Enlarge image

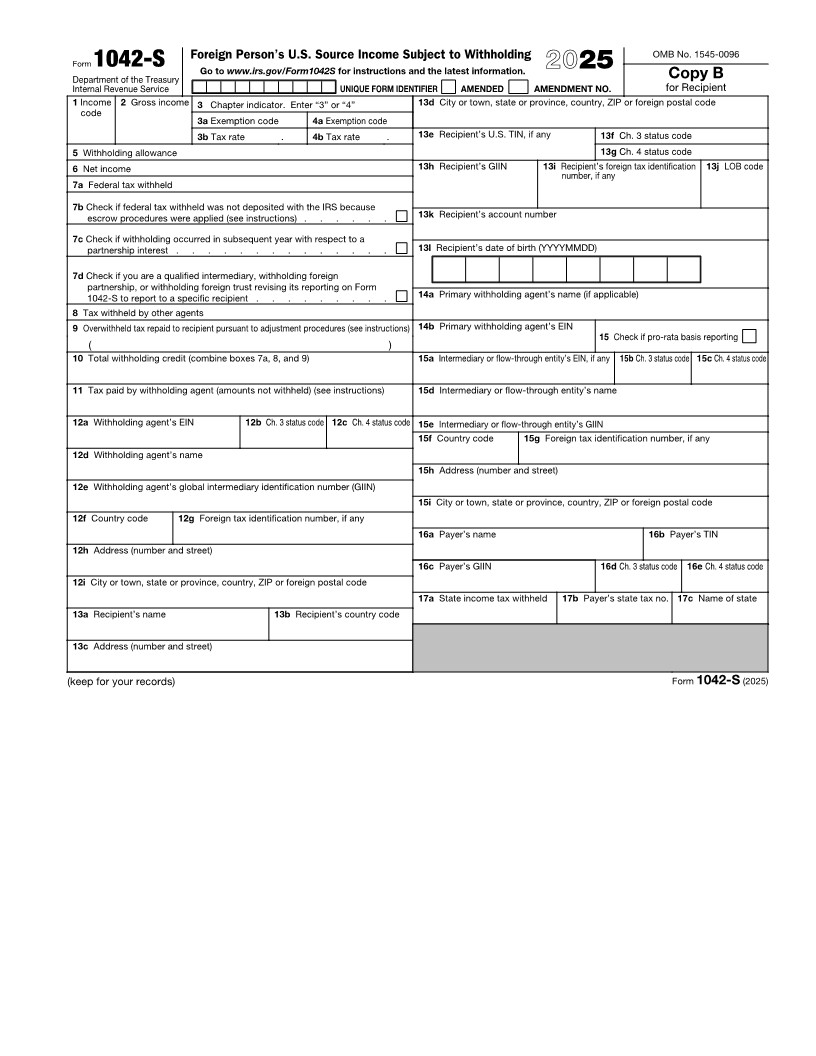

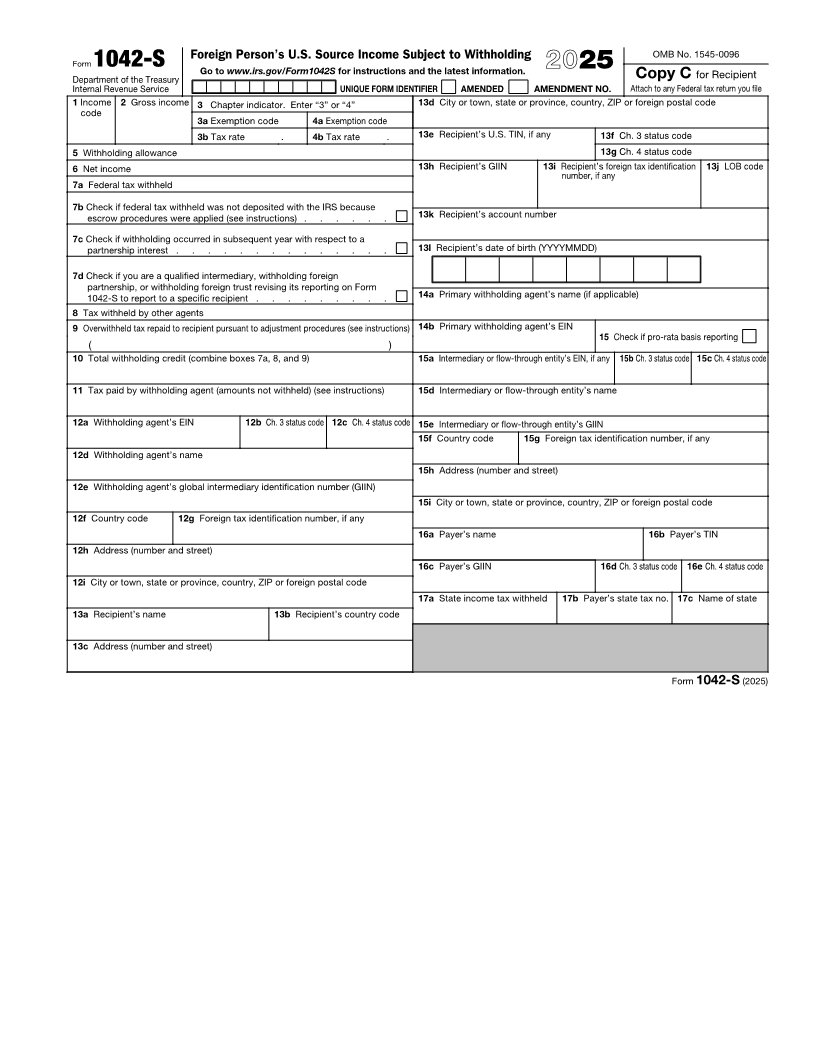

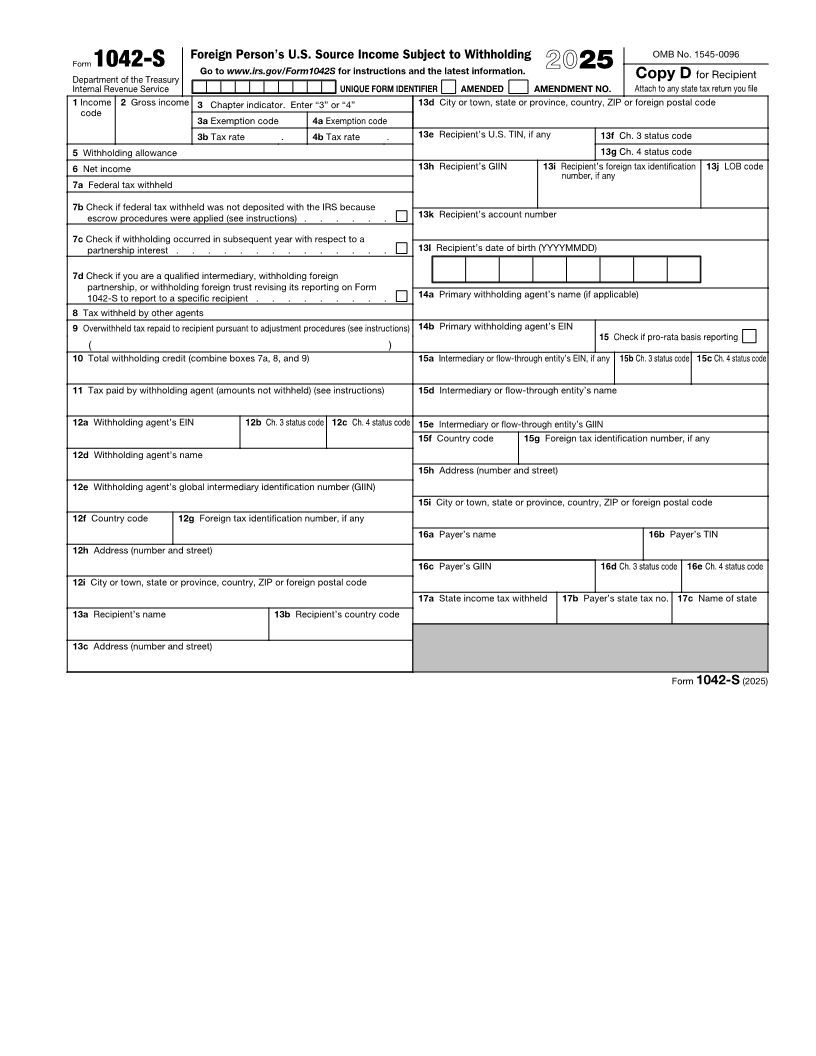

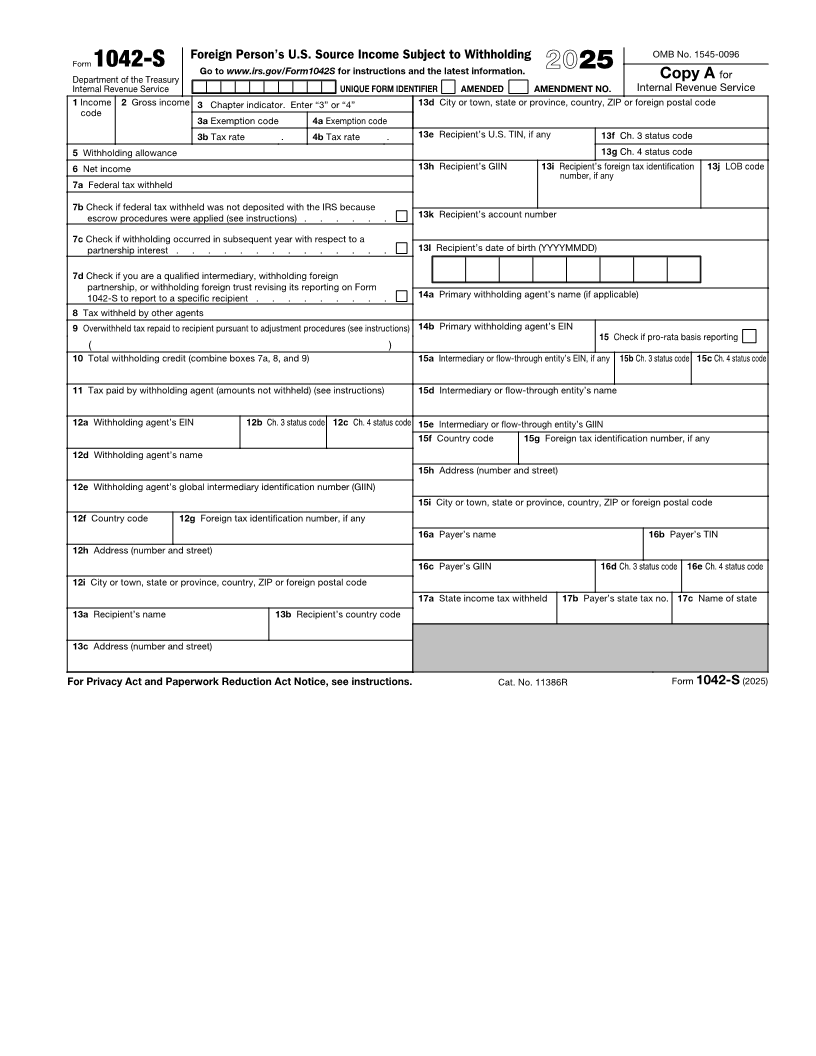

Foreign Person’s U.S. Source Income Subject to Withholding OMB No. 1545-0096

Form 1042-S Go to www.irs.gov/Form1042S for instructions and the latest information. 2025 for

Department of the Treasury Copy A

Internal Revenue Service UNIQUE FORM IDENTIFIER AMENDED AMENDMENT NO. Internal Revenue Service

1 Income 2 Gross income 3 Chapter indicator. Enter “3” or “4” 13d City or town, state or province, country, ZIP or foreign postal code

code

3a Exemption code 4a Exemption code

3b Tax rate . 4b Tax rate . 13e Recipient’s U.S. TIN, if any 13f Ch. 3 status code

5 Withholding allowance 13g Ch. 4 status code

6 Net income 13h Recipient’s GIIN 13i Recipient ’sforeign tax identification 13j LOB code

number, if any

7a Federal tax withheld

