Enlarge image

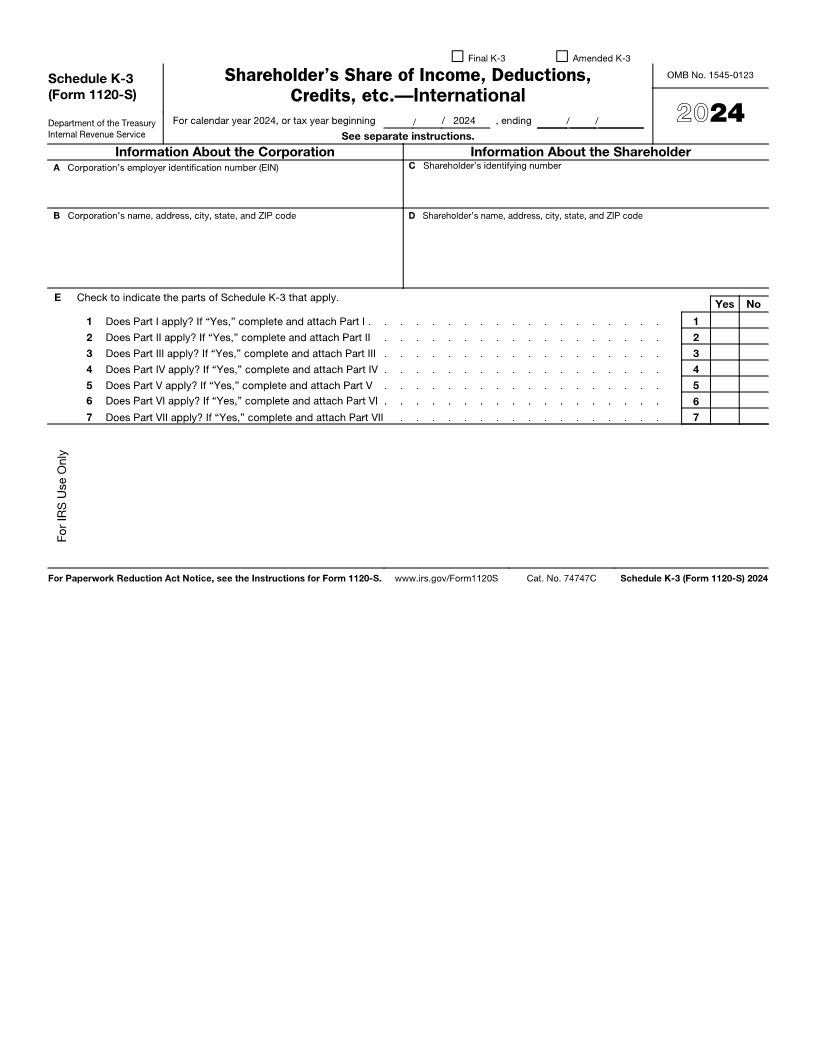

Final K-3 Amended K-3

Schedule K-3 Shareholder’s Share of Income, Deductions, OMB No. 1545-0123

(Form 1120-S) Credits, etc.—International

Department of the Treasury For calendar year 2024, or tax year beginning / / 2024 , ending / / 2024

Internal Revenue Service See separate instructions.

Information About the Corporation Information About the Shareholder

A Corporation’s employer identification number (EIN) C Shareholder’s identifying number

B Corporation’s name, address, city, state, and ZIP code D Shareholder’s name, address, city, state, and ZIP code

