Enlarge image

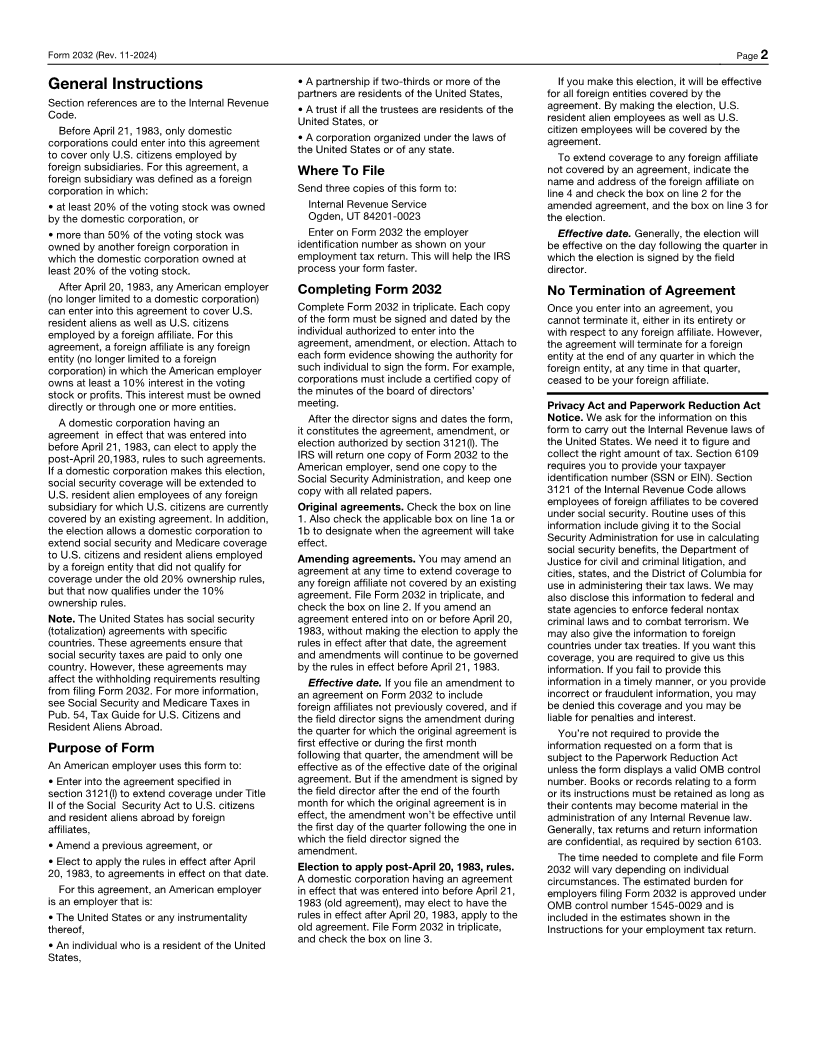

Contract Coverage Under Title II OMB No. 1545-0029

Form 2032

of the Social Security Act

(Rev. November 2024) For use by an American employer to extend social security coverage to File three copies

Department of the Treasury U.S. citizens and resident aliens employed by its foreign affiliates. of this form

Internal Revenue Service Go to www.irs.gov/Form2032 for the latest information.

Name of American employer Employer identification number

Address number and street (P.O. box if no mail delivery to street address) Apt. or suite no.

City, state, and ZIP code

This Form 2032 is filed as (check applicable box(es)):

1 An original (new) agreement.

This agreement is effective for services performed on and after (for original agreements only, check one):

a The first day of the calendar quarter in which the submission processing field director signs this agreement.

b The first day of the calendar quarter following the calendar quarter in which the submission processing field director signs

this agreement.

2 An amendment to an agreement previously entered into.

3 An election to apply the rules in effect after April 20, 1983, to agreements in effect on that date. By making this election, U.S.

resident aliens as well as U.S. citizens will be covered by social security.

If this is an amended election or agreement, provide the following information:

on

(Location where previous Form 2032 was filed) (Date submission processing field director signed original agreement on Form 2032)

4 This agreement extends the federal insurance system under Title II of the Social Security Act to certain services performed outside

the United States by U.S. citizens and resident aliens employed by any of the foreign affiliates listed below. If you checked the box

on line 2 and did not check the box on line 3 above, this amendment extends Title II social security coverage to certain services

performed outside the United States by U.S. citizens employed by any of the foreign affiliates listed below.

Note. Enter foreign affiliate addresses below in the following order: city, province or state, and country. Do not abbreviate the

country name, and follow the country’s practice for entering the postal code. If this agreement includes more than four foreign

affiliates, attach a separate sheet of paper identified as part of this agreement with the name and address of each additional

foreign affiliate.

a Name and address of foreign affiliate c Name and address of foreign affiliate

b Name and address of foreign affiliate d Name and address of foreign affiliate

5 Estimated number of employees to be initially covered by this agreement, amendment, or election:

Nonagricultural employees Agricultural employees

This agreement applies to all services performed outside the United States by each U.S. citizen or resident alien employed by any of the foreign

affiliates named above. However, the agreement applies only to the extent that payments to each employee for the services would be considered

wages if paid by the employer for services performed in the United States. This agreement does not apply to any service that is considered

employment for purposes of the employee tax and the employer tax under the Federal Insurance Contributions Act.

For an original agreement, an amendment to an agreement that was entered into after April 20, 1983, or an election to apply the rules in effect after

April 20, 1983, to agreements in effect on that date, the American employer declares that it owns at least a 10% interest (directly or through one or

more entities) in the voting stock or profits of each foreign entity named above. It also declares that section 3121(l) does not prevent this agreement.

For an amendment to an agreement in effect on April 20, 1983, without making the election to apply the new rules in effect after that date, the

domestic corporation declares that (a ) it owns at least 20% of the voting stock of each foreign corporation named above, or ( )b it owns at least 20% of

the voting stock of a foreign corporation that owns more than 50% of the voting stock of each foreign corporation named above. It also declares that

section 3121(l) does not prevent this agreement.

The American employer agrees:

1. To pay amounts equal to the taxes that would be imposed by sections 3101 and 3111 if the payment for the services was considered wages;

2. To pay, on written notification and demand, amounts equal to the interest, additions to taxes, and penalties that would apply if the payment for the

services were considered wages; and

3. To comply with the applicable regulations under section 3121(l).

This agreement (or amended agreement or election) is entered into under the provisions of section 3121(l) of the Internal Revenue Code and the

applicable regulations.

Signature of individual authorized to enter into this Title Date

agreement for the American employer

Field Director, Submission Processing Location Date

For Privacy Act and Paperwork Reduction Act Notice, see back of form. Cat. No. 49954D Form 2032 (Rev. 11-2024)