Enlarge image

OMB No. 1545-0074

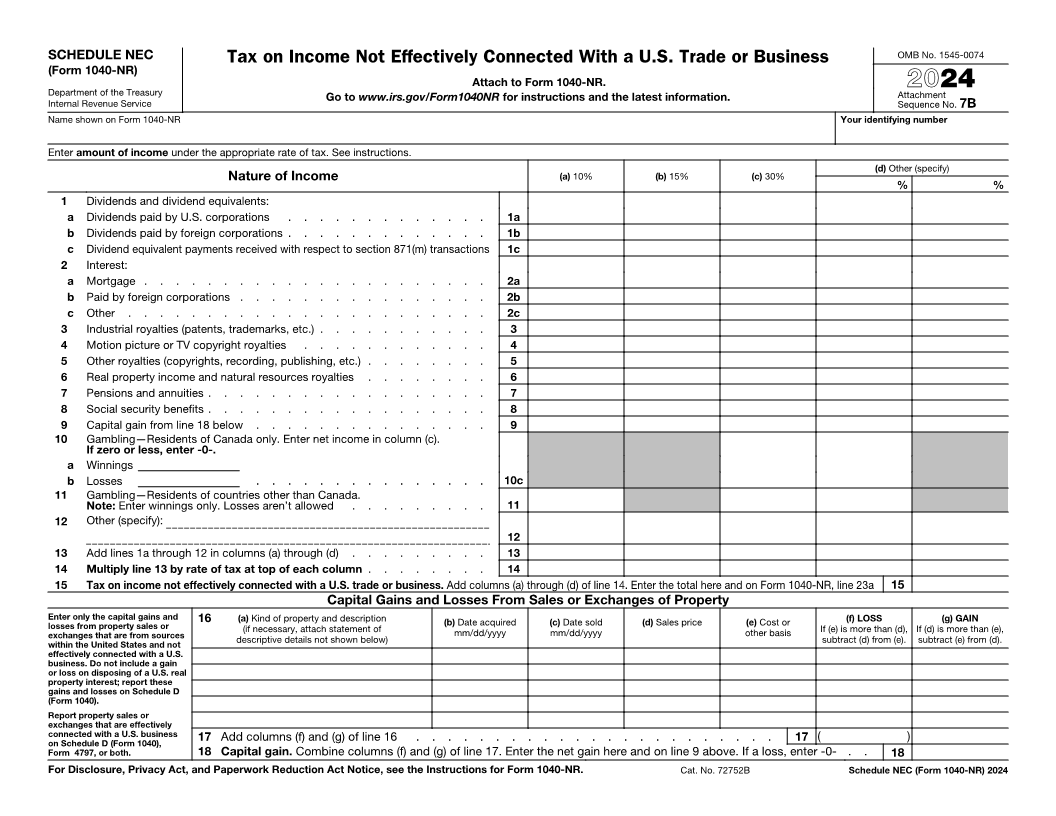

SCHEDULE NEC Tax on Income Not Effectively Connected With a U.S. Trade or Business

(Form 1040-NR)

Attach to Form 1040-NR. 2024

Department of the Treasury Go to www.irs.gov/Form1040NR for instructions and the latest information. Attachment

Internal Revenue Service Sequence No. 7B

Name shown on Form 1040-NR Your identifying number

Enter amount of income under the appropriate rate of tax. See instructions.

(d) Other (specify)

Nature of Income (a) 10% (b) 15% (c) 30%

% %

1 Dividends and dividend equivalents:

a Dividends paid by U.S. corporations . . . . . . . . . . . . . 1a

b Dividends paid by foreign corporations . . . . . . . . . . . . . 1b

c Dividend equivalent payments received with respect to section 871(m) transactions 1c

2 Interest:

a Mortgage . . . . . . . . . . . . . . . . . . . . . . 2a

b Paid by foreign corporations . . . . . . . . . . . . . . . . 2b

c Other . . . . . . . . . . . . . . . . . . . . . . . 2c

3 Industrial royalties (patents, trademarks, etc.) . . . . . . . . . . . 3

4 Motion picture or TV copyright royalties . . . . . . . . . . . . 4

5 Other royalties (copyrights, recording, publishing, etc.) . . . . . . . . 5

6 Real property income and natural resources royalties . . . . . . . . 6

7 Pensions and annuities . . . . . . . . . . . . . . . . . . 7

8 Social security benefits . . . . . . . . . . . . . . . . . . 8

9 Capital gain from line 18 below . . . . . . . . . . . . . . . 9

10 Gambling—Residents of Canada only. Enter net income in column (c).

If zero or less, enter -0-.

a Winnings

b Losses . . . . . . . . . . . . . . . 10c

11 Gambling—Residents of countries other than Canada.

Note: Enter winnings only. Losses aren’t allowed . . . . . . . . . 11

12 Other (specify):

12

13 Add lines 1a through 12 in columns (a) through (d) . . . . . . . . . 13

14 Multiply line 13 by rate of tax at top of each column . . . . . . . . 14

15 Tax on income not effectively connected with a U.S. trade or business.Add columns (a) through (d) of line 14. Enter the total here and on Form 1040-NR, line 23a15

Capital Gains and Losses From Sales or Exchanges of Property

Enter only the capital gains and 16 (a) Kind of property and description (b) Date acquired (c) Date sold (d) Sales price (e) Cost or (f) LOSS (g) GAIN

losses from property sales or (if necessary, attach statement of mm/dd/yyyy mm/dd/yyyy other basis If (e) is more than (d), If (d) is more than (e),

exchanges that are from sources descriptive details not shown below) subtract (d) from (e). subtract (e) from (d).

within the United States and not

effectively connected with a U.S.

business. Do not include a gain

or loss on disposing of a U.S. real

property interest; report these

gains and losses on Schedule D

(Form 1040).

Report property sales or

exchanges that are effectively

connected with a U.S. business 17 Add columns (f) and (g) of line 16 . . . . . . . . . . . . . . . . . . . . . . . 17 ( )

on Schedule D (Form 1040),

Form 4797, or both. 18 Capital gain. Combine columns (f) and (g) of line 17. Enter the net gain here and on line 9 above. If a loss, enter -0- . . 18

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see the Instructions for Form 1040-NR. Cat. No. 72752B Schedule NEC (Form 1040-NR) 2024