Enlarge image

Social Security and Medicare Tax OMB No. 1545-0074

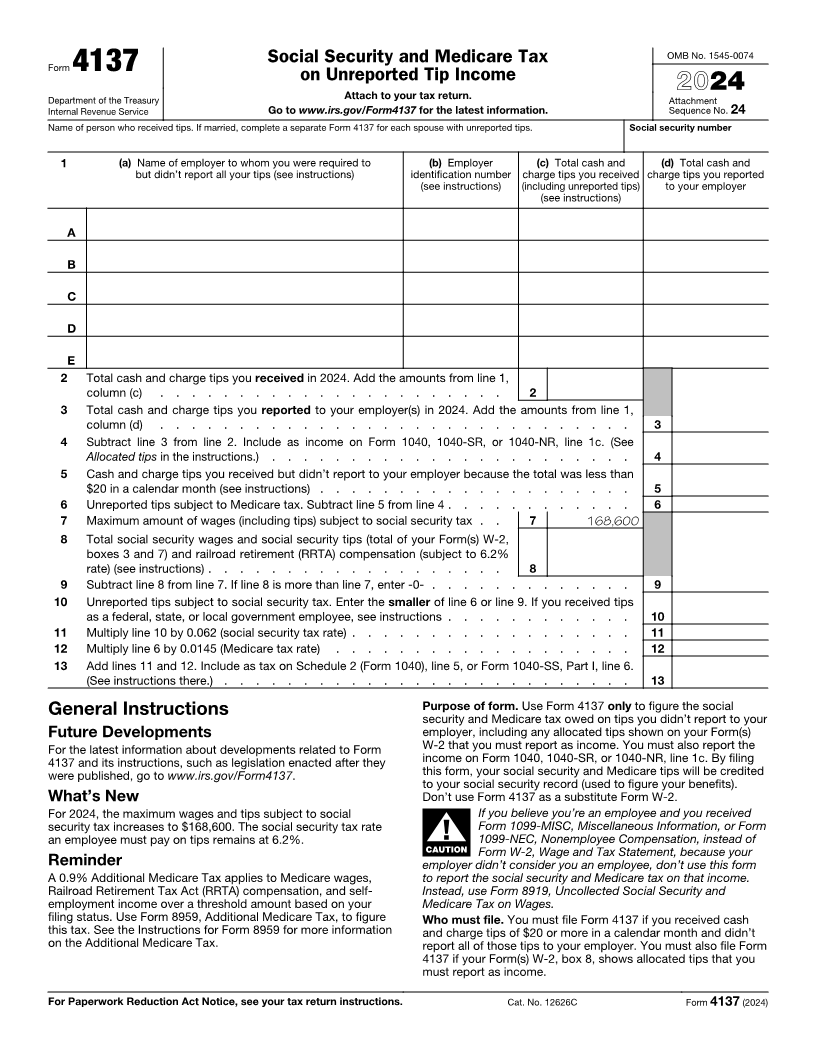

Form 4137 on Unreported Tip Income

Department of the Treasury Attach to your tax return. 2024

Attachment

Internal Revenue Service Go to www.irs.gov/Form4137 for the latest information. Sequence No. 24

Name of person who received tips. If married, complete a separate Form 4137 for each spouse with unreported tips. Social security number

1 (a) Name of employer to whom you were required to (b) Employer (c) Total cash and (d) Total cash and

but didn’t report all your tips (see instructions) identification number charge tips you received charge tips you reported

(see instructions) (including unreported tips) to your employer

(see instructions)

A

B

C

D

E

2 Total cash and charge tips you received in 2024. Add the amounts from line 1,

column (c) . . . . . . . . . . . . . . . . . . . . . . 2

3 Total cash and charge tips you reported to your employer(s) in 2024. Add the amounts from line 1,

column (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Subtract line 3 from line 2. Include as income on Form 1040, 1040-SR, or 1040-NR, line 1c. (See

Allocated tips in the instructions.) . . . . . . . . . . . . . . . . . . . . . . . 4

5 Cash and charge tips you received but didn’t report to your employer because the total was less than

$20 in a calendar month (see instructions) . . . . . . . . . . . . . . . . . . . . 5

6 Unreported tips subject to Medicare tax. Subtract line 5 from line 4 . . . . . . . . . . . . 6

7 Maximum amount of wages (including tips) subject to social security tax . . 7 168,600

8 Total social security wages and social security tips (total of your Form(s) W-2,

boxes 3 and 7) and railroad retirement (RRTA) compensation (subject to 6.2%

rate) (see instructions) . . . . . . . . . . . . . . . . . . . 8

9 Subtract line 8 from line 7. If line 8 is more than line 7, enter -0- . . . . . . . . . . . . . 9

10 Unreported tips subject to social security tax. Enter the smaller of line 6 or line 9. If you received tips

as a federal, state, or local government employee, see instructions . . . . . . . . . . . . 10

11 Multiply line 10 by 0.062 (social security tax rate) . . . . . . . . . . . . . . . . . . 11

12 Multiply line 6 by 0.0145 (Medicare tax rate) . . . . . . . . . . . . . . . . . . . 12

13 Add lines 11 and 12. Include as tax on Schedule 2 (Form 1040), line 5, or Form 1040-SS, Part I, line 6.

(See instructions there.) . . . . . . . . . . . . . . . . . . . . . . . . . . 13

General Instructions Purpose of form. Use Form 4137 only to figure the social

security and Medicare tax owed on tips you didn’t report to your

Future Developments employer, including any allocated tips shown on your Form(s)

For the latest information about developments related to Form W-2 that you must report as income. You must also report the

4137 and its instructions, such as legislation enacted after they income on Form 1040, 1040-SR, or 1040-NR, line 1c. By filing

were published, go to www.irs.gov/Form4137. this form, your social security and Medicare tips will be credited

to your social security record (used to figure your benefits).

What’s New Don’t use Form 4137 as a substitute Form W-2.

For 2024, the maximum wages and tips subject to social If you believe you’re an employee and you received

security tax increases to $168,600. The social security tax rate Form 1099-MISC, Miscellaneous Information, or Form

an employee must pay on tips remains at 6.2%. ▲! 1099-NEC, Nonemployee Compensation, instead of

CAUTION Form W-2, Wage and Tax Statement, because your

Reminder employer didn’t consider you an employee, don’t use this form

A 0.9% Additional Medicare Tax applies to Medicare wages, to report the social security and Medicare tax on that income.

Railroad Retirement Tax Act (RRTA) compensation, and self- Instead, use Form 8919, Uncollected Social Security and

employment income over a threshold amount based on your Medicare Tax on Wages.

filing status. Use Form 8959, Additional Medicare Tax, to figure Who must file. You must file Form 4137 if you received cash

this tax. See the Instructions for Form 8959 for more information and charge tips of $20 or more in a calendar month and didn’t

on the Additional Medicare Tax. report all of those tips to your employer. You must also file Form

4137 if your Form(s) W-2, box 8, shows allocated tips that you

must report as income.

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 12626C Form 4137 (2024)