Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 9 Draft Ok to Print

AH XSL/XML Fileid: … orm-990-pf/2024/a/xml/cycle02/source (Init. & Date) _______

Page 1 of 42 11:49 - 20-Nov-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

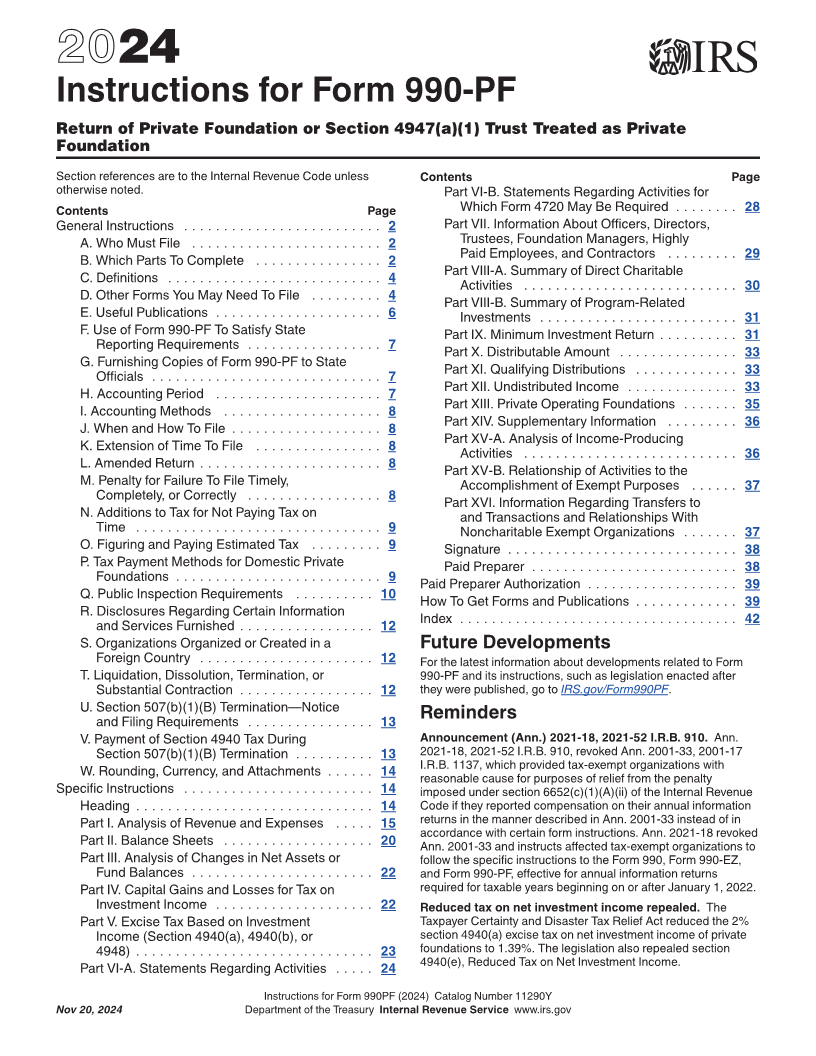

2024

Instructions for Form 990-PF

Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private

Foundation

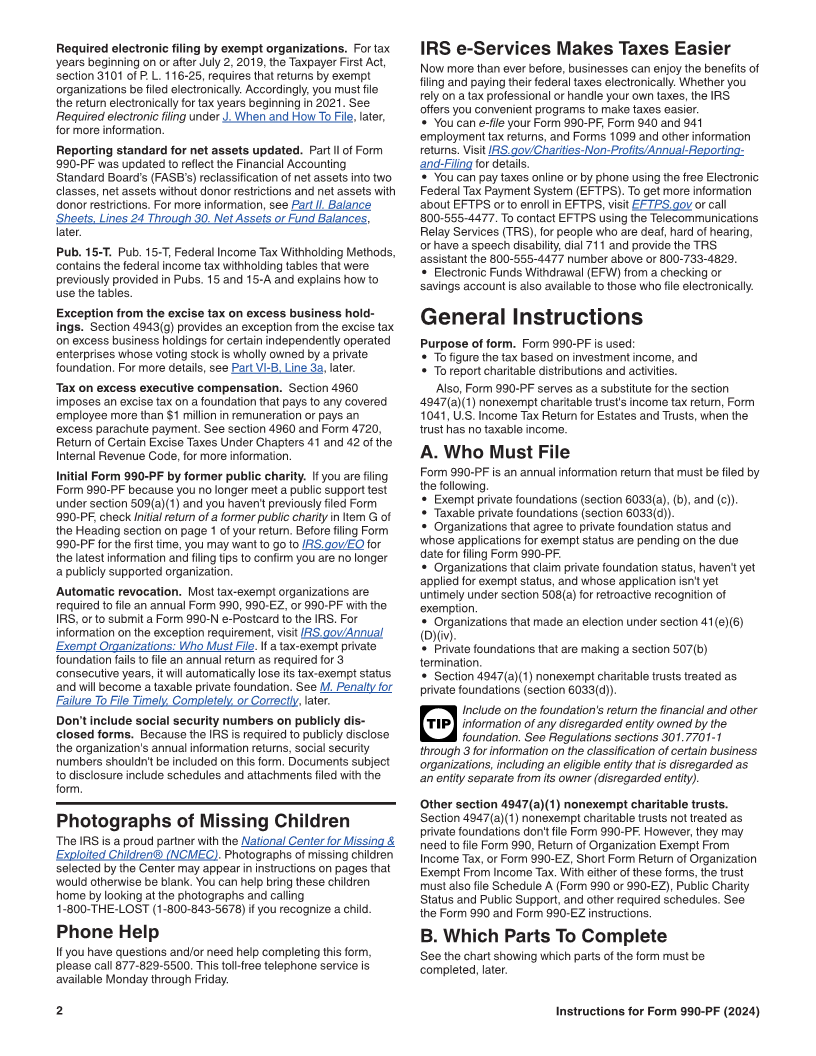

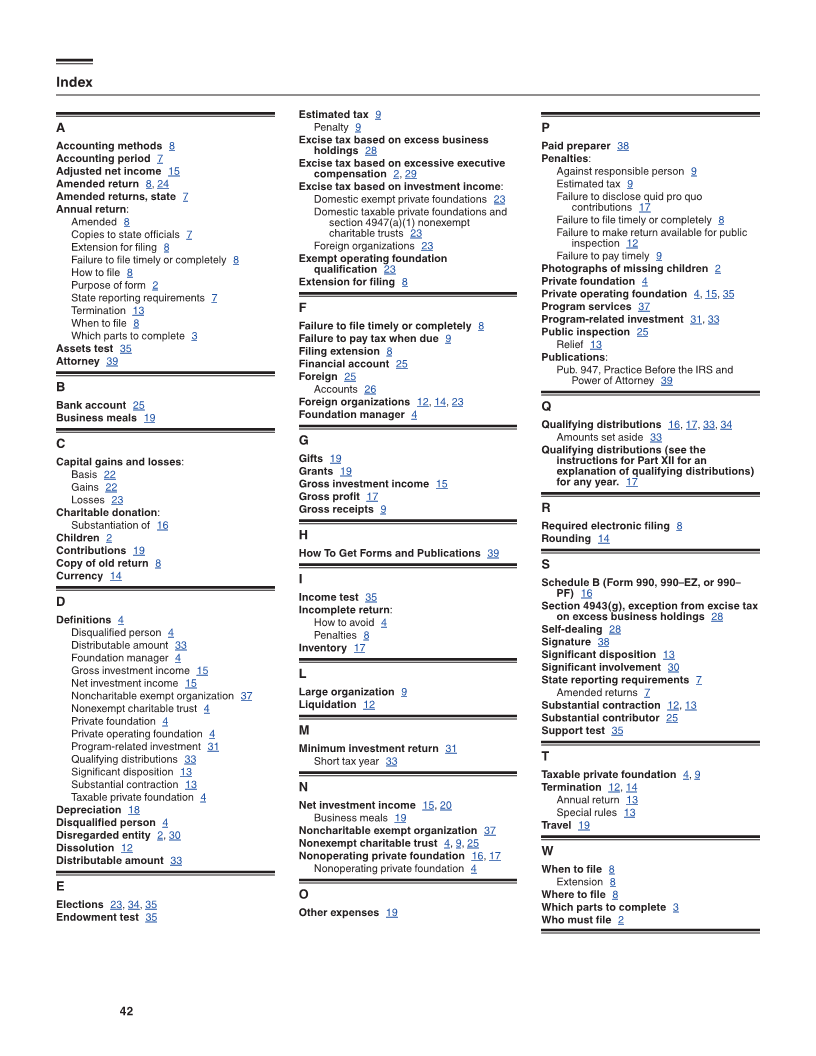

Section references are to the Internal Revenue Code unless Contents Page

otherwise noted. Part VI-B. Statements Regarding Activities for

Contents Page Which Form 4720 May Be Required . . . . . . . . 28

General Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 2 Part VII. Information About Officers, Directors,

A. Who Must File . . . . . . . . . . . . . . . . . . . . . . . . 2 Trustees, Foundation Managers, Highly

Paid Employees, and Contractors . . . . . . . . . 29

B. Which Parts To Complete . . . . . . . . . . . . . . . . 2

Part VIII-A. Summary of Direct Charitable

C. Definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Activities . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

