Enlarge image

Version A, Cycle 7

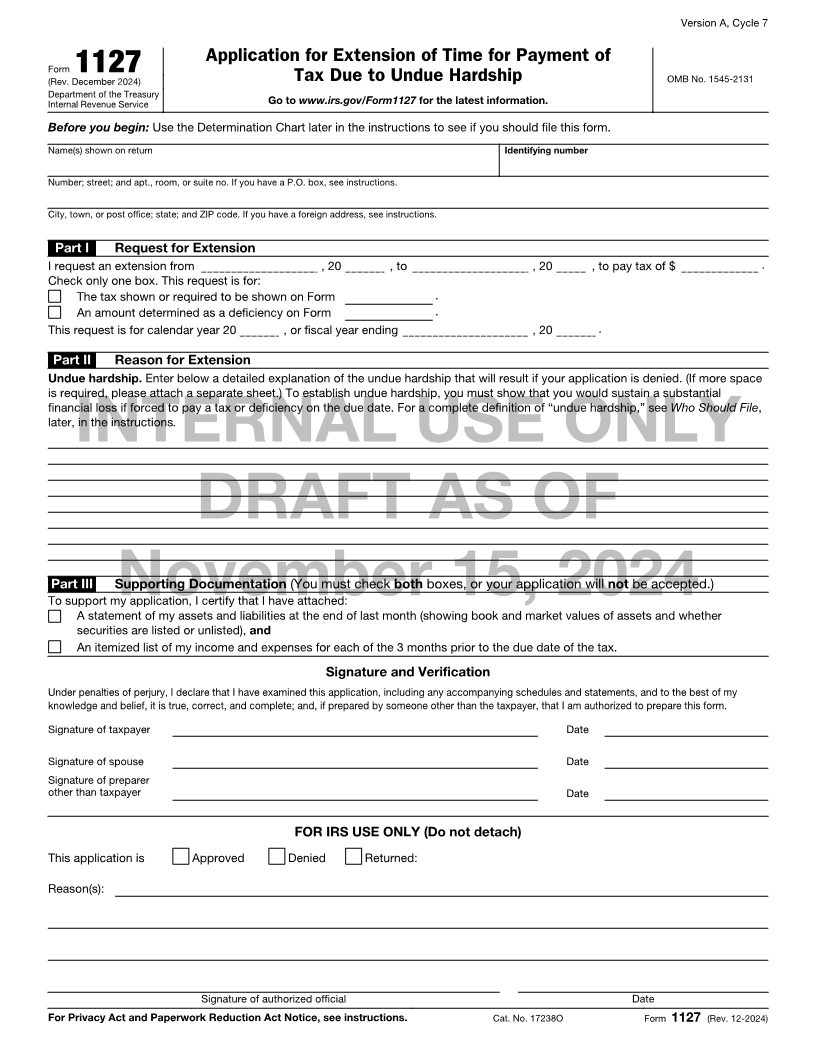

Application for Extension of Time for Payment of

Form 1127 Tax Due to Undue Hardship OMB No. 1545-2131

(Rev. December 2024)

Department of the Treasury

Internal Revenue Service Go to www.irs.gov/Form1127 for the latest information.

