Enlarge image

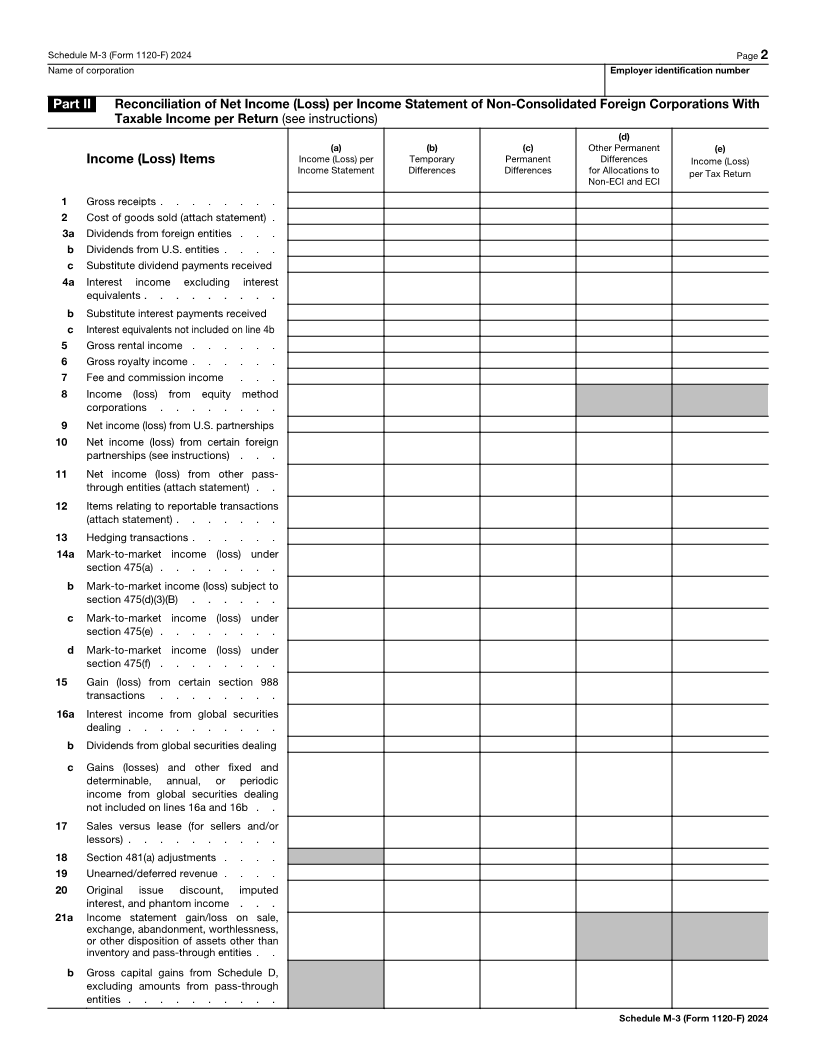

SCHEDULE M-3 Net Income (Loss) Reconciliation for Foreign OMB No. 1545-0123

(Form 1120-F) Corporations With Reportable Assets of $10 Million or More

Department of the Treasury Attach to Form 1120-F.

Internal Revenue Service Go to www.irs.gov/Form1120F for instructions and the latest information. 2024

Name of corporation Employer identification number

A Has the corporation reported taxable income on Form 1120-F, page 5, using a treaty provision to attribute

business profits to a U.S. permanent establishment under rules other than section 864(c)? . . . . . . Yes No

B Did the corporation prepare a non-consolidated, worldwide, certified audited income statement for the

period (see instructions)? . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

C Did the corporation prepare a non-consolidated, worldwide income statement for the period (see instructions)? Yes No

D Did the corporation prepare certified audited income statement(s) for the set(s) of books reported on

Form 1120-F, Schedule L? . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

Part I Financial Information and Net Income (Loss) Reconciliation (see instructions)

1 Is the corporation a foreign bank as defined in Regulations section 1.882-5(c)(4)?

Yes. Complete the remainder of Part I as follows:

If D is “Yes,” use the income statement described in D to complete lines 2 through 5 and 7 through 11.

If D is “No,” use the income statement(s) for the set(s) of books reported on Form 1120-F, Schedule L

to complete lines 2 through 5 and 7 through 11.

No. Complete the remainder of Part I as follows:

If B is “Yes,” use the income statement described in B to complete lines 2 through 11.

If B is “No” and C is “Yes,” use the income statement described in C to complete lines 2 through 11.

If B and C are “No” and D is “Yes,” use the income statement described in D to complete lines 2 through 11.

If B, C, and D are “No,” use the income statement described in the instructions to complete lines 2 through 11.

2a Enter the income statement period: Beginning Ending

b Has the corporation’s income statement been restated for the income statement period entered on line 2a?

Yes. Attach an explanation and the amount of each item restated.

No.

c Has the corporation’s income statement been restated for any of the 5 income statement periods immediately

preceding the period on line 2a?

Yes. Attach an explanation and the amount of each item restated.

No.

3 Is any of the corporation’s stock publicly traded on any exchange, U.S. or foreign?

Yes. List exchange(s) and symbol

No.

4 Non-consolidated foreign corporation net income (loss) in U.S. dollars from the income statement

source identified in line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5a Net income from includible disregarded foreign entities not included on line 4 (attach statement) . . 5a

b Net loss from includible disregarded foreign entities not included on line 4 (attach statement) . . . 5b ( )

c Net income from includible disregarded U.S. entities not included on line 4 (attach statement) . . . 5c

d Net loss from includible disregarded U.S. entities not included on line 4 (attach statement) . . . . 5d ( )

6 Net income (loss) from foreign locations not included on line 4 (attach statement) . . . . . . . 6

7a Net income of non-includible entities (attach statement) . . . . . . . . . . . . . . . 7a ( )

b Net loss of non-includible entities (attach statement) . . . . . . . . . . . . . . . . 7b

8 Adjustments to intercompany transactions (attach statement) . . . . . . . . . . . . . 8

9 Adjustments to reconcile income statement period to tax year (attach statement) . . . . . . . 9

10 Other adjustments to reconcile to amount on line 11 (attach statement) . . . . . . . . . . 10

11 Adjusted financial net income (loss) of non-consolidated foreign corporation. Combine lines 4

through 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Note: Part I, line 11, must equal Part II, line 28, column (a) or Schedule M-1, line 1 (see instructions).

For Paperwork Reduction Act Notice, see the Instructions Cat. No. 39667H Schedule M-3 (Form 1120-F) 2024

for Form 1120-F.