Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 9 Draft Ok to Print

AH XSL/XML Fileid: … -form-8839/2024/a/xml/cycle05/source (Init. & Date) _______

Page 1 of 8 16:26 - 6-Dec-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2024

Instructions for Form 8839

Qualified Adoption Expenses

Section references are to the Internal Revenue Code unless these benefits from income if your employer had a written

otherwise noted. qualified adoption assistance program (see Employer-Provided

Adoption Benefits, later) and any of the following statements are

true.

What's New

1. You received employer-provided adoption benefits in

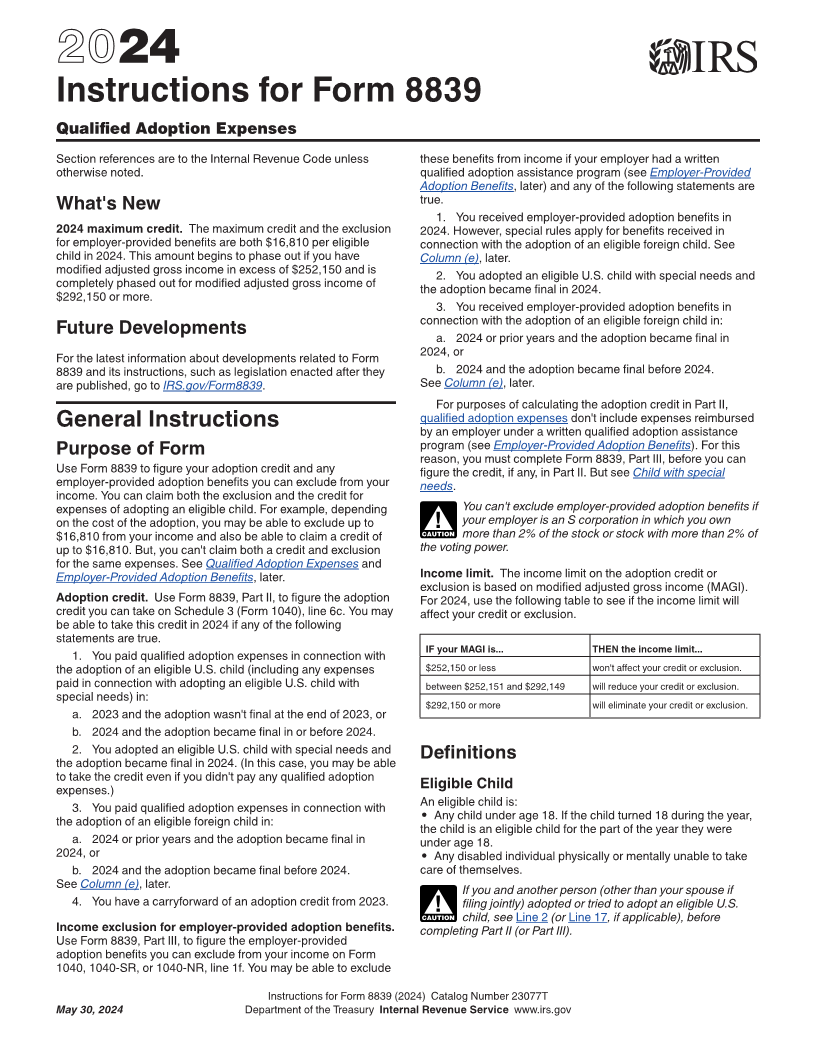

2024 maximum credit. The maximum credit and the exclusion 2024. However, special rules apply for benefits received in

for employer-provided benefits are both $16,810 per eligible connection with the adoption of an eligible foreign child. See

child in 2024. This amount begins to phase out if you have Column (e), later.

modified adjusted gross income in excess of $252,150 and is 2. You adopted an eligible U.S. child with special needs and

completely phased out for modified adjusted gross income of the adoption became final in 2024.

$292,150 or more.

3. You received employer-provided adoption benefits in

connection with the adoption of an eligible foreign child in:

Future Developments a. 2024 or prior years and the adoption became final in

2024, or

For the latest information about developments related to Form

8839 and its instructions, such as legislation enacted after they b. 2024 and the adoption became final before 2024.

are published, go to IRS.gov/Form8839. See Column (e), later.

For purposes of calculating the adoption credit in Part II,

qualified adoption expenses don't include expenses reimbursed

General Instructions by an employer under a written qualified adoption assistance

program (see Employer-Provided Adoption Benefits). For this

Purpose of Form reason, you must complete Form 8839, Part III, before you can

Use Form 8839 to figure your adoption credit and any figure the credit, if any, in Part II. But see Child with special

employer-provided adoption benefits you can exclude from your needs.

income. You can claim both the exclusion and the credit for

expenses of adopting an eligible child. For example, depending You can't exclude employer-provided adoption benefits if

on the cost of the adoption, you may be able to exclude up to ! your employer is an S corporation in which you own

$16,810 from your income and also be able to claim a credit of CAUTION more than 2% of the stock or stock with more than 2% of

up to $16,810. But, you can't claim both a credit and exclusion the voting power.

for the same expenses. See Qualified Adoption Expenses and

Employer-Provided Adoption Benefits, later. Income limit. The income limit on the adoption credit or

exclusion is based on modified adjusted gross income (MAGI).

