Enlarge image

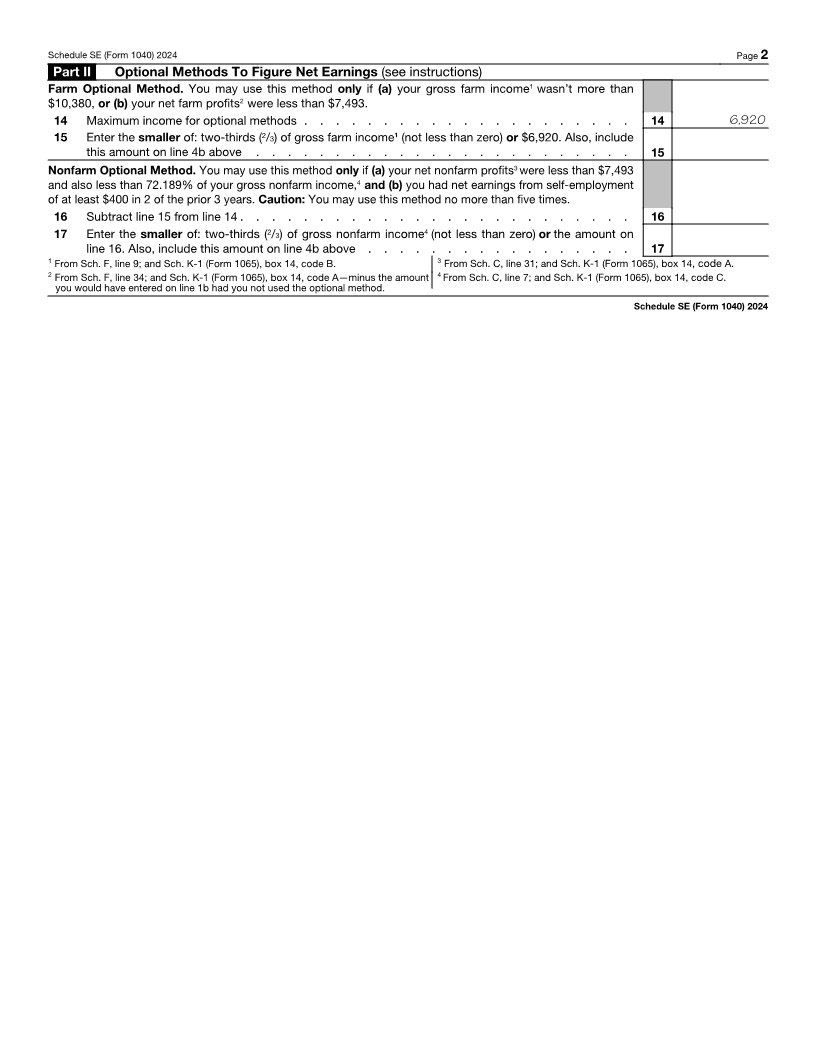

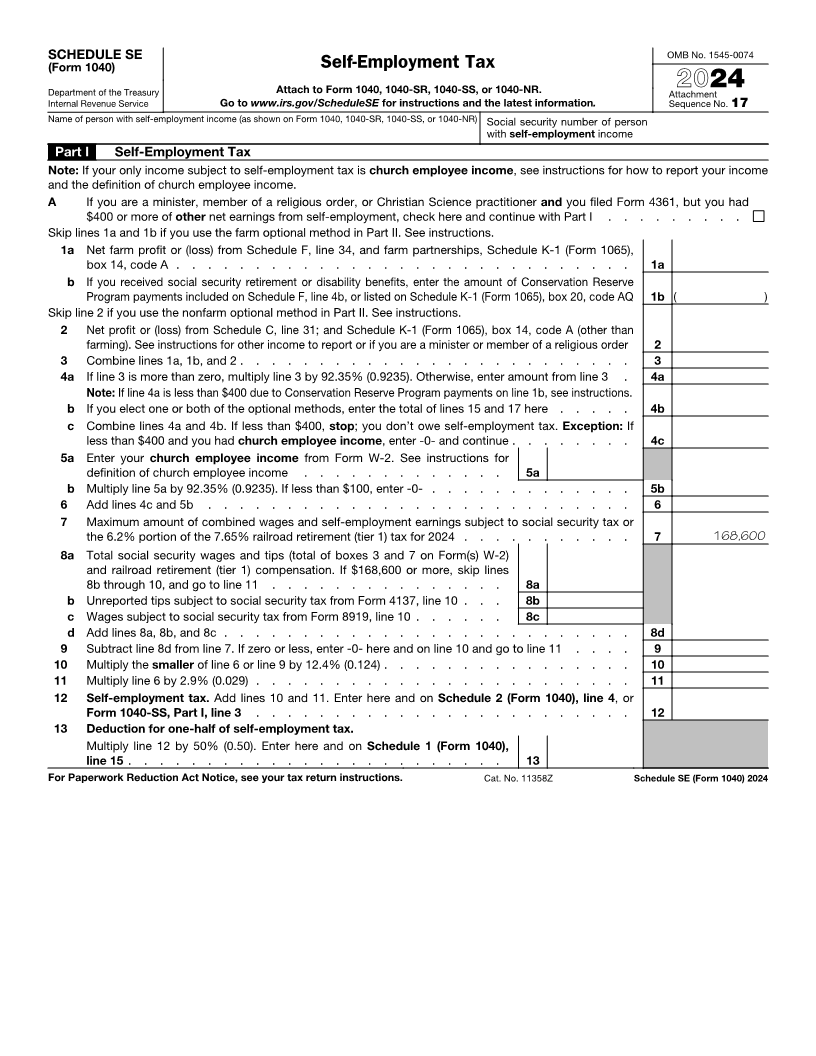

SCHEDULE SE OMB No. 1545-0074 (Form 1040) Self-Employment Tax Department of the Treasury Attach to Form 1040, 1040-SR, 1040-SS, or 1040-NR. Attachment 2024 Internal Revenue Service Go to www.irs.gov/ScheduleSE for instructions and the latest information. Sequence No. 17 Name of person with self-employment income (as shown on Form 1040, 1040-SR, 1040-SS, or 1040-NR) Social security number of person with self-employment income Part I Self-Employment Tax Note: If your only income subject to self-employment tax is church employee income , see instructions for how to report your income and the definition of church employee income. A If you are a minister, member of a religious order, or Christian Science practitioner and you filed Form 4361, but you had $400 or more of other net earnings from self-employment, check here and continue with Part I . . . . . . . . . Skip lines 1a and 1b if you use the farm optional method in Part II. See instructions. 1 a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AQ 1b ( ) Skip line 2 if you use the nonfarm optional method in Part II. See instructions. 2 Net profit or (loss) from Schedule C, line 31; and Schedule K-1 (Form 1065), box 14, code A (other than farming). See instructions for other income to report or if you are a minister or member of a religious order 2 3 Combine lines 1a, 1b, and 2 . . . . . . . . . . . . . . . . . . . . . . . . . 3 4 a If line 3 is more than zero, multiply line 3 by 92.35% (0.9235). Otherwise, enter amount from line 3 . 4a Note: If line 4a is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. b If you elect one or both of the optional methods, enter the total of lines 15 and 17 here . . . . . 