Enlarge image

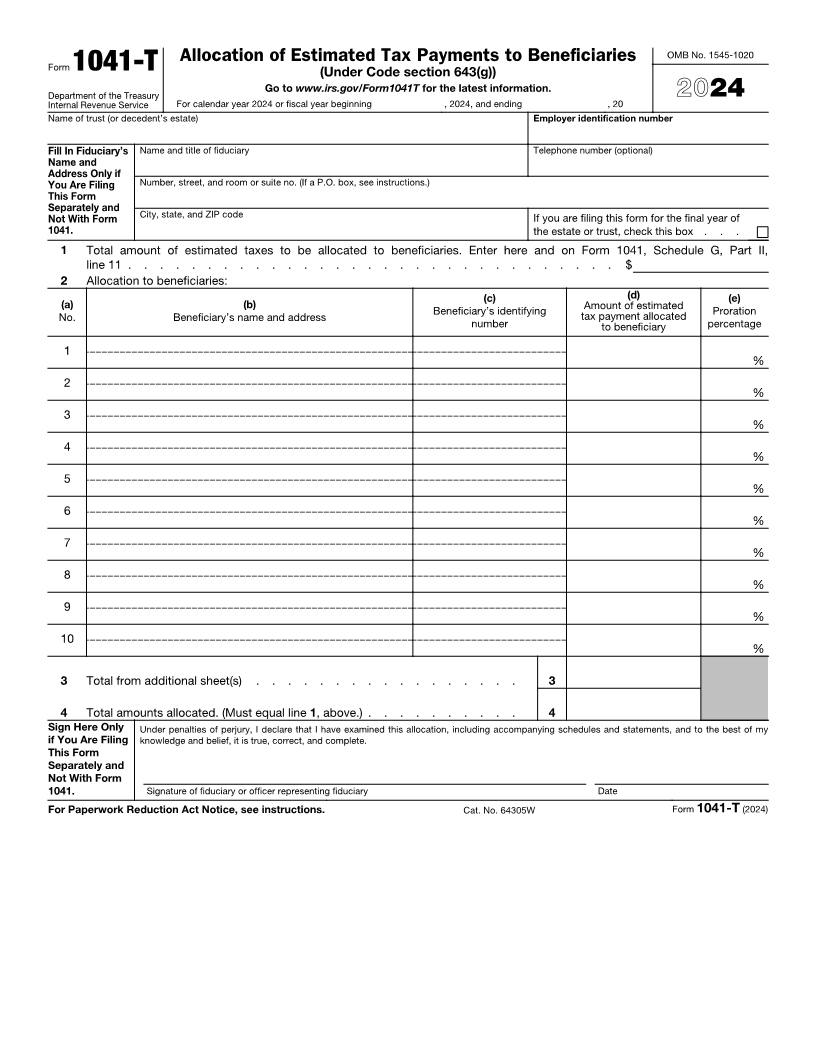

Allocation of Estimated Tax Payments to Beneficiaries OMB No. 1545-1020

Form 1041-T (Under Code section 643(g))

Go to www.irs.gov/Form1041T for the latest information.

Department of the Treasury 2024

Internal Revenue Service For calendar year 2024 or fiscal year beginning , 2024, and ending , 20

Name of trust (or decedent’s estate) Employer identification number

Fill In Fiduciary’s Name and title of fiduciary Telephone number (optional)

Name and

Address Only if

You Are Filing Number, street, and room or suite no. (If a P.O. box, see instructions.)

This Form

Separately and City, state, and ZIP code If you are filing this form for the final year of

Not With Form

1041. the estate or trust, check this box . . .

1 Total amount of estimated taxes to be allocated to beneficiaries. Enter here and on Form 1041, Schedule G, Part II,

line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

2 Allocation to beneficiaries:

(a) (b) (c) (d) (e)

No. Beneficiary’s name and address Beneficiary’s identifying Amount of estimated Proration

tax payment allocated

number to beneficiary percentage

1

%

2

%

3

%

4

%

5

%

6

%

7

%

8

%

9

%

10

%

3 Total from additional sheet(s) . . . . . . . . . . . . . . . . . 3

4 Total amounts allocated. (Must equal line 1 , above.) . . . . . . . . . . 4

Sign Here Only Under penalties of perjury, I declare that I have examined this allocation, including accompanying schedules and statements, and to the best of my

if You Are Filing knowledge and belief, it is true, correct, and complete.

This Form

Separately and

Not With Form

1041. Signature of fiduciary or officer representing fiduciary Date

For Paperwork Reduction Act Notice, see instructions. Cat. No. 64305W Form 1041-T (2024)