Enlarge image

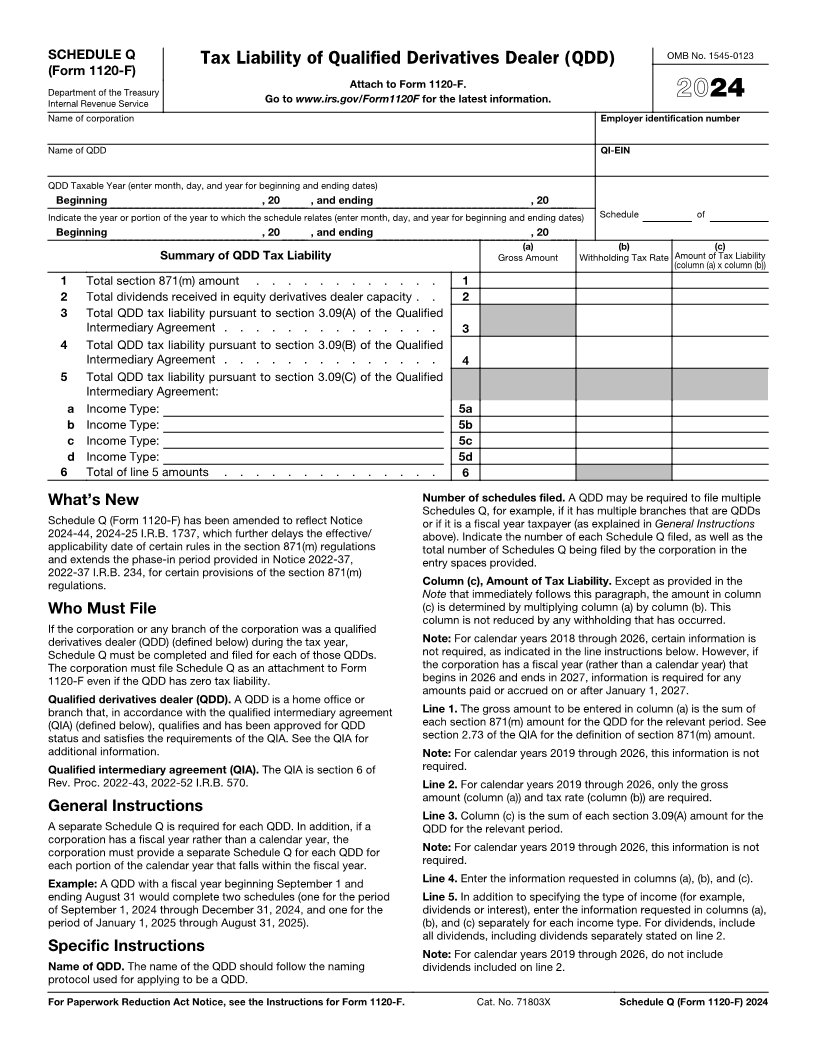

OMB No. 1545-0123 SCHEDULE Q Tax Liability of Qualified Derivatives Dealer (QDD) (Form 1120-F) Attach to Form 1120-F. Department of the Treasury 2024 Internal Revenue Service Go to www.irs.gov/Form1120F for the latest information. Name of corporation Employer identification number Name of QDD QI-EIN QDD Taxable Year (enter month, day, and year for beginning and ending dates) Beginning , 20 , and ending , 20 Indicate the year or portion of the year to which the schedule relates (enter month, day, and year for beginning and ending dates) Schedule of Beginning , 20 , and ending , 20 (a) (b) (c) Summary of QDD Tax Liability Gross Amount Withholding Tax Rate Amount of Tax Liability (column (a) x column (b)) 1 Total section 871(m) amount . . . . . . . . . . . . 1 2 Total dividends received in equity derivatives dealer capacity . . 2 3 Total QDD tax liability pursuant to section 3.09(A) of the Qualified Intermediary Agreement . . . . . . . . . . . . . . 3 4 Total QDD tax liability pursuant to section 3.09(B) of the Qualified Intermediary Agreement . . . . . . . . . . . . . . 4 5 Total QDD tax liability pursuant to section 3.09(C) of the Qualified Intermediary Agreement: a Income Type: 5a b Income Type: 5b c Income Type: 5c d Income Type: 5d 6 Total of line 5 amounts . . . . . . . . . . . . . . 6 What’s New Number of schedules filed. A QDD may be required to file multiple Schedules Q, for example, if it has multiple branches that are QDDs Schedule Q (Form 1120-F) has been amended to reflect Notice or if it is a fiscal year taxpayer (as explained in General Instructions 2024-44, 2024-25 I.R.B. 1737, which further delays the effective/ above). Indicate the number of each Schedule Q filed, as well as the applicability date of certain rules in the section 871(m) regulations total number of Schedules Q being filed by the corporation in the and extends the phase-in period provided in Notice 2022-37, entry spaces provided. 2022-37 I.R.B. 234, for certain provisions of the section 871(m) regulations. Column (c), Amount of Tax Liability. Except as provided in the Note that immediately follows this paragraph, the amount in column Who Must File (c) is determined by multiplying column (a) by column (b). This column is not reduced by any withholding that has occurred. If the corporation or any branch of the corporation was a qualified derivatives dealer (QDD) (defined below) during the tax year, Note: For calendar years 2018 through 2026, certain information is Schedule Q must be completed and filed for each of those QDDs. not required, as indicated in the line instructions below. However, if The corporation must file Schedule Q as an attachment to Form the corporation has a fiscal year (rather than a calendar year) that 1120-F even if the QDD has zero tax liability. begins in 2026 and ends in 2027, information is required for any amounts paid or accrued on or after January 1, 2027. Qualified derivatives dealer (QDD). A QDD is a home office or branch that, in accordance with the qualified intermediary agreement Line 1. The gross amount to be entered in column (a) is the sum of (QIA) (defined below), qualifies and has been approved for QDD each section 871(m) amount for the QDD for the relevant period. See status and satisfies the requirements of the QIA. See the QIA for section 2.73 of the QIA for the definition of section 871(m) amount. additional information. Note: For calendar years 2019 through 2026, this information is not Qualified intermediary agreement (QIA). The QIA is section 6 of required. Rev. Proc. 2022-43, 2022-52 I.R.B. 570. Line 2. For calendar years 2019 through 2026, only the gross amount (column (a)) and tax rate (column (b)) are required. General Instructions Line 3. Column (c) is the sum of each section 3.09(A) amount for the A separate Schedule Q is required for each QDD. In addition, if a QDD for the relevant period. corporation has a fiscal year rather than a calendar year, the corporation must provide a separate Schedule Q for each QDD for Note: For calendar years 2019 through 2026, this information is not each portion of the calendar year that falls within the fiscal year. required. Example: A QDD with a fiscal year beginning September 1 and Line 4. Enter the information requested in columns (a), (b), and (c). ending August 31 would complete two schedules (one for the period Line 5. In addition to specifying the type of income (for example, of September 1, 2024 through December 31, 2024, and one for the dividends or interest), enter the information requested in columns (a), period of January 1, 2025 through August 31, 2025). (b), and (c) separately for each income type. For dividends, include all dividends, including dividends separately stated on line 2. Specific Instructions Note: For calendar years 2019 through 2026, do not include Name of QDD. The name of the QDD should follow the naming dividends included on line 2. protocol used for applying to be a QDD. For Paperwork Reduction Act Notice, see the Instructions for Form 1120-F. Cat. No. 71803X Schedule Q (Form 1120-F) 2024