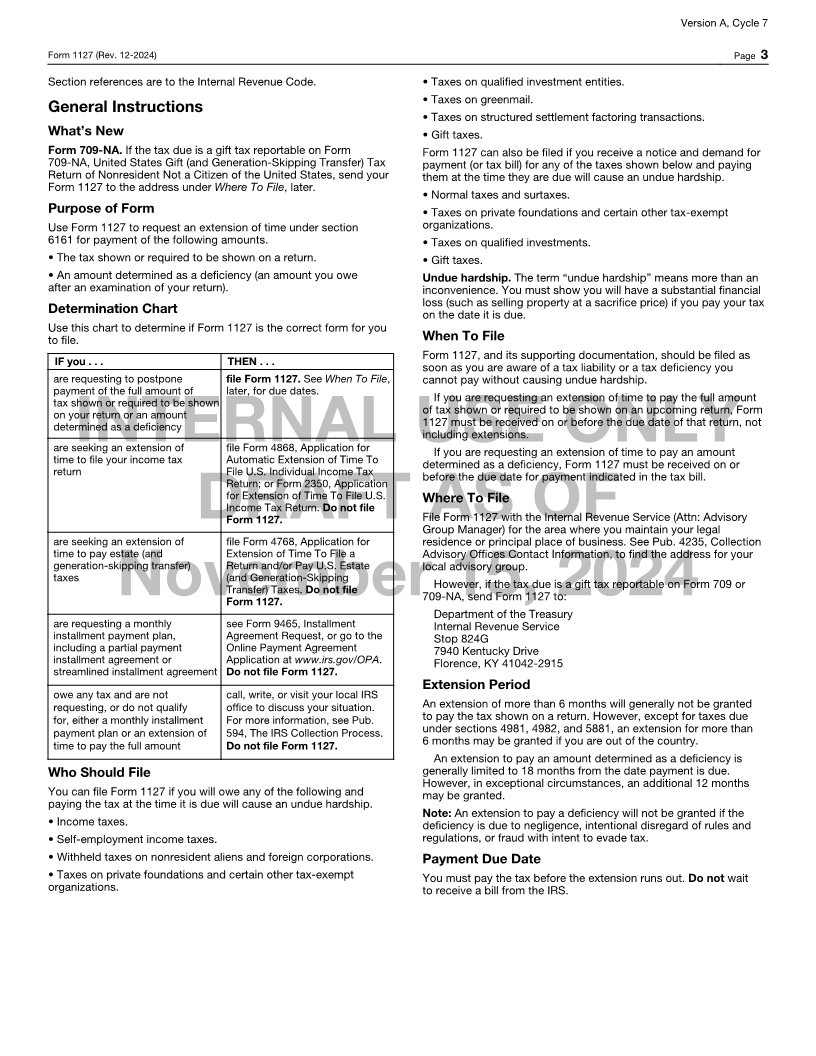

Before you begin: Use the Determination Chart later in the instructions to see if you should file this form.

Name(s) shown on return Identifying number

Number; street; and apt., room, or suite no. If you have a P.O. box, see instructions.

City, town, or post office; state; and ZIP code. If you have a foreign address, see instructions.

Part I Request for Extension

I request an extension from , 20 , to , 20 , to pay tax of $ .

Check only one box. This request is for:

The tax shown or required to be shown on Form .

An amount determined as a deficiency on Form .

This request is for calendar year 20 , or fiscal year ending , 20 .

Part II Reason for Extension

Undue hardship. Enter below a detailed explanation of the undue hardship that will result if your application is denied. (If more space

is required, please attach a separate sheet.) To establish undue hardship, you must show that you would sustain a substantial

financial loss if forced to pay a tax or deficiency on the due date. For a complete definition of “undue hardship,” see Who Should File,

later, in the instructions.

INTERNAL USE ONLY

DRAFT AS OF

Part III Supporting Documentation (You must check both boxes, or your application will not be accepted.)

To support my application, I certify that I have attached: November 15, 2024

A statement of my assets and liabilities at the end of last month (showing book and market values of assets and whether

securities are listed or unlisted), and

An itemized list of my income and expenses for each of the 3 months prior to the due date of the tax.

Signature and Verification

Under penalties of perjury, I declare that I have examined this application, including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete; and, if prepared by someone other than the taxpayer, that I am authorized to prepare this form.

Signature of taxpayer Date

Signature of spouse Date

Signature of preparer

other than taxpayer Date

FOR IRS USE ONLY (Do not detach)

This application is Approved Denied Returned:

Reason(s):

Signature of authorized official Date

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 17238O Form 1127 (Rev. 12-2024)