Enlarge image

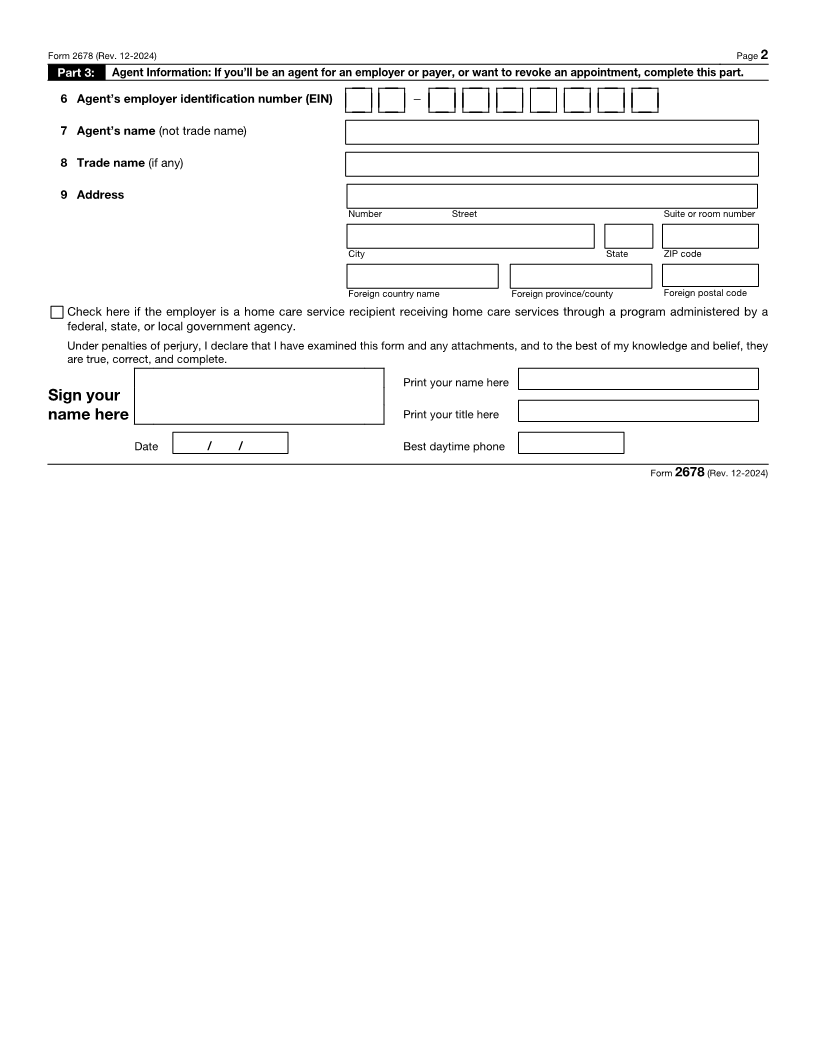

Form 2678 Employer/Payer Appointment of Agent

(Rev. December 2024) Department of the Treasury — Internal Revenue Service OMB No. 1545-0029

Use this form if you want to request approval to have an agent file returns and make

deposits or payments of employment or other withholding taxes or if you want to For IRS use:

revoke an existing appointment.

• If you’re an employer or payer who wants to request approval, complete Parts 1

and 2 and sign Part 2. Then give it to the agent. Have the agent complete Part 3 and

sign it.

Note: This appointment isn’t effective until we approve your request. See the instructions

for more information.

• If you’re an employer, payer, or agent who wants to revoke an existing appointment,

complete all three parts. In this case, only one signature is required.

Part 1: Why you’re filing this form.

(Check one)

You want to appoint an agent for tax reporting, depositing, and paying.

You want to revoke an existing appointment.

Part 2: Employer or Payer Information: Complete this part if you want to appoint an agent or revoke an appointment.

1 Employer identification number (EIN) —

2 Employer’s or payer’s name

(not your trade name)

3 Trade name (if any)

4 Address

Number Street Suite or room number

City State ZIP code

Foreign country name Foreign province/county Foreign postal code

5 Forms for which you want to appoint an agent or revoke the agent’s For ALL For SOME

appointment to file. (Check all that apply.) employees/ employees/

payees/payments payees/payments

Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return* (all 940 series)

Form 941, Employer’s QUARTERLY Federal Tax Return (all 941 series)

Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees (all 943 series)

Form 944, Employer’s ANNUAL Federal Tax Return (all 944 series)

Form 945, Annual Return of Withheld Federal Income Tax

Form CT-1, Employer’s Annual Railroad Retirement Tax Return

Form CT-2, Employee Representative's Quarterly Railroad Tax Return

* Generally, you can’t appoint an agent to report, deposit, and pay tax reported on Form 940, unless you’re a home care

service recipient.

Check here if you’re a home care service recipient, and you want to appoint the agent to report, deposit, and pay FUTA tax

for you. See the instructions.

I am authorizing the IRS to disclose otherwise confidential tax information to the agent relating to the authority granted under this

appointment, including disclosures required to process Form 2678. The agent may contract with a third party, such as a

reporting agent or certified public accountant, to prepare or file the returns covered by this appointment, or to make any required

deposits and payments. Such contract may authorize the IRS to disclose confidential tax information of the employer/payer and

agent to such third party. If a third party fails to file the returns or make the deposits and payments, the agent and employer/

payer remain liable.

Print your name here

Sign your

name here Print your title here

Date / / Best daytime phone

Now give this form to the agent to complete.

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. www.irs.gov/Form2678 Cat. No. 18770D Form 2678 (Rev. 12-2024)