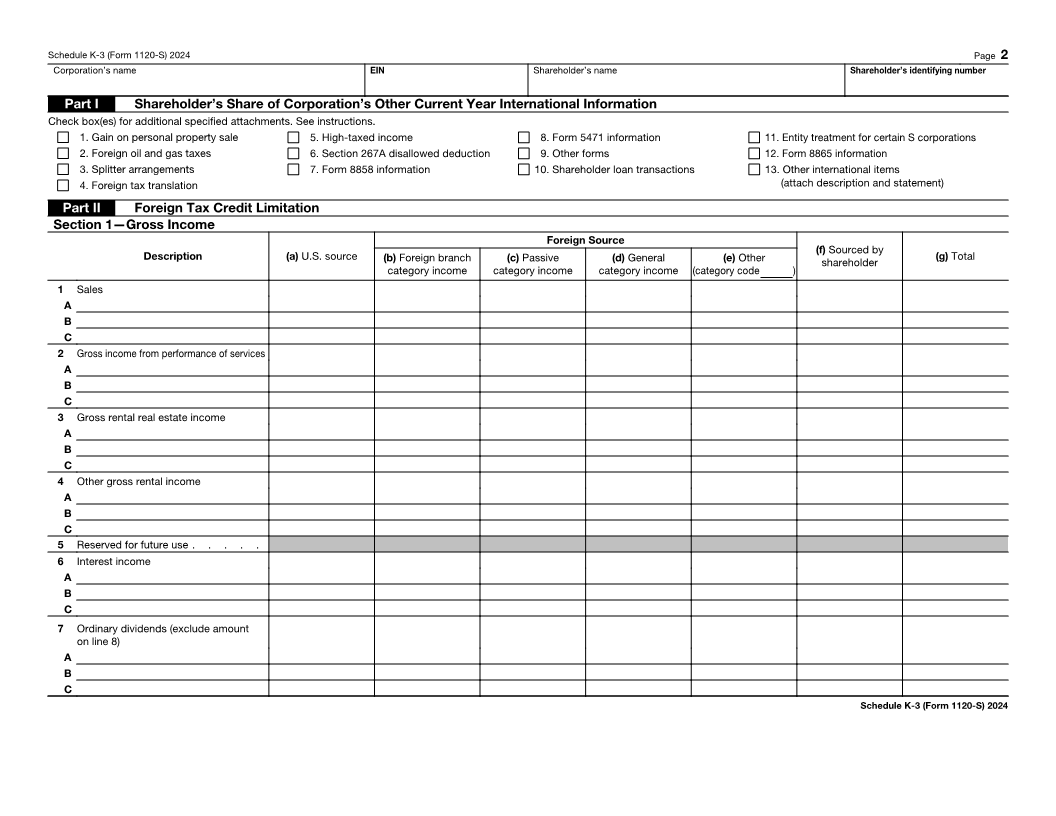

E Check to indicate the parts of Schedule K-3 that apply.

