Enlarge image

OMB No. 1545-0123

SCHEDULE H Deductions Allocated to Effectively Connected

(Form 1120-F)

Income Under Regulations Section 1.861-8

Department of the Treasury Attach to Form 1120-F. 24

Internal Revenue Service Go to www.irs.gov/Form1120F for instructions and the latest information. 20

Name of corporation Employer identification number

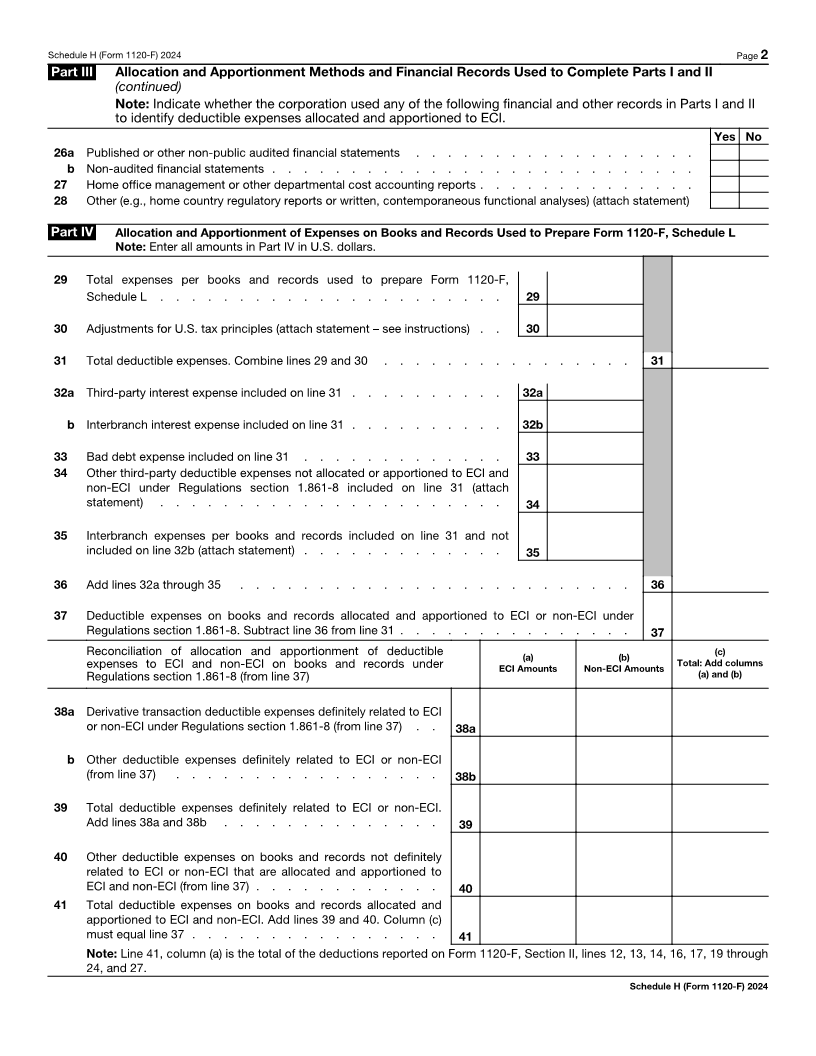

Part I Home Office Deductible Expenses Definitely Related Solely to ECI or Non-ECI

Note: Enter all amounts on lines 1a through 13 in only U.S. dollars or in only functional currency. If U.S. dollars, check box .

Otherwise, specify currency:

1a Total expenses on the books of the home office . . . . . . . . . . 1a

b Check the applicable box below to indicate the accounting convention used to

compute the amount on line 1a:

U.S. GAAP Home Country GAAP

IFRS Other (specify):

2 Adjustments for U.S. tax principles (attach statement – see instructions) . . 2

3 Total deductible expenses on the books of the home office. Combine lines 1a and 2 . . . . . . 3

4 Interest expense included on line 3 . . . . . . . . . . . . . . 4

5 Bad debt expense included on line 3 . . . . . . . . . . . . . . 5

6 Total of interest expense and bad debt expense. Add lines 4 and 5 . . . . . . . . . . . . 6

7 Remaining deductible expenses to be allocated and apportioned between ECI and non-ECI. Subtract line 6 from line 3 7

8 Deductible expenses definitely related solely to non-ECI from subsidiaries . . 8

9 Deductible expenses definitely related solely to other non-ECI booked in the home country 9

10 Deductible expenses definitely related solely to other non-ECI booked in other

countries (including the United States) . . . . . . . . . . . . . 10

11 Deductible expenses definitely related solely to ECI . . . . . . . . . 11

12 Total deductible expenses definitely related solely to ECI or non-ECI. Add lines 8 through 11 . . . 12

Part II Home Office Deductible Expenses Allocated and Apportioned to ECI

Note: Enter the amounts on lines 15 through 20 in U.S. dollars.

