Enlarge image

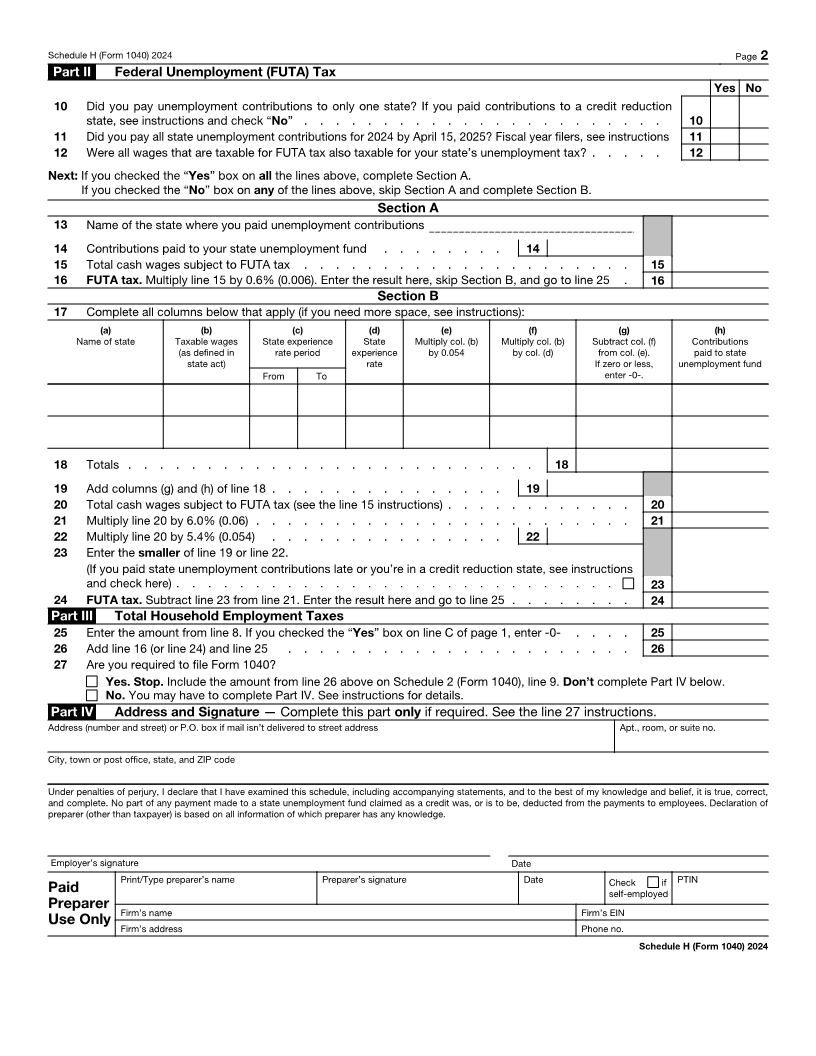

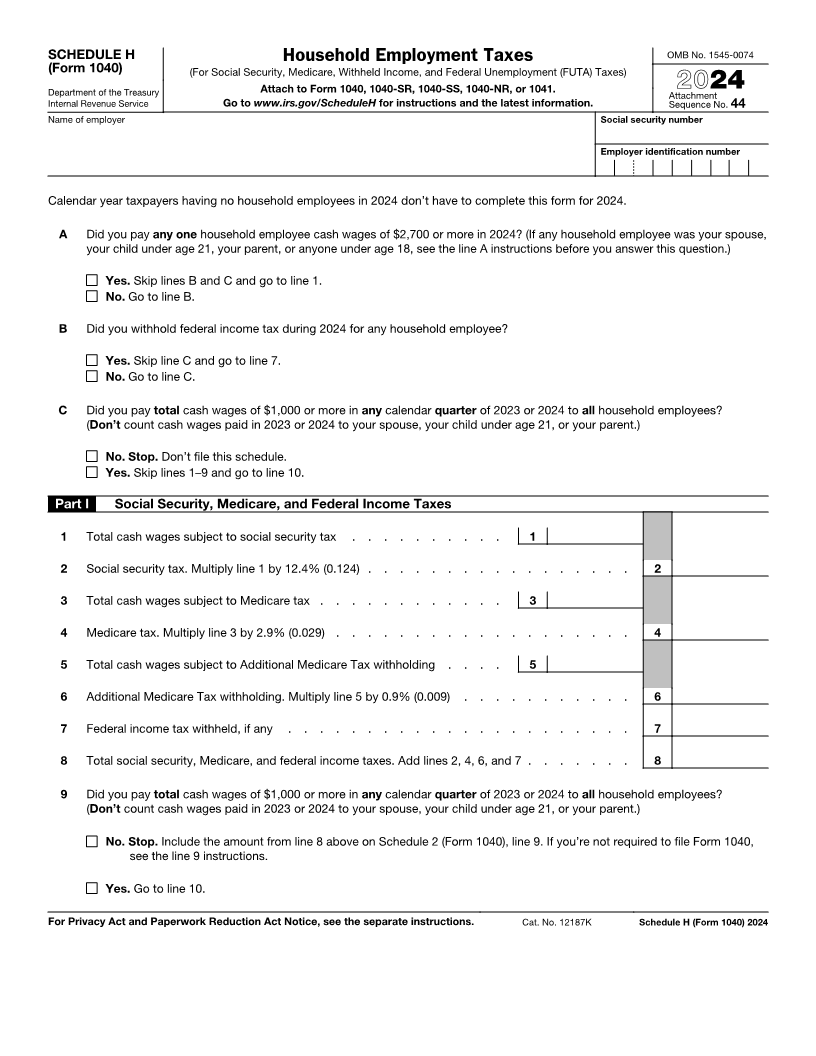

SCHEDULE H Household Employment Taxes OMB No. 1545-0074 (Form 1040) (For Social Security, Medicare, Withheld Income, and Federal Unemployment (FUTA) Taxes) Department of the Treasury Attach to Form 1040, 1040-SR, 1040-SS, 1040-NR, or 1041. Attachment 2024 Internal Revenue Service Go to www.irs.gov/ScheduleH for instructions and the latest information. Sequence No. 44 Name of employer Social security number Employer identification number Calendar year taxpayers having no household employees in 2024 don’t have to complete this form for 2024. A Did you pay any one household employee cash wages of $2,700 or more in 2024? (If any household employee was your spouse, your child under age 21, your parent, or anyone under age 18, see the line A instructions before you answer this question.) Yes. Skip lines B and C and go to line 1. No. Go to line B. B Did you withhold federal income tax during 2024 for any household employee? Yes. Skip line C and go to line 7. No. Go to line C. C Did you pay total cash wages of $1,000 or more in any calendar quarter of 2023 or 2024 to all household employees? (Don’t count cash wages paid in 2023 or 2024 to your spouse, your child under age 21, or your