Enlarge image

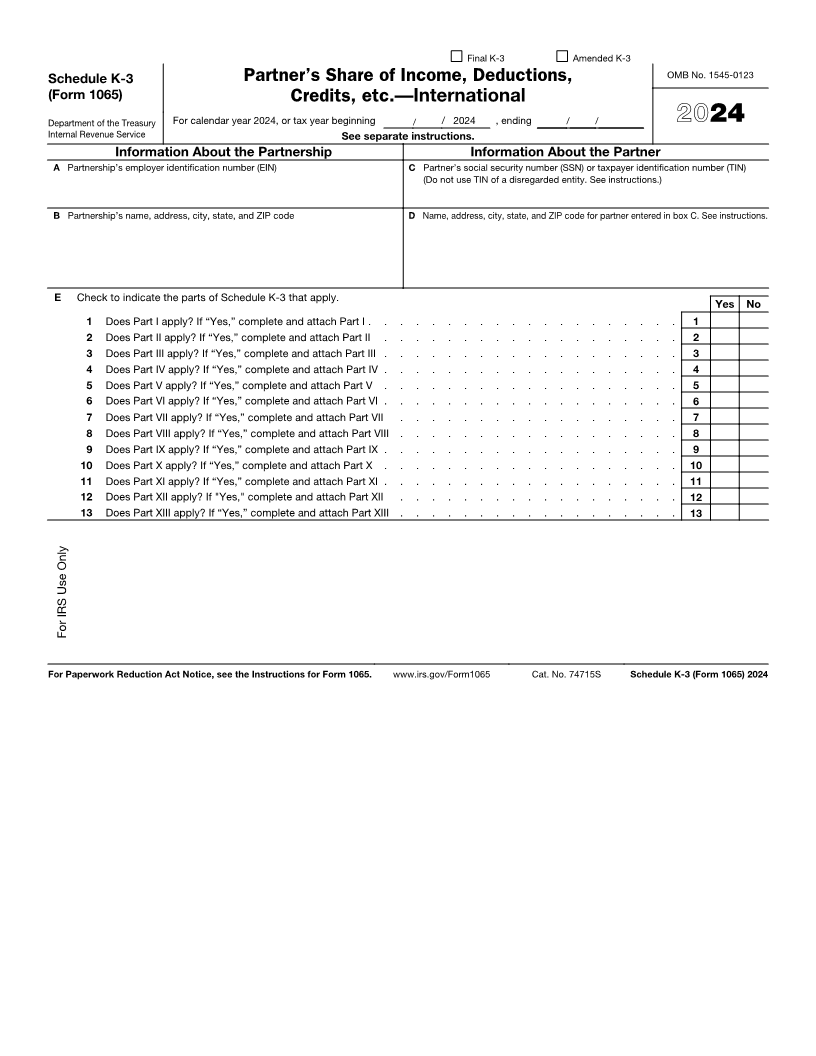

Final K-3 Amended K-3

Schedule K-3 Partner’s Share of Income, Deductions, OMB No. 1545-0123

(Form 1065) Credits, etc.—International

Department of the Treasury For calendar year 2024, or tax year beginning / / 2024 , ending / / 2024

Internal Revenue Service See separate instructions.

Information About the Partnership Information About the Partner

A Partnership’s employer identification number (EIN) C Partner’s social security number (SSN) or taxpayer identification number (TIN)

(Do not use TIN of a disregarded entity. See instructions.)

B Partnership’s name, address, city, state, and ZIP code D Name, address, city, state, and ZIP code for partner entered in box C. See instructions.

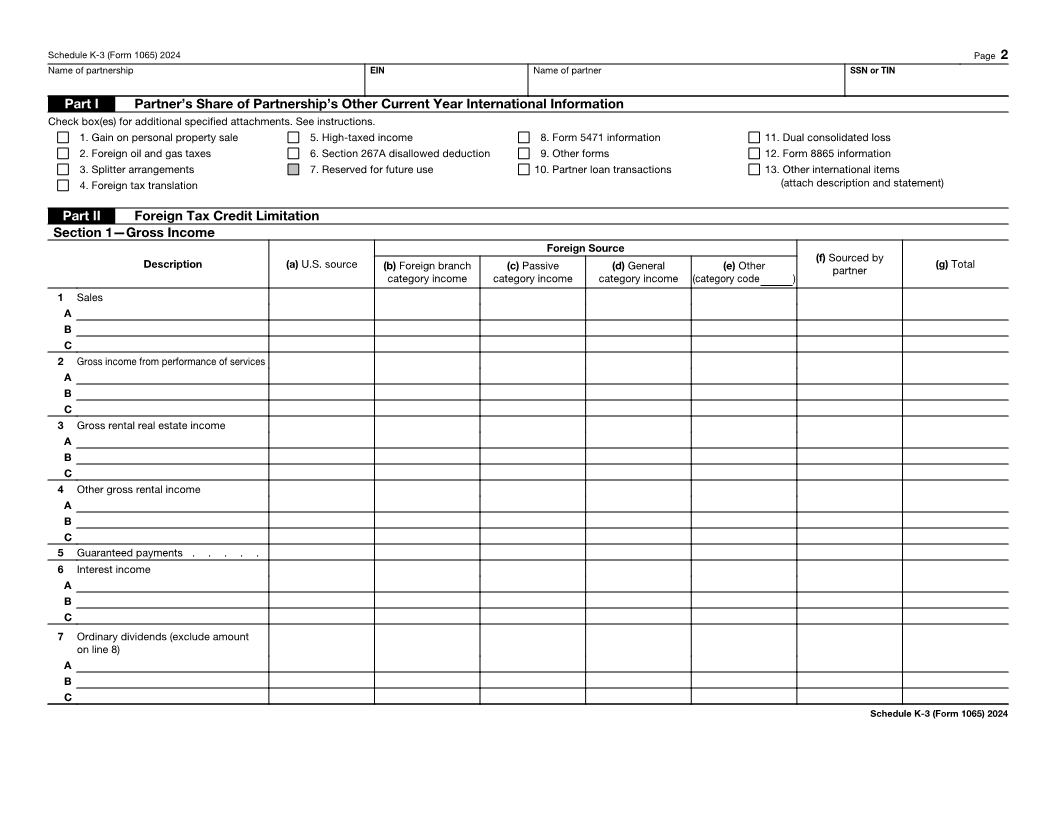

E Check to indicate the parts of Schedule K-3 that apply.

