Enlarge image

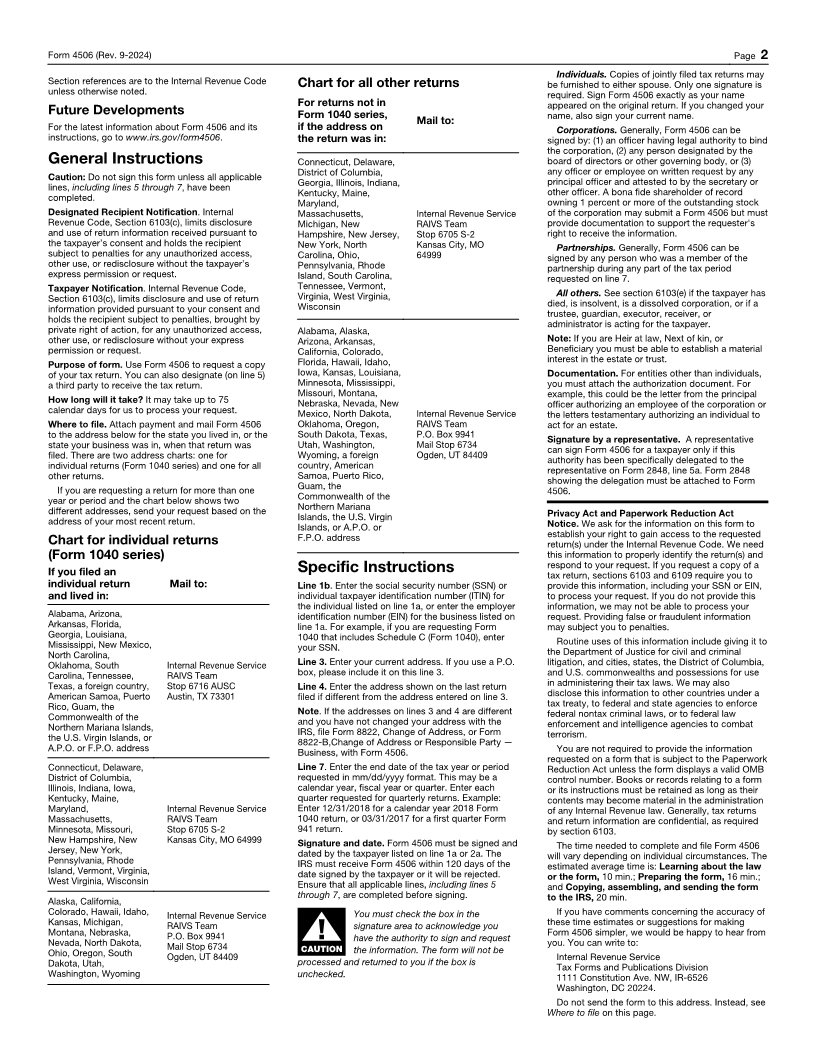

Form 4506 Request for Copy of Tax Return

(September 2024) ▶ Do not sign this form unless all applicable lines have been completed. OMB No. 1545-0429

▶ Request may be rejected if the form is incomplete or illegible.

Department of the Treasury ▶ For more information about Form 4506, visit www.irs.gov/form4506.

Internal Revenue Service

Tip: Get faster service: Online at www.irs.gov, Get Your Tax Record (Get Transcript) or by calling 1-800-908-9946 for specialized assistance. We

have teams available to assist. Note: Taxpayers may register to use Get Transcript to view, print, or download the following transcript types: Tax

Return Transcript (shows most line items including Adjusted Gross Income (AGI) from your original Form 1040-series tax return as filed, along with

any forms and schedules), Tax Account Transcript (shows basic data such as return type, marital status, AGI, taxable income and all payment types),

Record of Account Transcript (combines the tax return and tax account transcripts into one complete transcript), Wage and Income Transcript

(shows data from information returns we receive such as Forms W-2, 1099, 1098 and Form 5498), and Verification of Non-filing Letter (provides

proof that the IRS has no record of a filed Form 1040-series tax return for the year you request).

1a Name shown on tax return. If a joint return, enter the name shown first. 1b First social security number on tax return,

individual taxpayer identification number, or

employer identification number (see instructions)

2a If a joint return, enter spouse’s name shown on tax return. 2b Second social security number or individual

taxpayer identification number if joint tax return

3 Current name, address (including apt., room, or suite no.), city, state, and ZIP code (see instructions).

4 Previous address shown on the last return filed if different from line 3 (see instructions).

5 If the tax return is to be mailed to a third party (such as a mortgage company), enter the third party’s name, address, and telephone number.

Caution: If the tax return is being sent to the third party, ensure that lines 5 through 7 are completed before signing. (see instructions).

6 Tax return requested. Form 1040, 1120, 941, etc. and all attachments as originally submitted to the IRS, including Form(s) W-2,

schedules, or amended returns. Copies of Forms 1040, 1040A, and 1040EZ are generally available for 7 years from filing before they are

destroyed by law. Other returns may be available for a longer period of time. Enter only one return number. If you need more than one

type of return, you must complete another Form 4506. ▶

Note: If the copies must be certified for court or administrative proceedings, check here . . . . . . . . . . . . . . .

7 Year or period requested. Enter the ending date of the tax year or period using the mm/dd/yyyy format (see instructions).

/ / / / / / / /

/ / / / / / / /

8 Fee. There is a $30 fee for each return requested. Full payment must be included with your request or it will

be rejected. Make your check or money order payable to “United States Treasury.” Enter your SSN, ITIN,

or EIN and “Form 4506 request” on your check or money order

a Cost for each return . . . . . . . . . . . . . . . . . . . . . . . . . . . $

b Number of returns requested on line 7 . . . . . . . . . . . . . . . . . . . . . .

c Total cost. Multiply line 8a by line 8b . . . . . . . . . . . . . . . . . . . . . . $

9 If we cannot find the tax return, we will refund the fee. If the refund should go to the third party listed on line 5, check here . . . . .

Caution: Do not sign this form unless all applicable lines have been complete

Signature of taxpayer(s). I declare that I am either the taxpayer whose name is shown on line 1a or 2a, or a person authorized to obtain the tax return

requested. If the request applies to a joint return, at least one spouse must sign. If signed by a corporate officer, 1 percent or more shareholder, partner,

managing member, guardian, tax matters partner, executor, receiver, administrator, trustee, or party other than the taxpayer, I certify that I have the authority to

execute Form 4506 on behalf of the taxpayer. Note: This form must be received by IRS within 120 days of the signature date.

Signatory attests that he/she has read the attestation clause and upon so reading Phone number of taxpayer on line

1a or 2a

declares that he/she has the authority to sign the Form 4506. See instructions

▲

▲ Signature (see instructions) Date

Sign

Here Print/Type name Title (if line 1a above is a corporation, partnership, estate, or trust)

▲

▲ Spouse’s signature Date

Print/Type name

For Privacy Act and Paperwork Reduction Act Notice, see page 2. Cat. No. 41721E Form 4506 (Rev. 9-2024)