Enlarge image

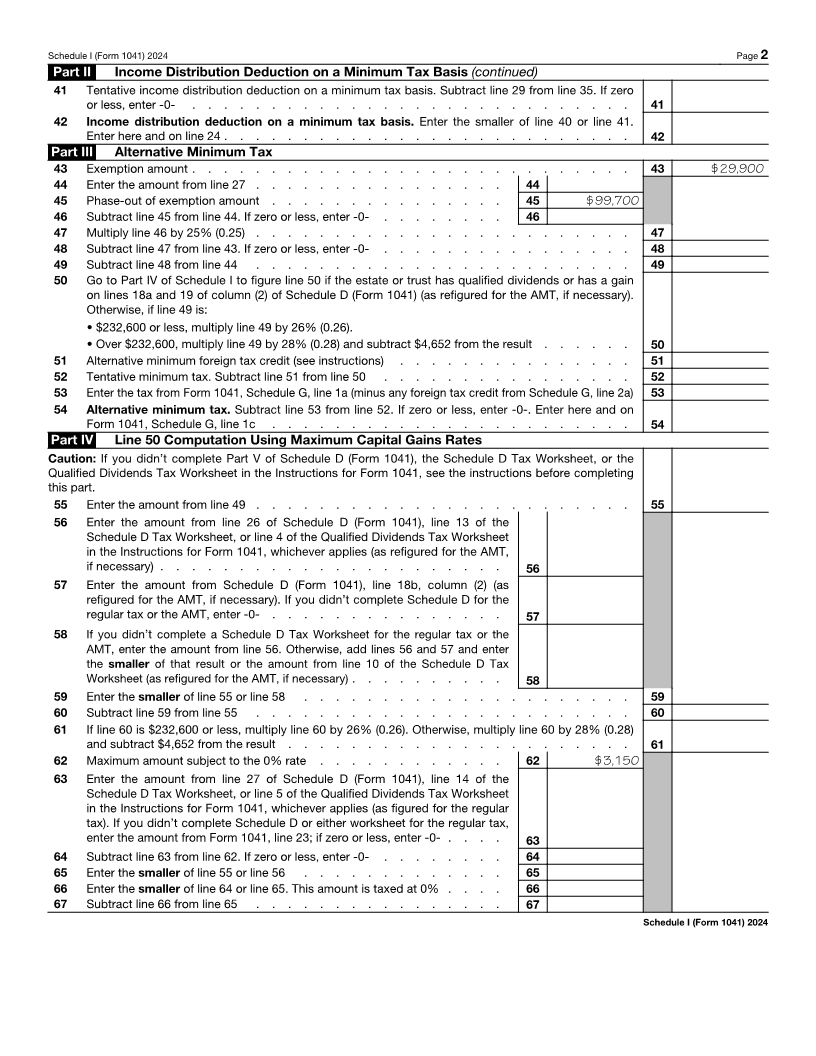

SCHEDULE I Alternative Minimum Tax—Estates and Trusts OMB No. 1545-0092 (Form 1041) Department of the Treasury Attach to Form 1041. Internal Revenue Service Go to www.irs.gov/Form1041 for instructions and the latest information. 2024 Name of estate or trust Employer identification number Part I Estate’s or Trust’s Share of Alternative Minimum Taxable Income 1 Adjusted total income or (loss) (from Form 1041, line 17). ESBTs, see instructions . . . . . . . 1 2 Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 3 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4 Refund of taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 ( ) 5 Depletion (difference between regular tax and AMT) . . . . . . . . . . . . . . . . . 5 6 Net operating loss deduction. Enter as a positive amount . . . . . . . . . . . . . . . 6 7 Interest from specified private activity bonds exempt from the regular tax . . . . . . . . . . 7 8 Qualified small business stock (see instructions) . . . . . . . . . . . . . . . . . . 8 9 Exercise of incentive stock options (excess of AMT income over regular tax income) . . . . . . 9 10 Other estates and trusts (amount from Schedule K-1 (Form 1041), box 12, code A) . . . . . . 10 11 Disposition of property (difference between AMT and regular tax gain or loss) . . . . . . . . 11 12 Depreciation on assets placed in service after 1986 (difference between regular tax and AMT) . . . 12 13 Passive activities (difference between AMT and regular tax income or loss) . . . . . . . . . 13 14 Loss limitations (difference between AMT and regular tax income or loss) . . . . . . . . . . 14 15 Circulation costs (difference between regular tax and AMT) . . . . . . . . . . . . . . 15 16 Long-term contracts (difference between AMT and regular tax income) . . . . . . . . . . 16 17 Mining costs (difference between regular tax and AMT) . . . . . . . . . . . . . . . . 17 18 Research and experimental costs (difference between regular tax and AMT) . . . . . . . . . 18 19 Income from certain installment sales before January 1, 1987 . . . . . . . . . . . . . 19 ( ) 20 Intangible drilling costs preference . . . . . . . . . . . . . . . . . . . . . . 20 21 Other adjustments, including income-based related adjustments . . . . . . . . . . . . 21 22 Alternative tax net operating loss deduction (See the instructions for the limitation that applies.) . . 22 ( ) 23 Adjusted alternative minimum taxable income. Combine lines 1 through 22 . . . . . . . . . 23 Complete Part II below before going to line 24. 24 Income distribution deduction from Part II, line 42 . . . . . . . . . 24 25 Estate tax deduction (from Form 1041, line 19) . . . . . . . . . . 25 26 Add lines 24 and 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . 26 27 Estate’s or trust’s share of alternative minimum taxable income. Subtract line 26 from line 23 . . . 27 If line 27 is: • $29,900 or less, stop here and enter -0- on Form 1041, Schedule G, line 1c. The estate or trust isn’t liable for the alternative minimum tax. • Over $29,900, but less than $219,300, go to line 43. • $219,300 or more, enter the amount from line 27 on line 49 and go to line 50. • ESBTs, see instructions. Part II Income Distribution Deduction on a Minimum Tax Basis 28 Adjusted alternative minimum taxable income (see instructions) . . . . . . . . . . . . . 28 29 Adjusted tax-exempt interest (other than amounts included on line 7) . . . . . . . . . . . 29 30 Total net gain from Schedule D (Form 1041), line 19, column (1). If a loss, enter -0- . . . . . . 30 31 Capital gains for the tax year allocated to corpus and paid or permanently set aside for charitable purposes (from Form 1041, Schedule A, line 4) . . . . . . . . . . . . . . . . . . 31 32 Capital gains paid or permanently set aside for charitable purposes from gross income (see instructions) 32 33 Capital gains computed on a minimum tax basis included on line 23 . . . . . . . . . . . 33 ( ) 34 Capital losses computed on a minimum tax basis included on line 23. Enter as a positive amount . . 34 35 Distributable net alternative minimum taxable income (DNAMTI). Combine lines 28 through 34. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35 36 Income required to be distributed currently (from Form 1041, Schedule B, line 9) . . . . . . . 36 37 Other amounts paid, credited, or otherwise required to be distributed (from Form 1041, Schedule B, line 10) 37 38 Total distributions. Add lines 36 and 37 . . . . . . . . . . . . . . . . . . . . . 38 39 Tax-exempt income included on line 38 (other than amounts included on line 7) . . . . . . . 39 40 Tentative income distribution deduction on a minimum tax basis. Subtract line 39 from line 38 . . . 40 For Paperwork Reduction Act Notice, see the Instructions for Form 1041. Cat. No. 51517Q Schedule I (Form 1041) 2024