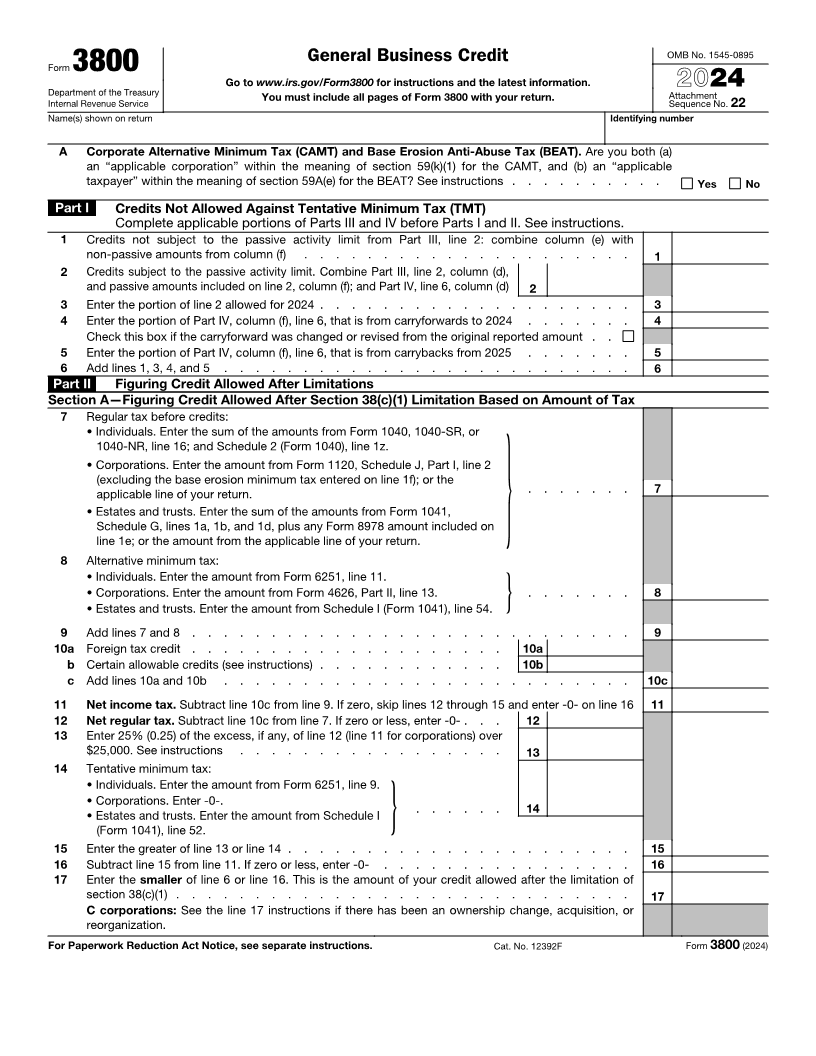

Enlarge image

General Business Credit OMB No. 1545-0895

Form 3800

Go to www.irs.gov/Form3800 for instructions and the latest information. 2024

Department of the Treasury You must include all pages of Form 3800 with your return. Attachment

Internal Revenue Service Sequence No. 22

Name(s) shown on return Identifying number

A Corporate Alternative Minimum Tax (CAMT) and Base Erosion Anti-Abuse Tax (BEAT). Are you both (a)

an “applicable corporation” within the meaning of section 59(k)(1) for the CAMT, and (b) an “applicable

taxpayer” within the meaning of section 59A(e) for the BEAT? See instructions . . . . . . . . . . Yes No

