Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 8.5 Draft Ok to Print

AH XSL/XML Fileid: … -form-8824/2024/a/xml/cycle03/source (Init. & Date) _______

Page 1 of 7 11:36 - 22-Nov-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2024

Instructions for Form 8824

Like-Kind Exchanges

(and section 1043 conflict-of-interest sales)

Section references are to the Internal Revenue Code unless Certain members of the executive branch of the federal

otherwise noted. government and judicial officers of the federal government use Part

IV to elect to defer gain on conflict-of-interest sales. Judicial officers

of the federal government are the following.

Future Developments

1. Chief Justice of the United States.

For the latest information about developments related to Form 8824 2. Associate Justices of the Supreme Court.

and its instructions, such as legislation enacted after they were

published, go to IRS.gov/Form8824. 3. Judges of the:

a. United States courts of appeals;

b. United States district courts, including the district courts in

What’s New Guam, the Northern Mariana Islands, and the Virgin Islands;

New instructions for completing lines 12a, 15a, and 25a c. Court of Appeals for the Federal Circuit;

through 25c on e-filed Forms 8824. Lines 12a, 15a, and 25a d. Court of International Trade;

through 25c have been added to e-filed Forms 8824. E-filers no

longer need to attach a separate sheet providing details for those e. Tax Court;

lines. See Line 12a Line 15a, , and Lines 25a, 25b, and 25c, later. f. Court of Federal Claims;

Expanded examples. We expanded the examples in Figuring g. Court of Appeals for Veterans Claims;

amounts for lines 15 through 20 and Figuring amounts for lines 21 h. United States Court of Appeals for the Armed Forces; and

through 24, later. i. Any court created by an Act of Congress, the judges of which

are entitled to hold office during good behavior.

General Instructions Multiple exchanges. If you made more than one like-kind

exchange, you can file a summary on one Form 8824 and attach

Reminders your own statement showing all the information requested on Form

Exchanges limited to real property. For 2018 and later years, 8824 for each exchange. Include your name and identifying number

section 1031 like-kind exchange treatment applies only to at the top of each page of the statement. On the summary Form

exchanges of real property held for use in a trade or business or for 8824, enter only your name and identifying number, “Summary” on

investment, other than real property held primarily for sale. line 1, the total recognized gain from all exchanges on line 23, and

Regulations sections 1.1031(a)-1, 1.1031(a)-3, and 1.1031(k)-1 the total basis of all like-kind property received on line 25.

provide a definition of real property under section 1031, address a

taxpayer's receipt of personal property incidental to the like-kind real When To File

property received, and apply to like-kind exchanges after December If during the current tax year you transferred property to another

2, 2020. See Definition of Real Property, later, for more details. party in a like-kind exchange, you must file Form 8824 with your tax

return for that year. Also file Form 8824 for the 2 years following the

Special rules for capital gains invested in qualified opportunity year of a related party exchange. See Line 7, later, for details.

funds (QOFs). Effective December 22, 2017, section 1400Z-2

provides a temporary deferral of inclusion in gross income for capital Like-Kind Exchanges (Form 8824:

gains invested in QOFs, and permanent exclusion of capital gains

from the sale or exchange of an investment in the QOF if the Parts I, II, and III)

