Enlarge image

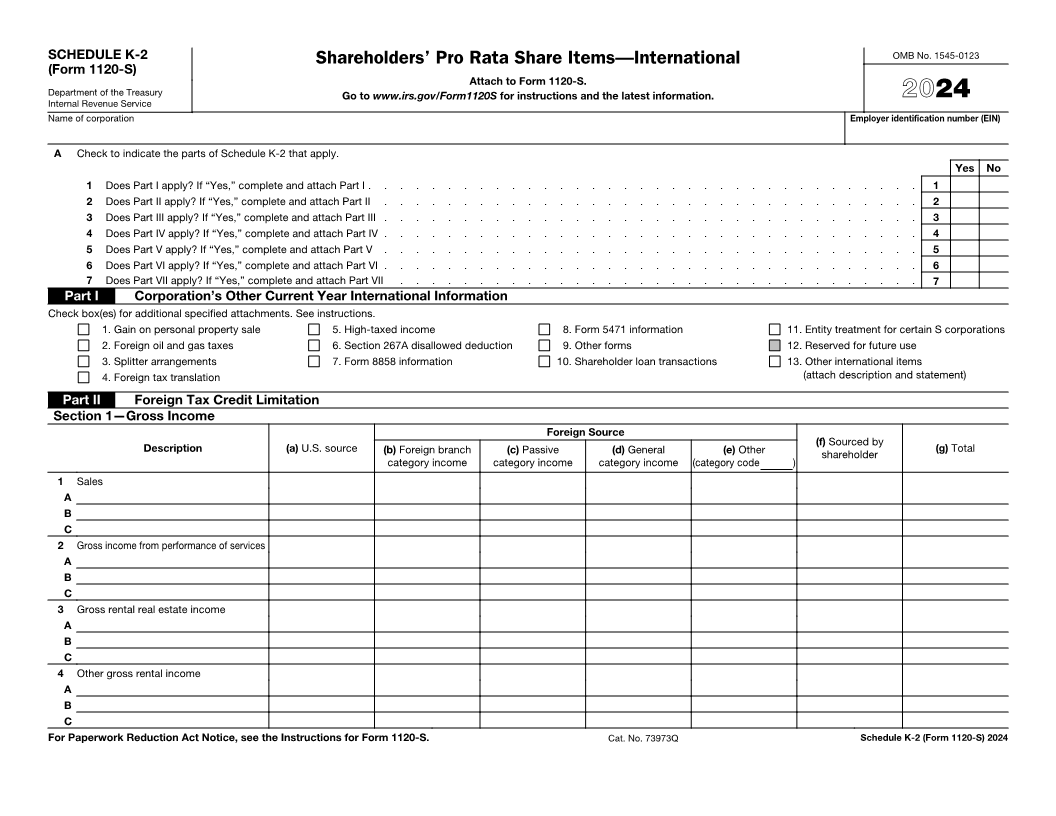

OMB No. 1545-0123

SCHEDULE K-2 Shareholders’ Pro Rata Share Items—International

(Form 1120-S)

Attach to Form 1120-S.

Department of the Treasury Go to www.irs.gov/Form1120S for instructions and the latest information. 2024

Internal Revenue Service

Name of corporation Employer identification number (EIN)

A Check to indicate the parts of Schedule K-2 that apply.

Yes No

1 Does Part I apply? If “Yes,” complete and attach Part I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Does Part II apply? If “Yes,” complete and attach Part II . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Does Part III apply? If “Yes,” complete and attach Part III . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Does Part IV apply? If “Yes,” complete and attach Part IV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

