Enlarge image

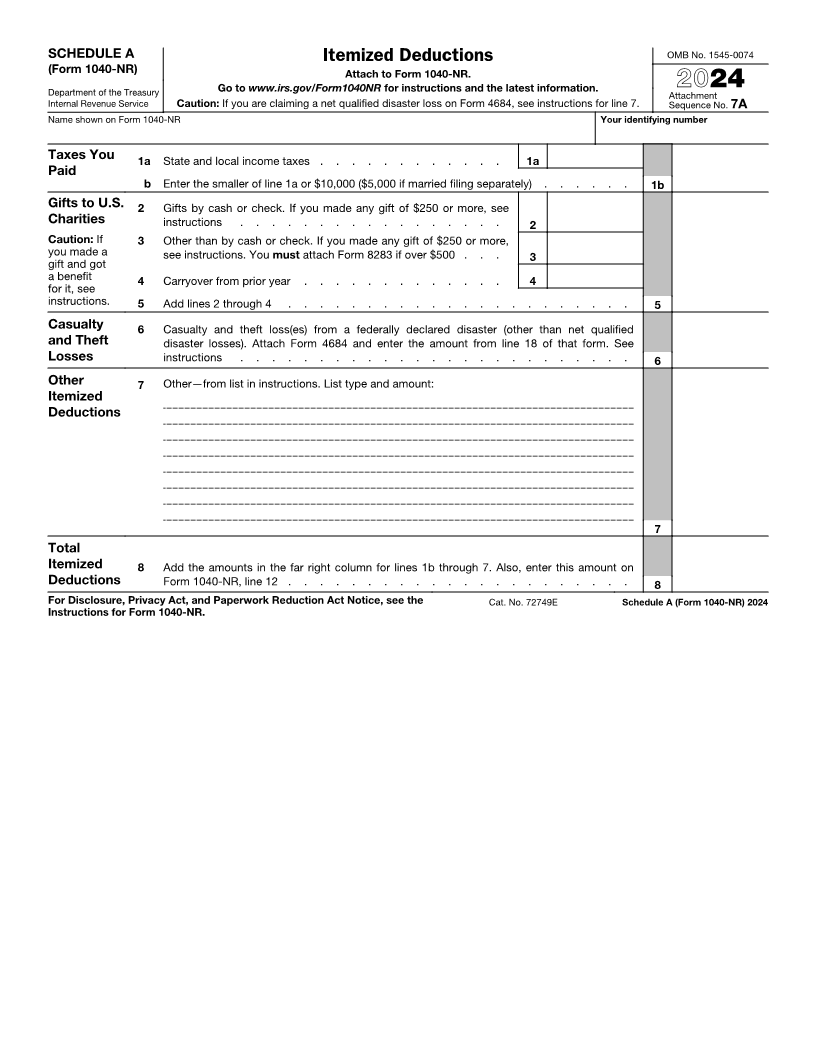

SCHEDULE A Itemized Deductions OMB No. 1545-0074

(Form 1040-NR) Attach to Form 1040-NR.

Department of the Treasury Go to www.irs.gov/Form1040NR for instructions and the latest information. 2024

Attachment

Internal Revenue Service Caution: If you are claiming a net qualified disaster loss on Form 4684, see instructions for line 7. Sequence No. 7A

Name shown on Form 1040-NR Your identifying number

Taxes You 1a State and local income taxes . . . . . . . . . . . . 1a

Paid

b Enter the smaller of line 1a or $10,000 ($5,000 if married filing separately) . . . . . . 1b

Gifts to U.S. 2 Gifts by cash or check. If you made any gift of $250 or more, see

Charities instructions . . . . . . . . . . . . . . . . . 2

Caution: If 3 Other than by cash or check. If you made any gift of $250 or more,

you made a see instructions. You must attach Form 8283 if over $500 . . . 3

gift and got

a benefit 4 Carryover from prior year . . . . . . . . . . . . . 4

for it, see

instructions. 5 Add lines 2 through 4 . . . . . . . . . . . . . . . . . . . . . . 5

Casualty 6 Casualty and theft loss(es) from a federally declared disaster (other than net qualified

and Theft disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See

Losses instructions . . . . . . . . . . . . . . . . . . . . . . . . . 6

Other 7 Other—from list in instructions. List type and amount:

Itemized

Deductions

7

Total

Itemized 8 Add the amounts in the far right column for lines 1b through 7. Also, enter this amount on

Deductions Form 1040-NR, line 12 . . . . . . . . . . . . . . . . . . . . . . 8

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see the Cat. No. 72749E Schedule A (Form 1040-NR) 2024

Instructions for Form 1040-NR.