Enlarge image

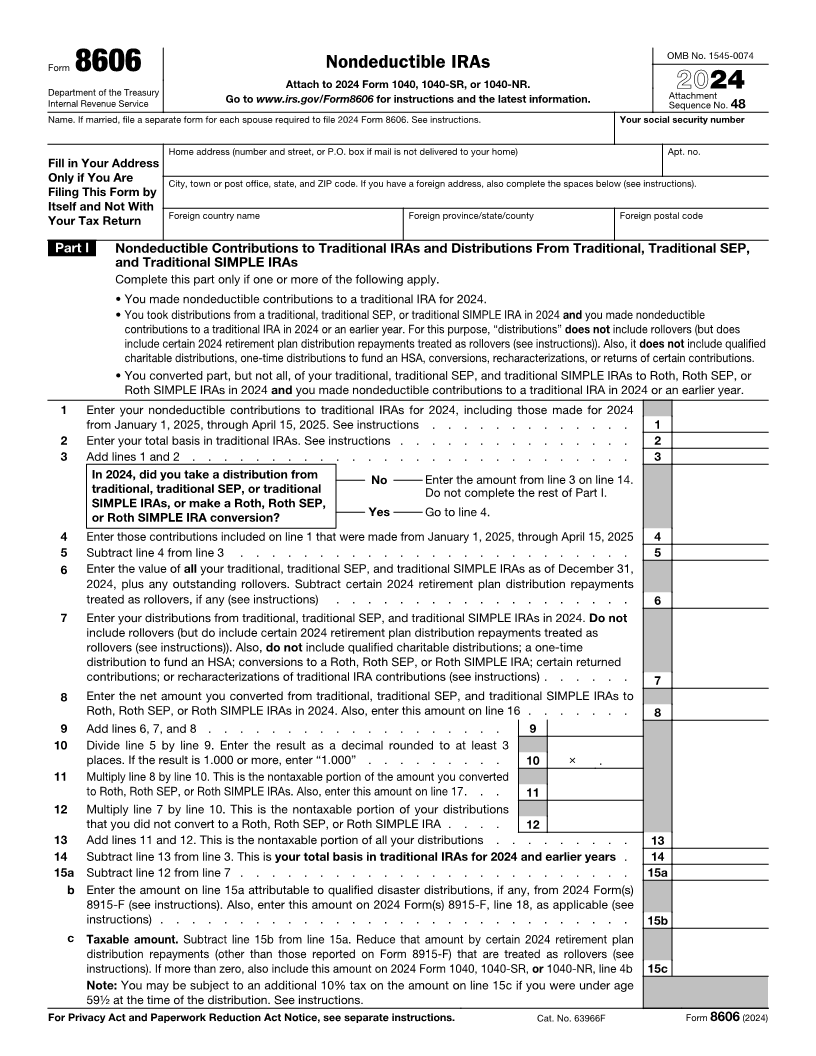

OMB No. 1545-0074

Form 8606 Nondeductible IRAs

Attach to 2024 Form 1040, 1040-SR, or 1040-NR.

Department of the Treasury Attachment 2024

Internal Revenue Service Go to www.irs.gov/Form8606 for instructions and the latest information. Sequence No. 48

Name. If married, file a separate form for each spouse required to file 2024 Form 8606. See instructions. Your social security number

Home address (number and street, or P.O. box if mail is not delivered to your home) Apt. no.

Fill in Your Address

Only if You Are City, town or post office, state, and ZIP code. If you have a foreign address, also complete the spaces below (see instructions).

Filing This Form by

Itself and Not With

Your Tax Return Foreign country name Foreign province/state/county Foreign postal code

Part I Nondeductible Contributions to Traditional IRAs and Distributions From Traditional, Traditional SEP,

and Traditional SIMPLE IRAs

Complete this part only if one or more of the following apply.

• You made nondeductible contributions to a traditional IRA for 2024.

