Enlarge image

Userid: CPM Schema: instrx Leadpct: 100% Pt. size: 9 Draft Ok to Print

AH XSL/XML Fileid: … r-form-709/2024/a/xml/cycle03/source (Init. & Date) _______

Page 1 of 24 16:06 - 16-Oct-2024

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Department of the Treasury

Internal Revenue Service

2024

Instructions for Form 709

United States Gift (and Generation-Skipping Transfer) Tax Return

For gifts made during calendar year 2024

Section references are to the Internal Revenue Code unless For Gifts Made Use Revision of

otherwise noted. After and Before Form 709 Dated

Contents Page

– – – – – January 1, 1982 November 1981

General Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 2

Purpose of Form . . . . . . . . . . . . . . . . . . . . . . . . . 2 December 31, 1981 January 1, 1987 January 1987

Who Must File . . . . . . . . . . . . . . . . . . . . . . . . . . 2 December 31, 1986 January 1, 1989 December 1988

When To File . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 December 31, 1988 January 1, 1990 December 1989

Where To File . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 December 31, 1989 October 9, 1990 October 1990

Amending Form 709 To Provide October 8, 1990 January 1, 1992 November 1991

Supplemental Information . . . . . . . . . . . . . . . . 6 December 31, 1992 January 1, 1998 December 1996

Adequate Disclosure . . . . . . . . . . . . . . . . . . . . . . 6

December 31, 1997 – – – – – *

Penalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

* Use the corresponding annual form.

Joint Tenancy . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Transfer of Certain Life Estates Received

From Spouse . . . . . . . . . . . . . . . . . . . . . . . . . 6

Specific Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 7

What's New

Part I—General Information . . . . . . . . . . . . . . . . . 7

• Part I, General Information. Entry lines in this section were

Part III—Spouse's Consent on Gifts to Third reorganized and the address includes foreign address

Parties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 entries. Lines 12 through 18 were moved to Part III.

Schedule A. Computation of Taxable Gifts . . . . . . 8 • Part III, Spouse's consent on gifts to third parties. Part

Gifts Subject to Both Gift and GST Taxes . . . . . . . 9 I, entries 12 through 18 were moved to a new Part III on the