Yes No

1 Does Part I apply? If “Yes,” complete and attach Part I . . . . . . . . . . . . . . . . . . . 1

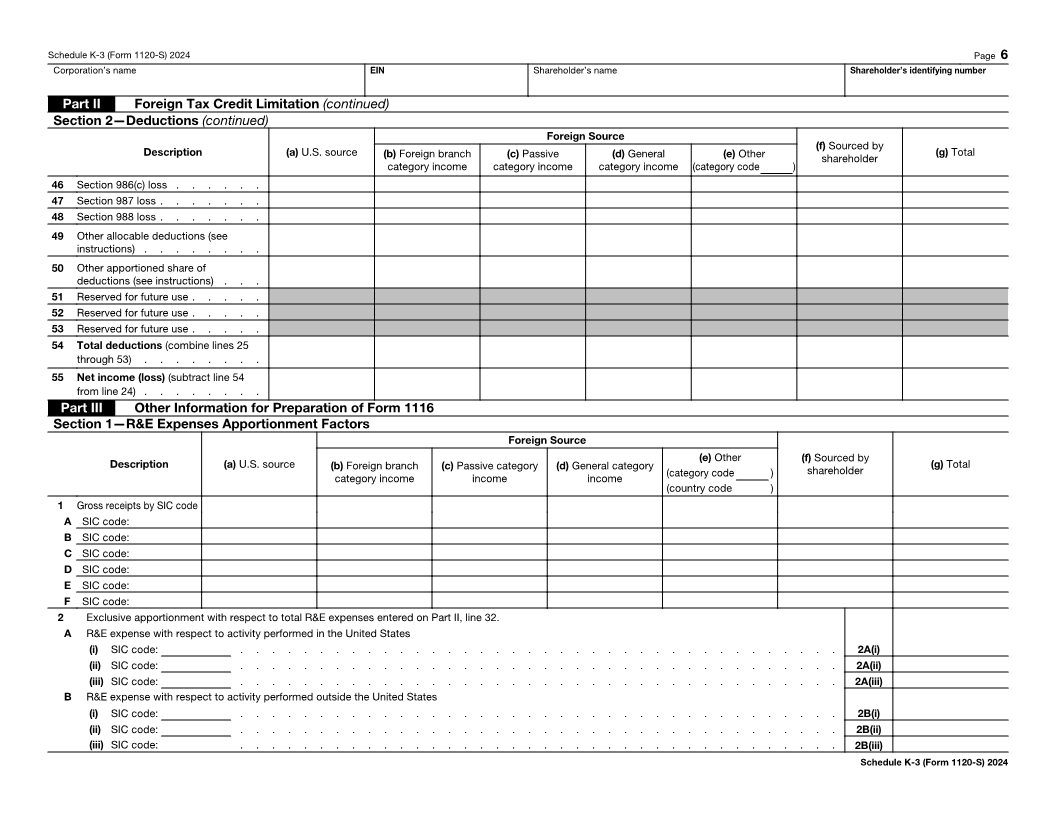

2 Does Part II apply? If “Yes,” complete and attach Part II . . . . . . . . . . . . . . . . . . 2

