Enlarge image

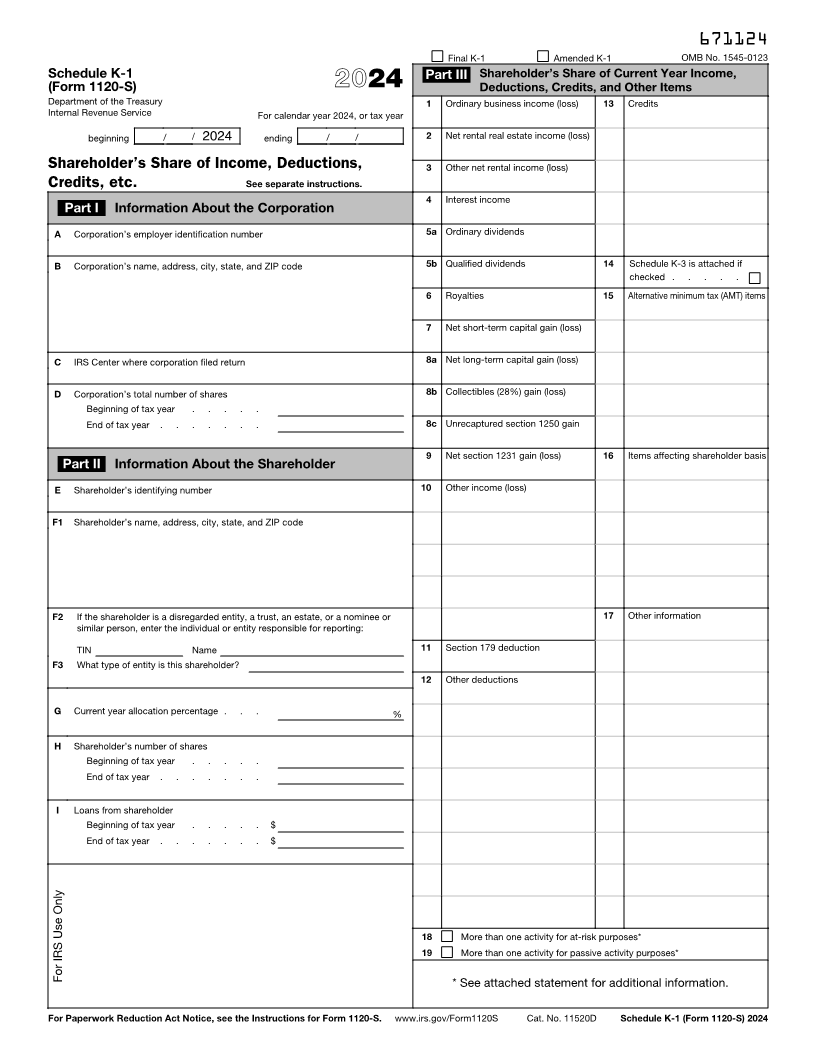

671124

Final K-1 Amended K-1 OMB No. 1545-0123

Schedule K-1 Part III Shareholder’s Share of Current Year Income,

(Form 1120-S) 2024 Deductions, Credits, and Other Items

Department of the Treasury 1 Ordinary business income (loss) 13 Credits

Internal Revenue Service For calendar year 2024, or tax year

beginning / / 2024 ending / / 2 Net rental real estate income (loss)

Shareholder’s Share of Income, Deductions, 3 Other net rental income (loss)

Credits, etc. See separate instructions.

4 Interest income

Part I Information About the Corporation

A Corporation’s employer identification number 5a Ordinary dividends

B Corporation’s name, address, city, state, and ZIP code 5b Qualified dividends 14 Schedule K-3 is attached if

checked . . . . .

6 Royalties 15 Alternative minimum tax (AMT) items

7 Net short-term capital gain (loss)

C IRS Center where corporation filed return 8a Net long-term capital gain (loss)

D Corporation’s total number of shares 8b Collectibles (28%) gain (loss)

Beginning of tax year . . . . .

End of tax year . . . . . . . 8c Unrecaptured section 1250 gain

9 Net section 1231 gain (loss) 16 Items affecting shareholder basis

Part II Information About the Shareholder

E Shareholder’s identifying number 10 Other income (loss)

F1 Shareholder’s name, address, city, state, and ZIP code

F2 If the shareholder is a disregarded entity, a trust, an estate, or a nominee or 17 Other information

similar person, enter the individual or entity responsible for reporting:

TIN Name 11 Section 179 deduction

F3 What type of entity is this shareholder?

12 Other deductions

G Current year allocation percentage . . . %

H Shareholder’s number of shares

Beginning of tax year . . . . .

End of tax year . . . . . . .

I Loans from shareholder

Beginning of tax year . . . . . $

End of tax year . . . . . . . $

18 More than one activity for at-risk purposes*

19 More than one activity for passive activity purposes*

For IRS Use Only

* See attached statement for additional information.

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-S. www.irs.gov/Form1120S Cat. No. 11520D Schedule K-1 (Form 1120-S) 2024