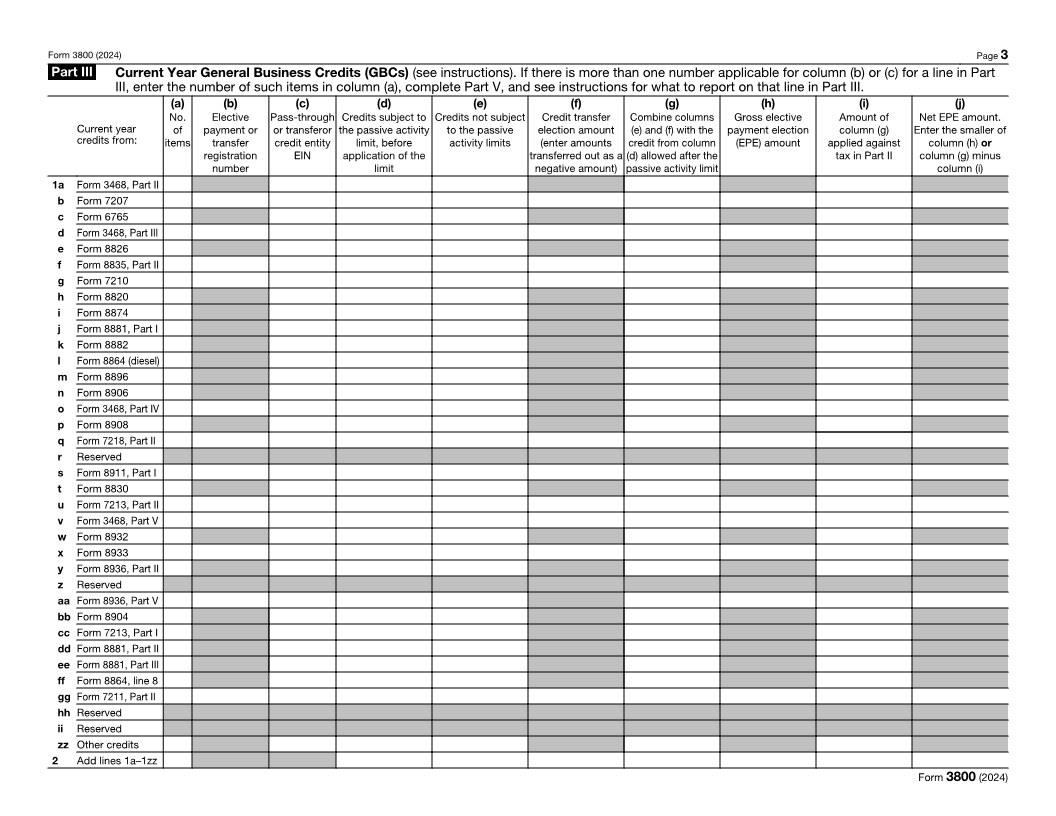

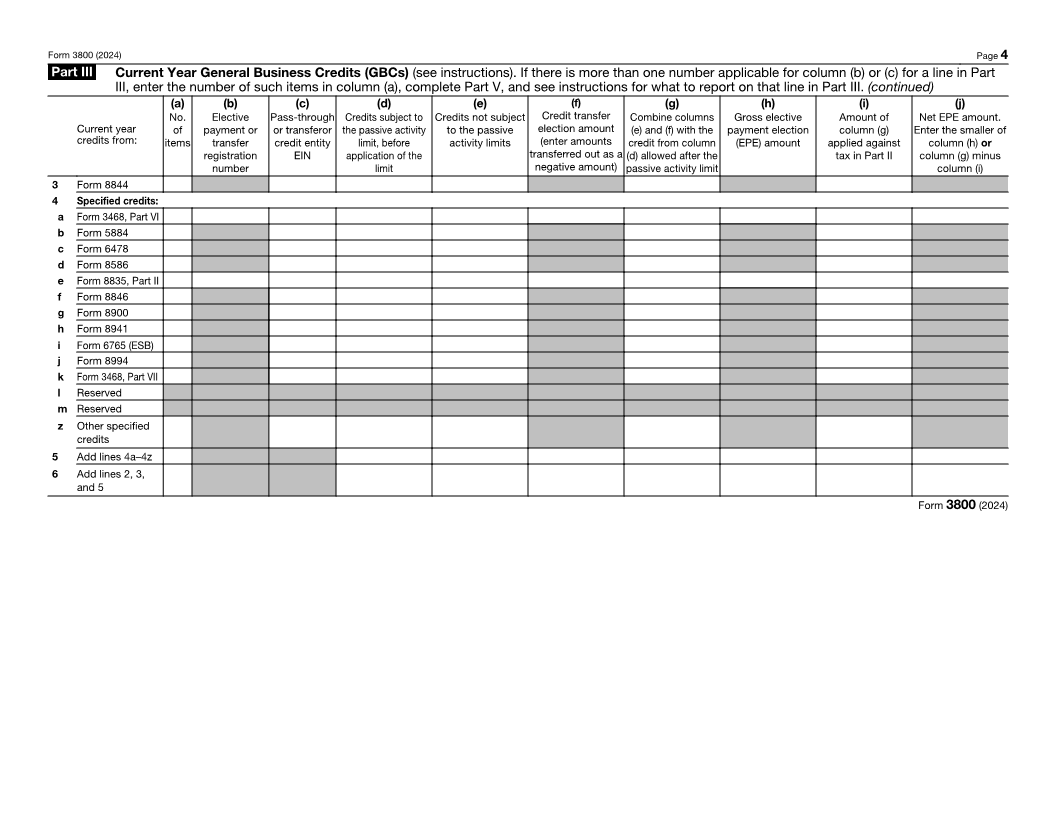

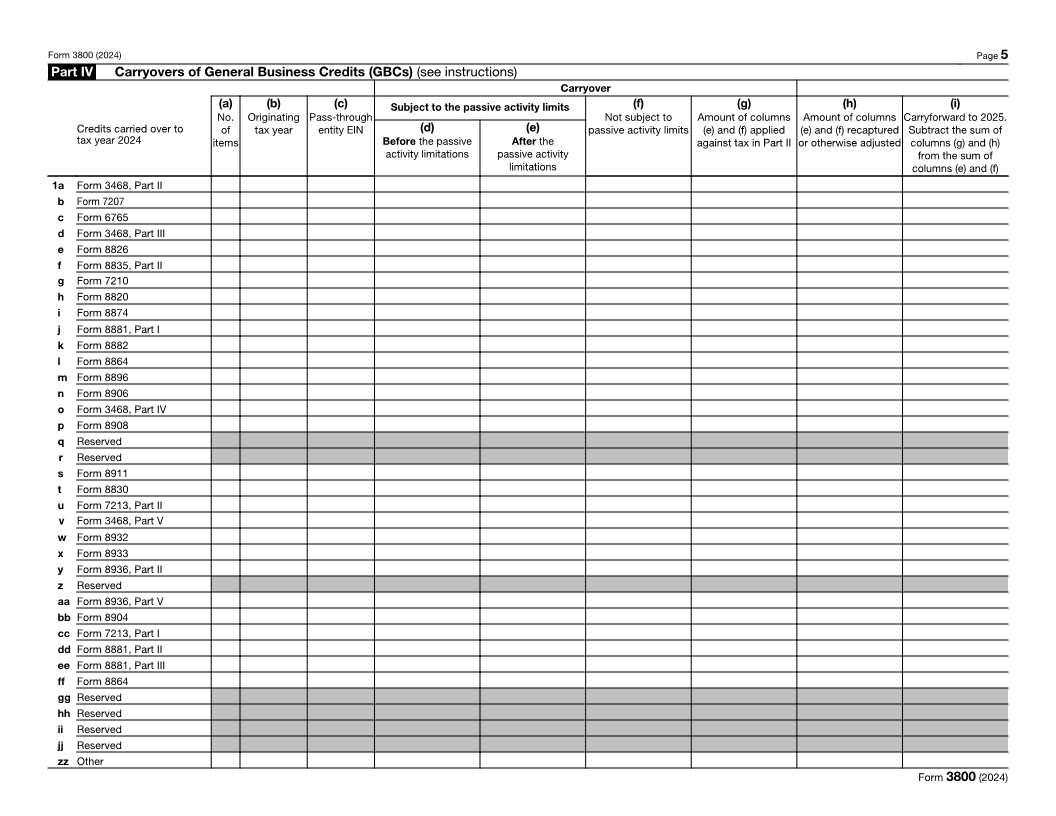

Part I Credits Not Allowed Against Tentative Minimum Tax (TMT)

Complete applicable portions of Parts III and IV before Parts I and II. See instructions.

1 Credits not subject to the passive activity limit from Part III, line 2: combine column (e) with

non-passive amounts from column (f) . . . . . . . . . . . . . . . . . . . . . 1

2 Credits subject to the passive activity limit. Combine Part III, line 2, column (d),

and passive amounts included on line 2, column (f); and Part IV, line 6, column (d) 2

3 Enter the portion of line 2 allowed for 2024 . . . . . . . . . . . . . . . . . . . . 3

4 Enter the portion of Part IV, column (f), line 6, that is from carryforwards to 2024 . . . . . . . 4

Check this box if the carryforward was changed or revised from the original reported amount . .

