Enlarge image

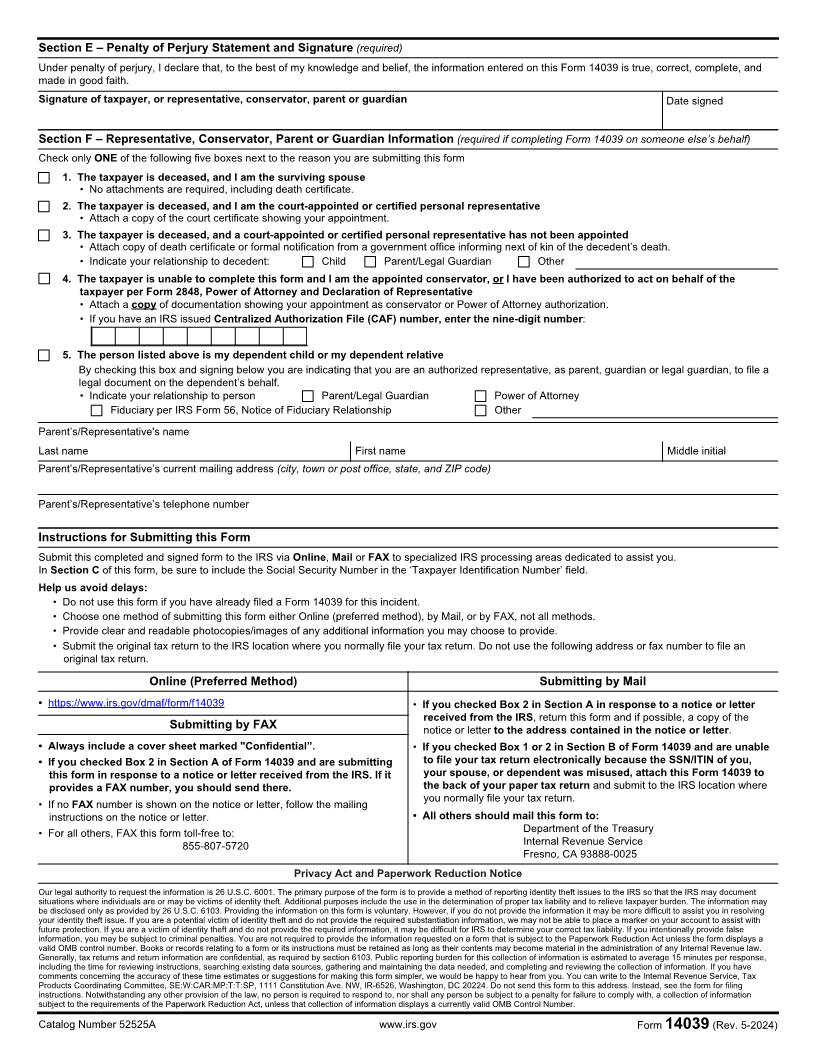

Department of the Treasury - Internal Revenue Service OMB Number

Form 14039 1545-2139

(May 2024) Identity Theft Affidavit

This affidavit is for victims of identity theft. To avoid delays do not use this form if you have already filed a Form 14039 for this incident.

Form 14039 can also be completed online at https://www.irs.gov/dmaf/form/f14039.

The IRS process for assisting victims selecting Section B ,Box 1 below is explained at irs.gov/victimassistance.

Get an IP PIN: We encourage everyone to opt-in to the Identity Protection Personal Identification Number (IP PIN) program. If you don’t have an IP PIN, you

can get one by going to irs.gov/ippin. If unable to do so online, you may schedule an appointment at your closest Taxpayer Assistance Center by calling

(844-545-5640). Or, if eligible, you may use IRS Form 15227 to apply for an IP PIN by mail or FAX, also available by going to irs.gov/ippin.

Section A - Check the following boxes in this section that apply to the specific situation you are reporting (required for all filers)

1. I am submitting this Form 14039 for myself

2. I am submitting this Form 14039 in response to an IRS Notice or Letter received

• Provide ‘Notice’ or ‘Letter’ number(s) on the line to the right

• Check box 1 in Section B and see special mailing and faxing instructions on reverse side of this form.

3. I am submitting this Form 14039 on behalf of my dependent child or dependent relative (include that person’s information below in Section C and D)

• Complete Sections A-F of this form. Do not use this form If dependent’s identity was misused by a parent or guardian in filing taxes, this is not

identity theft.

4. I am submitting this Form 14039 on behalf of another person living or deceased (other than my dependent child or dependent relative)

• Complete Sections A- F of this form.

Section B – How I Am Impacted (required when reporting misuse of Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN))

Check all boxes that apply to the person listed in Section C below. If the person in Section C has previously submitted a Form 14039 for the same incident,

there’s no need to submit another Form 14039.

1. I know or suspect that someone used my information to fraudulently file a federal tax return

I/My dependent was fraudulently/incorrectly claimed as a dependent (use that person’s information for Section C & D)

My SSN or ITIN was fraudulently used for employment purposes

Note: If you are a victim of Identity theft but it does not involve your federal tax return, you should request an IP PIN to protect yourself. Get An Identity

Protection PIN | Internal Revenue Service (irs.gov)

Provide an explanation of the identity theft issue, how it impacts your tax account, when you became aware of it and provide relevant dates. If needed,

attach additional information and/or pages to this form

Section C – Name and Contact Information of Identity Theft Victim (required)

Victim’s last name First name Middle Taxpayer Identification Number

initial (provide 9-digit SSN or ITIN)

Current mailing address (apartment or suite number and street, or P.O. Box) Current city State ZIP code

If deceased, provide last known address

-

Address used on last filed tax return (if different than ‘Current’) City (on last tax return filed) State ZIP code

-

Telephone number with area code. The IRS may call you regarding this affidavit Best time(s) to call

Home phone number Cell phone number

Language in which you would like to be contacted English Spanish Other

Section D – Tax Account Information: Last tax return filed (year shown on the tax return) and Returns Impacted

I was not required to file a return or filed a return with no income information

Names used on last filed tax return The last tax return filed (year shown on the tax return)

What Tax Year(s) you believe were impacted by tax-related identity theft (example: 2020 is input for citing the 2020 tax return though filed the next

year(s). (if not known, enter ‘Unknown’ below))

Submit this completed form to either the mailing address or the FAX number provided on the reverse side of this form.

Catalog Number 52525A www.irs.gov Form 14039 (Rev. 5-2024)