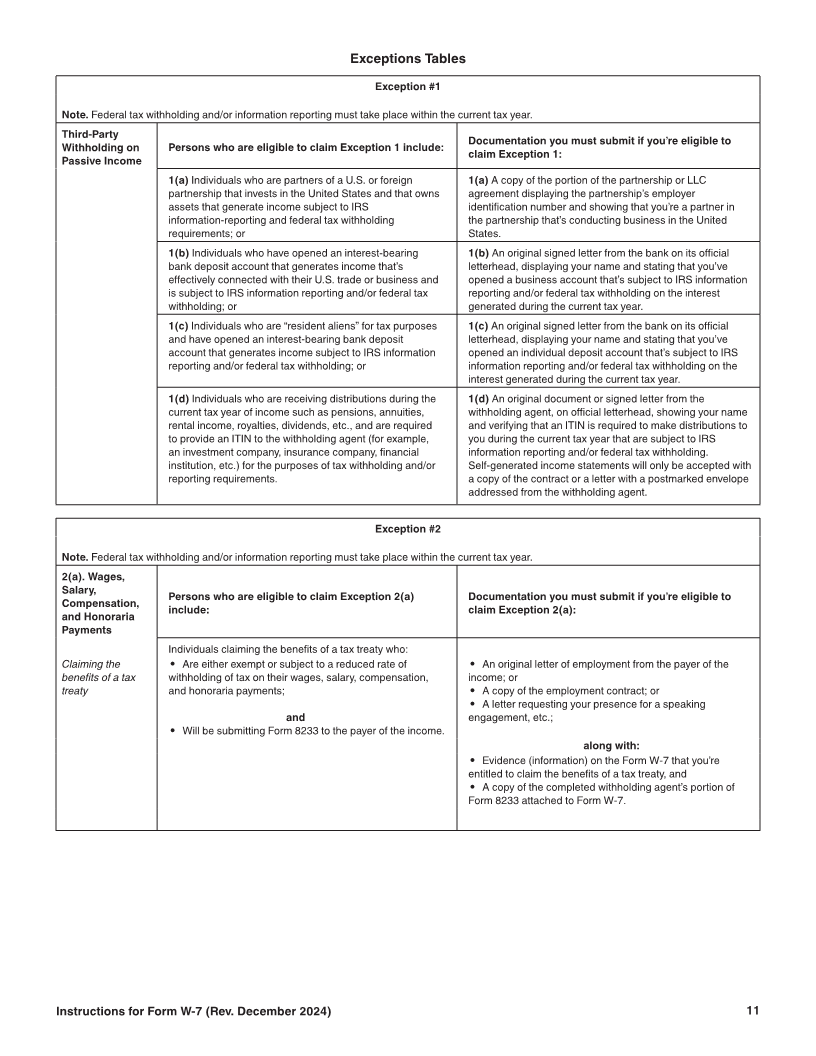

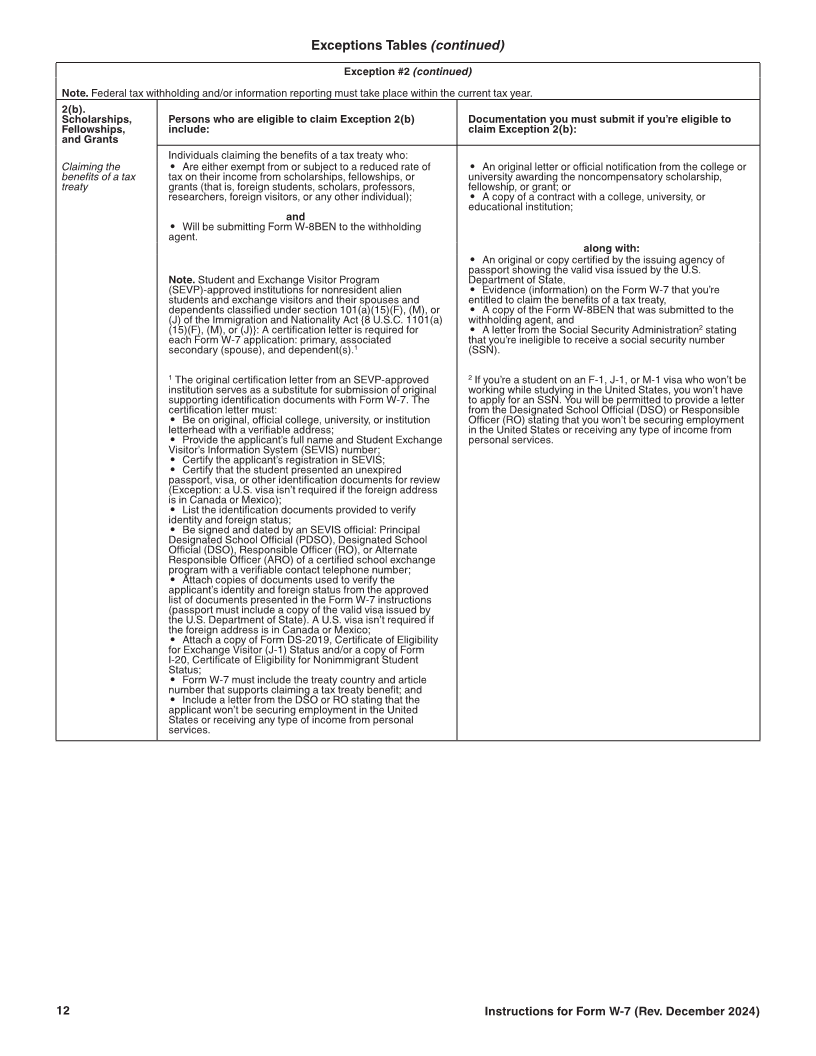

