Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 9 Draft Ok to Print

AH XSL/XML Fileid: … -ic-disc/202412/a/xml/cycle05/source (Init. & Date) _______

Page 1 of 18 17:19 - 5-Nov-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

Instructions for Form

1120-IC-DISC

(Rev. December 2024)

(Use with December 2024 revision of Form 1120-IC-DISC, November 2018 revision

of separate Schedule K, September 2017 revision of separate Schedule P, and

September 2016 revision of separate Schedule Q)

Interest Charge Domestic International Sales Corporation Return

Section references are to the Internal Revenue Code unless amount is adjusted annually for inflation. For the annual adjusted

otherwise noted. inflation amount:

Contents Page 1. Go to IRS.gov/Newsroom/Inflation-Adjusted-Tax-Items-by-

General Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 1 Tax-Year,

Purpose of Form . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2. Click on the link for the IRS tax inflation adjustments for

your tax year,

Who Must File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3. Click on the Revenue Procedure for the tax year, and

When To File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

4. Find section 3.31, Limitation on Use of Cash Method of

Where To File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 Accounting, in the Revenue Procedure for the applicable amount

Who Must Sign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 for the average annual gross receipts.

Other Forms and Statements That May Be

Required . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 The term U.S. possession changed to U.S. territory. We

have updated the term U.S. possession to U.S. territory

Assembling the Return . . . . . . . . . . . . . . . . . . . . . . . 3 throughout these instructions. The meaning of these terms

Accounting Methods . . . . . . . . . . . . . . . . . . . . . . . . . 3 remains the same.

Accounting Periods . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Photographs of Missing Children

Rounding Off to Whole Dollars . . . . . . . . . . . . . . . . . . 3

The IRS is a proud partner with the National Center for Missing &

Recordkeeping . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Exploited Children® (NCMEC). Photographs of missing children

Definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 selected by the Center may appear in instructions on pages that

Penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 would otherwise be blank. You can help bring these children

Specific Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 5 home by looking at the photographs and calling

1-800-THE-LOST (1-800-843-5678) if you recognize a child.

Schedule A—Cost of Goods Sold . . . . . . . . . . . . . . . 6

Schedule B—Gross Income . . . . . . . . . . . . . . . . . . . 7

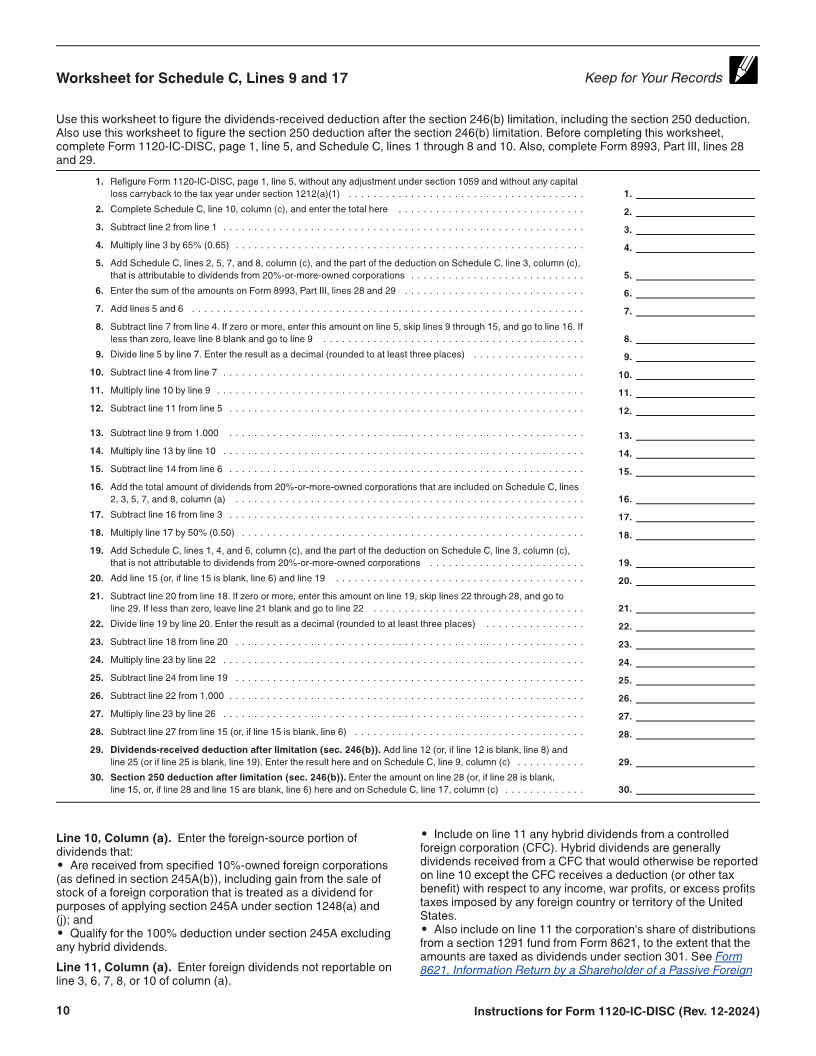

Schedule C—Dividends, Inclusions, and Special General Instructions

Deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Purpose of Form

Schedule E—Deductions . . . . . . . . . . . . . . . . . . . . 11

Form 1120-IC-DISC is an information return filed by interest

Schedule J—Deemed and Actual Distributions and charge domestic international sales corporations (IC-DISCs),

Deferred DISC Income for the Tax Year . . . . . . . . 13 former DISCs, and former IC-DISCs.

Schedule K (Form 1120-IC-DISC)—Shareholder's

Statement of IC-DISC Distributions . . . . . . . . . . 14 What Is an IC-DISC?

Schedule L—Balance Sheets per Books . . . . . . . . . 14 An IC-DISC is a domestic corporation that has elected to be an

Schedule N—Export Gross Receipts of the IC-DISC and its election is still in effect. The IC-DISC election is

made by filing Form 4876-A, Election To Be Treated as an

IC-DISC and Related U.S. Persons . . . . . . . . . . 15 Interest Charge DISC.

Schedule O—Other Information . . . . . . . . . . . . . . . . 15

Generally, an IC-DISC is not taxed on its income.

Schedule P (Form 1120-IC-DISC)—Intercompany Shareholders of an IC-DISC are taxed on its income when the

Transfer Price or Commission . . . . . . . . . . . . . . 16 income is actually (or deemed) distributed. In addition, section

995(f) imposes an interest charge on shareholders for their

Future Developments share of DISC-related deferred tax liability. See Form 8404,

For the latest information about developments related to Form Interest Charge on DISC-Related Deferred Tax Liability, for

1120-IC-DISC and its instructions, such as legislation enacted details.

after they were published, go to IRS.gov/Form1120ICDISC. To be an IC-DISC, a corporation must be organized under the

laws of a state or the District of Columbia and meet the following

What’s New tests.

Gross receipts test relating to method-of-accounting re- • At least 95% of its gross receipts during the tax year are

quirements change. We removed the threshold amount for the qualified export receipts.

gross receipts test throughout these instructions because this • At the end of the tax year, the adjusted basis of its qualified

export assets is at least 95% of the sum of the adjusted basis of

all of its assets.

Nov 5, 2024 Cat. No. 11476W