Yes No

1 Does Part I apply? If “Yes,” complete and attach Part I . . . . . . . . . . . . . . . . . . . . 1

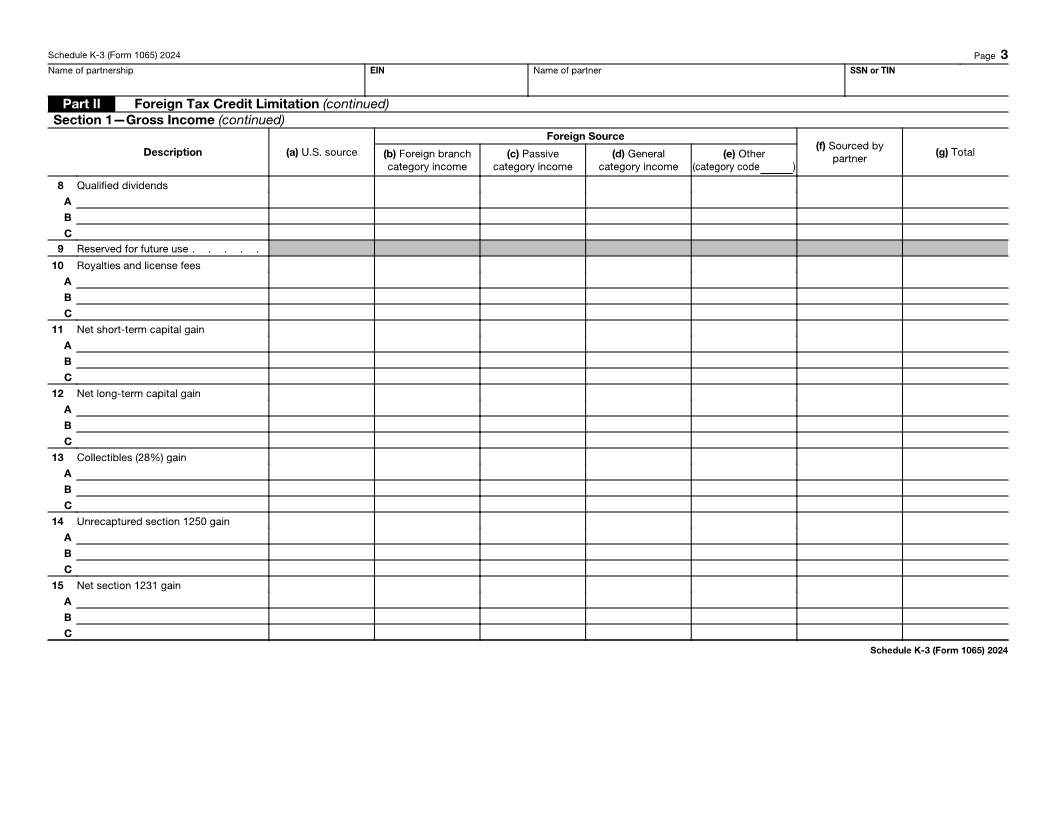

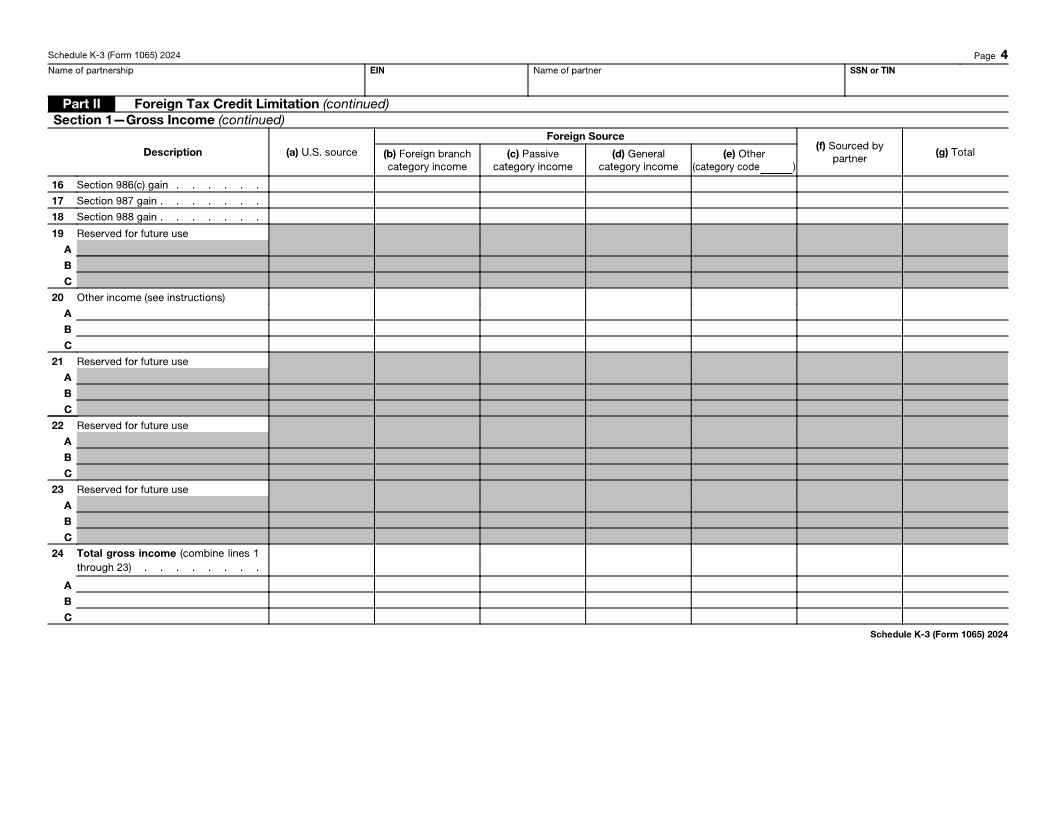

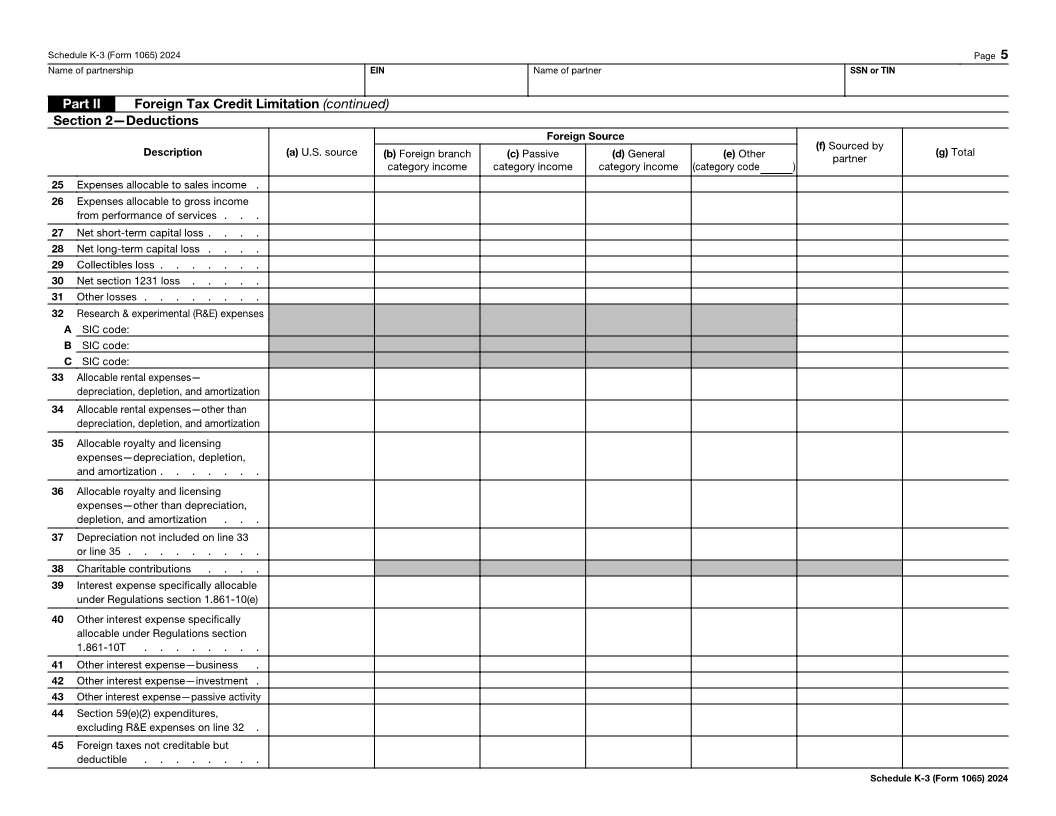

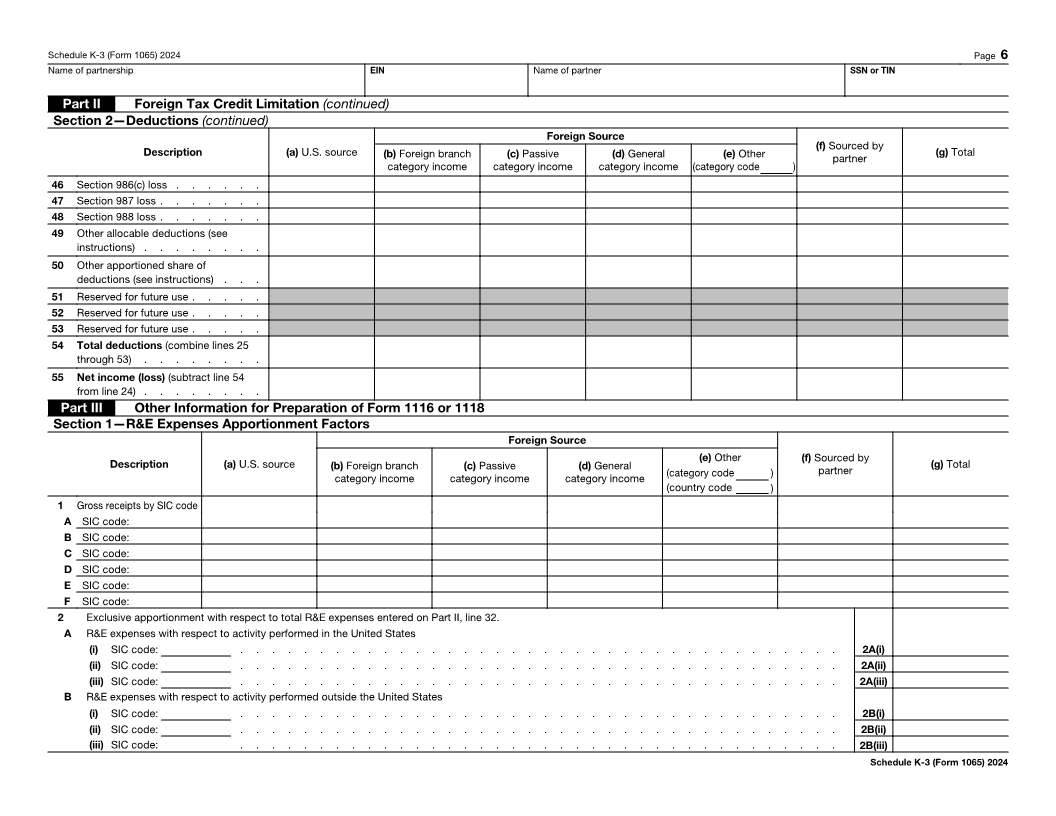