13 Remaining deductible expenses on the books of the home office not definitely related solely to ECI or

non-ECI. Subtract line 12 from line 7 . . . . . . . . . . . . . . . . . . . . . . 13

14 Average exchange rate used to convert amounts to U.S. dollars (see instructions) . . . . . . . 14

15 Enter the amount from line 13. If line 13 is stated in functional currency, divide line 13 by line 14 . . 15

16 Remaining home office deductible expenses on line 15 allocated and apportioned under Regulations

section 1.861-8 to ECI (attach computation) . . . . . . . . . . . . . . . . . . . 16

17 Enter the amount from line 11. If line 11 is stated in functional currency, divide line 11 by line 14 . . 17

18 Total home office deductible expenses allocated and apportioned to ECI. Add lines 16 and 17 . . . 18

19 Total deductible expenses from other non-U.S. locations allocated and apportioned to ECI . . . . 19

20 Total deductible expenses allocated and apportioned to ECI. Add lines 18 and 19 and enter the

amount here and on Form 1120-F, Section II, line 26 . . . . . . . . . . . . . . . . 20

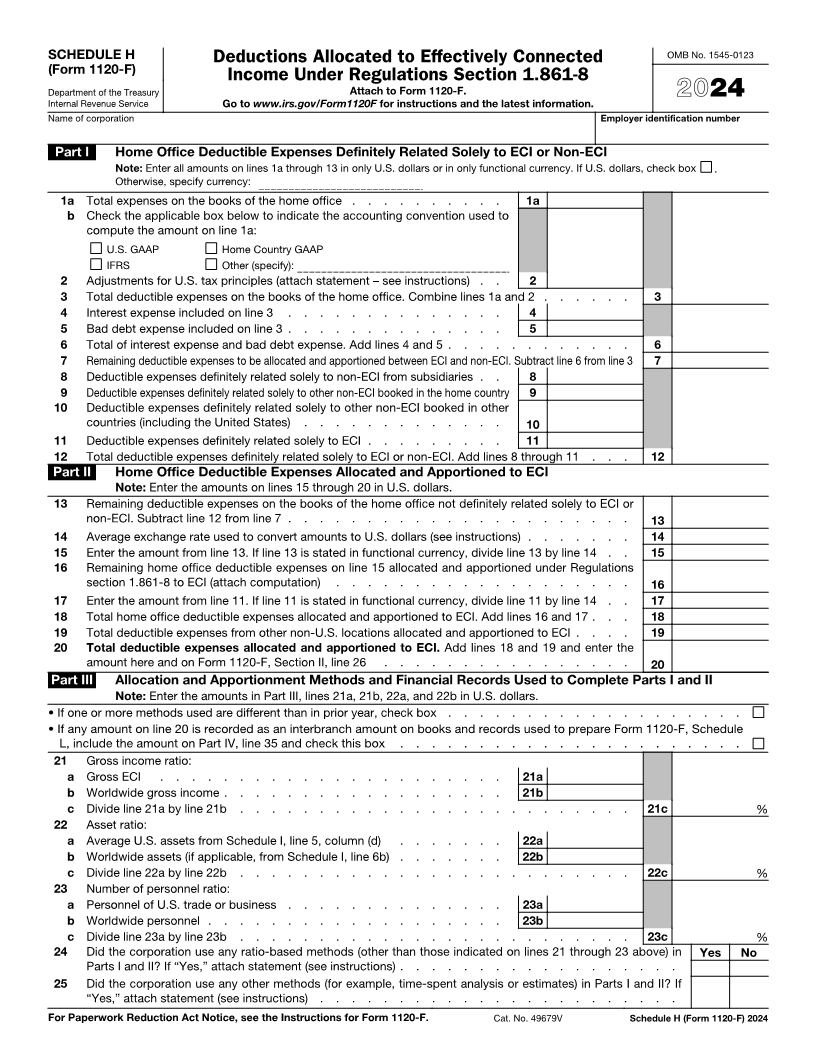

Part III Allocation and Apportionment Methods and Financial Records Used to Complete Parts I and II

Note: Enter the amounts in Part III, lines 21a, 21b, 22a, and 22b in U.S. dollars.

• If one or more methods used are different than in prior year, check box . . . . . . . . . . . . . . . . . . .

• If any amount on line 20 is recorded as an interbranch amount on books and records used to prepare Form 1120-F, Schedule

L, include the amount on Part IV, line 35 and check this box . . . . . . . . . . . . . . . . . . . . . .

21 Gross income ratio:

a Gross ECI . . . . . . . . . . . . . . . . . . . . . . 21a

b Worldwide gross income . . . . . . . . . . . . . . . . . . 21b

c Divide line 21a by line 21b . . . . . . . . . . . . . . . . . . . . . . . . . 21c %

22 Asset ratio:

a Average U.S. assets from Schedule I, line 5, column (d) . . . . . . . 22a

b Worldwide assets (if applicable, from Schedule I, line 6b) . . . . . . . 22b

c Divide line 22a by line 22b . . . . . . . . . . . . . . . . . . . . . . . . . 22c %

23 Number of personnel ratio:

a Personnel of U.S. trade or business . . . . . . . . . . . . . . 23a

b Worldwide personnel . . . . . . . . . . . . . . . . . . . 23b

c Divide line 23a by line 23b . . . . . . . . . . . . . . . . . . . . . . . . . 23c %

24 Did the corporation use any ratio-based methods (other than those indicated on lines 21 through 23 above) in Yes No

Parts I and II? If “Yes,” attach statement (see instructions) . . . . . . . . . . . . . . . . . .

25 Did the corporation use any other methods (for example, time-spent analysis or estimates) in Parts I and II? If

“Yes,” attach statement (see instructions) . . . . . . . . . . . . . . . . . . . . . . .

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-F. Cat. No. 49679V Schedule H (Form 1120-F) 2024