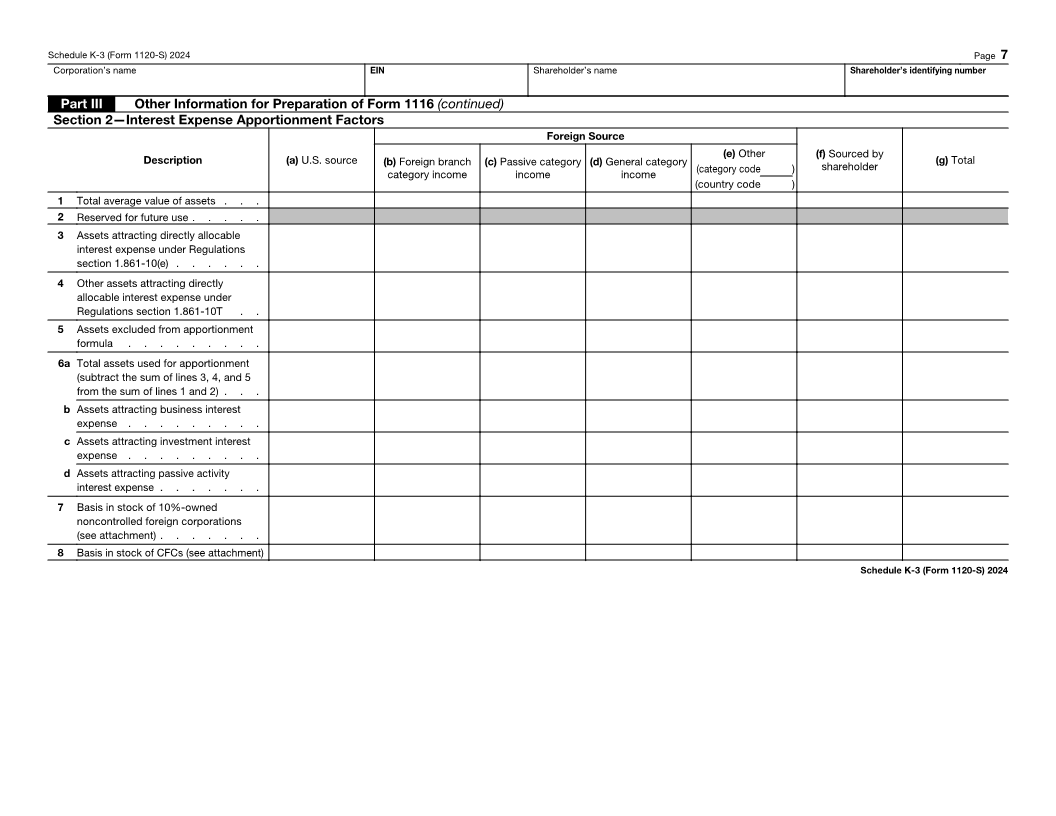

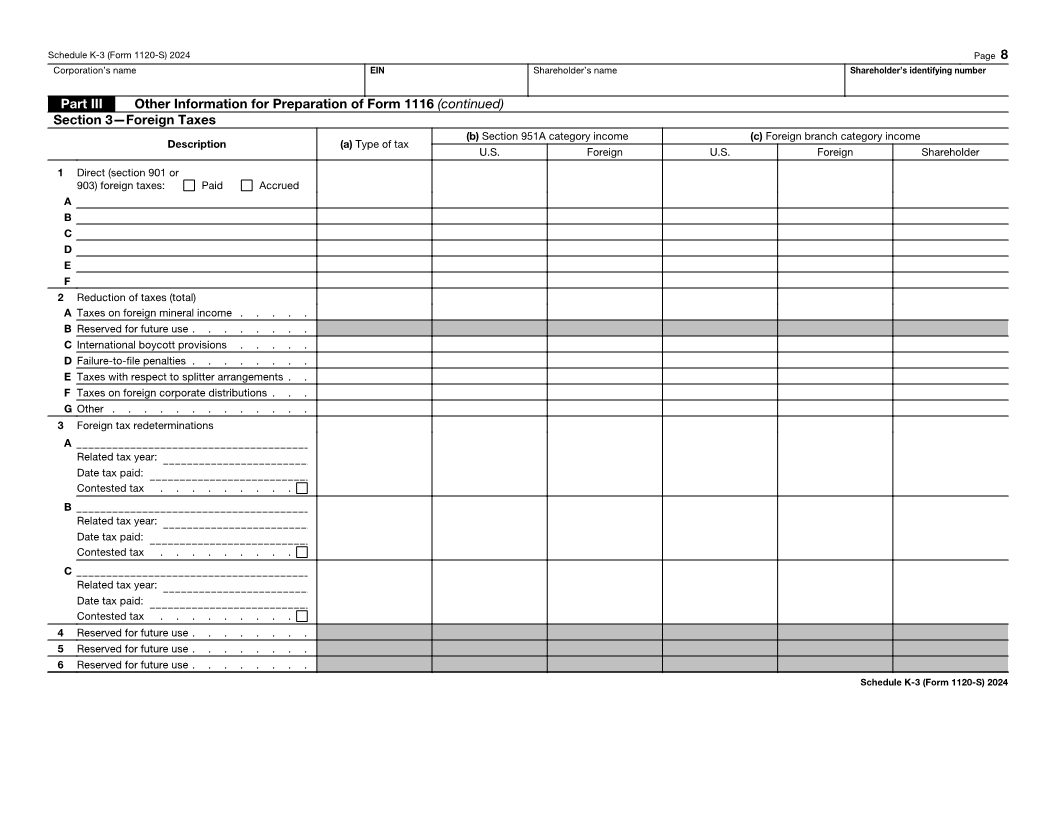

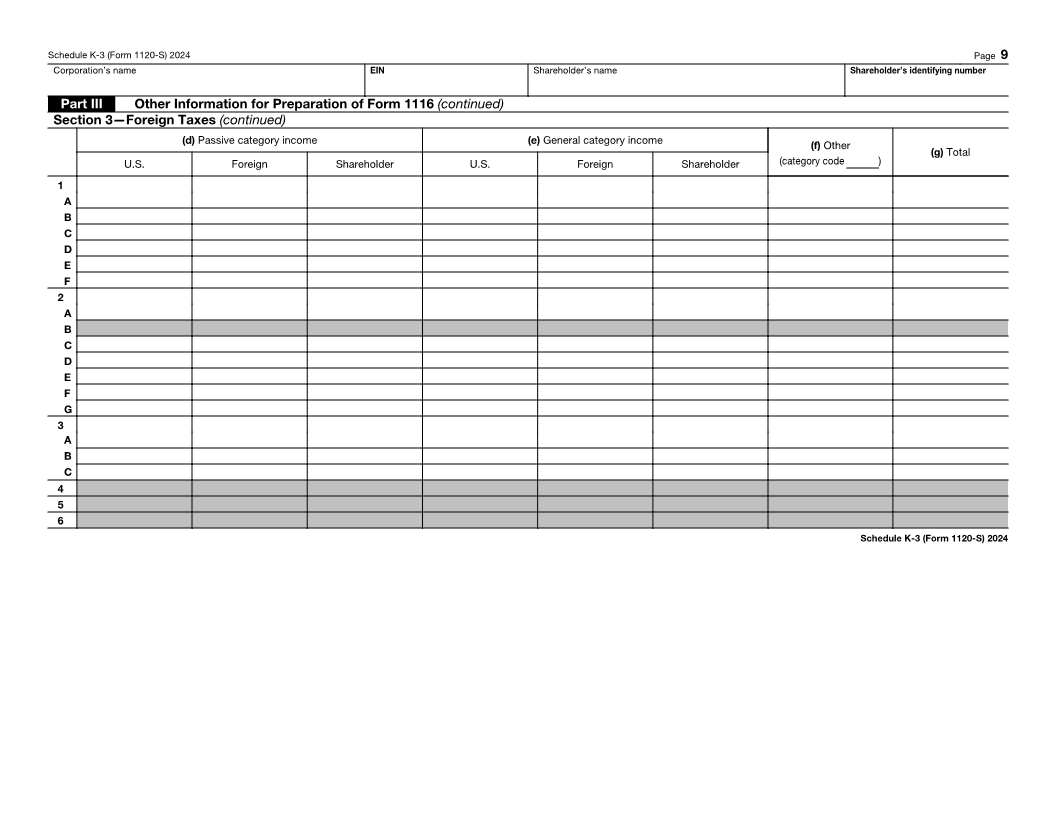

3 Does Part III apply? If “Yes,” complete and attach Part III . . . . . . . . . . . . . . . . . . 3