2 Does Part II apply? If “Yes,” complete and attach Part II . . . . . . . . . . . . . . . . . . . 2

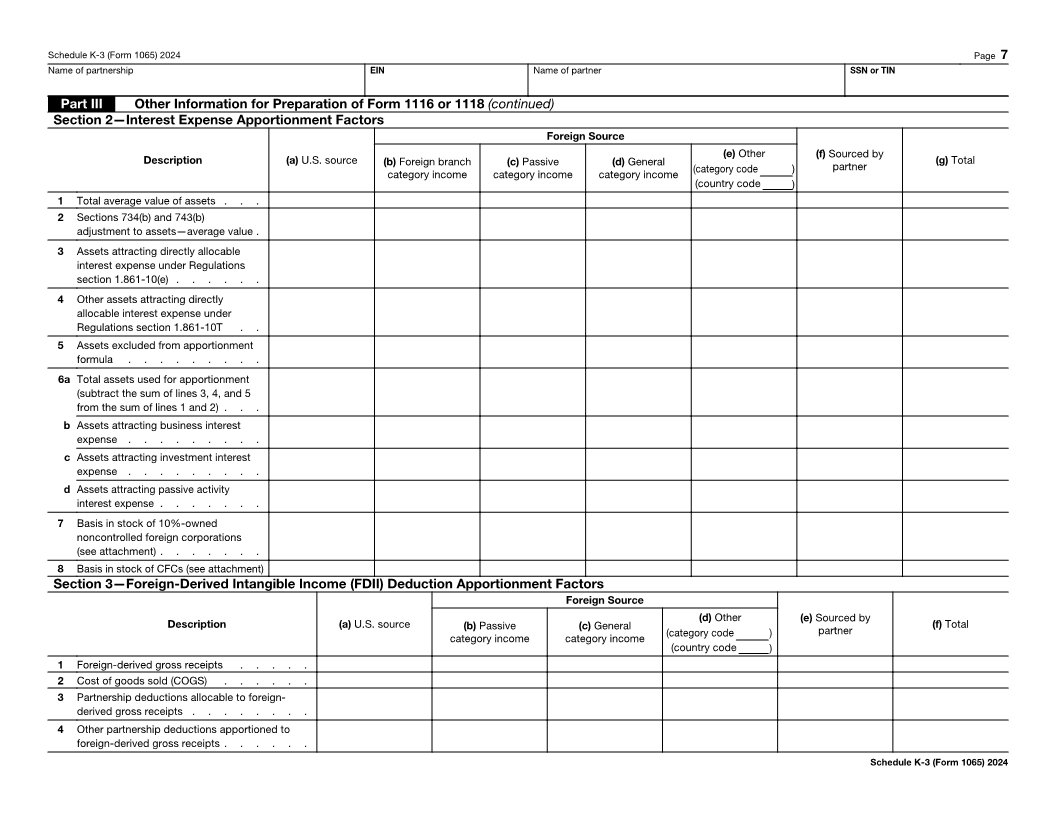

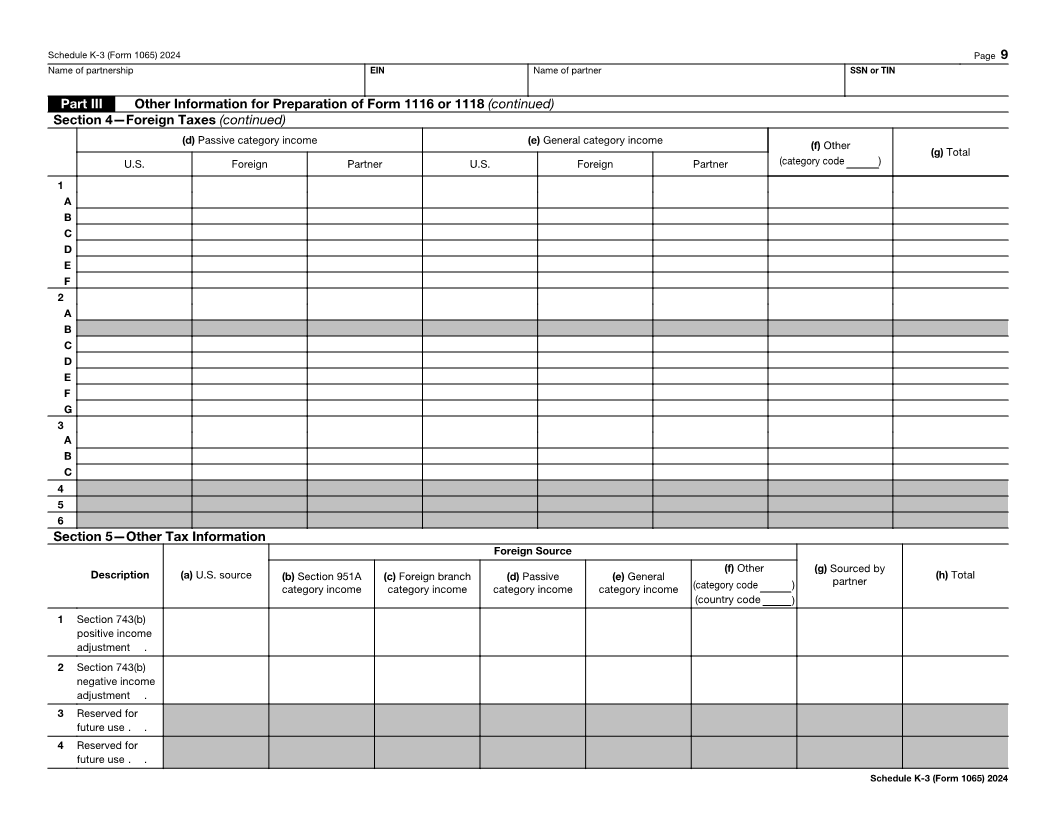

3 Does Part III apply? If “Yes,” complete and attach Part III . . . . . . . . . . . . . . . . . . . 3

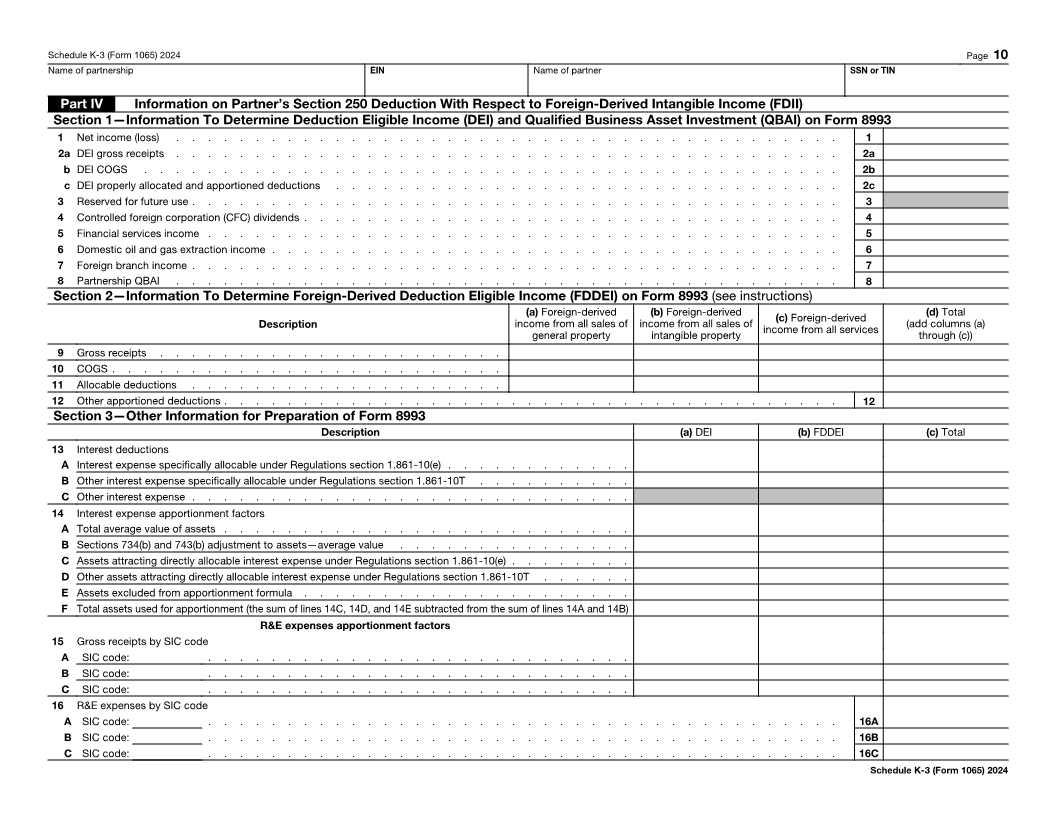