• You took distributions from a traditional, traditional SEP, or traditional SIMPLE IRA in 2024 and you made nondeductible

contributions to a traditional IRA in 2024 or an earlier year. For this purpose, “distributions” does not include rollovers (but does

include certain 2024 retirement plan distribution repayments treated as rollovers (see instructions)). Also, it does not include qualified

charitable distributions, one-time distributions to fund an HSA, conversions, recharacterizations, or returns of certain contributions.

• You converted part, but not all, of your traditional, traditional SEP, and traditional SIMPLE IRAs to Roth, Roth SEP, or

Roth SIMPLE IRAs in 2024 and you made nondeductible contributions to a traditional IRA in 2024 or an earlier year.

1 Enter your nondeductible contributions to traditional IRAs for 2024, including those made for 2024

from January 1, 2025, through April 15, 2025. See instructions . . . . . . . . . . . . . 1

2 Enter your total basis in traditional IRAs. See instructions . . . . . . . . . . . . . . . 2

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

In 2024, did you take a distribution from No Enter the amount from line 3 on line 14.

traditional, traditional SEP, or traditional Do not complete the rest of Part I.

SIMPLE IRAs, or make a Roth, Roth SEP,

or Roth SIMPLE IRA conversion? Yes Go to line 4.

4 Enter those contributions included on line 1 that were made from January 1, 2025, through April 15, 2025 4

5 Subtract line 4 from line 3 . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Enter the value of all your traditional, traditional SEP, and traditional SIMPLE IRAs as of December 31,

2024, plus any outstanding rollovers. Subtract certain 2024 retirement plan distribution repayments

treated as rollovers, if any (see instructions) . . . . . . . . . . . . . . . . . . . 6

7 Enter your distributions from traditional, traditional SEP, and traditional SIMPLE IRAs in 2024. Do not

include rollovers (but do include certain 2024 retirement plan distribution repayments treated as

rollovers (see instructions)). Also, do not include qualified charitable distributions; a one-time

distribution to fund an HSA; conversions to a Roth, Roth SEP, or Roth SIMPLE IRA; certain returned

contributions; or recharacterizations of traditional IRA contributions (see instructions) . . . . . . 7

8 Enter the net amount you converted from traditional, traditional SEP, and traditional SIMPLE IRAs to

Roth, Roth SEP, or Roth SIMPLE IRAs in 2024. Also, enter this amount on line 16 . . . . . . . 8

9 Add lines 6, 7, and 8 . . . . . . . . . . . . . . . . . . . 9

10 Divide line 5 by line 9. Enter the result as a decimal rounded to at least 3

places. If the result is 1.000 or more, enter “1.000” . . . . . . . . . 10 × .

11 Multiply line 8 by line 10. This is the nontaxable portion of the amount you converted

to Roth, Roth SEP, or Roth SIMPLE IRAs. Also, enter this amount on line 17. . . 11

12 Multiply line 7 by line 10. This is the nontaxable portion of your distributions

that you did not convert to a Roth, Roth SEP, or Roth SIMPLE IRA . . . . 12

13 Add lines 11 and 12. This is the nontaxable portion of all your distributions . . . . . . . . . 13

14 Subtract line 13 from line 3. This is your total basis in traditional IRAs for 2024 and earlier years . 14

15 a Subtract line 12 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . 15a

b Enter the amount on line 15a attributable to qualified disaster distributions, if any, from 2024 Form(s)

8915-F (see instructions). Also, enter this amount on 2024 Form(s) 8915-F, line 18, as applicable (see

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15b

c Taxable amount. Subtract line 15b from line 15a. Reduce that amount by certain 2024 retirement plan

distribution repayments (other than those reported on Form 8915-F) that are treated as rollovers (see

instructions). If more than zero, also include this amount on 2024 Form 1040, 1040-SR, or 1040-NR, line 4b15c

Note: You may be subject to an additional 10% tax on the amount on line 15c if you were under age

59½ at the time of the distribution. See instructions.

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 63966F Form 8606 (2024)