4b c Combine lines 4a and 4b. If less than $400, stop; you don’t owe self-employment tax. Exception: If less than $400 and you had church employee income , enter -0- and continue . . . . . . . . 4c 5 a Enter your church employee income from Form W-2. See instructions for definition of church employee income . . . . . . . . . . . . . 5a b Multiply line 5a by 92.35% (0.9235). If less than $100, enter -0- . . . . . . . . . . . . . 5b 6 Add lines 4c and 5b . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 7 Maximum amount of combined wages and self-employment earnings subject to social security tax or the 6.2% portion of the 7.65% railroad retirement (tier 1) tax for 2024 . . . . . . . . . . . 7 168,600 8 a Total social security wages and tips (total of boxes 3 and 7 on Form(s) W-2) and railroad retirement (tier 1) compensation. If $168,600 or more, skip lines 8b through 10, and go to line 11 . . . . . . . . . . . . . . . 8a b Unreported tips subject to social security tax from Form 4137, line 10 . . . 8b c Wages subject to social security tax from Form 8919, line 10 . . . . . . 8c d Add lines 8a, 8b, and 8c . . . . . . . . . . . . . . . . . . . . . . . . . . 8d 9 Subtract line 8d from line 7. If zero or less, enter -0- here and on line 10 and go to line 11 . . . . 9 10 Multiply the smaller of line 6 or line 9 by 12.4% (0.124) . . . . . . . . . . . . . . . . 10 11 Multiply line 6 by 2.9% (0.029) . . . . . . . . . . . . . . . . . . . . . . . . 11 12 Self-employment tax. Add lines 10 and 11. Enter here and on Schedule 2 (Form 1040), line 4, or Form 1040-SS, Part I, line 3 . . . . . . . . . . . . . . . . . . . . . . . . 12 13 Deduction for one-half of self-employment tax. Multiply line 12 by 50% (0.50). Enter here and on Schedule 1 (Form 1040), line 15 . . . . . . . . . . . . . . . . . . . . . . . . 13 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358Z Schedule SE (Form 1040) 2024