Enlarge image

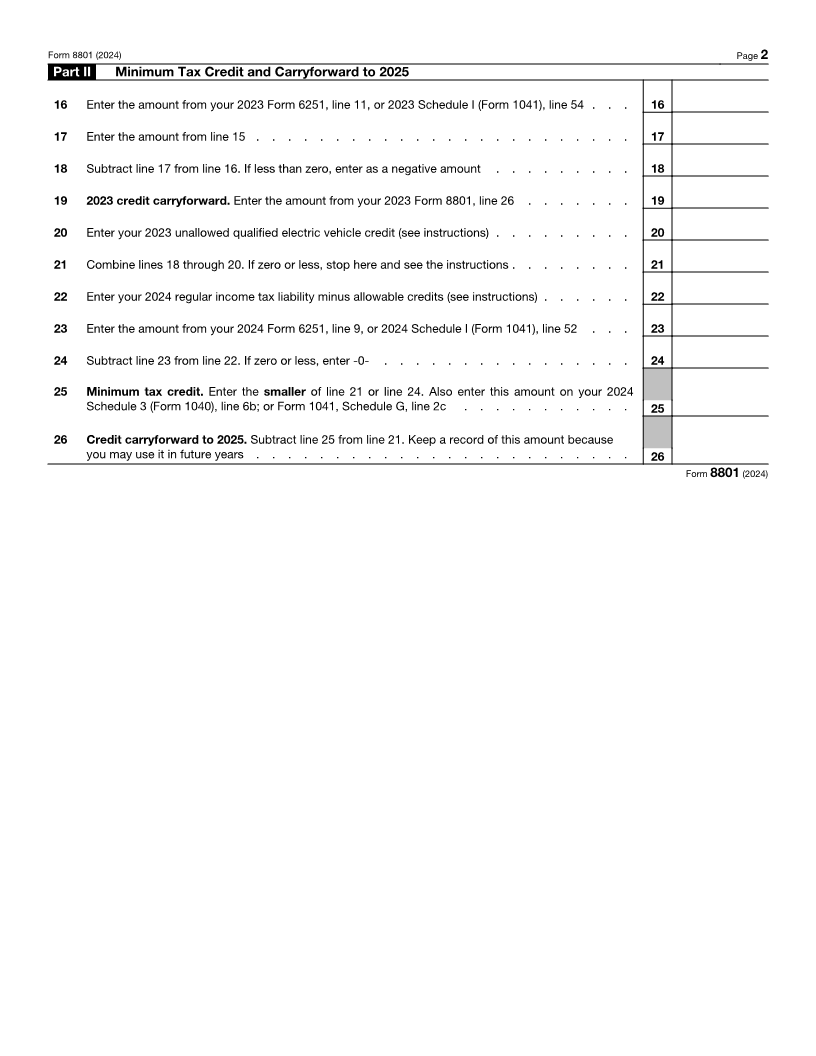

Credit for Prior Year Minimum Tax— OMB No. 1545-1073

Form 8801 Individuals, Estates, and Trusts

Department of the Treasury Attach to Form 1040, 1040-SR, 1040-NR, or 1041. 2024

Attachment

Internal Revenue Service Go to www.irs.gov/Form8801 for instructions and the latest information. Sequence No. 801

Name(s) shown on return Identifying number

Part I Net Minimum Tax on Exclusion Items

1 Combine lines 1 and 2e of your 2023 Form 6251. Estates and trusts, see instructions . . . . . . 1

2 Enter adjustments and preferences treated as exclusion items (see instructions) . . . . . . . 2

3 Minimum tax credit net operating loss deduction (see instructions) . . . . . . . . . . . . 3 ( )

4 Combine lines 1, 2, and 3. If zero or less, enter -0- here and on line 15 and go to Part II. If more than

$831,150 and you were married filing separately for 2023, see instructions . . . . . . . . . 4

