Enlarge image

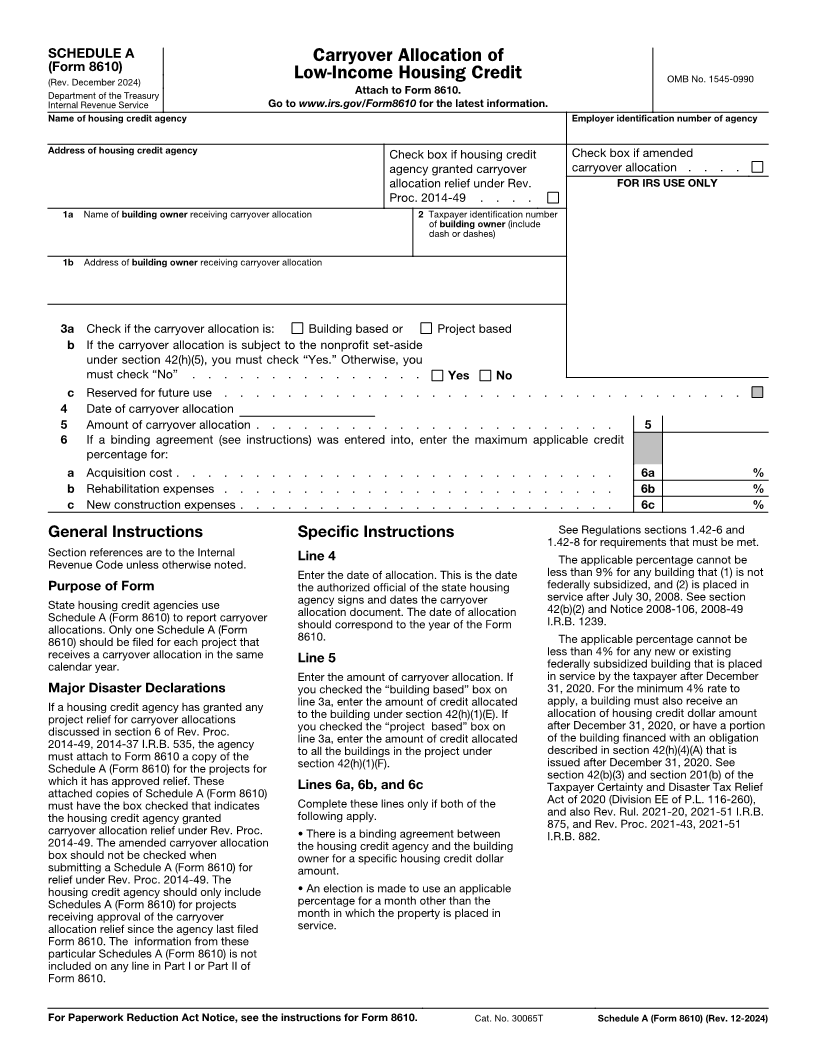

SCHEDULE A Carryover Allocation of

(Form 8610)

(Rev. December 2024) Low-Income Housing Credit OMB No. 1545-0990

Department of the Treasury Attach to Form 8610.

Internal Revenue Service Go to www.irs.gov/Form8610 for the latest information.

Name of housing credit agency Employer identification number of agency

Address of housing credit agency Check box if housing credit Check box if amended

agency granted carryover carryover allocation . . . .

allocation relief under Rev. FOR IRS USE ONLY

Proc. 2014-49 . . . .

1a Name of building owner receiving carryover allocation 2 Taxpayer identification number

of building owner (include

dash or dashes)

1b Address of building owner receiving carryover allocation

3 a Check if the carryover allocation is: Building based or Project based

b If the carryover allocation is subject to the nonprofit set-aside

under section 42(h)(5), you must check “Yes.” Otherwise, you

must check “No” . . . . . . . . . . . . . . . Yes No

c Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 Date of carryover allocation

5 Amount of carryover allocation . . . . . . . . . . . . . . . . . . . . . . . 5

6 If a binding agreement (see instructions) was entered into, enter the maximum applicable credit

percentage for:

a Acquisition cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a %

b Rehabilitation expenses . . . . . . . . . . . . . . . . . . . . . . . . . 6b %

c New construction expenses . . . . . . . . . . . . . . . . . . . . . . . . 6c %

General Instructions Specific Instructions See Regulations sections 1.42-6 and

1.42-8 for requirements that must be met.

Section references are to the Internal Line 4 The applicable percentage cannot be

Revenue Code unless otherwise noted.

Enter the date of allocation. This is the date less than 9% for any building that (1) is not

Purpose of Form the authorized official of the state housing federally subsidized, and (2) is placed in

State housing credit agencies use agency signs and dates the carryover service after July 30, 2008. See section

Schedule A (Form 8610) to report carryover allocation document. The date of allocation 42(b)(2) and Notice 2008-106, 2008-49

allocations. Only one Schedule A (Form should correspond to the year of the Form I.R.B. 1239.

8610) should be filed for each project that 8610. The applicable percentage cannot be

less than 4% for any new or existing

receives a carryover allocation in the same Line 5 federally subsidized building that is placed

calendar year.

Enter the amount of carryover allocation. If in service by the taxpayer after December

Major Disaster Declarations you checked the “building based” box on 31, 2020. For the minimum 4% rate to

If a housing credit agency has granted any line 3a, enter the amount of credit allocated apply, a building must also receive an

project relief for carryover allocations to the building under section 42(h)(1)(E). If allocation of housing credit dollar amount

discussed in section 6 of Rev. Proc. you checked the “project based” box on after December 31, 2020, or have a portion

2014-49, 2014-37 I.R.B. 535, the agency line 3a, enter the amount of credit allocated of the building financed with an obligation

must attach to Form 8610 a copy of the to all the buildings in the project under described in section 42(h)(4)(A) that is

Schedule A (Form 8610) for the projects for section 42(h)(1)(F). issued after December 31, 2020. See

section 42(b)(3) and section 201(b) of the

which it has approved relief. These Lines 6a, 6b, and 6c Taxpayer Certainty and Disaster Tax Relief

attached copies of Schedule A (Form 8610) Act of 2020 (Division EE of P.L. 116-260),

must have the box checked that indicates Complete these lines only if both of the

the housing credit agency granted following apply. and also Rev. Rul. 2021-20, 2021-51 I.R.B.

875, and Rev. Proc. 2021-43, 2021-51

carryover allocation relief under Rev. Proc. • There is a binding agreement between I.R.B. 882.

2014-49. The amended carryover allocation the housing credit agency and the building

box should not be checked when owner for a specific housing credit dollar

submitting a Schedule A (Form 8610) for amount.

relief under Rev. Proc. 2014-49. The

housing credit agency should only include • An election is made to use an applicable

Schedules A (Form 8610) for projects percentage for a month other than the

receiving approval of the carryover month in which the property is placed in

allocation relief since the agency last filed service.

Form 8610. The information from these

particular Schedules A (Form 8610) is not

included on any line in Part I or Part II of

Form 8610.

For Paperwork Reduction Act Notice, see the instructions for Form 8610. Cat. No. 30065T Schedule A (Form 8610) (Rev. 12-2024)