investment is held for at least 10 years. See the Form 8949

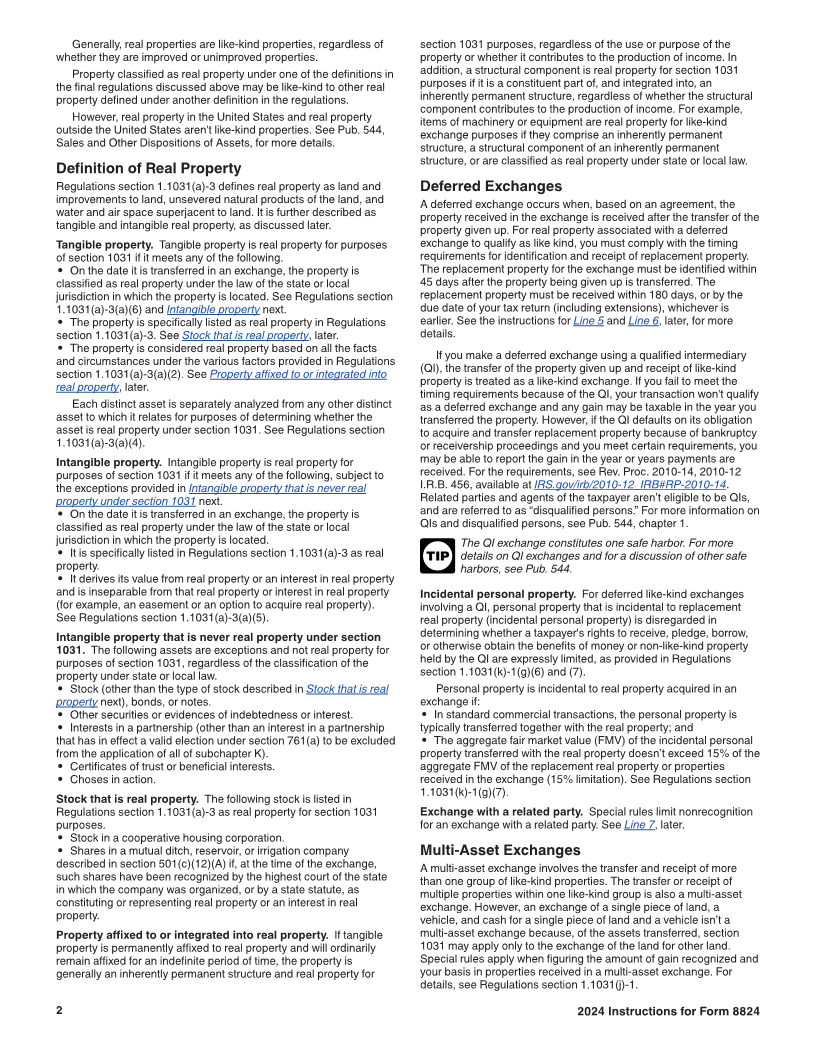

instructions on how to report your election to defer eligible gains Section 1031 regulations. Regulations sections 1.1031(a)-1,

invested in a QOF. 1.1031(a)-3, and 1.1031(k)-1 implement statutory changes limiting

For additional information (including details on investments in the application of section 1031 to exchanges of real property. These

QOFs held for at least 10 years), see Opportunity Zones Frequently regulations, which apply to like-kind exchanges beginning after

Asked Questions, at IRS.gov. December 2, 2020, provide a definition of real property under

section 1031, and address a taxpayer's receipt of personal property

Qualified opportunity investment. If you are an eligible taxpayer that is incidental to real property the taxpayer receives in the

who held a qualified investment in a QOF at any time during the year, exchange.

you must file your tax return with Form 8997, Initial and Annual Generally, if you exchange business or investment real property

Statement of Qualified Opportunity Fund (QOF) Investments, solely for business or investment real property of a like kind, section

attached. See the Form 8997 instructions. 1031 provides that no gain or loss is recognized. If, as part of the

exchange, you also receive other (non-like-kind) property or money,

Purpose of Form gain is recognized to the extent of the other property and money

Use Parts I, II, and III of Form 8824 to report each exchange of received, but a loss isn't recognized.

business or investment real property for real property of a like kind. Section 1031 doesn’t apply to exchanges of real property held

Form 8824 figures the amount of gain deferred as a result of a primarily for sale. See section 1031(a)(2). In addition, section 1031

like-kind exchange. Use Part III to figure the amount of gain required doesn't apply to certain exchanges involving tax-exempt use

to be reported on the tax return in the current year if cash or property property subject to a lease. See section 470(e)(4).

that isn't of a like kind is involved in the exchange. Also, use Part III to

figure the basis of the like-kind property received. Like-kind property. Properties are of like kind if they are of the

same nature or character, even if they differ in grade or quality.

Instructions for Form 8824 (2024) Catalog Number 12597K

Oct 18, 2024 Department of the Treasury Internal Revenue Service www.irs.gov