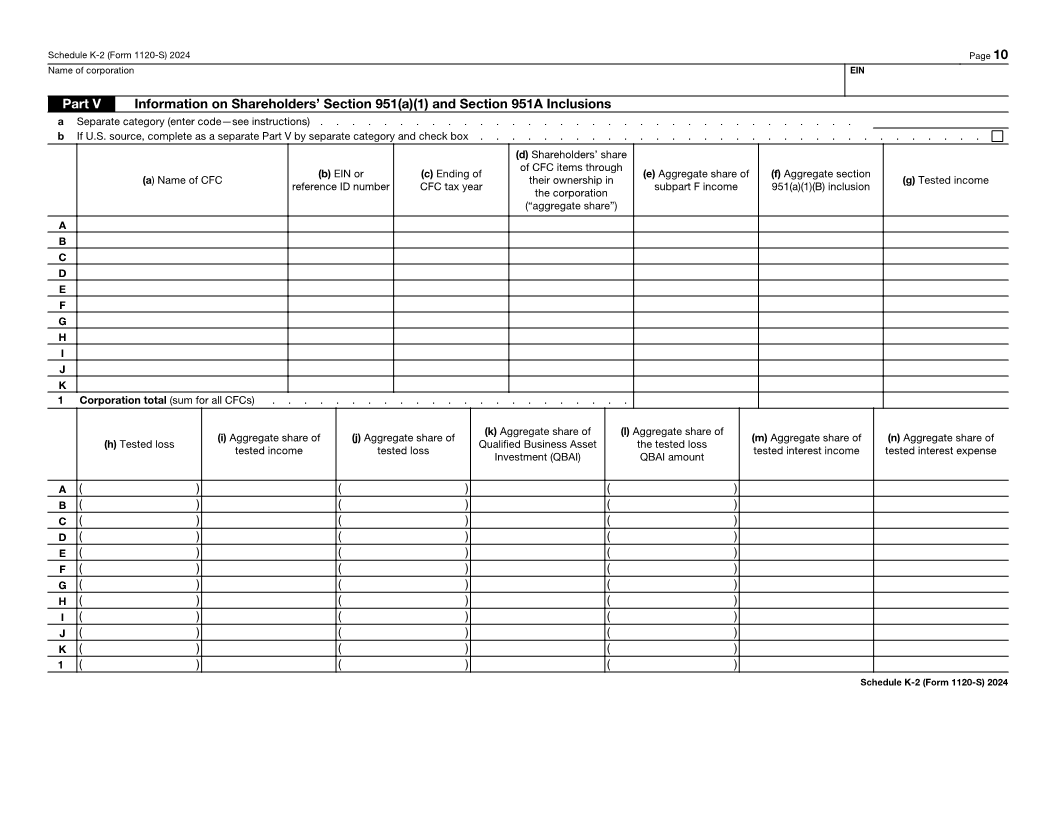

5 Does Part V apply? If “Yes,” complete and attach Part V . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

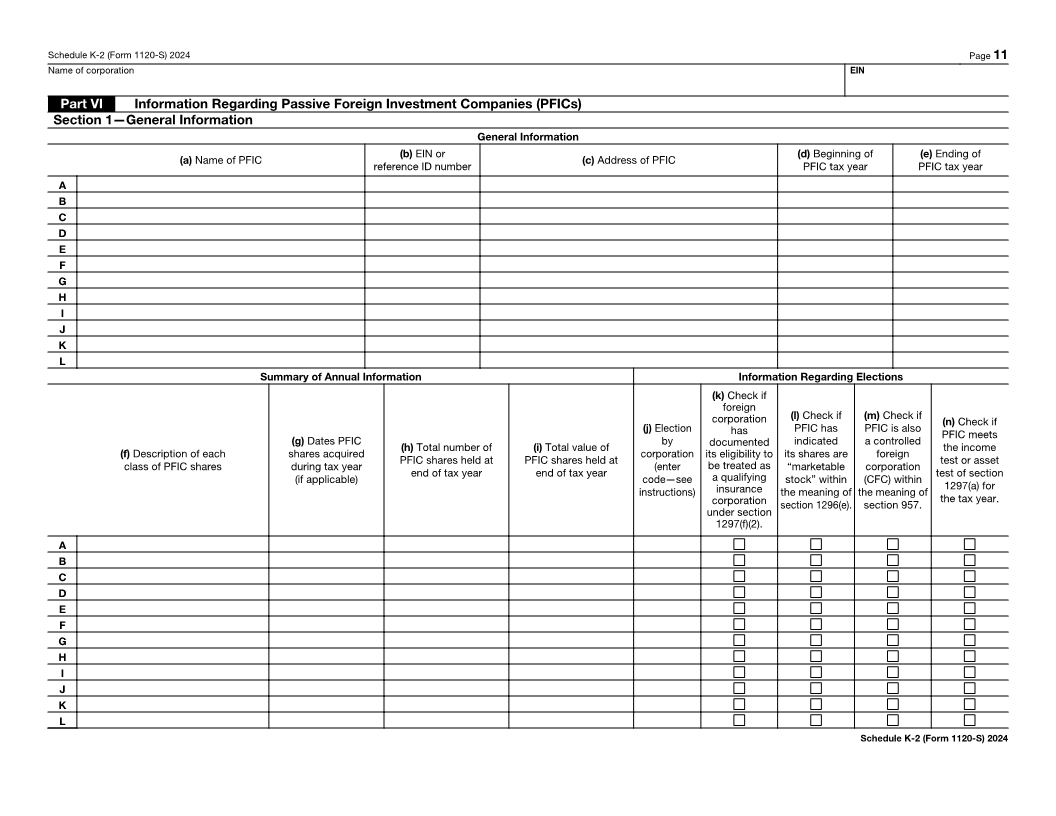

