Enlarge image

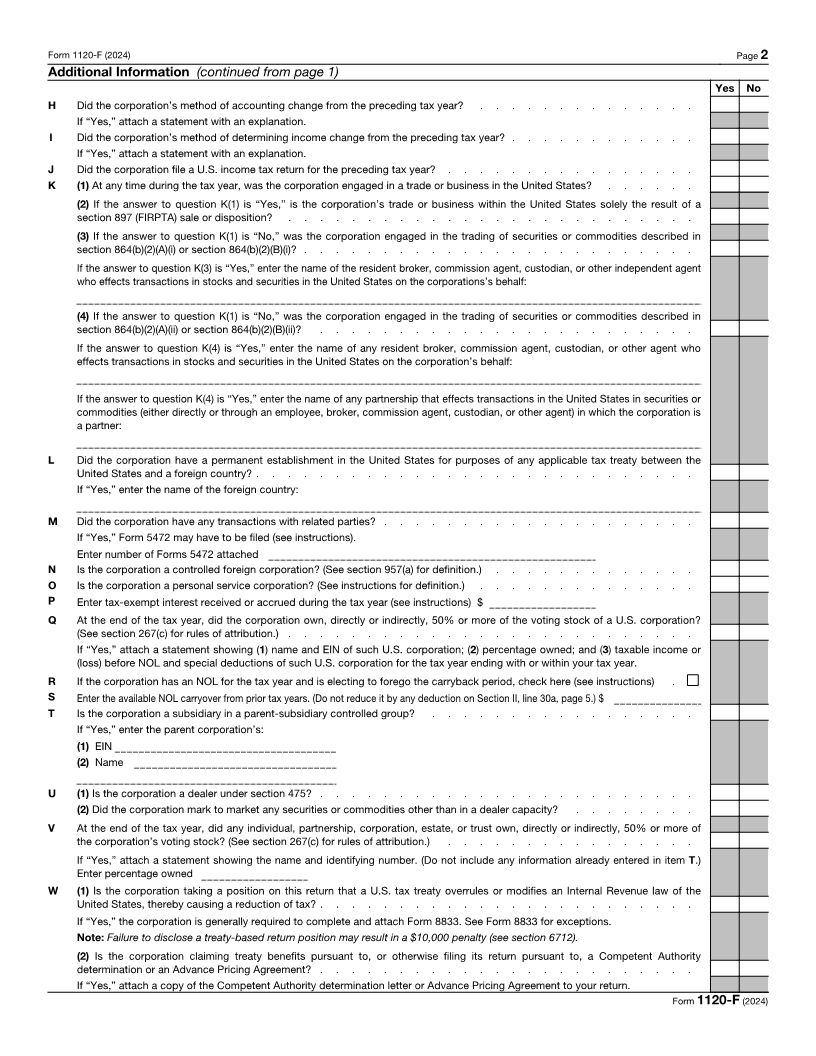

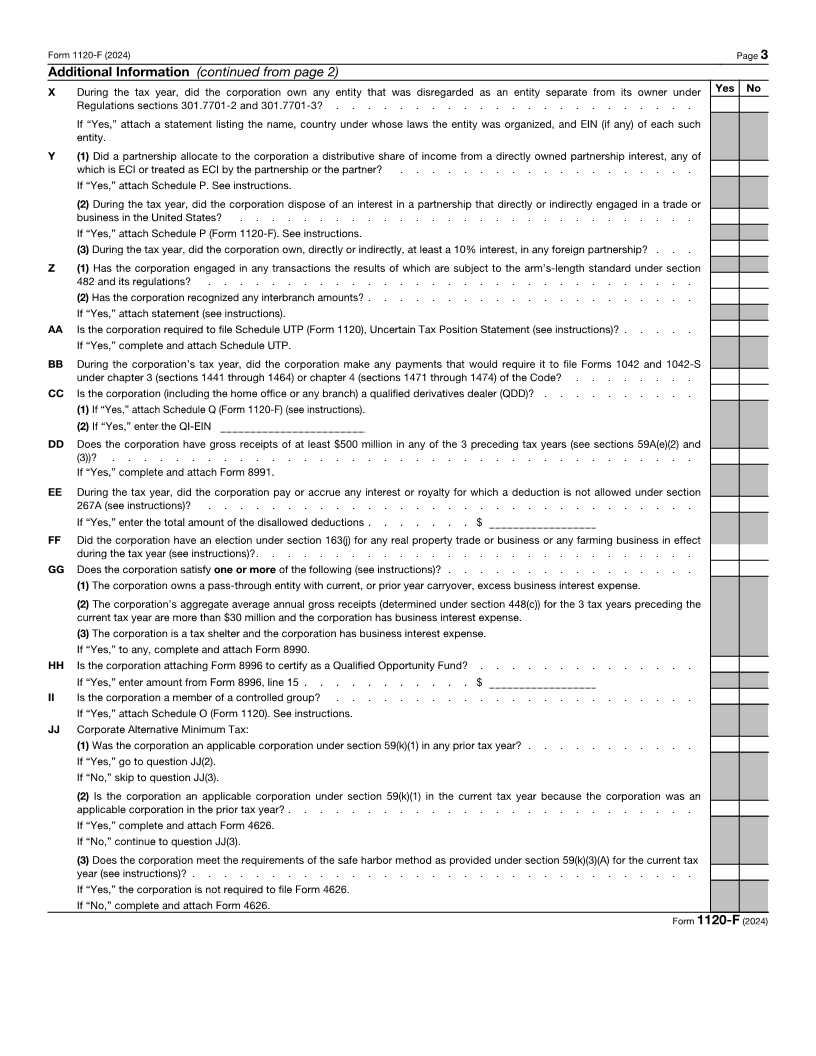

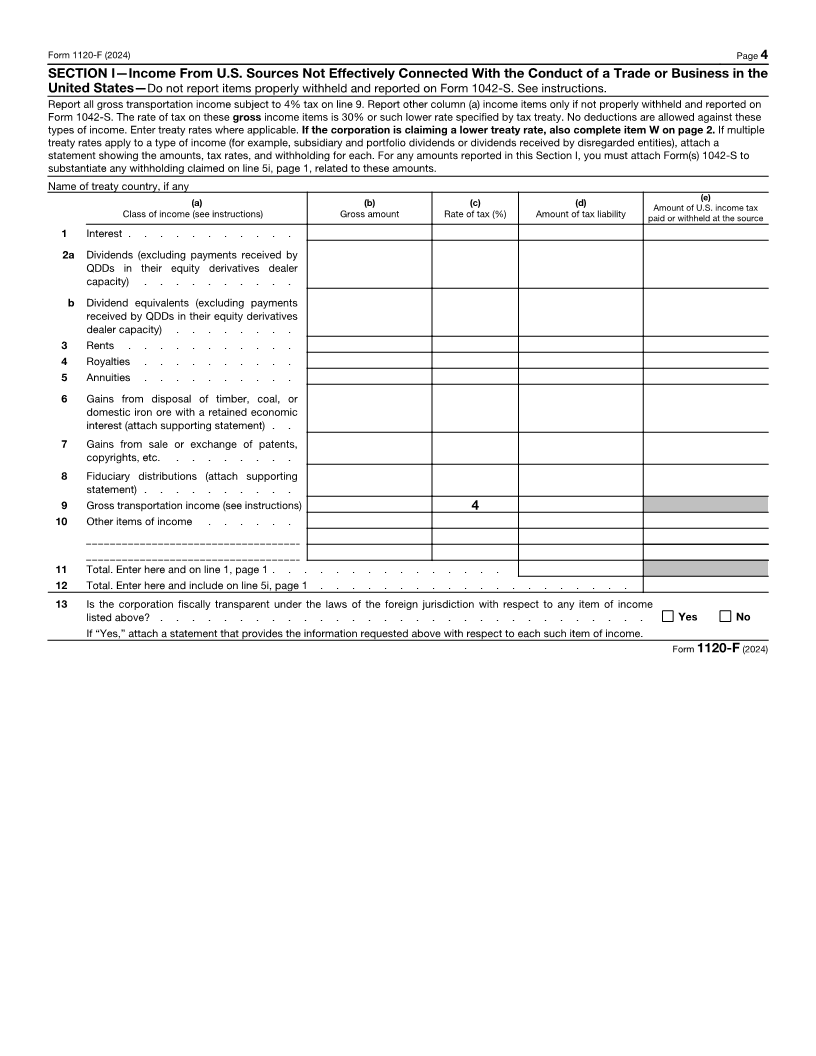

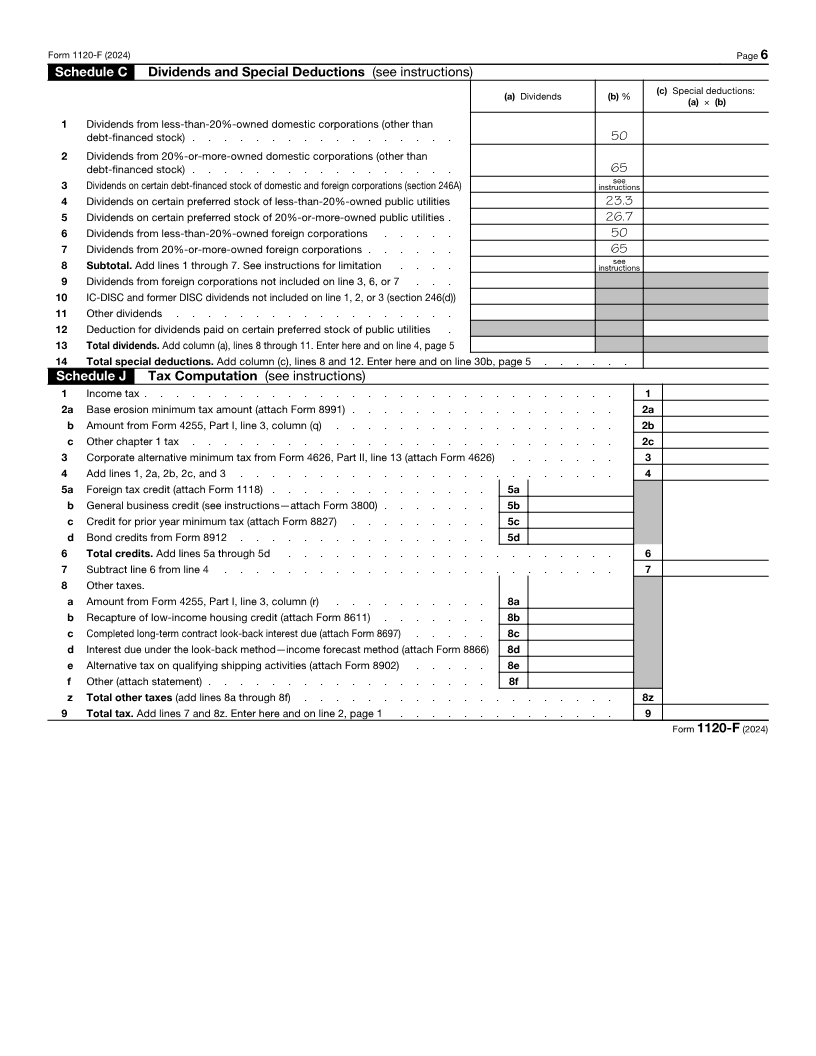

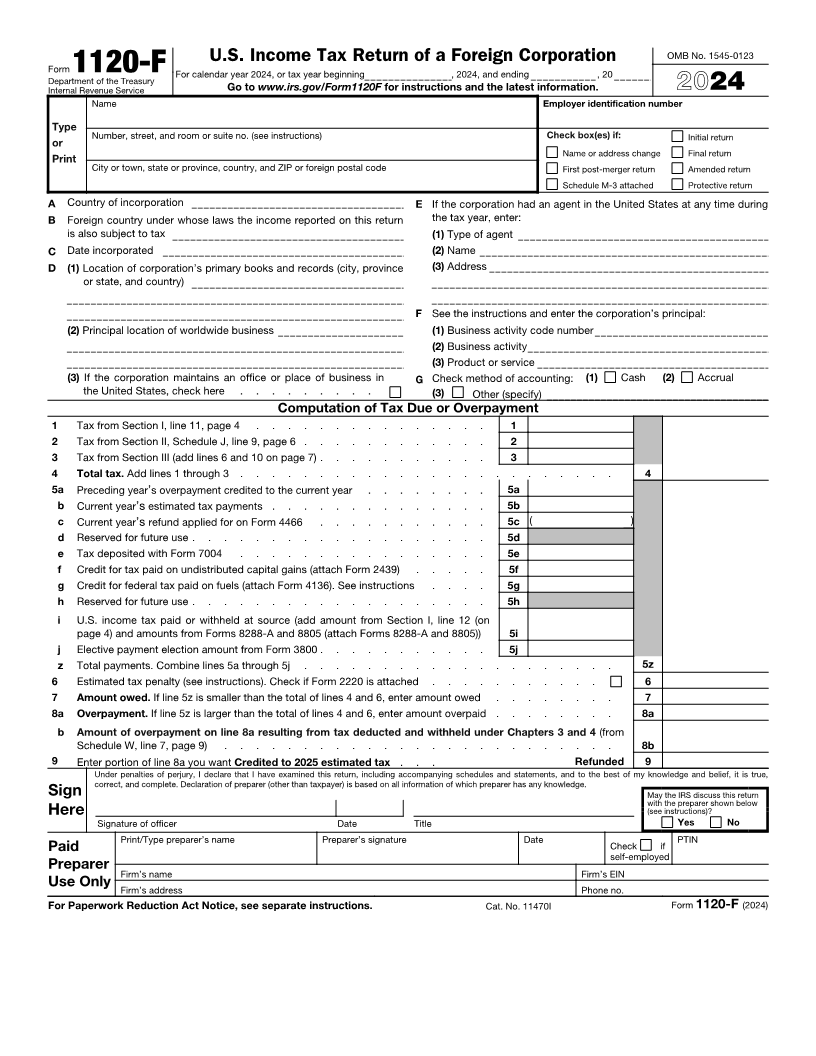

U.S. Income Tax Return of a Foreign Corporation OMB No. 1545-0123

Form Department of the Treasury 1120-F For calendar year 2024, or tax year beginning , 2024, and ending , 20

Internal Revenue Service Go to www.irs.gov/Form1120F for instructions and the latest information. 2024

Name Employer identification number

Type

Number, street, and room or suite no. (see instructions) Check box(es) if:

or Initial return

Print Name or address change Final return

City or town, state or province, country, and ZIP or foreign postal code First post-merger return Amended return

Schedule M-3 attached Protective return

A Country of incorporation E If the corporation had an agent in the United States at any time during

