Enlarge image

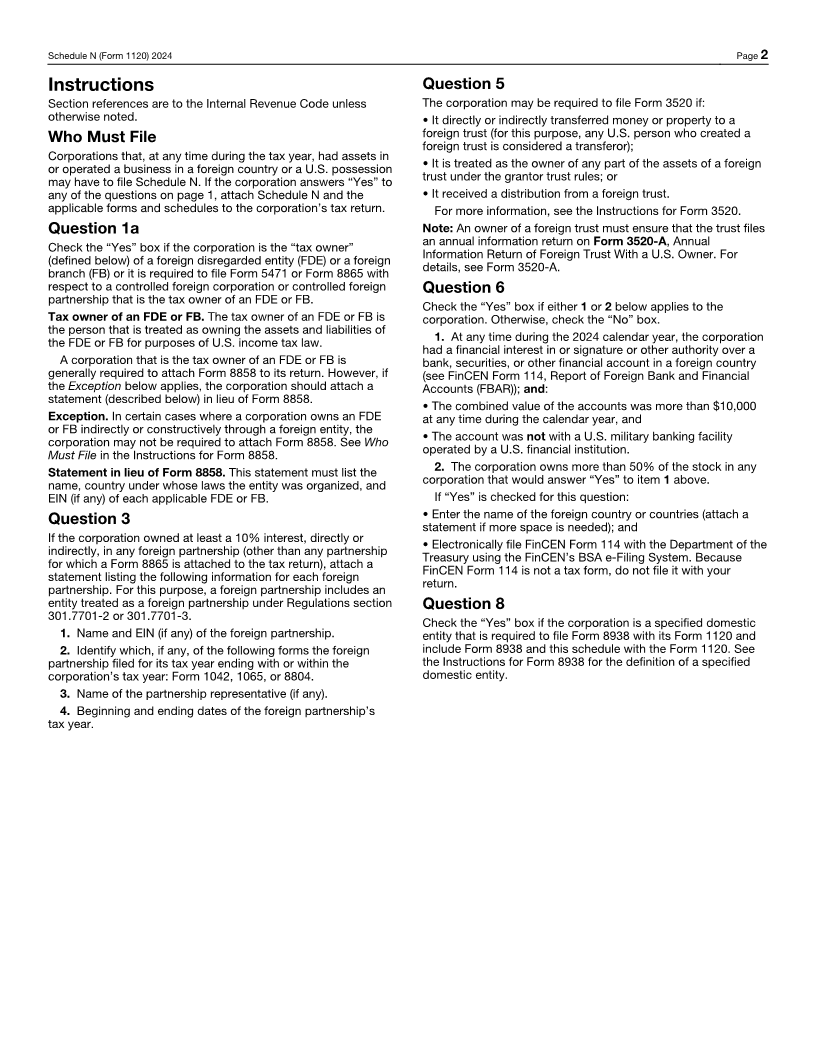

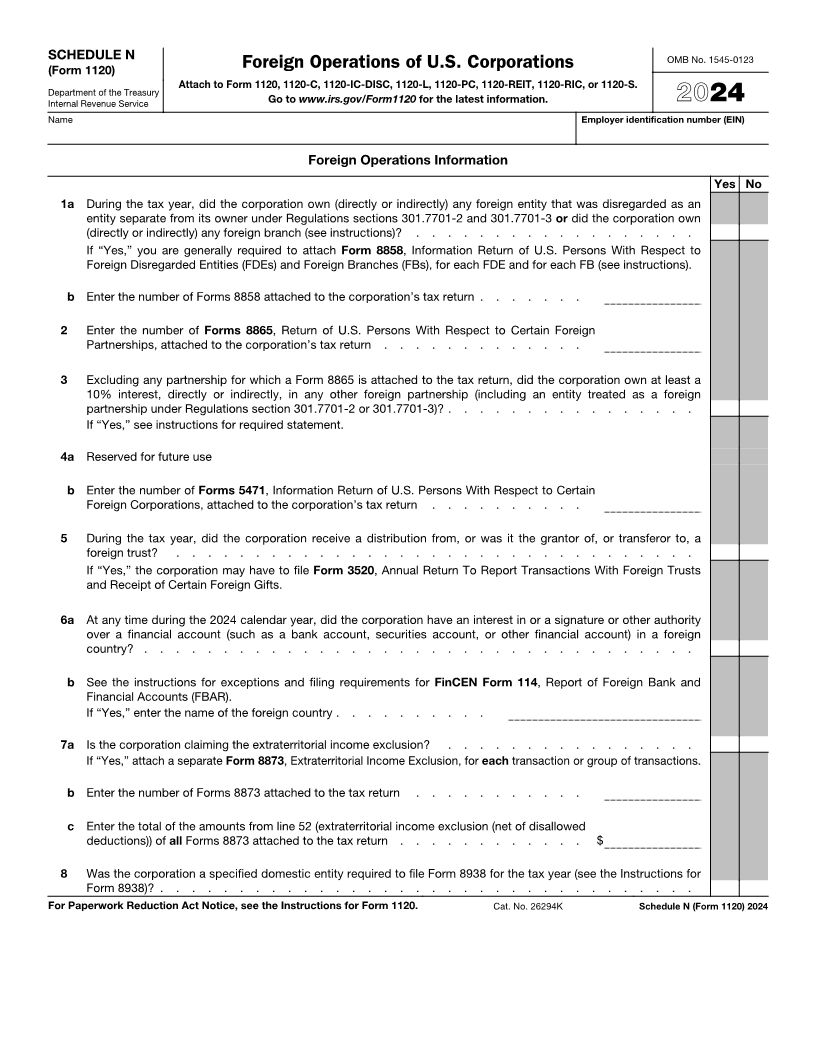

SCHEDULE N OMB No. 1545-0123

(Form 1120) Foreign Operations of U.S. Corporations

Attach to Form 1120, 1120-C, 1120-IC-DISC, 1120-L, 1120-PC, 1120-REIT, 1120-RIC, or 1120-S.

Department of the Treasury

Internal Revenue Service Go to www.irs.gov/Form1120 for the latest information. 2024

Name Employer identification number (EIN)

Foreign Operations Information

Yes No

1 a During the tax year, did the corporation own (directly or indirectly) any foreign entity that was disregarded as an

entity separate from its owner under Regulations sections 301.7701-2 and 301.7701-3 or did the corporation own

(directly or indirectly) any foreign branch (see instructions)? . . . . . . . . . . . . . . . . . .

If “Yes,” you are generally required to attach Form 8858, Information Return of U.S. Persons With Respect to

Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs), for each FDE and for each FB (see instructions).

b Enter the number of Forms 8858 attached to the corporation’s tax return . . . . . . .

2 Enter the number of Forms 8865, Return of U.S. Persons With Respect to Certain Foreign

Partnerships, attached to the corporation’s tax return . . . . . . . . . . . . .

3 Excluding any partnership for which a Form 8865 is attached to the tax return, did the corporation own at least a

10% interest, directly or indirectly, in any other foreign partnership (including an entity treated as a foreign

partnership under Regulations section 301.7701-2 or 301.7701-3)? . . . . . . . . . . . . . . . .

If “Yes,” see instructions for required statement.

4a Reserved for future use

b Enter the number of Forms 5471, Information Return of U.S. Persons With Respect to Certain

