Enlarge image

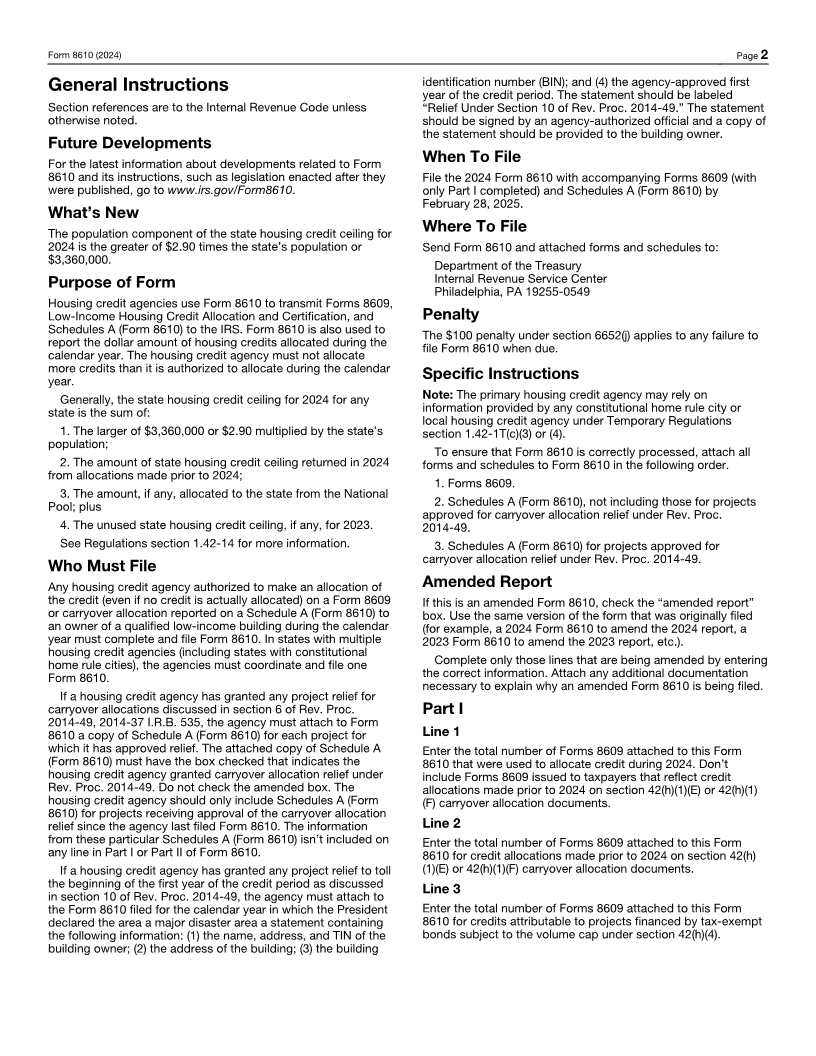

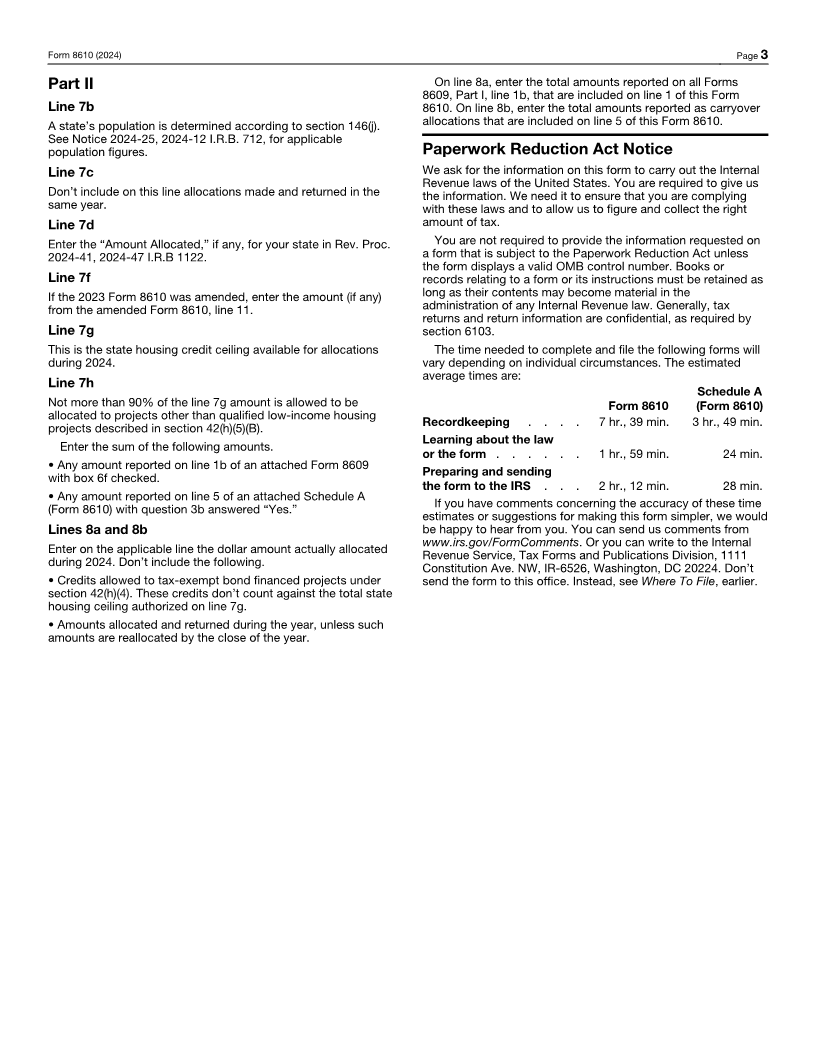

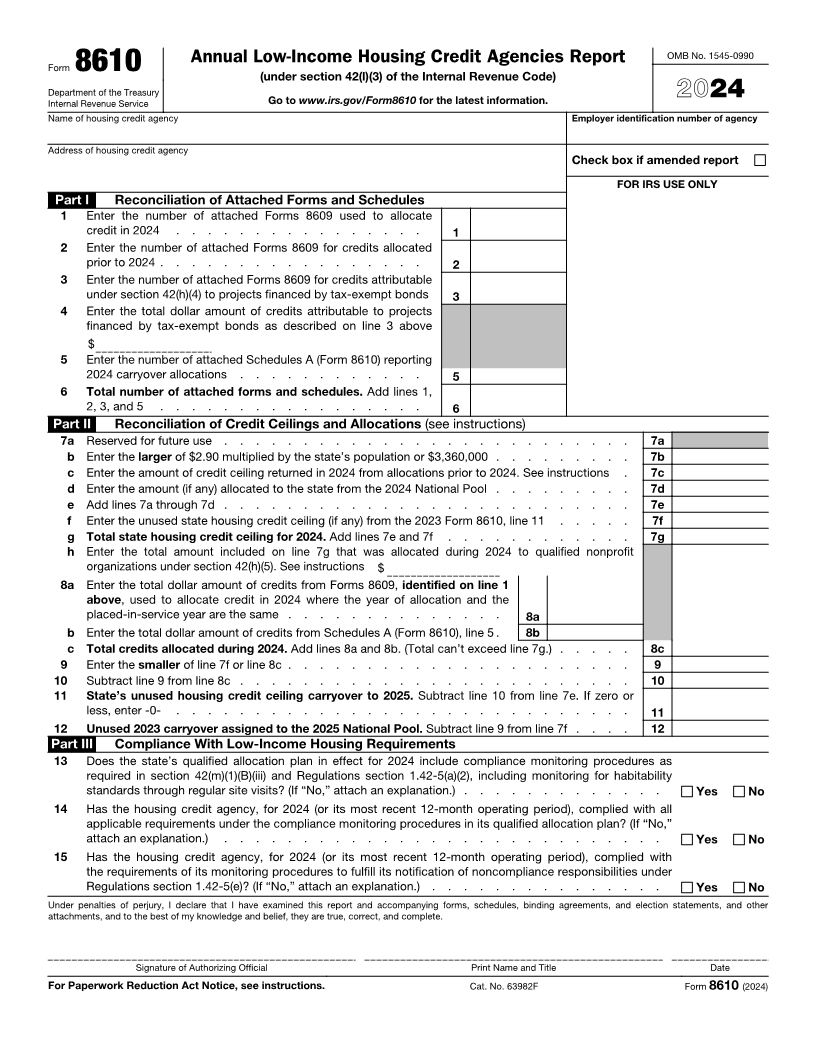

Annual Low-Income Housing Credit Agencies Report OMB No. 1545-0990

Form 8610 (under section 42(l)(3) of the Internal Revenue Code)

