Enlarge image

Department of the Treasury - Internal Revenue Service

Form 13844

(November 2024) Application For Reduced User Fee For Installment Agreements

For low income taxpayers, the user fee for entering into an installment agreement (payment plan) is reduced to $43 and

this $43 may be waived or reimbursed if certain conditions are met. Low-income taxpayers, for installment agreement

purposes, are individuals with adjusted gross incomes, as determined for the most recent year for which such information

is available, at or below 250% of the criteria established by the poverty guidelines updated annually by the U.S.

Department of Health and Human Services.

If you are a low-income taxpayer and you agree to make electronic payments through a debit instrument by entering into a

direct debit installment agreement, then the IRS will waive the user fees for the installment agreement. If you are a low-

income taxpayer and you are unable to make electronic payments through a debit instrument by entering into a direct

debit installment agreement, then the IRS will reimburse the user fees that you paid for the installment agreement upon

completion of the installment agreement.

The reduced user fee for individuals does not apply to corporations or partnerships. Use this form to apply for low-income

taxpayer status for installment agreement purposes. If your application for low-income taxpayer status for installment

agreement purposes is granted, the IRS will waive or reimburse your installment agreement user fees if certain conditions

are met. To request the reduced user fee, which may be waived or reimbursed if certain conditions apply, mail this form

to: IRS ACS Correspondence, P.O. Box 24017, Stop 76101, Fresno, CA. 93779.

If you are an individual, follow the steps below to determine if you qualify for a reduced installment agreement

user fee.

1. If you are unable to make electronic payments through a debit instrument by entering into a direct debit installment

agreement (DDIA) please check the box below:

I am unable to make electronic payments through a debit instrument by entering into a DDIA.

Note: Not checking this box indicates that you are able but choosing not to make electronic payments

through a debit instrument. The reduced user fee will not be reimbursed upon completion of your

installment agreement.

2. Family Unit Size Enter the total number of dependents (including yourself and your spouse) claimed on

your most recent income tax return.

3. Adjusted Gross Income Enter the amount of adjusted gross income from the most recent year for

which such information is available. (Form 1040 and Form 1040-SR, Line 11).

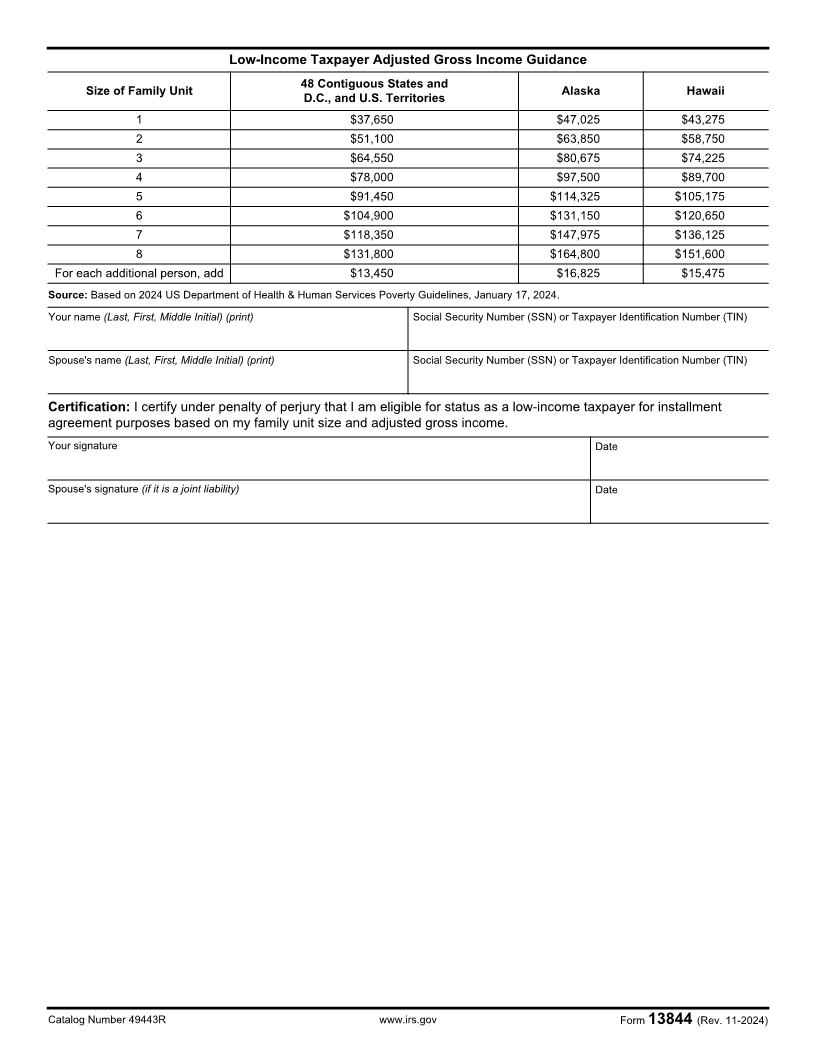

4. Compare the information you entered in items 2 and 3, above, to the Low-Income Taxpayer Adjusted Gross

Income Guidance table below. Find the “Size of Family Unit” equal to the number you entered in item 2. Next, find

the column, which represents where you reside (48 Contiguous States and DC and U.S. Territories…, Alaska or

Hawaii). Compare the adjusted gross income you entered in item 3 to the number in the row and column that

corresponds to your family unit size and residence. For example, if you reside in one of the 48 contiguous states,

and your family unit size from item 2 above is 4, and your adjusted gross income from item 3 above is $70,000,

then you are a low-income taxpayer because your income is less than the $78,000 guideline amount.

5. If the adjusted gross income you entered in item 3 is more than the amount shown for your family unit size and

residence in the Low-Income Taxpayer Adjusted Gross Income Guidance table below, you are not a low-income

taxpayer.

6. If the adjusted gross income you entered in item 3 is equal to or less than the amount shown for your family unit

size and residence in the Low-Income Taxpayer Adjusted Gross Income Guidance table below, you are a low-

income taxpayer. If you are a low-income taxpayer based on your income level, you must sign and date the

certification portion of this form and submit it to the IRS within 30 days from the date of the Installment Agreement

acceptance letter that you received. Applications for low income taxpayer status, for installment agreement

purposes, will not be considered if submitted 30 days after the date on the installment agreement

acceptance letter you received.

Catalog Number 49443R www.irs.gov Form 13844 (Rev. 11-2024)