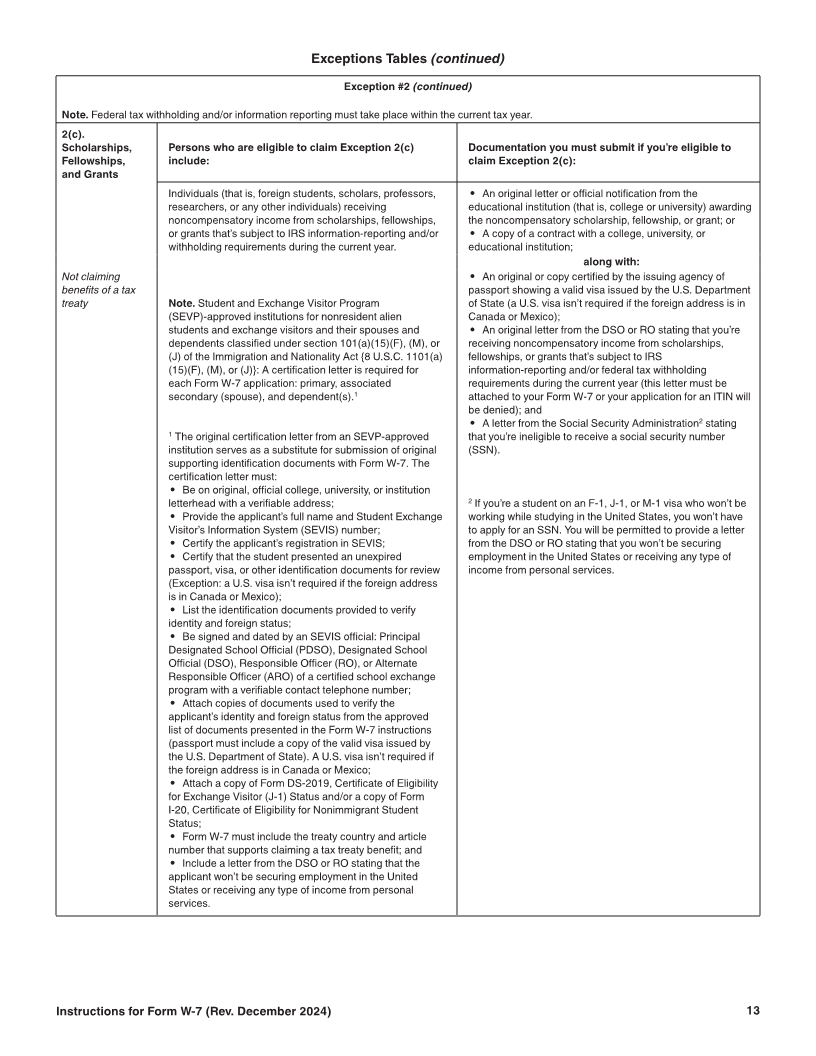

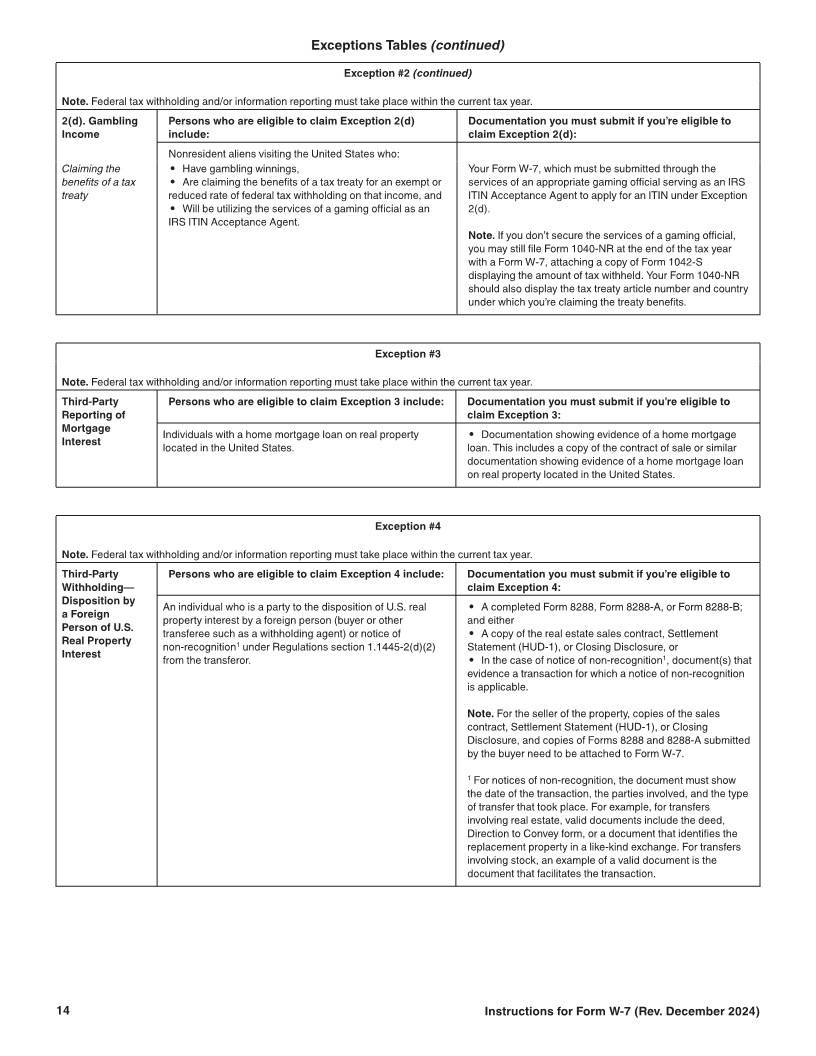

Exceptions Tables . . . . . . . . . . . . . . . . . . . . . . . . . . 11 may use the ITIN notice you received or send a letter to the IRS