parent.) No. Stop.Don’t file this schedule. Yes. Skip lines 1–9 and go to line 10. Part I Social Security, Medicare, and Federal Income Taxes 1 Total cash wages subject to social security tax . . . . . . . . . . 1 2 Social security tax. Multiply line 1 by 12.4% (0.124) . . . . . . . . . . . . . . . . . 2 3 Total cash wages subject to Medicare tax . . . . . . . . . . . . 3 4 Medicare tax. Multiply line 3 by 2.9% (0.029) . . . . . . . . . . . . . . . . . . . 4 5 Total cash wages subject to Additional Medicare Tax withholding . . . . 5 6 Additional Medicare Tax withholding. Multiply line 5 by 0.9% (0.009) . . . . . . . . . . . 6 7 Federal income tax withheld, if any . . . . . . . . . . . . . . . . . . . . . . 7 8 Total social security, Medicare, and federal income taxes. Add lines 2, 4, 6, and 7 . . . . . . . 8 9 Did you pay total cash wages of $1,000 or more in any calendar quarter of 2023 or 2024 to all household employees? (Don’t count cash wages paid in 2023 or 2024 to your spouse, your child under age 21, or your parent.) No. Stop.Include the amount from line 8 above on Schedule 2 (Form 1040), line 9. If you’re not required to file Form 1040, see the line 9 instructions. Yes. Go to line 10. For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Cat. No. 12187K Schedule H (Form 1040) 2024