Enlarge image

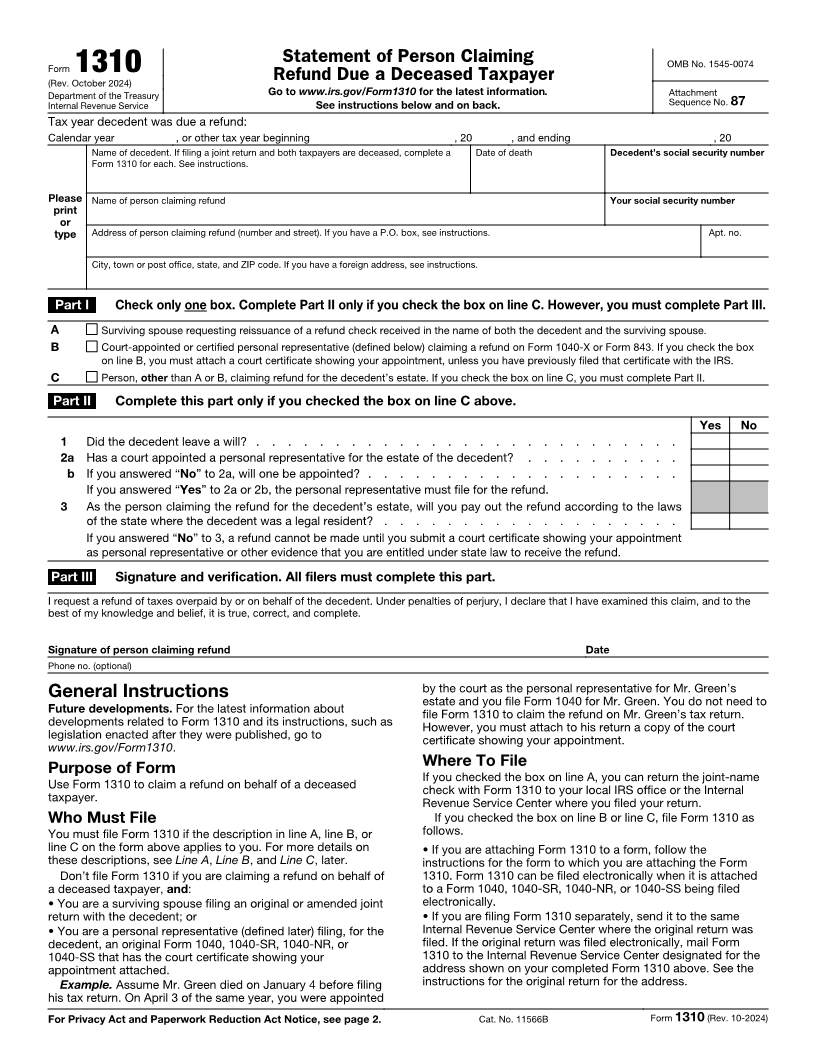

Statement of Person Claiming OMB No. 1545-0074

Form 1310 Refund Due a Deceased Taxpayer

(Rev. October 2024)

Department of the Treasury Go to www.irs.gov/Form1310 for the latest information . Attachment

Internal Revenue Service See instructions below and on back. Sequence No. 87

Tax year decedent was due a refund:

Calendar year , or other tax year beginning , 20 , and ending , 20

Name of decedent. If filing a joint return and both taxpayers are deceased, complete a Date of death Decedent’s social security number

Form 1310 for each. See instructions.

Please Name of person claiming refund Your social security number

print

or

type Address of person claiming refund (number and street). If you have a P.O. box, see instructions. Apt. no.

City, town or post office, state, and ZIP code. If you have a foreign address, see instructions.

Part I Check only one box. Complete Part II only if you check the box on line C. However, you must complete Part III.

A Surviving spouse requesting reissuance of a refund check received in the name of both the decedent and the surviving spouse.

B Court-appointed or certified personal representative (defined below) claiming a refund on Form 1040-X or Form 843. If you check the box

on line B, you must attach a court certificate showing your appointment, unless you have previously filed that certificate with the IRS.

C Person, other than A or B, claiming refund for the decedent’s estate. If you check the box on line C, you must complete Part II.

Part II Complete this part only if you checked the box on line C above.

Yes No

1 Did the decedent leave a will? . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 a Has a court appointed a personal representative for the estate of the decedent? . . . . . . . . . .

b If you answered “No” to 2a, will one be appointed? . . . . . . . . . . . . . . . . . . . .

If you answered “Yes” to 2a or 2b, the personal representative must file for the refund.

3 As the person claiming the refund for the decedent’s estate, will you pay out the refund according to the laws

of the state where the decedent was a legal resident? . . . . . . . . . . . . . . . . . . .

If you answered “No” to 3, a refund cannot be made until you submit a court certificate showing your appointment

as personal representative or other evidence that you are entitled under state law to receive the refund.

Part III Signature and verification. All filers must complete this part.

I request a refund of taxes overpaid by or on behalf of the decedent. Under penalties of perjury, I declare that I have examined this claim, and to the

best of my knowledge and belief, it is true, correct, and complete.

Signature of person claiming refund Date

Phone no. (optional)

General Instructions by the court as the personal representative for Mr. Green’s

estate and you file Form 1040 for Mr. Green. You do not need to

Future developments. For the latest information about file Form 1310 to claim the refund on Mr. Green’s tax return.

developments related to Form 1310 and its instructions, such as However, you must attach to his return a copy of the court

legislation enacted after they were published, go to certificate showing your appointment.

www.irs.gov/Form1310.

Where To File

Purpose of Form

If you checked the box on line A, you can return the joint-name

Use Form 1310 to claim a refund on behalf of a deceased check with Form 1310 to your local IRS office or the Internal

taxpayer. Revenue Service Center where you filed your return.

Who Must File If you checked the box on line B or line C, file Form 1310 as

You must file Form 1310 if the description in line A, line B, or follows.

line C on the form above applies to you. For more details on • If you are attaching Form 1310 to a form, follow the

these descriptions, see Line A ,Line B , and Line C, later. instructions for the form to which you are attaching the Form

Don’t file Form 1310 if you are claiming a refund on behalf of 1310. Form 1310 can be filed electronically when it is attached

a deceased taxpayer, and: to a Form 1040, 1040-SR, 1040-NR, or 1040-SS being filed

• You are a surviving spouse filing an original or amended joint electronically.

return with the decedent; or • If you are filing Form 1310 separately, send it to the same

• You are a personal representative (defined later) filing, for the Internal Revenue Service Center where the original return was

decedent, an original Form 1040, 1040-SR, 1040-NR, or filed. If the original return was filed electronically, mail Form

1040-SS that has the court certificate showing your 1310 to the Internal Revenue Service Center designated for the

appointment attached. address shown on your completed Form 1310 above. See the

Example. Assume Mr. Green died on January 4 before filing instructions for the original return for the address.

his tax return. On April 3 of the same year, you were appointed

For Privacy Act and Paperwork Reduction Act Notice, see page 2. Cat. No. 11566B Form 1310 (Rev. 10-2024)