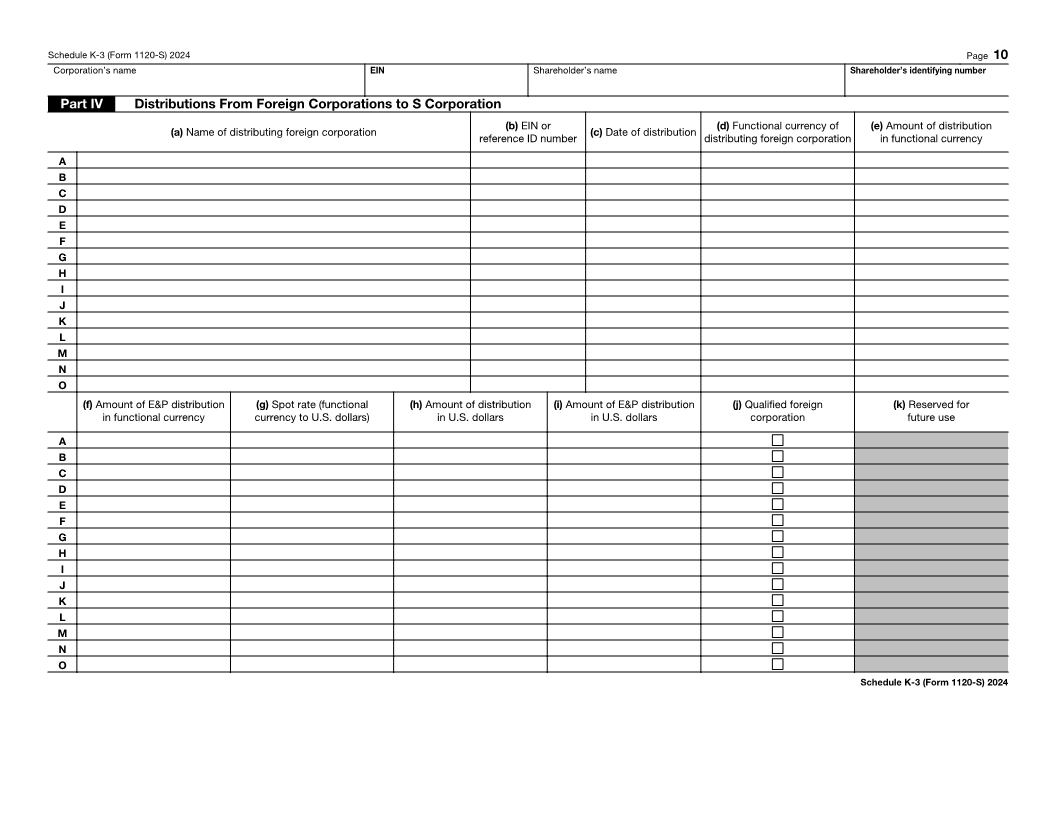

4 Does Part IV apply? If “Yes,” complete and attach Part IV . . . . . . . . . . . . . . . . . . 4

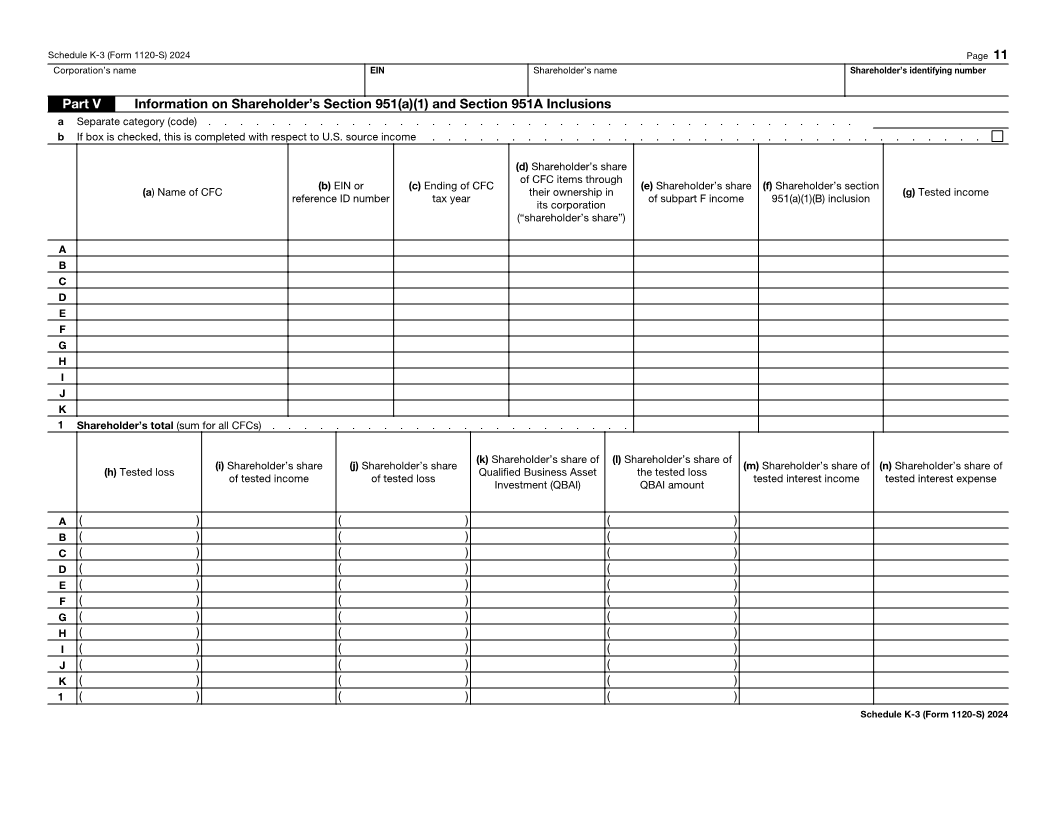

5 Does Part V apply? If “Yes,” complete and attach