4 Does Part IV apply? If “Yes,” complete and attach Part IV . . . . . . . . . . . . . . . . . . . 4

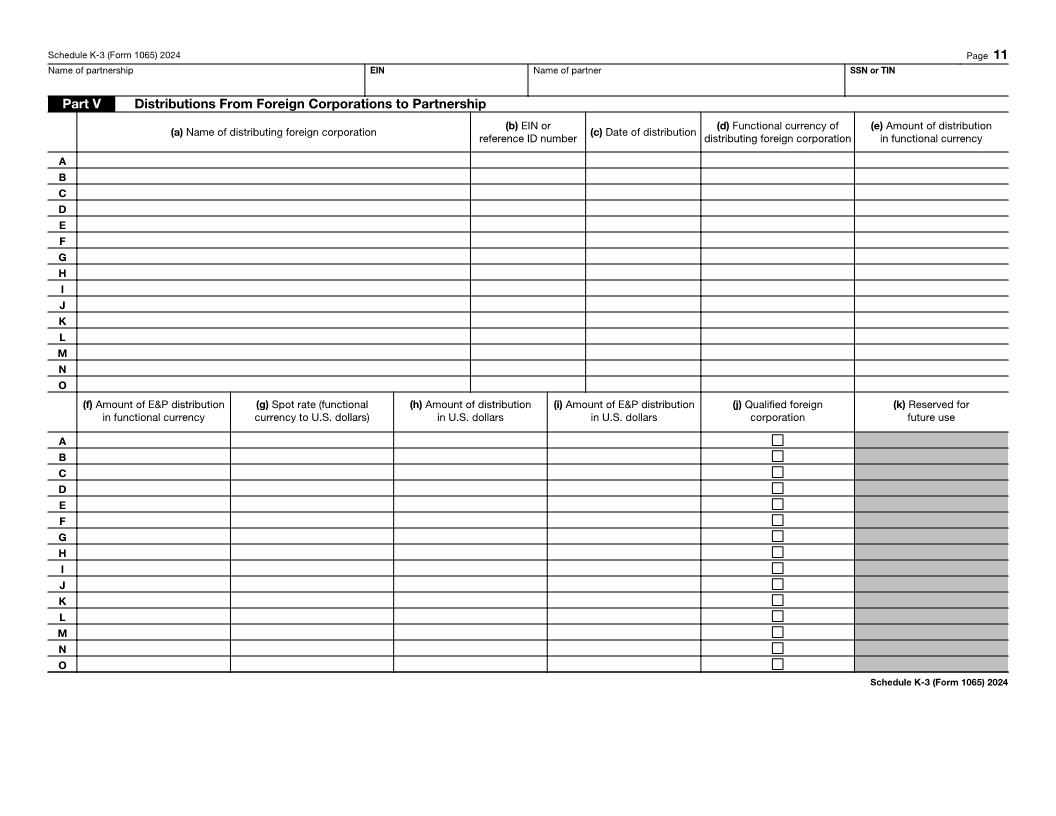

5 Does Part V apply? If “Yes,” complete and attach Part V . . . . . . . . . . . . . . . . . . . 5

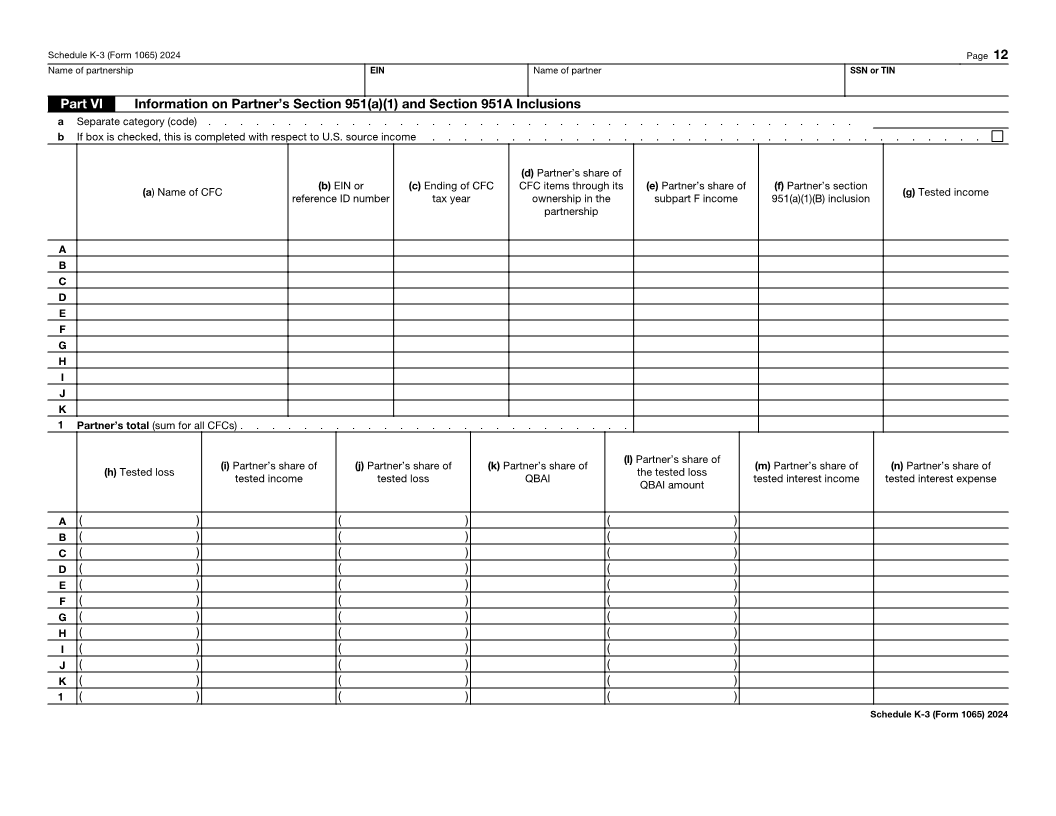