D. Other Forms You May Need To File . . . . . . . . . 4

Part VIII-B. Summary of Program-Related

E. Useful Publications . . . . . . . . . . . . . . . . . . . . . 6 Investments . . . . . . . . . . . . . . . . . . . . . . . . . 31

F. Use of Form 990-PF To Satisfy State Part IX. Minimum Investment Return . . . . . . . . . . 31

Reporting Requirements . . . . . . . . . . . . . . . . . 7

Part X. Distributable Amount . . . . . . . . . . . . . . . 33

G. Furnishing Copies of Form 990-PF to State

Part XI. Qualifying Distributions . . . . . . . . . . . . . 33

Officials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Part XII. Undistributed Income . . . . . . . . . . . . . . 33

H. Accounting Period . . . . . . . . . . . . . . . . . . . . . 7

Part XIII. Private Operating Foundations . . . . . . . 35

I. Accounting Methods . . . . . . . . . . . . . . . . . . . . 8

Part XIV. Supplementary Information . . . . . . . . . 36

J. When and How To File . . . . . . . . . . . . . . . . . . . 8

Part XV-A. Analysis of Income-Producing

K. Extension of Time To File . . . . . . . . . . . . . . . . 8

Activities . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

L. Amended Return . . . . . . . . . . . . . . . . . . . . . . . 8

Part XV-B. Relationship of Activities to the

M. Penalty for Failure To File Timely, Accomplishment of Exempt Purposes . . . . . . 37

Completely, or Correctly . . . . . . . . . . . . . . . . . 8

Part XVI. Information Regarding Transfers to

N. Additions to Tax for Not Paying Tax on and Transactions and Relationships With

Time . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 Noncharitable Exempt Organizations . . . . . . . 37

O. Figuring and Paying Estimated Tax . . . . . . . . . 9 Signature . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

P. Tax Payment Methods for Domestic Private Paid Preparer . . . . . . . . . . . . . . . . . . . . . . . . . . 38

Foundations . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Paid Preparer Authorization . . . . . . . . . . . . . . . . . . . 39

Q. Public Inspection Requirements . . . . . . . . . . 10

How To Get Forms and Publications . . . . . . . . . . . . . 39

R. Disclosures Regarding Certain Information

Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

and Services Furnished . . . . . . . . . . . . . . . . . 12

S. Organizations Organized or Created in a Future Developments

Foreign Country . . . . . . . . . . . . . . . . . . . . . . 12 For the latest information about developments related to Form

T. Liquidation, Dissolution, Termination, or 990-PF and its instructions, such as legislation enacted after

Substantial Contraction . . . . . . . . . . . . . . . . . 12 they were published, go to IRS.gov/Form990PF.

U. Section 507(b)(1)(B) Termination—Notice

and Filing Requirements . . . . . . . . . . . . . . . . 13 Reminders

V. Payment of Section 4940 Tax During Announcement (Ann.) 2021-18, 2021-52 I.R.B. 910. Ann.

Section 507(b)(1)(B) Termination . . . . . . . . . . 13 2021-18, 2021-52 I.R.B. 910, revoked Ann. 2001-33, 2001-17

I.R.B. 1137, which provided tax-exempt organizations with

W. Rounding, Currency, and Attachments . . . . . . 14 reasonable cause for purposes of relief from the penalty

Specific Instructions . . . . . . . . . . . . . . . . . . . . . . . . 14 imposed under section 6652(c)(1)(A)(ii) of the Internal Revenue

Heading . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 Code if they reported compensation on their annual information

Part I. Analysis of Revenue and Expenses . . . . . 15 returns in the manner described in Ann. 2001-33 instead of in

accordance with certain form instructions. Ann. 2021-18 revoked

Part II. Balance Sheets . . . . . . . . . . . . . . . . . . . 20 Ann. 2001-33 and instructs affected tax-exempt organizations to

Part III. Analysis of Changes in Net Assets or follow the specific instructions to the Form 990, Form 990-EZ,

Fund Balances . . . . . . . . . . . . . . . . . . . . . . . 22 and Form 990-PF, effective for annual information returns

Part IV. Capital Gains and Losses for Tax on required for taxable years beginning on or after January 1, 2022.

Investment Income . . . . . . . . . . . . . . . . . . . . 22 Reduced tax on net investment income repealed. The

Part V. Excise Tax Based on Investment Taxpayer Certainty and Disaster Tax Relief Act reduced the 2%

Income (Section 4940(a), 4940(b), or section 4940(a) excise tax on net investment income of private

4948) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 foundations to 1.39%. The legislation also repealed section

4940(e), Reduced Tax on Net Investment Income.

Part VI-A. Statements Regarding Activities . . . . . 24

Instructions for Form 990PF (2024) Catalog Number 11290Y

Nov 20, 2024 Department of the Treasury Internal Revenue Service www.irs.gov