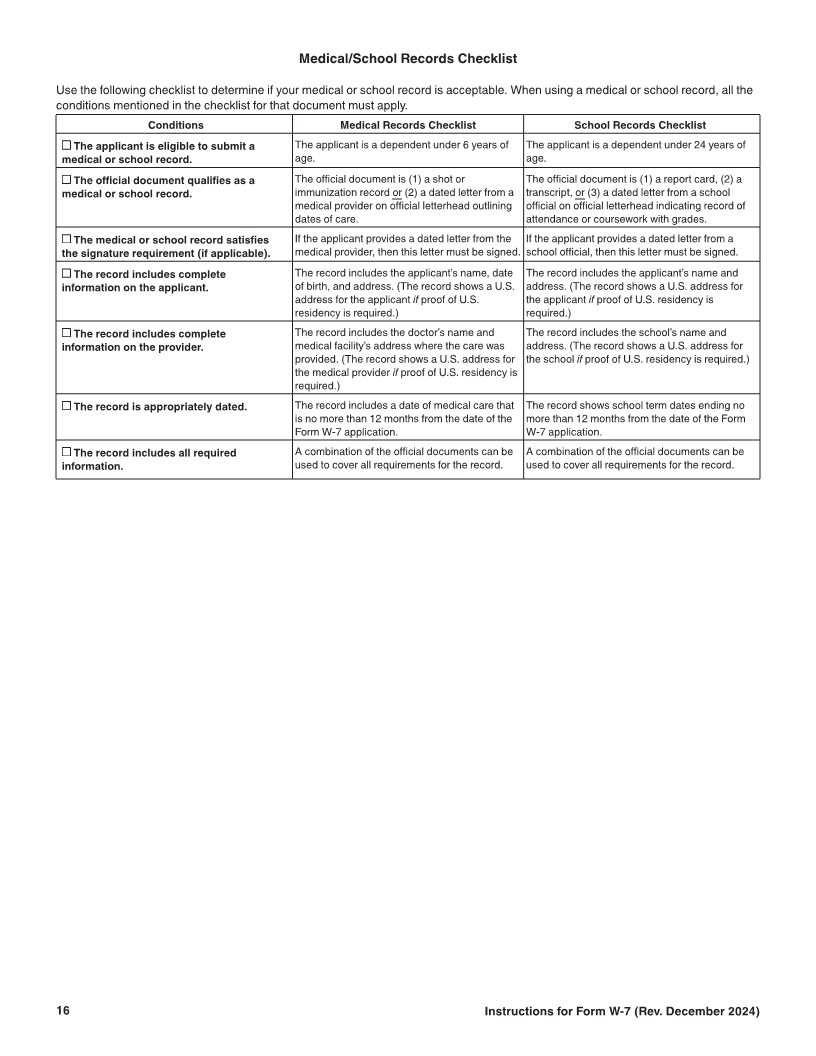

Medical/School Records Checklist . . . . . . . . . . . . . . 16 using the address under Where To Apply, later.

Renewal applications. All Form W-7 renewal applications must

include a U.S. federal tax return unless you meet an exception to

Future Developments

the requirement. See Exceptions Tables, later, for more

For the latest information about developments related to Form information.

W-7 and its instructions, such as legislation enacted after they

were published, go to IRS.gov/FormW7. Information returns. If your ITIN is only being used on

information returns for reporting purposes, you don’t need to

renew your ITIN at this time. However, in the future, if you need to

What’s New use the ITIN to file a U.S. federal tax return, you will need to

renew the ITIN at that time.

Estimated tax payments and extensions. We moved ITIN not

needed for Forms 4868, 1040-ES, or 1040-ES (NR) from How To Expanded discussion of allowable tax benefit. Spouses and

File to Reminders, made clarifying changes in the text, and dependents are not eligible for an ITIN or to renew an ITIN

revised the title to ITIN not needed for estimated tax payments or unless they are claimed for an allowable tax benefit or they file

extensions. their own tax return. See Allowable tax benefit, later, for more

information.

Allowable tax benefit. We added qualifying surviving spouse

to the list of allowable tax benefits. Also, we added a TIP Expired ITINs. If your ITIN wasn’t included on at least one U.S.

explaining what it takes to demonstrate if a dependent qualifies federal tax return for the last 3 consecutive tax years, it expires

for an allowable tax benefit. Form W-7 can be submitted for a on December 31 of the third consecutive tax year, and must be

dependent claimed for the child and dependent care credit or renewed before being used again on a U.S. federal tax return.

credit for other dependents even if the return has no tax to be If your ITIN was assigned before 2013 and was never

reduced by those credits. See Allowable tax benefit, later. renewed, you'll need to submit a renewal application with your

Supporting documentation requirements. We are making U.S. federal tax return.

significant changes to the medical and school record See How To Apply, later, for more information.

documentation requirements. Also, we restructured the text to ITIN not needed for estimated tax payments or extensions.

clarify when applicants claimed as dependents must prove If you receive income such as self-employment income without

residency and what documentation needs to be provided when having taxes withheld, you may have to make estimated tax

residency must be proved. See Supporting Documentation payments even if you don't have an ITIN when you earn the

Requirements, later. income. If you're making an estimated tax payment using Form

Medical/School records checklist. We added a new detailed 1040-ES or Form 1040-ES (NR) or filing an application for an

medical/school records checklist at the end of the instructions. extension of time to file using Form 4868, mail payments to the

IRS with an estimated tax payment voucher or Form 4868 and

Proof of residency. We added text throughout clarifying proof

complete all required information on the voucher except enter

of residency requirements for a dependent.

Instructions for Form W-7 (Rev. 12-2024) Catalog Number 54092G

Dec 10, 2024 Department of the Treasury Internal Revenue Service www.irs.gov