6 Does Part VI apply? If “Yes,” complete and attach Part VI . . . . . . . . . . . . . . . . . . . 6

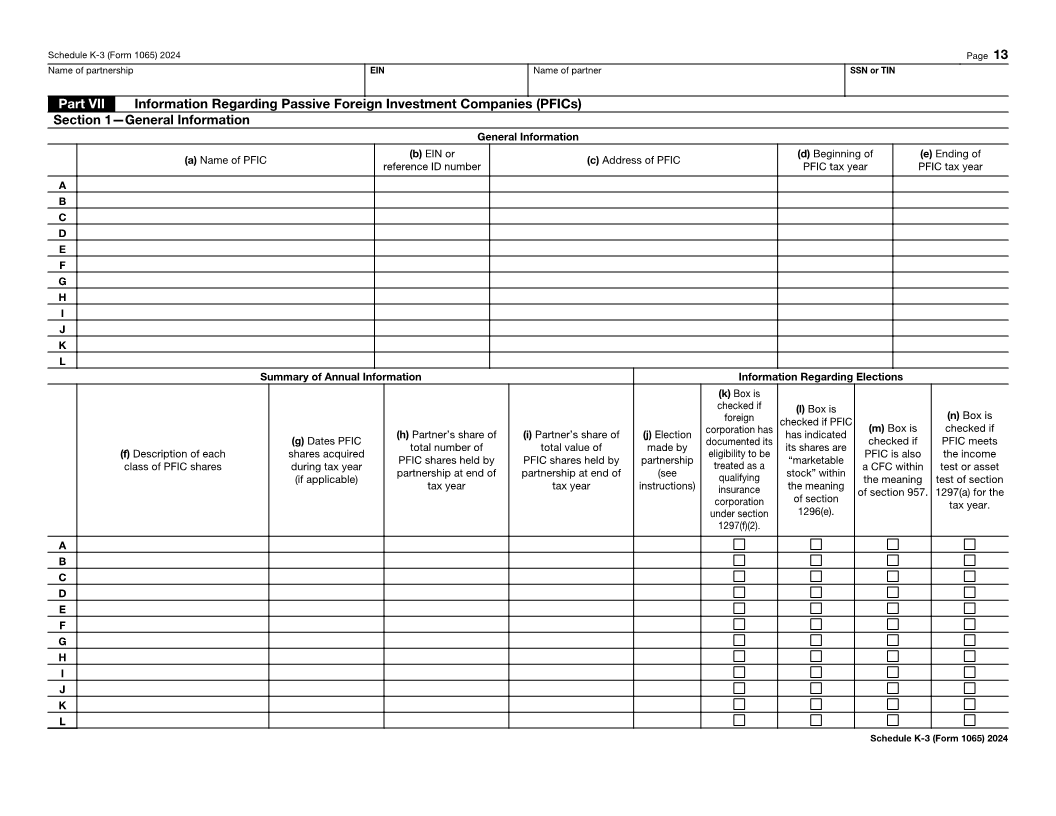

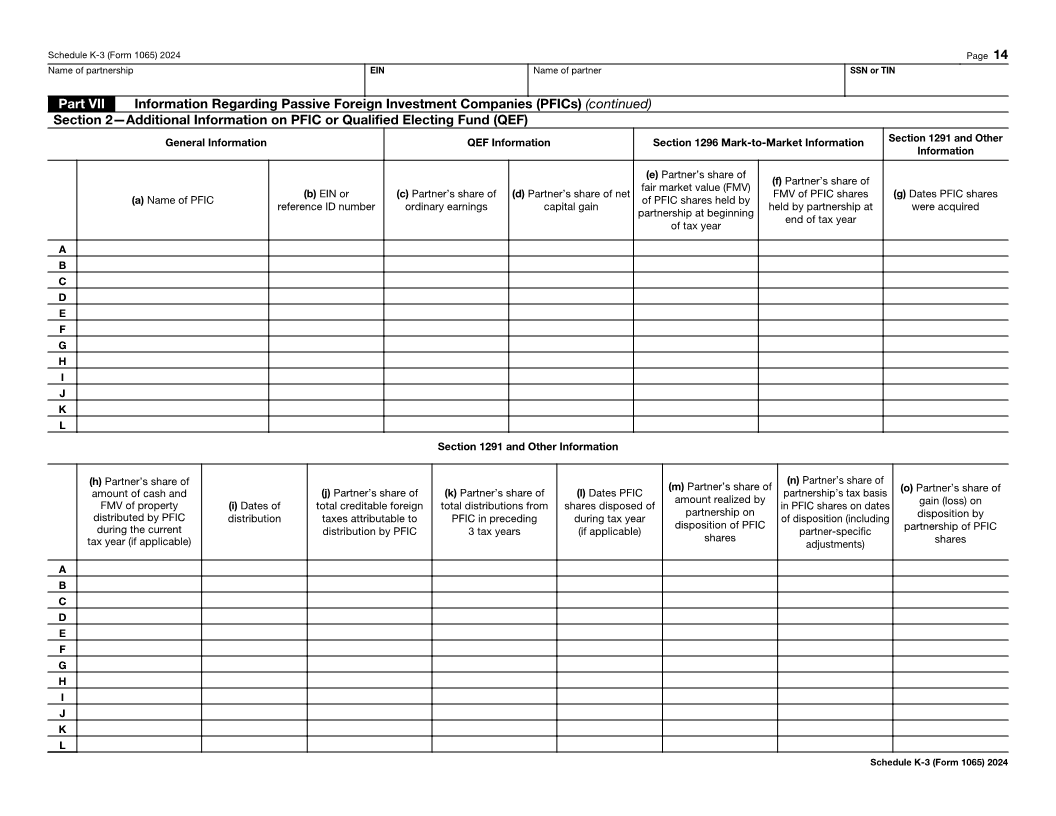

7 Does Part VII apply? If “Yes,” complete and attach Part VII . . . . . . . . . . . . . . . . . . 7

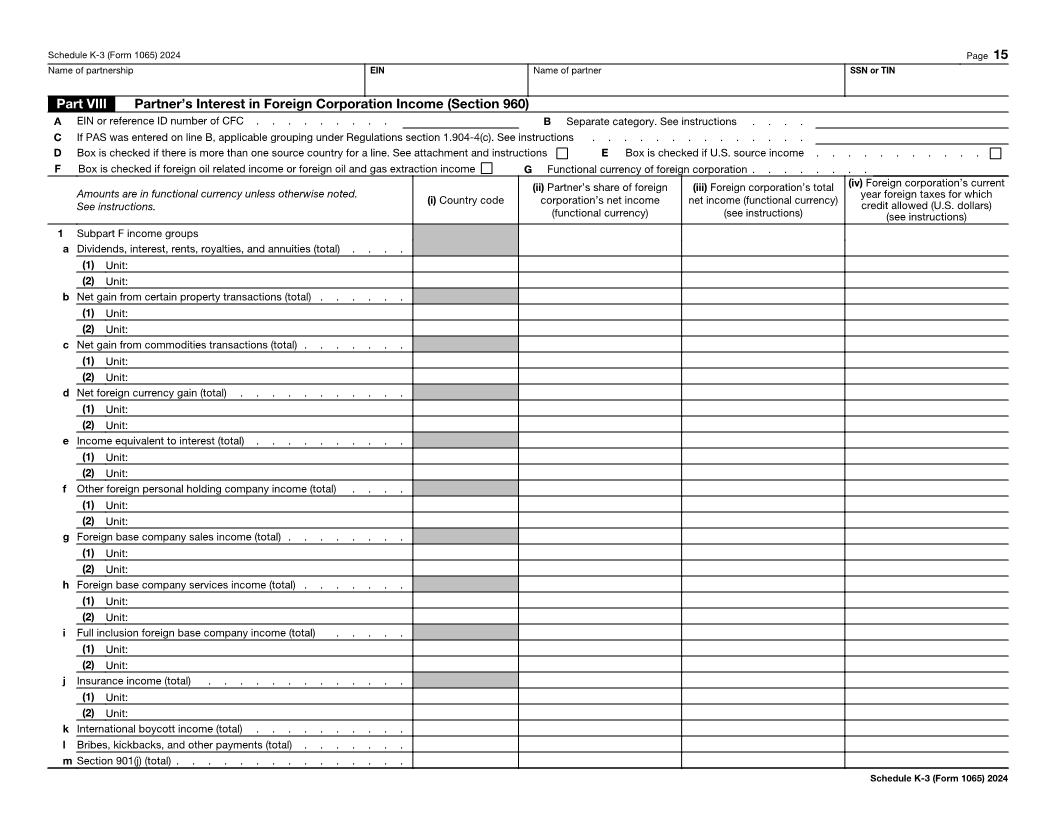

