Enlarge image

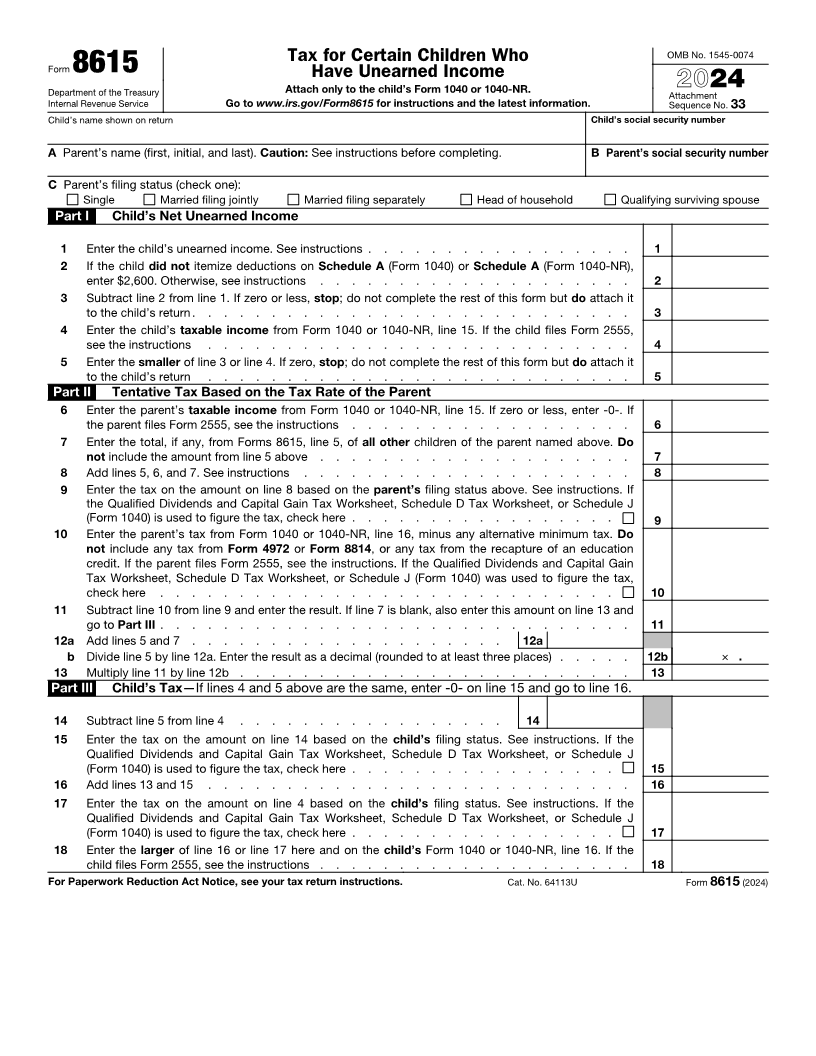

Tax for Certain Children Who OMB No. 1545-0074

Form 8615 Have Unearned Income

Department of the Treasury Attach only to the child’s Form 1040 or 1040-NR. 2024

Attachment

Internal Revenue Service Go to www.irs.gov/Form8615 for instructions and the latest information. Sequence No. 33

Child’s name shown on return Child’s social security number

A Parent’s name (first, initial, and last). Caution: See instructions before completing. B Parent’s social security number

C Parent’s filing status (check one):

Single Married filing jointly Married filing separately Head of household Qualifying surviving spouse

Part I Child’s Net Unearned Income

1 Enter the child’s unearned income. See instructions . . . . . . . . . . . . . . . . . 1

2 If the child did not itemize deductions on Schedule A (Form 1040) or Schedule A (Form 1040-NR),

enter $2,600. Otherwise, see instructions . . . . . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1. If zero or less, stop; do not complete the rest of this form but do attach it

to the child’s return. . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Enter the child’s taxable income from Form 1040 or 1040-NR, line 15. If the child files Form 2555,

see the instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Enter the smaller of line 3 or line 4. If zero, stop; do not complete the rest of this form but do attach it

to the child’s return . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Part II Tentative Tax Based on the Tax Rate of the Parent

6 Enter the parent’s taxable income from Form 1040 or 1040-NR, line 15. If zero or less, enter -0-. If

the parent files Form 2555, see the instructions . . . . . . . . . . . . . . . . . . 6

7 Enter the total, if any, from Forms 8615, line 5, of all other children of the parent named above. Do

not include the amount from line 5 above . . . . . . . . . . . . . . . . . . . . 7

8 Add lines 5, 6, and 7. See instructions . . . . . . . . . . . . . . . . . . . . . 8

9 Enter the tax on the amount on line 8 based on the parent’s filing status above. See instructions. If

the Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, or Schedule J

(Form 1040) is used to figure the tax, check here . . . . . . . . . . . . . . . . . 9

10 Enter the parent’s tax from Form 1040 or 1040-NR, line 16, minus any alternative minimum tax. Do

not include any tax from Form 4972 or Form 8814, or any tax from the recapture of an education

credit. If the parent files Form 2555, see the instructions. If the Qualified Dividends and Capital Gain

Tax Worksheet, Schedule D Tax Worksheet, or Schedule J (Form 1040) was used to figure the tax,

check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Subtract line 10 from line 9 and enter the result. If line 7 is blank, also enter this amount on line 13 and

go to Part III . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12a Add lines 5 and 7 . . . . . . . . . . . . . . . . . . . . 12a

b Divide line 5 by line 12a. Enter the result as a decimal (rounded to at least three places) . . . . . 12b × .

13 Multiply line 11 by line 12b . . . . . . . . . . . . . . . . . . . . . . . . . 13

Part III Child’s Tax—If lines 4 and 5 above are the same, enter -0- on line 15 and go to line 16.

14 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . 14

15 Enter the tax on the amount on line 14 based on the child’s filing status. See instructions. If the

Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, or Schedule J

(Form 1040) is used to figure the tax, check here . . . . . . . . . . . . . . . . . 15

16 Add lines 13 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Enter the tax on the amount on line 4 based on the child’s filing status. See instructions. If the

Qualified Dividends and Capital Gain Tax Worksheet, Schedule D Tax Worksheet, or Schedule J

(Form 1040) is used to figure the tax, check here . . . . . . . . . . . . . . . . . 17

18 Enter the larger of line 16 or line 17 here and on the child’s Form 1040 or 1040-NR, line 16. If the

child files Form 2555, see the instructions . . . . . . . . . . . . . . . . . . . . 18

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 64113U Form 8615 (2024)