second page of Form 709. A consenting spouse is no longer

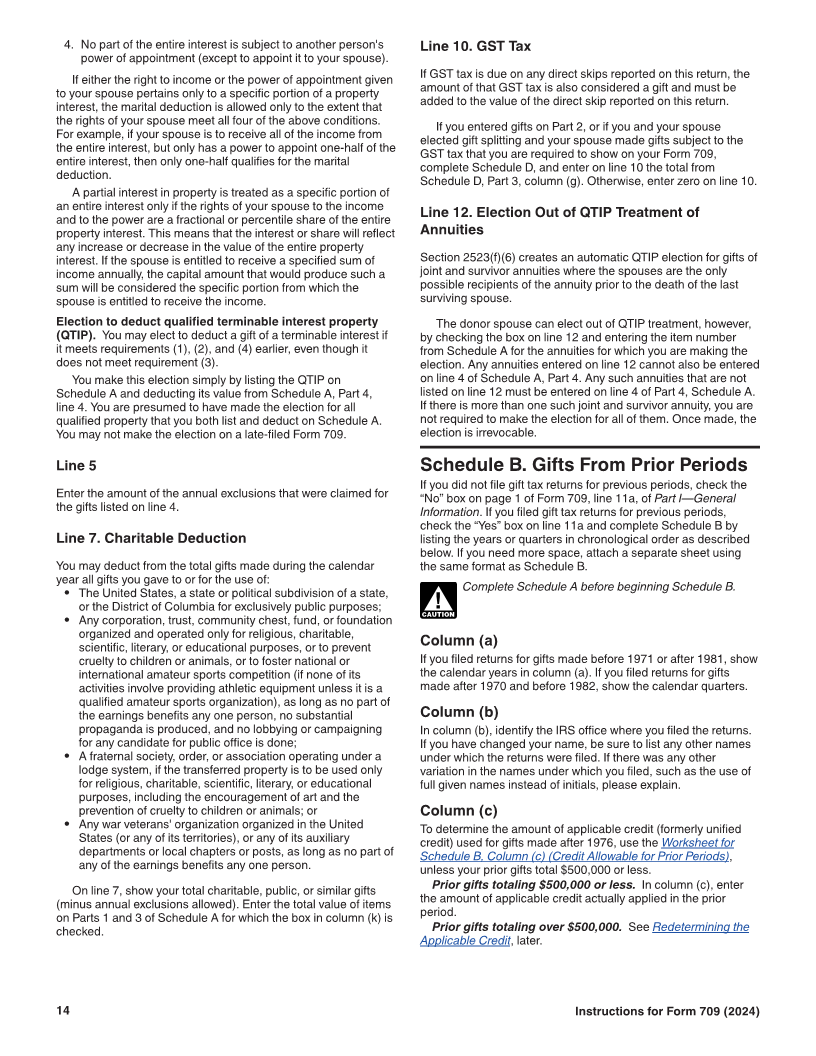

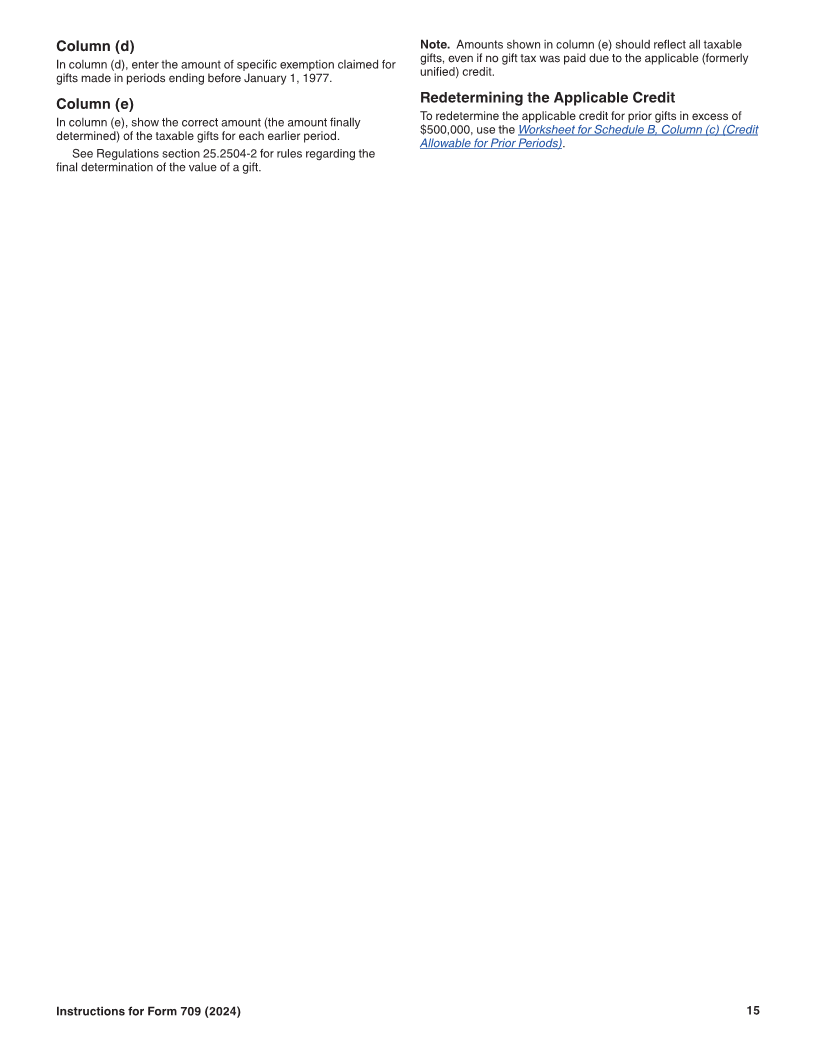

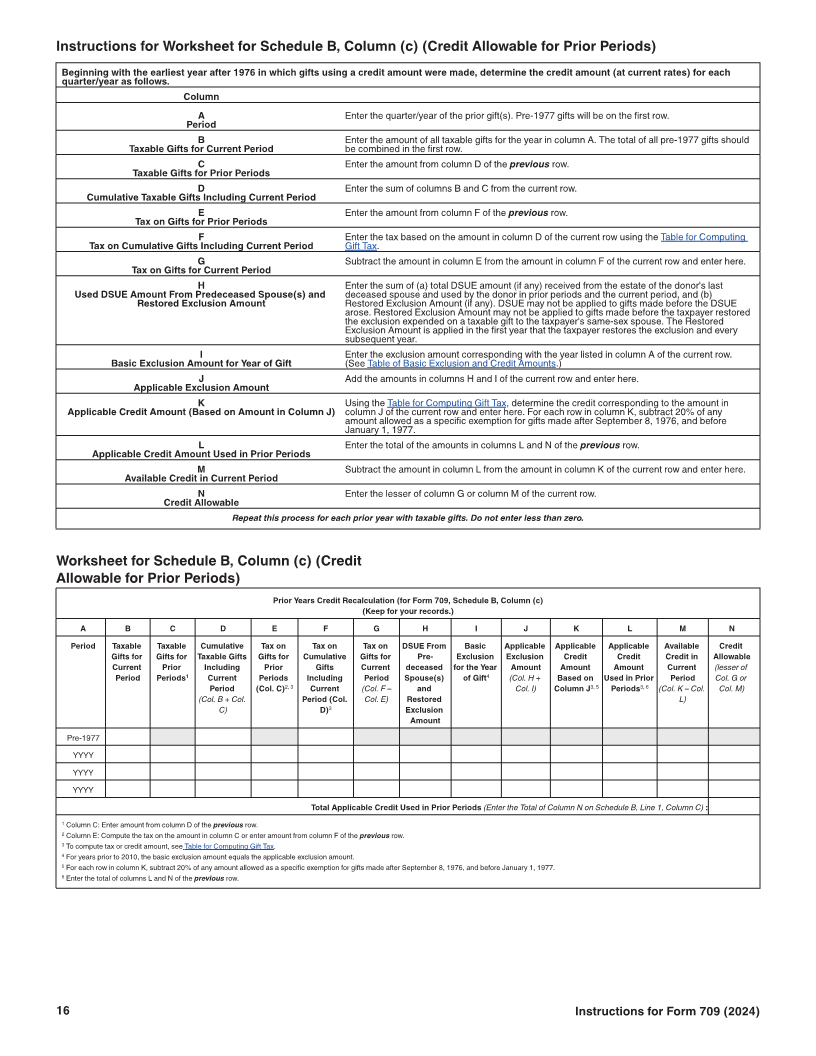

Schedule B. Gifts From Prior Periods . . . . . . . . . 14 required to sign the return but must sign a Notice of Consent

Schedule C. Portability of Deceased Spousal to be attached to the donor's return.

Unused Exclusion (DSUE) Amount and • Schedule A. Columns for Parts 1, 2 and 3 of Schedule A

Restored Exclusion Amount . . . . . . . . . . . . . . 19 were reorganized. New columns (k), (l) and (m) with

Schedule D. Computation of GST Tax . . . . . . . . . 20 checkbox on parts 1 and 3 was added to identify if gift is a

charitable gift, deductible gift to spouse, or 2652(a)(3)

Part II—Tax Computation (Page 1 of Form election.

709) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 • New Form 709-NA. If you are a nonresident not a citizen of

Signature . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 the United States and made gifts of tangible property

situated in the United States, file Form 709-NA, United

States Gift (and Generation-Skipping Transfer) Tax Return of

Future Developments Nonresident Not a Citizen of the United States.

For the latest information about developments related to Form • The annual gift exclusion for 2024 is $18,000. See Annual

709 and its instructions, such as legislation enacted after they Exclusion, later.

were published, go to IRS.gov/Form709. • For gifts made to spouses who are not U.S. citizens, the

annual exclusion has increased to $185,000. See

Nonresidents Not Citizens of the United States, later.