5 Enter the portion of Part IV, column (f), line 6, that is from carrybacks from 2025 . . . . . . . 5

6 Add lines 1, 3, 4, and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . 6

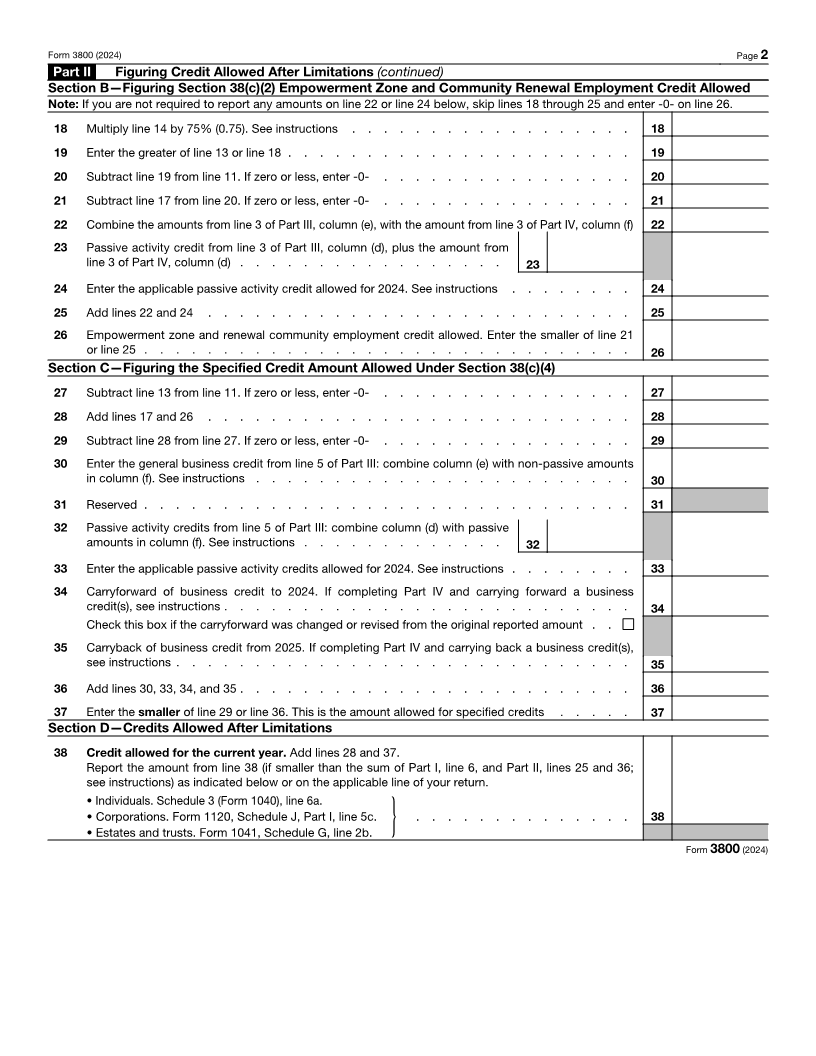

Part II Figuring Credit Allowed After Limitations

Section A—Figuring Credit Allowed After Section 38(c)(1) Limitation Based on Amount of Tax

7 Regular tax before credits:

• Individuals. Enter the sum of the amounts from Form 1040, 1040-SR, or

1040-NR, line 16; and Schedule 2 (Form 1040), line 1z.

• Corporations. Enter the amount from Form 1120, Schedule J, Part I, line 2

(excluding the base erosion minimum tax entered on line 1f); or the

applicable line of your return. . . . . . . . 7

• Estates and trusts. Enter the sum of the amounts from Form 1041,

Schedule G, lines 1a, 1b, and 1d, plus any Form 8978 amount included on

line 1e; or the amount from the applicable line of your return. }

8 Alternative minimum tax:

• Individuals. Enter the amount from Form 6251, line 11.

• Corporations. Enter the amount from Form 4626, Part II, line 13. . . . . . . . 8

• Estates and trusts. Enter the amount from Schedule I (Form 1041), line 54. }

9 Add lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10a Foreign tax credit . . . . . . . . . . . . . . . . . . . . 10a

b Certain allowable credits (see instructions) . . . . . . . . . . . . 10b

c Add lines 10a and 10b . . . . . . . . . . . . . . . . . . . . . . . . . . 10c

11 Net income tax. Subtract line 10c from line 9. If zero, skip lines 12 through 15 and enter -0- on line 16 11

12 Net regular tax. Subtract line 10c from line 7. If zero or less, enter -0- . . . 12

13 Enter 25% (0.25) of the excess, if any, of line 12 (line 11 for corporations) over

$25,000. See instructions . . . . . . . . . . . . . . . . . 13

14 Tentative minimum tax:

• Individuals. Enter the amount from Form 6251, line 9.

• Corporations. Enter -0-.

. . . . . . 14

• Estates and trusts. Enter the amount from Schedule I

(Form 1041), line 52. }

15 Enter the greater of line 13 or line 14 . . . . . . . . . . . . . . . . . . . . . . 15

16 Subtract line 15 from line 11. If zero or less, enter -0- . . . . . . . . . . . . . . . . 16

17 Enter the smaller of line 6 or line 16. This is the amount of your credit allowed after the limitation of

section 38(c)(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

C corporations: See the line 17 instructions if there has been an ownership change, acquisition, or

reorganization.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 12392F Form 3800 (2024)