Enlarge image

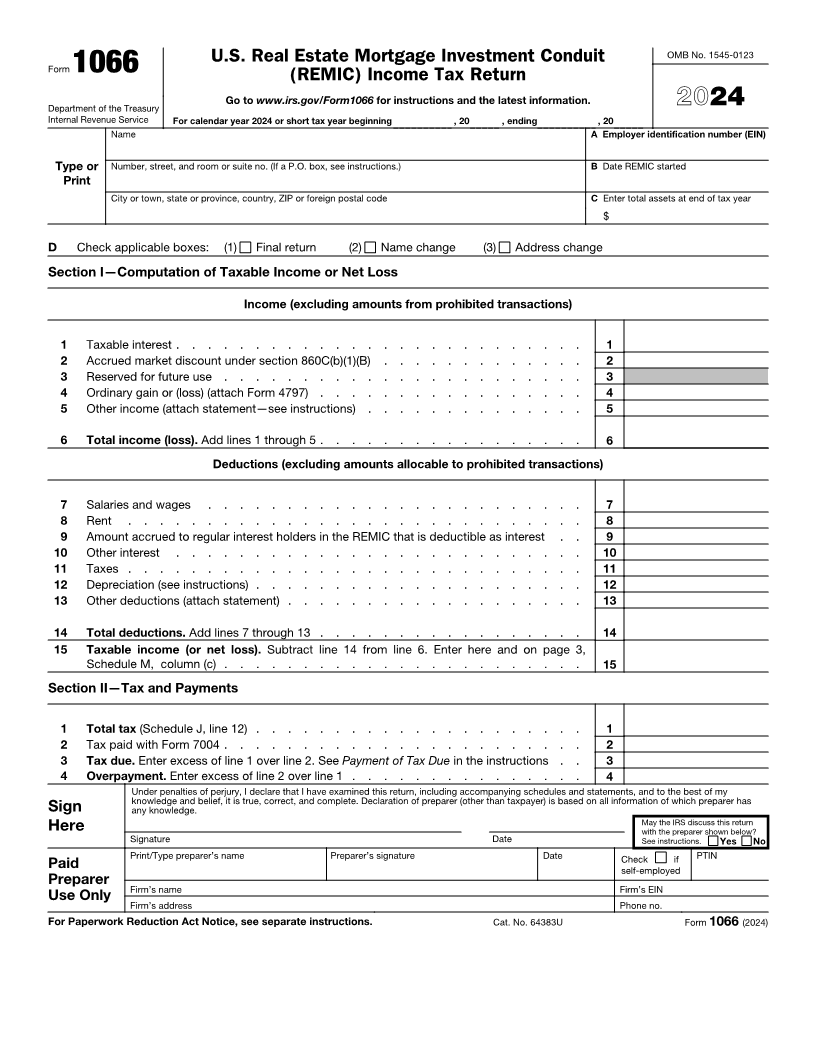

U.S. Real Estate Mortgage Investment Conduit OMB No. 1545-0123

Form 1066 (REMIC) Income Tax Return

Go to www.irs.gov/Form1066 for instructions and the latest information.

Department of the Treasury 2024

Internal Revenue Service For calendar year 2024 or short tax year beginning , 20 , ending , 20

Name A Employer identification number (EIN)

Type or Number, street, and room or suite no. (If a P.O. box, see instructions.) B Date REMIC started

Print

City or town, state or province, country, ZIP or foreign postal code C Enter total assets at end of tax year