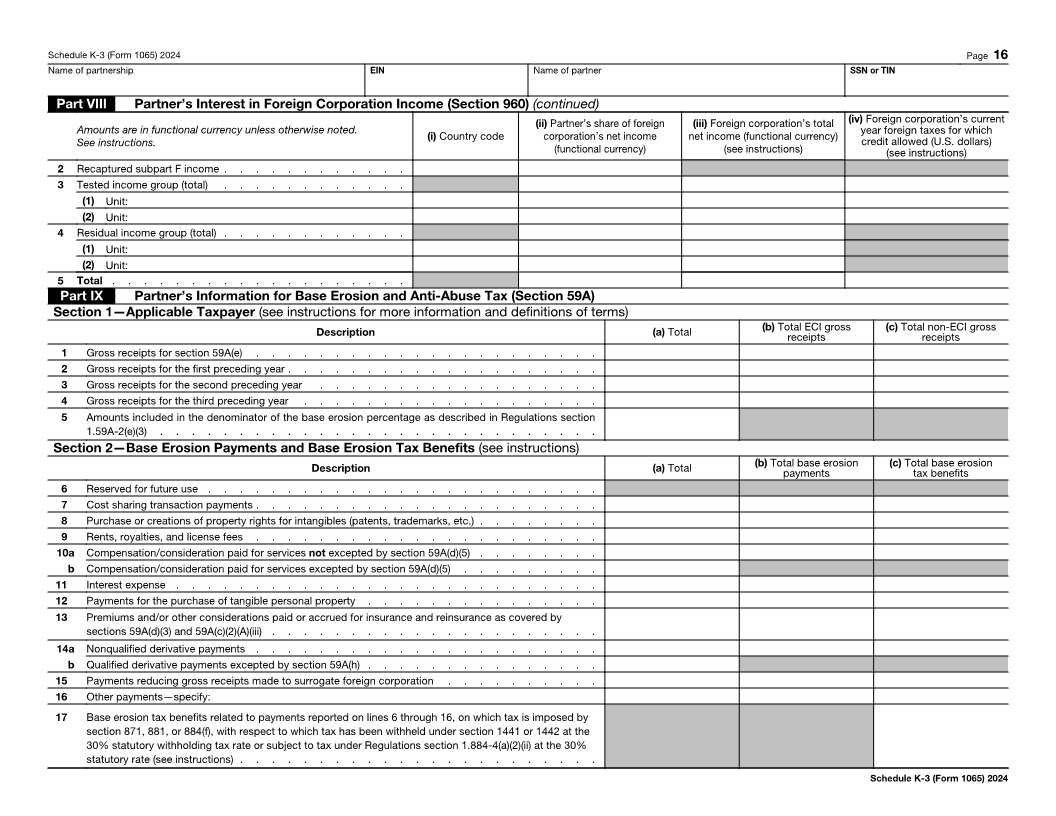

8 Does Part VIII apply? If “Yes,” complete and attach Part VIII . . . . . . . . . . . . . . . . . . 8

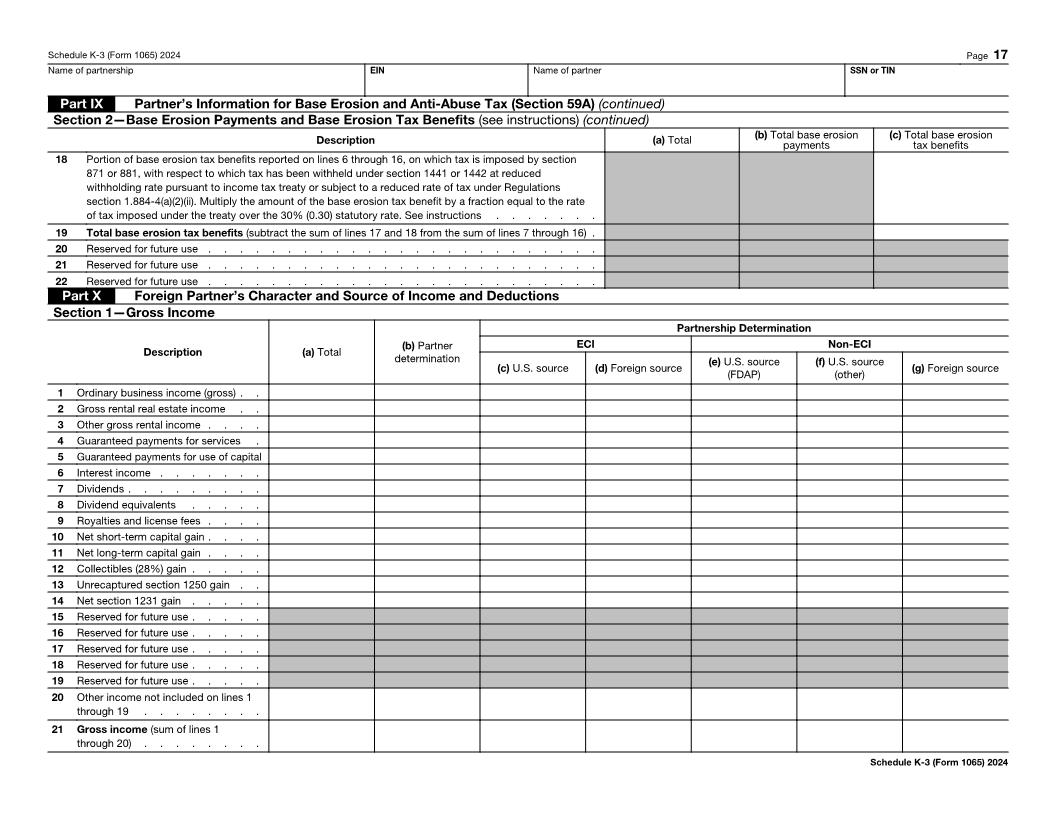

9 Does Part IX apply? If “Yes,” complete and attach Part IX . . . . . . . . . . . . . . . . . . . 9