Adoption credit. Use Form 8839, Part II, to figure the adoption For 2024, use the following table to see if the income limit will

credit you can take on Schedule 3 (Form 1040), line 6c. You may affect your credit or exclusion.

be able to take this credit in 2024 if any of the following

statements are true.

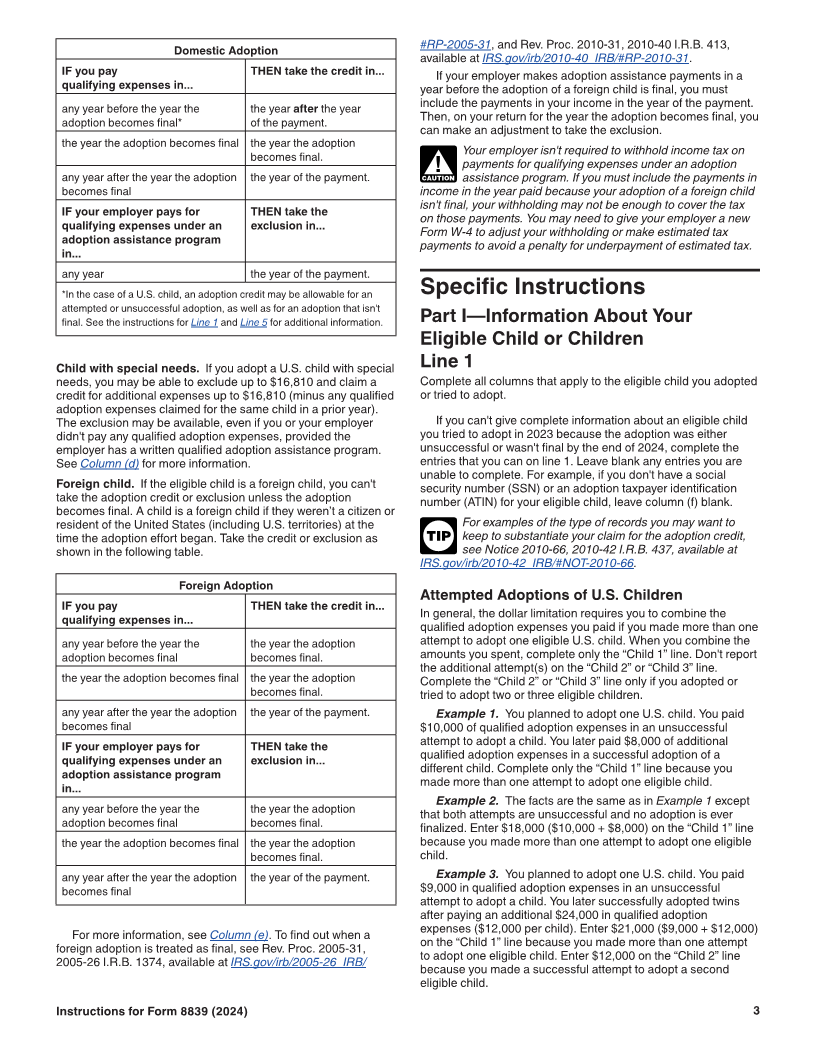

IF your MAGI is... THEN the income limit...

1. You paid qualified adoption expenses in connection with

the adoption of an eligible U.S. child (including any expenses $252,150 or less won't affect your credit or exclusion.

paid in connection with adopting an eligible U.S. child with between $252,151 and $292,149 will reduce your credit or exclusion.

special needs) in:

$292,150 or more will eliminate your credit or exclusion.

a. 2023 and the adoption wasn't final at the end of 2023, or

b. 2024 and the adoption became final in or before 2024.

2. You adopted an eligible U.S. child with special needs and

Definitions

the adoption became final in 2024. (In this case, you may be able

to take the credit even if you didn't pay any qualified adoption

expenses.) Eligible Child

3. You paid qualified adoption expenses in connection with An eligible child is:

the adoption of an eligible foreign child in: • Any child under age 18. If the child turned 18 during the year,

the child is an eligible child for the part of the year they were

a. 2024 or prior years and the adoption became final in under age 18.

2024, or • Any disabled individual physically or mentally unable to take

b. 2024 and the adoption became final before 2024. care of themselves.

See Column (e), later. If you and another person (other than your spouse if

4. You have a carryforward of an adoption credit from 2023. ! filing jointly) adopted or tried to adopt an eligible U.S.

CAUTION child, see Line 2 (or Line 17, if applicable), before

Income exclusion for employer-provided adoption benefits. completing Part II (or Part III).

Use Form 8839, Part III, to figure the employer-provided

adoption benefits you can exclude from your income on Form

1040, 1040-SR, or 1040-NR, line 1f. You may be able to exclude

Instructions for Form 8839 (2024) Catalog Number 23077T

May 30, 2024 Department of the Treasury Internal Revenue Service www.irs.gov