B Foreign country under whose laws the income reported on this return the tax year, enter:

is also subject to tax (1) Type of agent

C Date incorporated (2) Name

D (1) Location of corporation’s primary books and records (city, province (3) Address

or state, and country)

F See the instructions and enter the corporation’s principal:

(2) Principal location of worldwide business (1) Business activity code number

(2) Business activity

(3) Product or service

(3) If the corporation maintains an office or place of business in G Check method of accounting: (1) Cash (2) Accrual

the United States, check here . . . . . . . . . (3) Other (specify)

Computation of Tax Due or Overpayment

1 Tax from Section I, line 11, page 4 . . . . . . . . . . . . . . . 1

2 Tax from Section II, Schedule J, line 9, page 6 . . . . . . . . . . . . 2

3 Tax from Section III (add lines 6 and 10 on page 7) . . . . . . . . . . . 3

4 Total tax. Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . 4

5a Preceding year’s overpayment credited to the current year . . . . . . . . 5a

b Current year ’sestimated tax payments . . . . . . . . . . . . . . 5b

c Current year’s refund applied for on Form 4466 . . . . . . . . . . . 5c ( )

d Reserved for future use . . . . . . . . . . . . . . . . . . . 5d

e Tax deposited with Form 7004 . . . . . . . . . . . . . . . . 5e

f Credit for tax paid on undistributed capital gains (attach Form 2439) . . . . . 5f

g Credit for federal tax paid on fuels (attach Form 4136). See instructions . . . . 5g

h Reserved for future use . . . . . . . . . . . . . . . . . . . 5h

i U.S. income tax paid or withheld at source (add amount from Section I, line 12 (on

page 4) and amounts from Forms 8288-A and 8805 (attach Forms 8288-A and 8805)) 5i

j Elective payment election amount from Form 3800 . . . . . . . . . . . 5j

z Total payments. Combine lines 5a through 5j . . . . . . . . . . . . . . . . . . . . 5z

6 Estimated tax penalty (see instructions). Check if Form 2220 is attached . . . . . . . . . . . 6

7 Amount owed. If line 5z is smaller than the total of lines 4 and 6, enter amount owed . . . . . . . . 7

8 a Overpayment. If line 5z is larger than the total of lines 4 and 6, enter amount overpaid . . . . . . . . 8a

b Amount of overpayment on line 8a resulting from tax deducted and withheld under Chapters 3 and 4 (from

Schedule W, line 7, page 9) . . . . . . . . . . . . . . . . . . . . . . . . . 8b

9 Enter portion of line 8a you want Credited to 2025 estimated tax . . . Refunded 9

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign May the IRS discuss this return

with the preparer shown below

Here (see instructions)?

Signature of officer Date Title Yes No

Print/Type preparer’s name Preparer’s signature Date

Paid Check if PTIN

self-employed

Preparer

Firm’s name Firm’s EIN

Use Only Firm’s address Phone no.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11470I Form 1120-F (2024)