Department of the Treasury 24

Internal Revenue Service Go to www.irs.gov/Form8610 for the latest information. 20

Name of housing credit agency Employer identification number of agency

Address of housing credit agency

Check box if amended report

FOR IRS USE ONLY

Part I Reconciliation of Attached Forms and Schedules

1 Enter the number of attached Forms 8609 used to allocate

credit in 2024 . . . . . . . . . . . . . . . . 1

2 Enter the number of attached Forms 8609 for credits allocated

prior to 2024 . . . . . . . . . . . . . . . . . 2

3 Enter the number of attached Forms 8609 for credits attributable

under section 42(h)(4) to projects financed by tax-exempt bonds 3

4 Enter the total dollar amount of credits attributable to projects

financed by tax-exempt bonds as described on line 3 above

$

5 Enter the number of attached Schedules A (Form 8610) reporting

2024 carryover allocations . . . . . . . . . . . . 5

6 Total number of attached forms and schedules. Add lines 1,

2, 3, and 5 . . . . . . . . . . . . . . . . . 6

Part II Reconciliation of Credit Ceilings and Allocations (see instructions)

7a Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . 7a

b Enter the larger of $2.90 multiplied by the state’s population or $3,360,000 . . . . . . . . . 7b

c Enter the amount of credit ceiling returned in 2024 from allocations prior to 2024. See instructions . 7c

d Enter the amount (if any) allocated to the state from the 2024 National Pool . . . . . . . . . 7d

e Add lines 7a through 7d . . . . . . . . . . . . . . . . . . . . . . . . . . 7e

f Enter the unused state housing credit ceiling (if any) from the 2023 Form 8610, line 11 . . . . . 7f

g Total state housing credit ceiling for 2024. Add lines 7e and 7f . . . . . . . . . . . . 7g

h Enter the total amount included on line 7g that was allocated during 2024 to qualified nonprofit

organizations under section 42(h)(5). See instructions $

8 a Enter the total dollar amount of credits from Forms 8609, identified on line 1

above, used to allocate credit in 2024 where the year of allocation and the

placed-in-service year are the same . . . . . . . . . . . . . . 8a

b Enter the total dollar amount of credits from Schedules A (Form 8610), line 5 . 8b

c Total credits allocated during 2024. Add lines 8a and 8b. (Total can’t exceed line 7g.) . . . . . 8c

9 Enter the smaller of line 7f or line 8c . . . . . . . . . . . . . . . . . . . . . . 9

10 Subtract line 9 from line 8c . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 State’s unused housing credit ceiling carryover to 2025. Subtract line 10 from line 7e. If zero or

less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Unused 2023 carryover assigned to the 2025 National Pool. Subtract line 9 from line 7f . . . . 12

Part III Compliance With Low-Income Housing Requirements

13 Does the state’s qualified allocation plan in effect for 2024 include compliance monitoring procedures as

required in section 42(m)(1)(B)(iii) and Regulations section 1.42-5(a)(2), including monitoring for habitability

standards through regular site visits? (If “No,” attach an explanation.) . . . . . . . . . . . . . Yes No

14 Has the housing credit agency, for 2024 (or its most recent 12-month operating period), complied with all

applicable requirements under the compliance monitoring procedures in its qualified allocation plan? (If “No,”

attach an explanation.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

15 Has the housing credit agency, for 2024 (or its most recent 12-month operating period), complied with

the requirements of its monitoring procedures to fulfill its notification of noncompliance responsibilities under

Regulations section 1.42-5(e)? (If “No,” attach an explanation.) . . . . . . . . . . . . . . . Yes No

Under penalties of perjury, I declare that I have examined this report and accompanying forms, schedules, binding agreements, and election statements, and other

attachments, and to the best of my knowledge and belief, they are true, correct, and complete.

Signature of Authorizing Official Print Name and Title Date

For Paperwork Reduction Act Notice, see instructions. Cat. No. 63982F Form 8610 (2024)