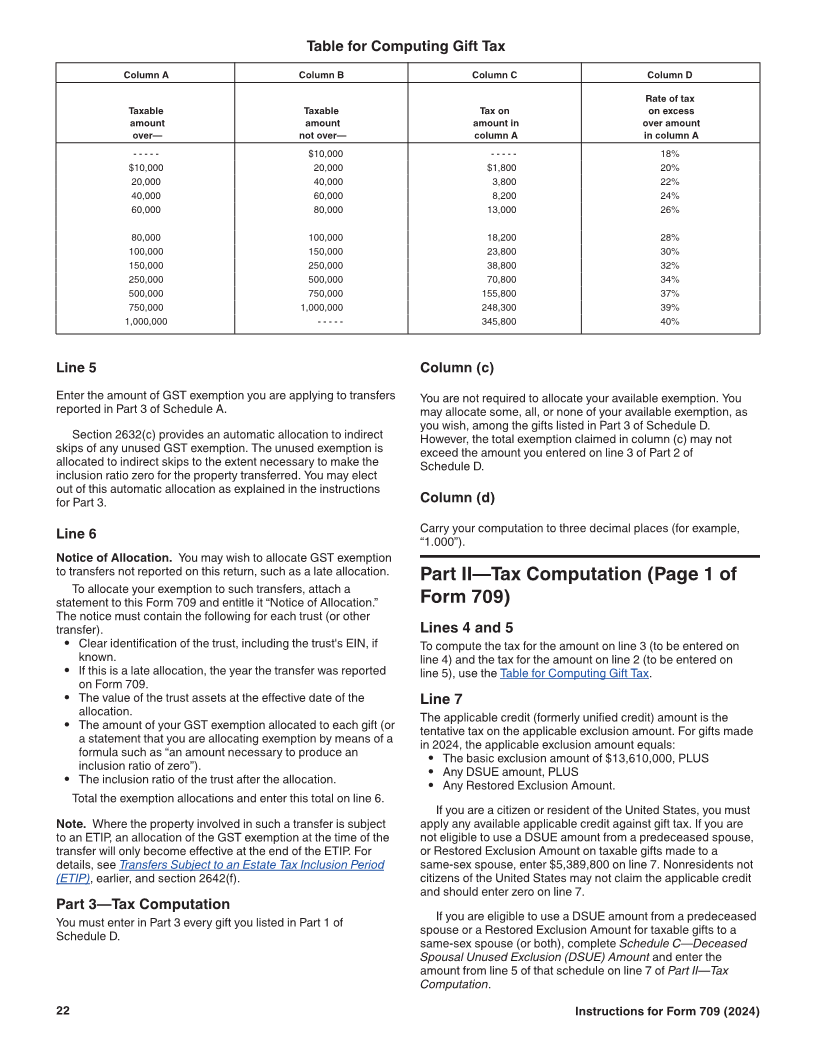

• The top rate for gifts and generation-skipping transfers

remains at 40%. See Table for Computing Gift Tax.

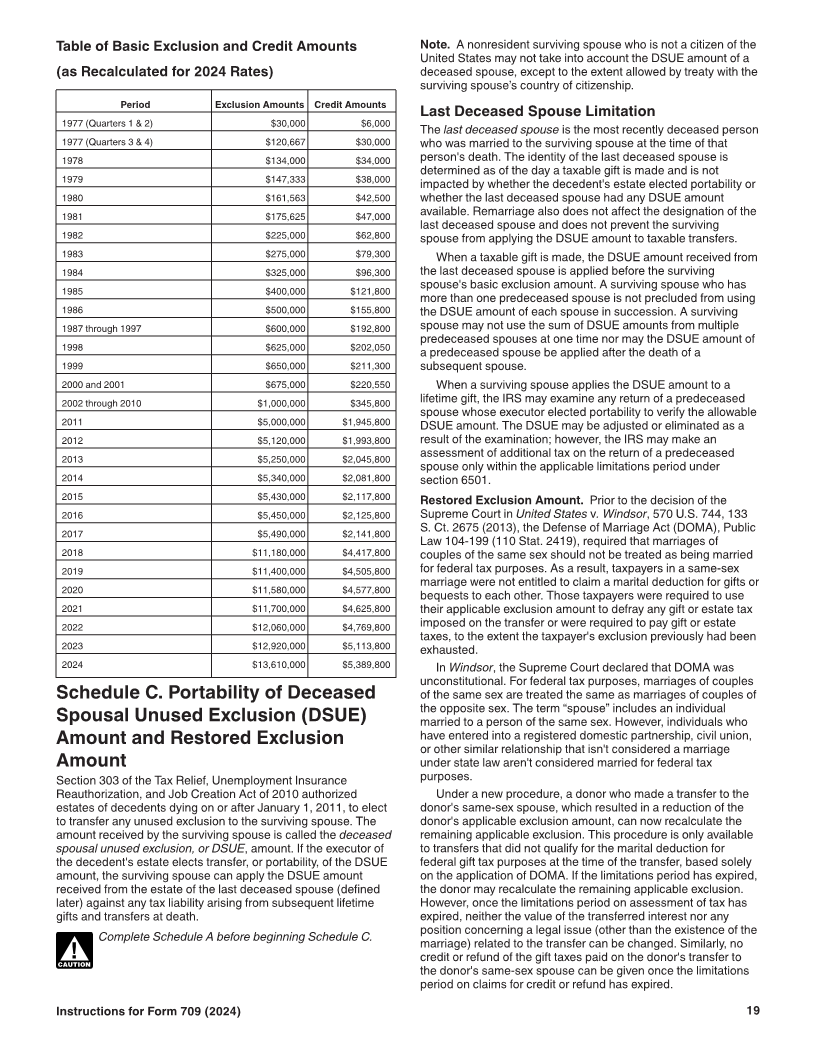

• The basic credit amount for 2024 is $5,389,800. See Table

of Basic Exclusion and Credit Amounts.

• The applicable exclusion amount consists of the basic

exclusion amount ($13,610,000 in 2024) and, in the case of

a surviving spouse, any unused exclusion amount of the last

deceased spouse (who died after December 31, 2010). The

executor of the predeceased spouse's estate must have

elected on a timely and complete Form 706 to allow the

donor to use the predeceased spouse's unused exclusion

amount.

Oct 16, 2024 Cat. No. 16784X