7b Check if federal tax withheld was not deposited with the IRS because

escrow procedures were applied (see instructions) . . . . . . 13k Recipient’s account number

7c Check if withholding occurred in subsequent year with respect to a

partnership interest . . . . . . . . . . . . . . 13l Recipient’s date of birth (YYYYMMDD)

7d Check if you are a qualified intermediary, withholding foreign

partnership, or withholding foreign trust revising its reporting on Form

1042-S to report to a specific recipient . . . . . . . . . 14a Primary withholding agent’s name (if applicable)

8 Tax withheld by other agents

9 Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions) 14b Primary withholding agent’s EIN

15 Check if pro-rata basis reporting

( )

10 Total withholding credit (combine boxes 7a, 8, and 9) 15a Intermediary or flow-through entity’s EIN, if any 15b Ch. 3 status code 15c Ch. 4 status code

11 Tax paid by withholding agent (amounts not withheld) (see instructions) 15d Intermediary or flow-through entity’s name

12a Withholding agent’s EIN 12b Ch. 3 status code12c Ch. 4 status code15e Intermediary or flow-through entity’s GIIN

15f Country code 15g Foreign tax identification number, if any

12d Withholding agent’s name

15h Address (number and street)

12e Withholding agent’s global intermediary identification number (GIIN)

15i City or town, state or province, country, ZIP or foreign postal code

12f Country code 12g Foreign tax identification number, if any

16a Payer’s name 16b Payer’s TIN

12h Address (number and street)

16c Payer’s GIIN 16d Ch. 3 status code 16e Ch. 4 status code

12i City or town, state or province, country, ZIP or foreign postal code

17a State income tax withheld 17b Payer’s state tax no. 17c Name of state

13a Recipient’s name 13b Recipient’s country code

13c Address (number and street)

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 11386R Form 1042-S (2025)