5 Enter: $126,500 if married filing jointly or qualifying surviving spouse for 2023; $81,300 if single or

head of household for 2023; or $63,250 if married filing separately for 2023. Estates and trusts, enter

$28,400 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Enter: $1,156,300 if married filing jointly or qualifying surviving spouse for 2023; $578,150 if single,

head of household, or married filing separately for 2023. Estates and trusts, enter $94,600 . . . . 6

7 Subtract line 6 from line 4. If zero or less, enter -0- here and on line 8 and go to line 9 . . . . . 7

8 Multiply line 7 by 25% (0.25) . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Subtract line 8 from line 5. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . 9

10 Subtract line 9 from line 4. If zero or less, enter -0- here and on line 15 and go to Part II. Form

1040-NR filers, see instructions . . . . . . . . . . . . . . . . . . . . . . . 10

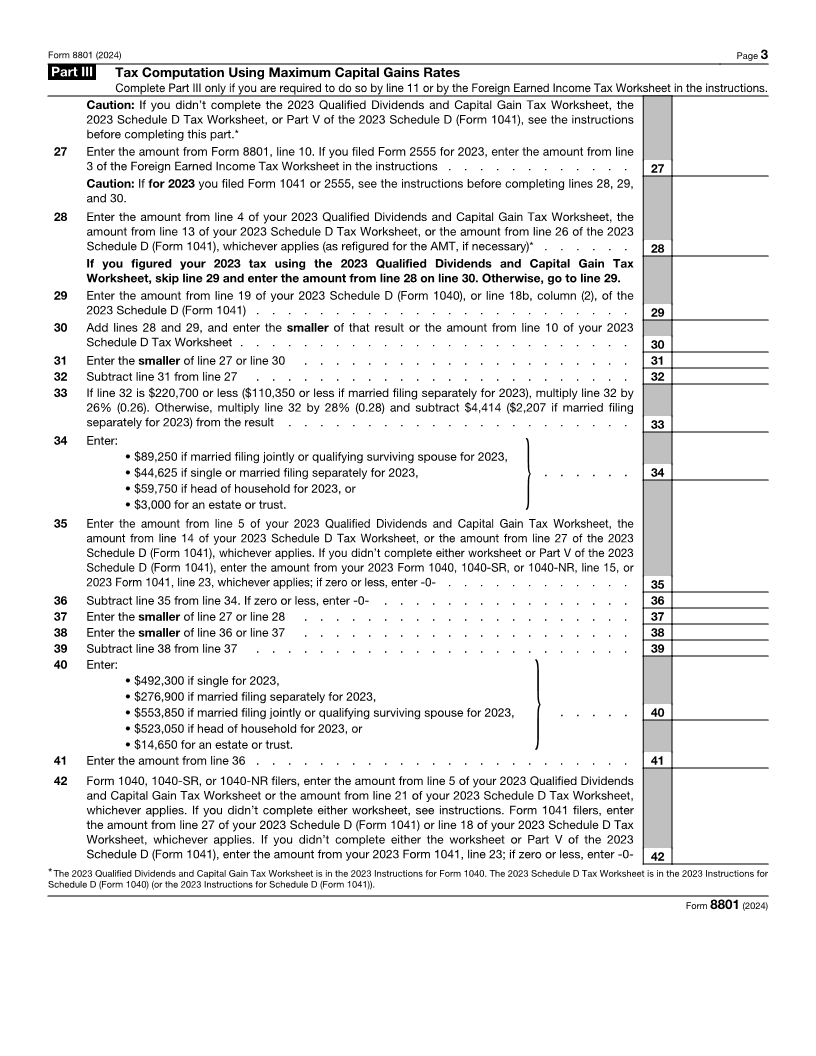

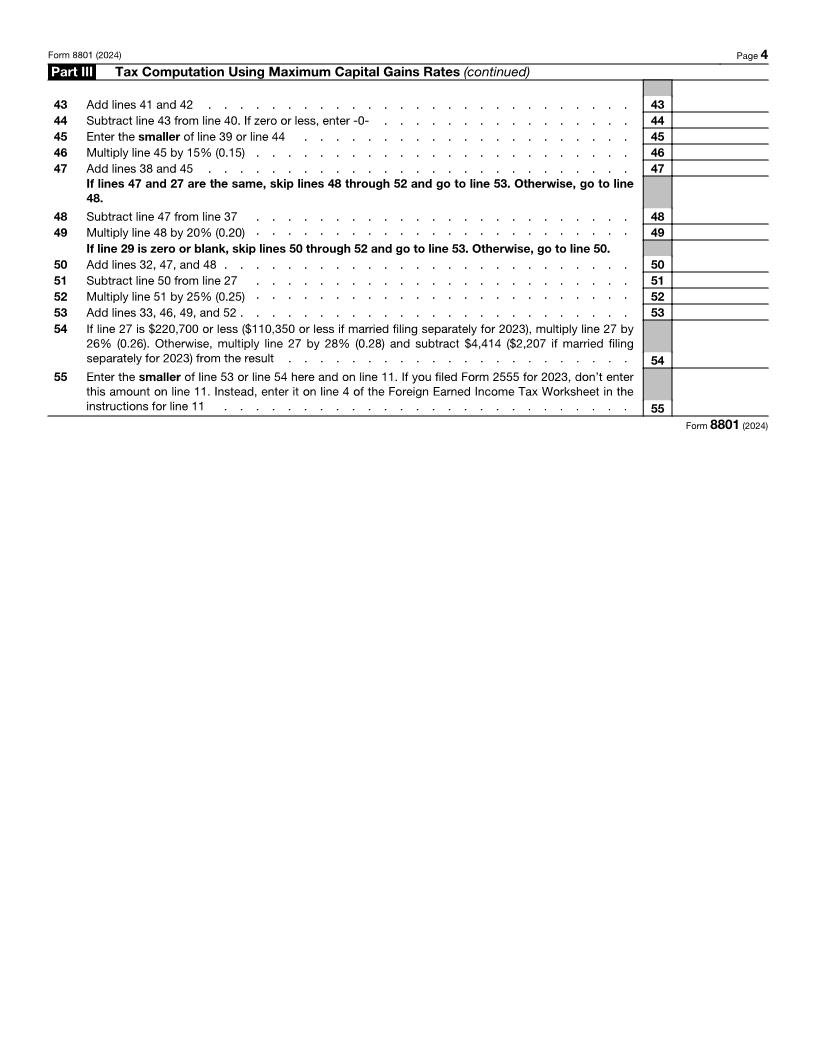

11 • If for 2023 you filed Form 2555, see instructions for the amount to enter.

• If for 2023 you reported capital gain distributions directly on Form 1040, 1040-SR, or

1040-NR, line 7; you reported qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a

(Form 1041, line 2b(2)); or you had a gain on both lines 15 and 16 of Schedule D (Form 1040)

(lines 18a and 19, column (2), of Schedule D (Form 1041)), complete Part III of Form 8801 and 11

enter the amount from line 55 here.

• All others: If line 10 is $220,700 or less ($110,350 or less if married filing separately for 2023),

multiply line 10 by 26% (0.26). Otherwise, multiply line 10 by 28% (0.28) and subtract $4,414

($2,207 if married filing separately for 2023) from the result. }

12 Minimum tax foreign tax credit on exclusion items (see instructions) . . . . . . . . . . . 12

13 Tentative minimum tax on exclusion items. Subtract line 12 from line 11 . . . . . . . . . . 13

14 Enter the amount from your 2023 Form 6251, line 10, or 2023 Schedule I (Form 1041), line 53 . . . 14

15 Net minimum tax on exclusion items. Subtract line 14 from line 13. If zero or less, enter -0- . . . 15

For Paperwork Reduction Act Notice, see instructions. Cat. No. 10002S Form 8801 (2024)