$

D Check applicable boxes: (1) Final return (2) Name change (3) Address change

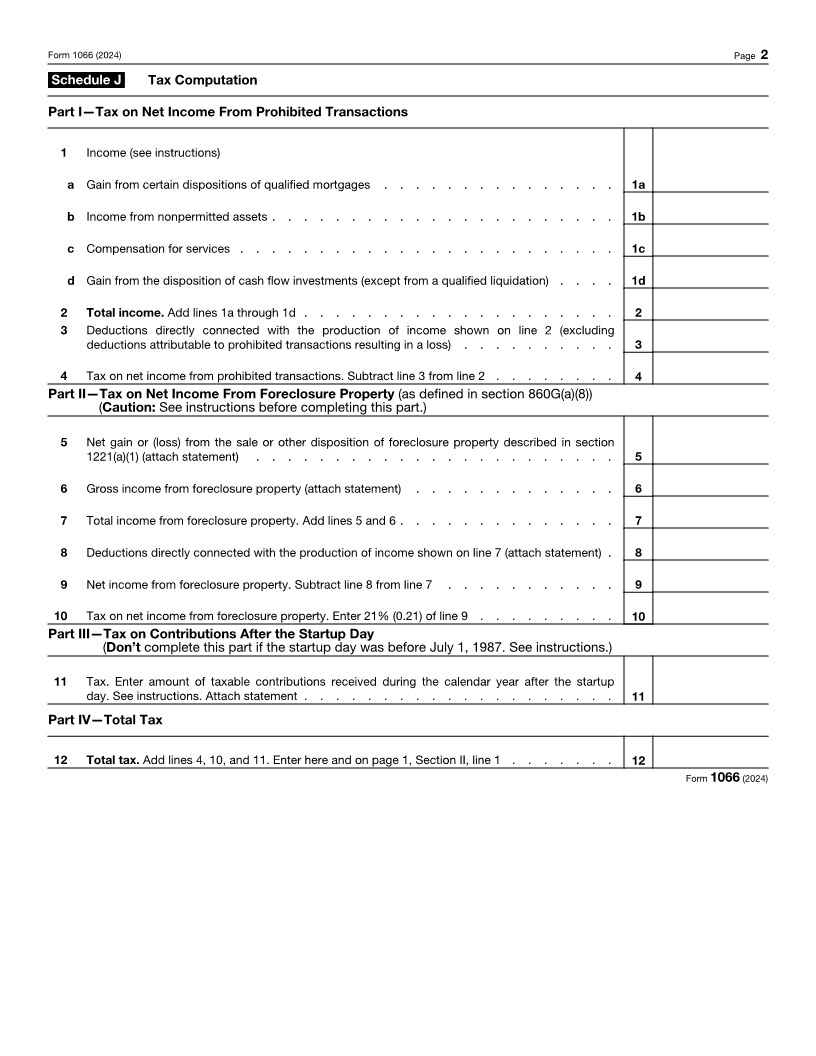

Section I—Computation of Taxable Income or Net Loss

Income (excluding amounts from prohibited transactions)

1 Taxable interest . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Accrued market discount under section 860C(b)(1)(B) . . . . . . . . . . . . . 2

3 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . 3

4 Ordinary gain or (loss) (attach Form 4797) . . . . . . . . . . . . . . . . . 4

5 Other income (attach statement—see instructions) . . . . . . . . . . . . . . 5

6 Total income (loss). Add lines 1 through 5 . . . . . . . . . . . . . . . . . 6

Deductions (excluding amounts allocable to prohibited transactions)

7 Salaries and wages . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Amount accrued to regular interest holders in the REMIC that is deductible as interest . . 9

10 Other interest . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Depreciation (see instructions) . . . . . . . . . . . . . . . . . . . . . 12

13 Other deductions (attach statement) . . . . . . . . . . . . . . . . . . . 13

14 Total deductions. Add lines 7 through 13 . . . . . . . . . . . . . . . . . 14

15 Taxable income (or net loss). Subtract line 14 from line 6. Enter here and on page 3,

Schedule M, column (c) . . . . . . . . . . . . . . . . . . . . . . . 15

Section II—Tax and Payments

1 Total tax (Schedule J, line 12) . . . . . . . . . . . . . . . . . . . . . 1

2 Tax paid with Form 7004 . . . . . . . . . . . . . . . . . . . . . . . 2

3 Tax due. Enter excess of line 1 over line 2. See Payment of Tax Due in the instructions . . 3

4 Overpayment. Enter excess of line 2 over line 1 . . . . . . . . . . . . . . . 4

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has

Sign any knowledge.

May the IRS discuss this return

Here with the preparer shown below?

Signature Date See instructions. Yes No

Print/Type preparer’s name Preparer’s signature Date

Paid Check if PTIN

self-employed

Preparer

Firm’s name Firm’s EIN

Use Only

Firm’s address Phone no.

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 64383U Form 1066 (2024)