Foreign Corporations, attached to the corporation’s tax return . . . . . . . . . .

5 During the tax year, did the corporation receive a distribution from, or was it the grantor of, or transferor to, a

foreign trust? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If “Yes,” the corporation may have to file Form 3520, Annual Return To Report Transactions With Foreign Trusts

and Receipt of Certain Foreign Gifts.

6 a At any time during the 2024 calendar year, did the corporation have an interest in or a signature or other authority

over a financial account (such as a bank account, securities account, or other financial account) in a foreign

country? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b See the instructions for exceptions and filing requirements for FinCEN Form 114, Report of Foreign Bank and

Financial Accounts (FBAR).

If “Yes,” enter the name of the foreign country . . . . . . . . . .

7a Is the corporation claiming the extraterritorial income exclusion? . . . . . . . . . . . . . . . .

If “Yes,” attach a separate Form 8873, Extraterritorial Income Exclusion, for each transaction or group of transactions.

b Enter the number of Forms 8873 attached to the tax return . . . . . . . . . . .

c Enter the total of the amounts from line 52 (extraterritorial income exclusion (net of disallowed

deductions)) of all Forms 8873 attached to the tax return . . . . . . . . . . . . $

8 Was the corporation a specified domestic entity required to file Form 8938 for the tax year (see the Instructions for

Form 8938)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

For Paperwork Reduction Act Notice, see the Instructions for Form 1120. Cat. No. 26294K Schedule N (Form 1120) 2024