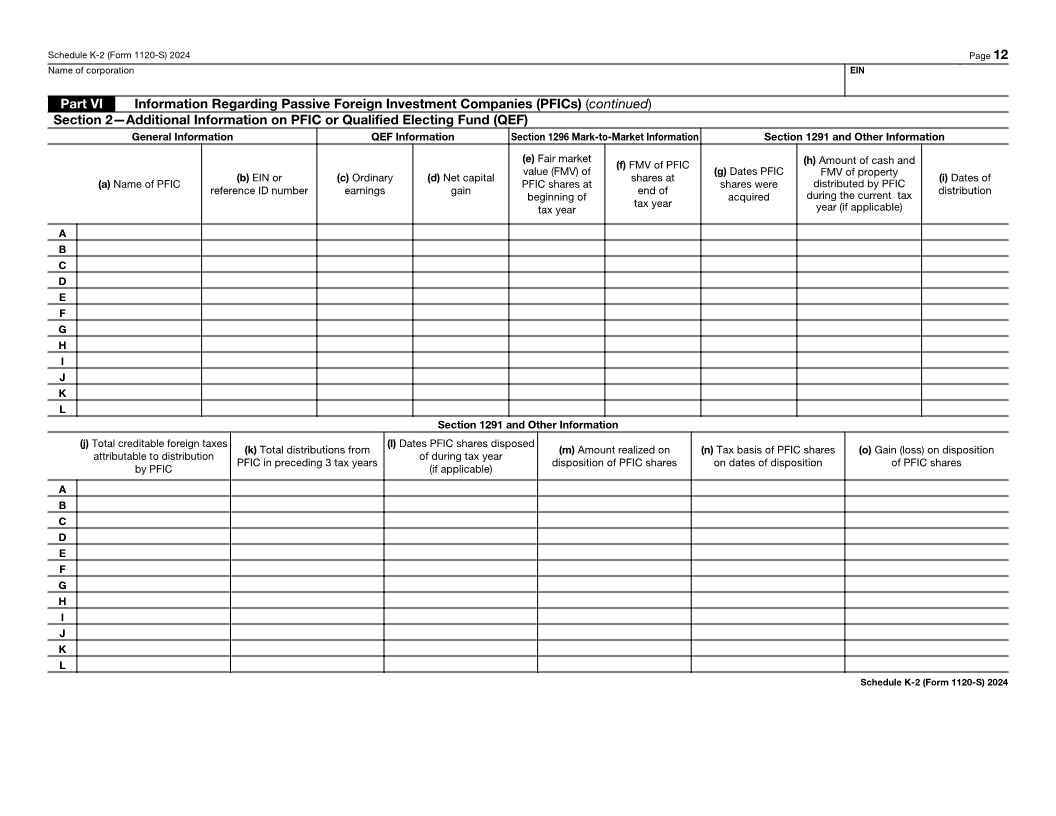

6 Does Part VI apply? If “Yes,” complete and attach Part VI . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

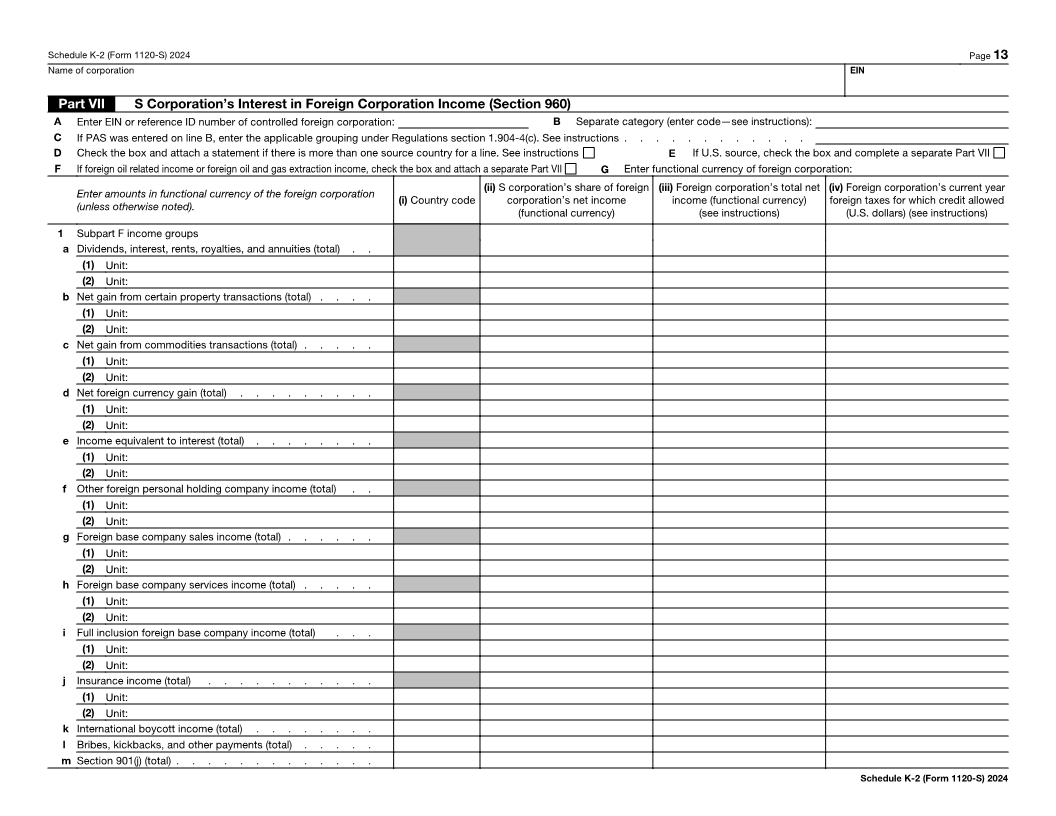

7 Does Part VII apply? If “Yes,” complete and attach Part VII . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Part I Corporation’s Other Current Year International Information

Check box(es) for additional specified attachments. See instructions.

