Enlarge image

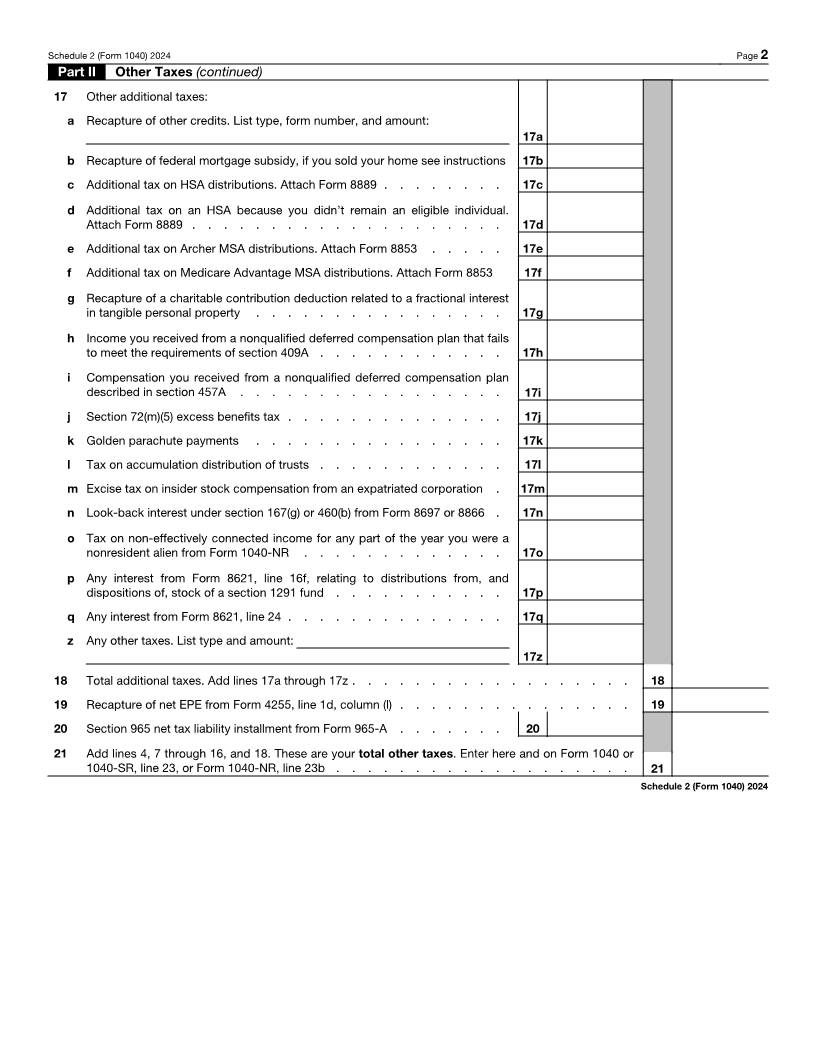

SCHEDULE 2 OMB No. 1545-0074

(Form 1040) Additional Taxes

Attach to Form 1040, 1040-SR, or 1040-NR.

Department of the Treasury Attachment 2024

Internal Revenue Service Go to www.irs.gov/Form1040 for instructions and the latest information. Sequence No. 02

Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number

Part I Tax

1 Additions to tax:

a Excess advance premium tax credit repayment. Attach Form 8962 . . . . 1a

b Repayment of new clean vehicle credit(s) transferred to a registered dealer

from Schedule A (Form 8936), Part II. Attach Form 8936 and Schedule A (Form

8936) . . . . . . . . . . . . . . . . . . . . . . . . 1b

c Repayment of previously owned clean vehicle credit(s) transferred to a

registered dealer from Schedule A (Form 8936), Part IV. Attach Form 8936 and

Schedule A (Form 8936) . . . . . . . . . . . . . . . . . . 1c

d Recapture of net EPE from Form 4255, line 2a, column (l) . . . . . . . 1d

e Excessive payments (EP) from Form 4255. Check applicable box and enter

amount.

(i) Line 1a, column (n) (ii) Line 1c, column (n)

(iii) Line 1d, column (n) (iv) Line 2a, column (n) . . . . 1e

f 20% EP from Form 4255. Check applicable box and enter amount. See

instructions.

(i) Line 1a, column (o) (ii) Line 1c, column (o)

(iii) Line 1d, column (o) (iv) Line 2a, column (o) . . . . 1f

y Other additions to tax (see instructions): 1y

z Add lines 1a through 1y . . . . . . . . . . . . . . . . . . . . . . . . . . 1z

2 Alternative minimum tax. Attach Form 6251 . . . . . . . . . . . . . . . . . . . 2

3 Add lines 1z and 2. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 17 . . . . . . . 3

Part II Other Taxes

4 Self-employment tax. Attach Schedule SE . . . . . . . . . . . . . . . . . . . . 4

5 Social security and Medicare tax on unreported tip income. Attach Form 4137 5

6 Uncollected social security and Medicare tax on wages. Attach Form 8919 . 6

7 Total additional social security and Medicare tax. Add lines 5 and 6 . . . . . . . . . . . 7

8 Additional tax on IRAs or other tax-favored accounts. Attach Form 5329 if required.

If not required, check here . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Household employment taxes. Attach Schedule H . . . . . . . . . . . . . . . . . 9

10 Repayment of first-time homebuyer credit. Attach Form 5405 if required . . . . . . . . . . 10

11 Additional Medicare Tax. Attach Form 8959 . . . . . . . . . . . . . . . . . . . 11

12 Net investment income tax. Attach Form 8960 . . . . . . . . . . . . . . . . . . 12

13 Uncollected social security and Medicare or RRTA tax on tips or group-term life insurance from Form

W-2, box 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Interest on tax due on installment income from the sale of certain residential lots and timeshares . . 14

15 Interest on the deferred tax on gain from certain installment sales with a sales price over $150,000 . 15

16 Recapture of low-income housing credit. Attach Form 8611 . . . . . . . . . . . . . . 16

(continued on page 2)

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71478U Schedule 2 (Form 1040) 2024