Part V . . . . . . . . . . . . . . . . . . 5

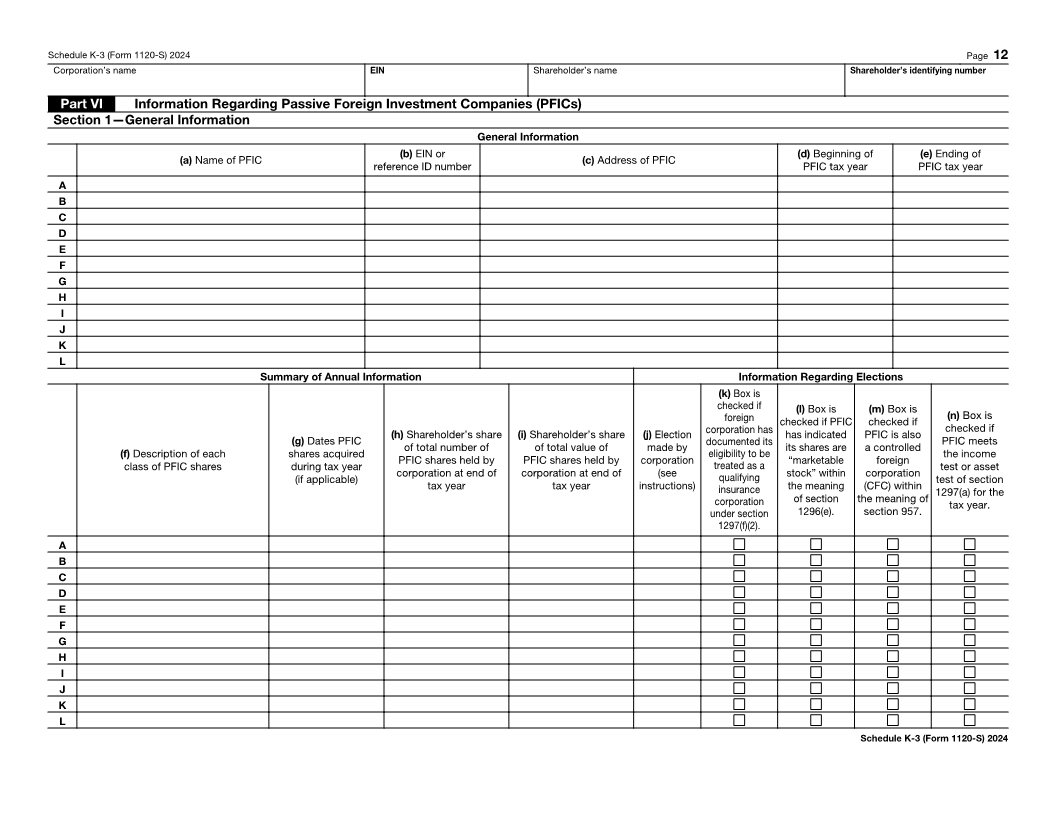

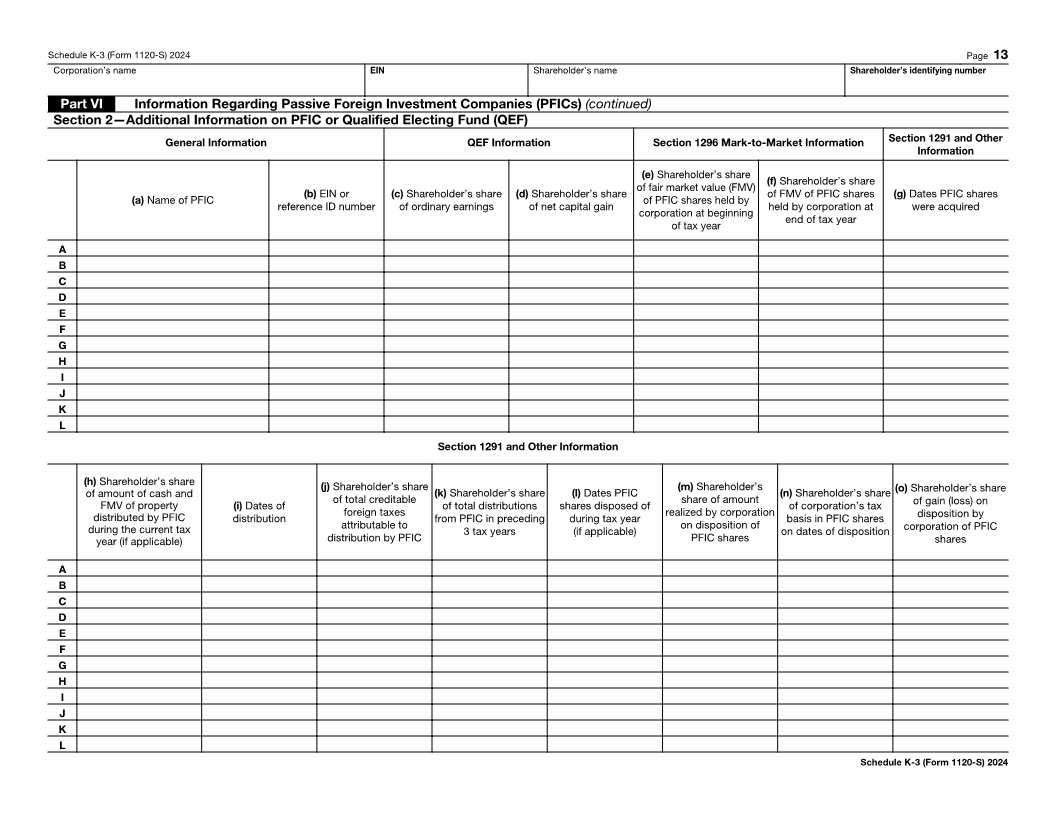

6 Does Part VI apply? If “Yes,” complete and attach Part VI . . . . . . . . . . . . . . . . . . 6

7 Does Part VII apply? If “Yes,” complete and attach Part VII . . . . . . . . . . . . . . . . . 7

For IRS Use Only

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-S. www.irs.gov/Form1120S Cat. No. 74747C Schedule K-3 (Form 1120-S) 2024