1. Gain on personal property sale 5. High-taxed income 8. Form 5471 information 11. Entity treatment for certain S corporations

2. Foreign oil and gas taxes 6. Section 267A disallowed deduction 9. Other forms 12. Reserved for future use

✣❈❅❃❋ ✢❏❘

3. Splitter arrangements 7. Form 8858 information 10. Shareholder loan transactions 13. Other international items

4. Foreign tax translation (attach description and statement)

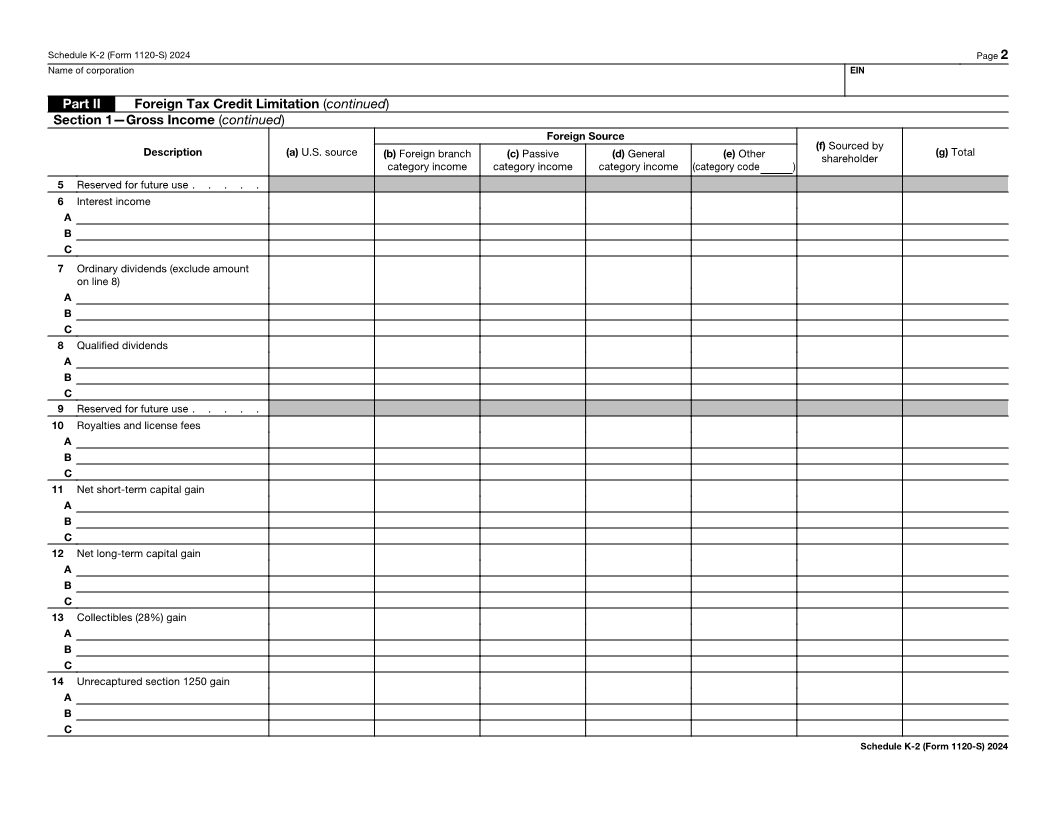

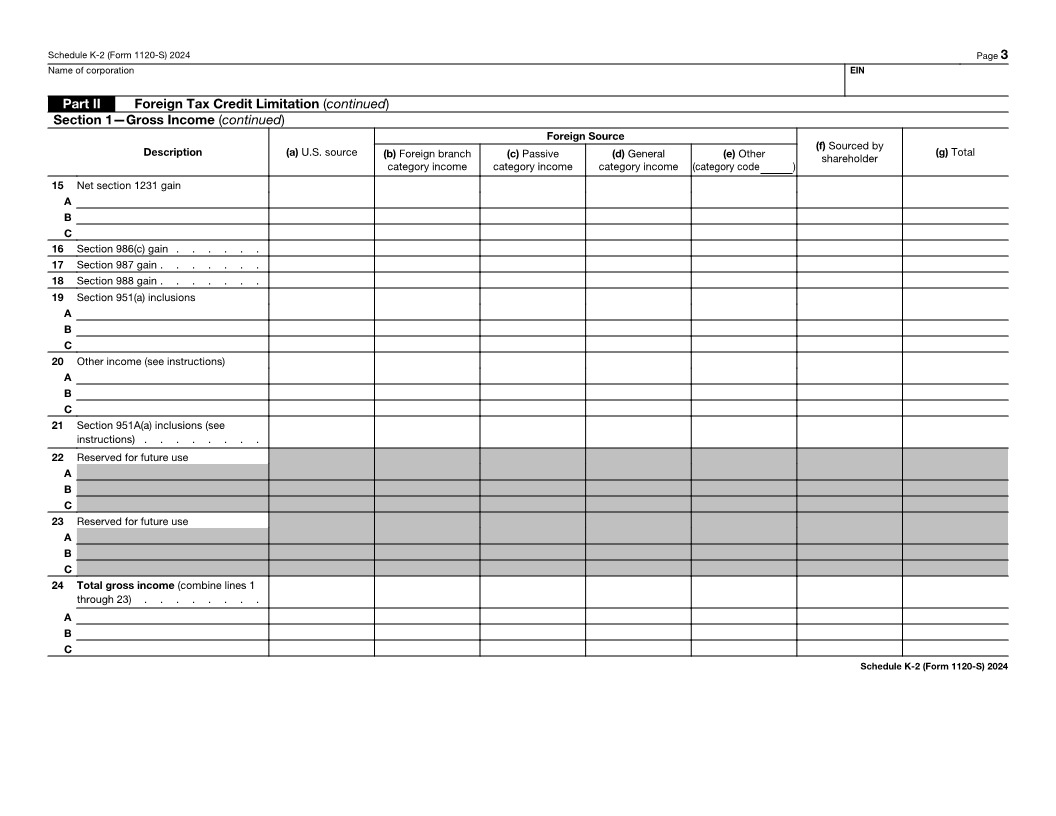

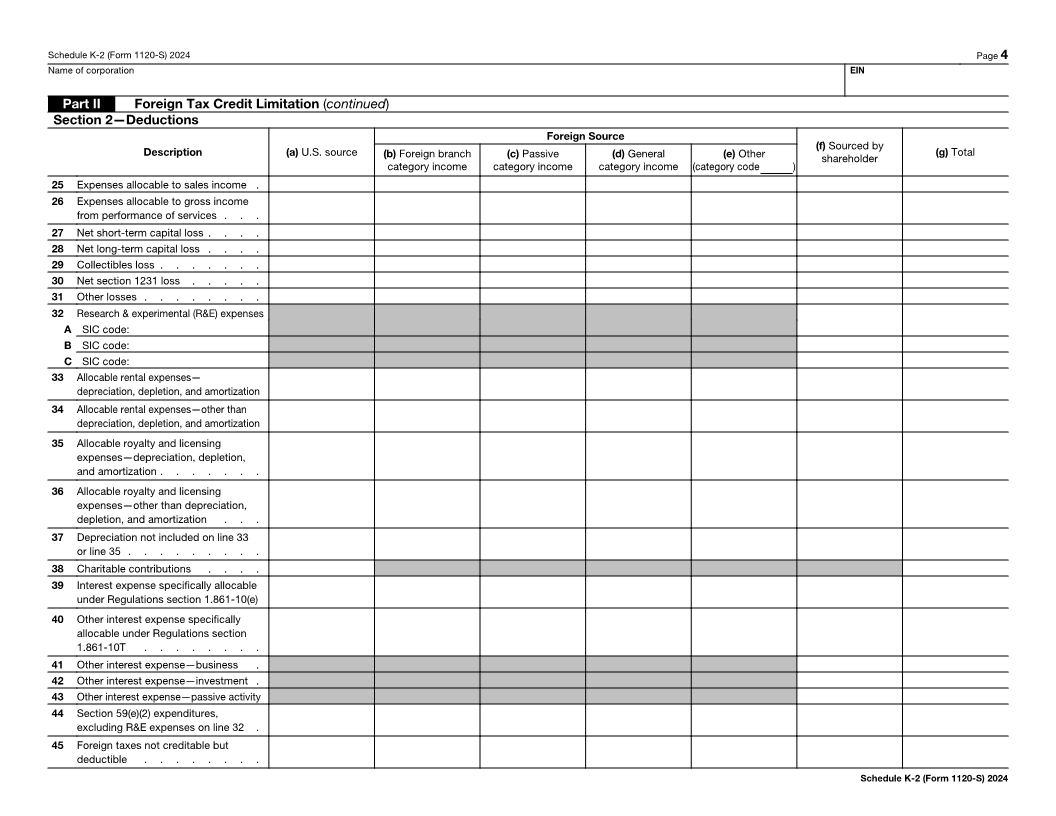

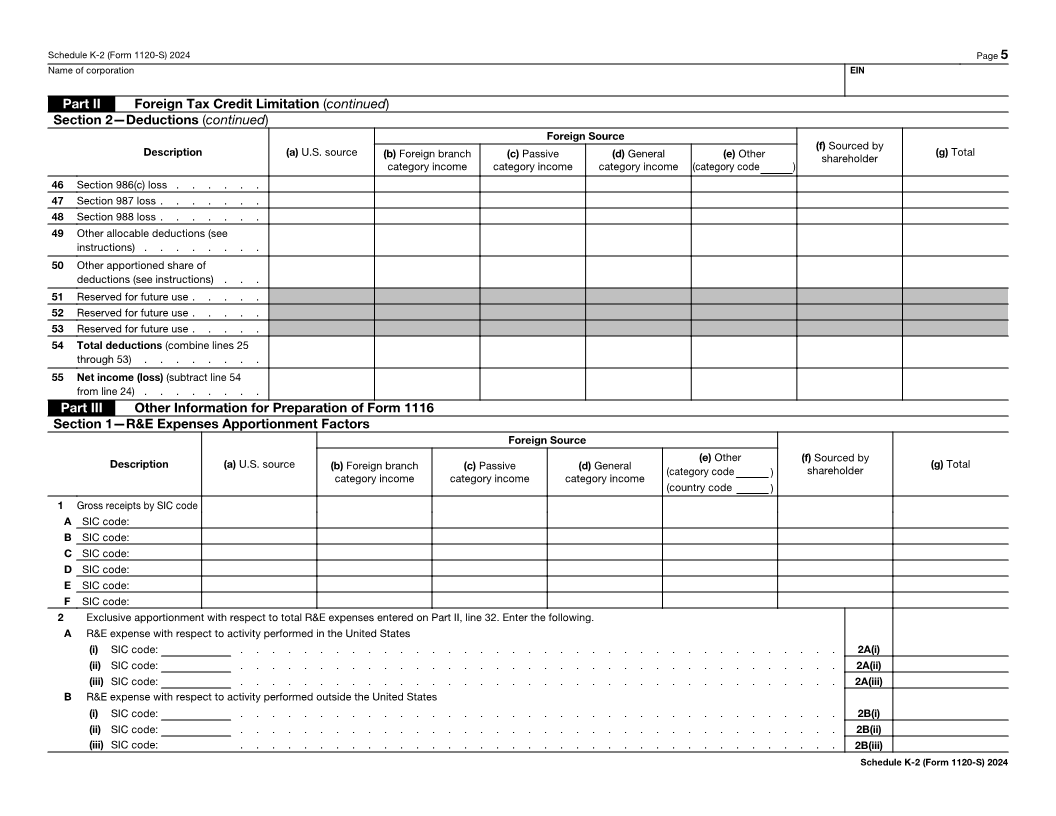

Part II Foreign Tax Credit Limitation

Section 1—Gross Income

Foreign Source

Description (a) U.S. source (b) Foreign branch (c) Passive (d) General (e) Other (f) Sourced by (g) Total

shareholder

category income category income category income (category code )

1 Sales

A

B

C

2 Gross income from performance of services

A

B

C

3 Gross rental real estate income

A

B

C

4 Other gross rental income

A

B

C

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-S. Cat. No. 73973Q Schedule K-2 (Form 1120-S) 2024