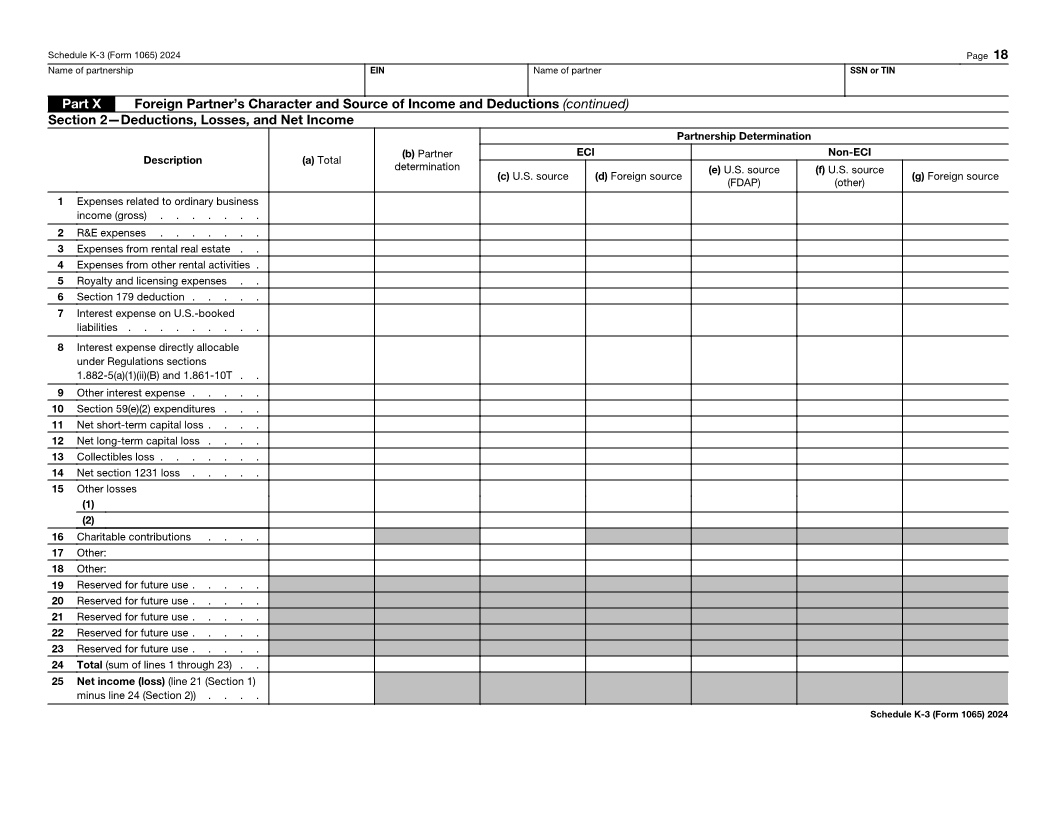

10 Does Part X apply? If “Yes,” complete and attach Part X . . . . . . . . . . . . . . . . . . . 10

11 Does Part XI apply? If “Yes,” complete and attach Part XI . . . . . . . . . . . . . . . . . . . 11

12 Does Part XII apply? If "Yes," complete and attach Part XII . . . . . . . . . . . . . . . . . . 12

13 Does Part XIII apply? If “Yes,” complete and attach Part XIII . . . . . . . . . . . . . . . . . . 13

For IRS Use Only

For Paperwork Reduction Act Notice, see the Instructions for Form 1065. www.irs.gov/Form1065 Cat. No. 74715S Schedule K-3 (Form 1065) 2024