Enlarge image

OMB No. 1545-0155

Investment Credit

Form 3468

Attach to your tax return.

Department of the Treasury Go to www.irs.gov/Form3468 for instructions and the latest information. Attachment 2024

Internal Revenue Service Sequence No. 174

Name(s) shown on return Identifying number

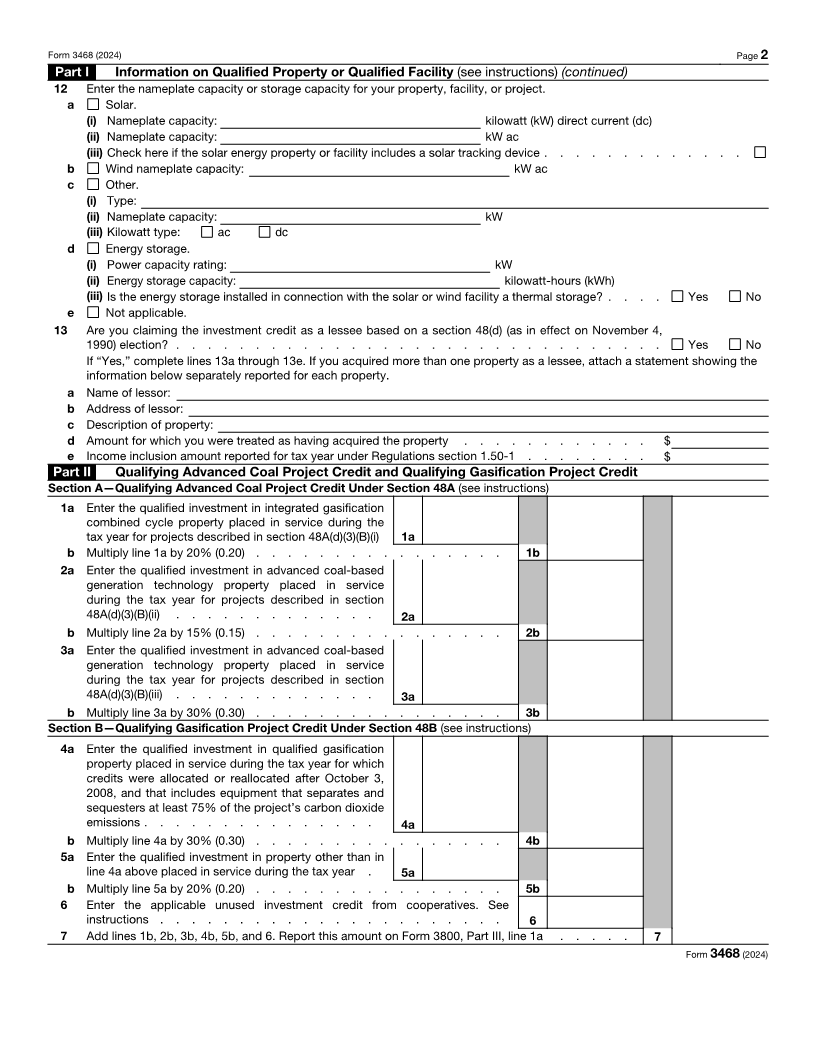

Part I Information on Qualified Property or Qualified Facility (see instructions)

1 If making an elective payment election or transfer election, enter the IRS-issued registration

number for the facility . . . . . . . . . . . . . . . . . . . . . . . .

2a (i) Enter the facility’s emissions value or rate (kg of CO2e per kg of qualified clean hydrogen):

(ii) Enter the Department of Energy (DOE) control number, if applicable (see instructions):

b Check this box if you are claiming a section 48E credit for a qualified facility and you have petitioned for a provisional

emissions rate, and have received an emissions value from the DOE and/or used a designated lifecycle analysis (LCA)

model to determine an emissions value. See instructions . . . . . . . . . . . . . . . . . . . . . .

3a Type (solar, clean hydrogen, rehabilitation, etc.):

b If different from filer, enter:

(i) Owner’s name:

(ii) Owner’s TIN:

c Address of the facility (if applicable):

d Coordinates. (i) Latitude: . (ii) Longitude: .

Enter a “+” (plus) or “-” (minus) sign in the first box. Enter a “+” (plus) or “-” (minus) sign in the first box.

e Check this box if the property includes qualified interconnection property under section 48(a)(8) or 48E(b)(1)(B)(i) . . . .

4 Date construction began (MM/DD/YYYY):

5 Date placed in service (MM/DD/YYYY):

6 Is the facility an expansion of an existing facility? . . . . . . . . . . . . . . . . . . . . Yes No

7 Does the property, facility, or project produce a net output of less than 1 megawatt (MW) alternating current (ac), or equivalent

thermal energy?

a Yes.

b No.

c Not applicable; the facility doesn’t produce electricity.

8 Does the property, facility, or project satisfy the prevailing wage and apprenticeship requirements?

a Yes, and sections 48C(e)(5) and (6) apply, and it was declared as provided per Notice 2023-18.

b Yes, and either (i) section 48(a)(9)(B)(ii), 48E(a)(2)(A)(ii)(ll), or 48E(a)(2)(B)(ii)(ll) applies if construction began before January 29,

2023; or (ii) sections 48(a)(10) and (11), or 48E(d)(3) and (4) apply.

c No.

d Not applicable.

9 Does the property, facility, or project qualify for a domestic content bonus credit per section 48(a)(12)(B) or 48E(a)(3)(B)?

a Yes, and section 48(a)(9)(B), 48E(a)(2)(A)(ii), or 48E(a)(2)(B)(ii) is satisfied (10% bonus). Attach the required information.

b Yes, and section 48(a)(9)(B), 48E(a)(2)(A)(ii), or 48E(a)(2)(B)(ii) is not satisfied (2% bonus). Attach the required information.

c No.

10 Does the property, facility, or project qualify for an energy community bonus credit per section 48(a)(14) or 48E(a)(3)(A)?

a Yes, and section 48(a)(9)(B), 48E(a)(2)(A)(ii), or 48E(a)(2)(B)(ii) is satisfied (10% bonus).

b Yes, and section 48(a)(9)(B), 48E(a)(2)(A)(ii), or 48E(a)(2)(B)(ii) is not satisfied (2% bonus).

c No.

11 Does the property, facility, or project qualify for the low-income communities bonus credit under section 48(e)(2) or 48E(h)(2)?

(The facility must have received an allocation of capacity limitation.)

a Yes, and the facility is located in a low-income community per section 45D(e) (10% bonus).

b Yes, and the facility is located on Indian land per section 2601(2) of P.L. 102-486 (10% bonus).

c Yes, and the facility is part of a qualified low-income residential building project facility per section 48(e)(2)(B) or 48E(h)(2)(B)

(20% bonus).

d Yes, and the facility is part of a qualified low-income economic benefit project facility per section 48(e)(2)(C) or 48E(h)(2)(C)

(20% bonus).

e If “Yes” to line 11a, 11b, 11c, or 11d, enter your 48(e) or 48E(h) Control Number:

f Enter the originating pass-through entity’s employer identification number (EIN) (if applicable):

g No.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12276E Form 3468 (2024)