Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 8.5 Draft Ok to Print

AH XSL/XML Fileid: … -form-8615/2024/a/xml/cycle03/source (Init. & Date) _______

Page 1 of 11 7:47 - 18-Nov-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2024

Instructions for Form 8615

Tax for Certain Children Who Have Unearned Income

Section references are to the Internal Revenue Code unless others. However, a scholarship received by your child isn’t

otherwise noted. considered support if your child is a full-time student. For details, see

Pub. 501, Dependents, Standard Deduction, and Filing Information.

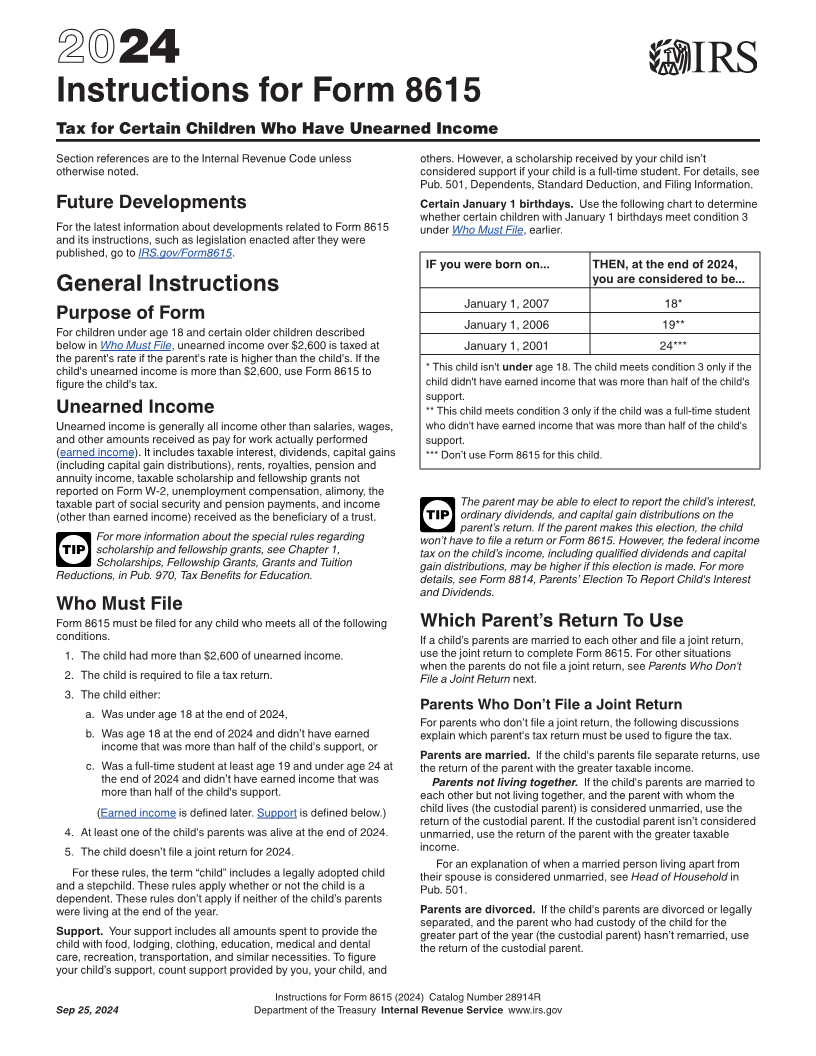

Future Developments Certain January 1 birthdays. Use the following chart to determine

whether certain children with January 1 birthdays meet condition 3

For the latest information about developments related to Form 8615 under Who Must File, earlier.

and its instructions, such as legislation enacted after they were

published, go to IRS.gov/Form8615.

IF you were born on... THEN, at the end of 2024,

you are considered to be...

General Instructions

January 1, 2007 18*

Purpose of Form

January 1, 2006 19**

For children under age 18 and certain older children described

below in Who Must File, unearned income over $2,600 is taxed at January 1, 2001 24***

the parent's rate if the parent's rate is higher than the child's. If the

child's unearned income is more than $2,600, use Form 8615 to * This child isn't under age 18. The child meets condition 3 only if the

figure the child's tax. child didn't have earned income that was more than half of the child's

support.

Unearned Income ** This child meets condition 3 only if the child was a full-time student

Unearned income is generally all income other than salaries, wages, who didn't have earned income that was more than half of the child's

and other amounts received as pay for work actually performed support.

(earned income). It includes taxable interest, dividends, capital gains *** Don’t use Form 8615 for this child.

(including capital gain distributions), rents, royalties, pension and

annuity income, taxable scholarship and fellowship grants not

reported on Form W-2, unemployment compensation, alimony, the

taxable part of social security and pension payments, and income The parent may be able to elect to report the child’s interest,

(other than earned income) received as the beneficiary of a trust. TIP ordinary dividends, and capital gain distributions on the

parent’s return. If the parent makes this election, the child

For more information about the special rules regarding won’t have to file a return or Form 8615. However, the federal income

TIP scholarship and fellowship grants, see Chapter 1, tax on the child’s income, including qualified dividends and capital

Scholarships, Fellowship Grants, Grants and Tuition gain distributions, may be higher if this election is made. For more

Reductions, in Pub. 970, Tax Benefits for Education. details, see Form 8814, Parents’ Election To Report Child's Interest

and Dividends.

Who Must File

Form 8615 must be filed for any child who meets all of the following Which Parent’s Return To Use

conditions. If a child’s parents are married to each other and file a joint return,

1. The child had more than $2,600 of unearned income. use the joint return to complete Form 8615. For other situations

when the parents do not file a joint return, see Parents Who Don't

2. The child is required to file a tax return. File a Joint Return next.

3. The child either:

Parents Who Don’t File a Joint Return

a. Was under age 18 at the end of 2024,

For parents who don’t file a joint return, the following discussions

b. Was age 18 at the end of 2024 and didn’t have earned explain which parent's tax return must be used to figure the tax.

income that was more than half of the child's support, or

Parents are married. If the child's parents file separate returns, use

c. Was a full-time student at least age 19 and under age 24 at the return of the parent with the greater taxable income.

the end of 2024 and didn’t have earned income that was Parents not living together. If the child's parents are married to

more than half of the child's support. each other but not living together, and the parent with whom the

(Earned income is defined later. Support is defined below.) child lives (the custodial parent) is considered unmarried, use the

return of the custodial parent. If the custodial parent isn’t considered

4. At least one of the child's parents was alive at the end of 2024. unmarried, use the return of the parent with the greater taxable

5. The child doesn’t file a joint return for 2024. income.

For an explanation of when a married person living apart from

For these rules, the term “child” includes a legally adopted child their spouse is considered unmarried, see Head of Household in

and a stepchild. These rules apply whether or not the child is a Pub. 501.

dependent. These rules don’t apply if neither of the child’s parents

were living at the end of the year. Parents are divorced. If the child's parents are divorced or legally

separated, and the parent who had custody of the child for the

Support. Your support includes all amounts spent to provide the greater part of the year (the custodial parent) hasn’t remarried, use

child with food, lodging, clothing, education, medical and dental the return of the custodial parent.

care, recreation, transportation, and similar necessities. To figure

your child’s support, count support provided by you, your child, and

Instructions for Form 8615 (2024) Catalog Number 28914R

Sep 25, 2024 Department of the Treasury Internal Revenue Service www.irs.gov