Enlarge image

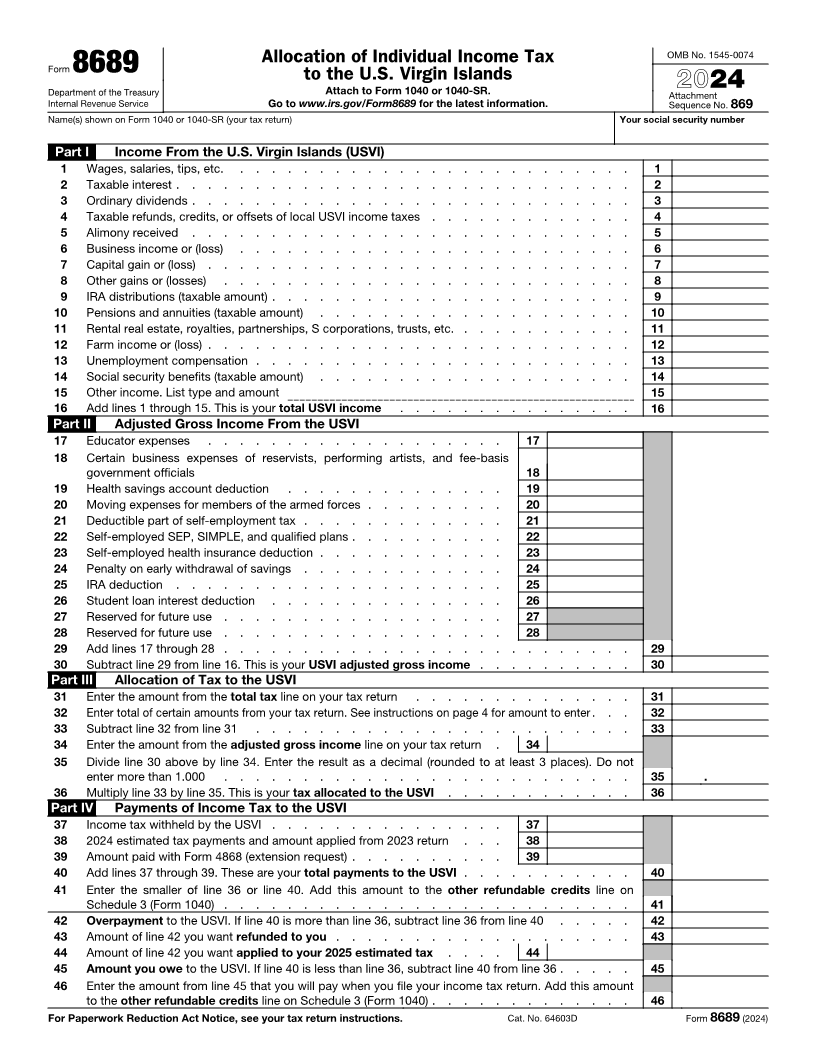

OMB No. 1545-0074

Allocation of Individual Income Tax

Form 8689 to the U.S. Virgin Islands

Department of the Treasury Attach to Form 1040 or 1040-SR. 2024

Attachment

Internal Revenue Service Go to www.irs.gov/Form8689 for the latest information. Sequence No. 869

Name(s) shown on Form 1040 or 1040-SR (your tax return) Your social security number

Part I Income From the U.S. Virgin Islands (USVI)

1 Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Taxable interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Taxable refunds, credits, or offsets of local USVI income taxes . . . . . . . . . . . . . 4

5 Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Other gains or (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 IRA distributions (taxable amount) . . . . . . . . . . . . . . . . . . . . . . . 9

10 Pensions and annuities (taxable amount) . . . . . . . . . . . . . . . . . . . . 10

11 Rental real estate, royalties, partnerships, S corporations, trusts, etc. . . . . . . . . . . . 11

12 Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Social security benefits (taxable amount) . . . . . . . . . . . . . . . . . . . . 14

15 Other income. List type and amount 15

16 Add lines 1 through 15. This is your total USVI income . . . . . . . . . . . . . . . 16

Part II Adjusted Gross Income From the USVI

17 Educator expenses . . . . . . . . . . . . . . . . . . . 17

18 Certain business expenses of reservists, performing artists, and fee-basis

government officials 18

19 Health savings account deduction . . . . . . . . . . . . . . 19

20 Moving expenses for members of the armed forces . . . . . . . . . 20

21 Deductible part of self-employment tax . . . . . . . . . . . . . 21

22 Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . 22

23 Self-employed health insurance deduction . . . . . . . . . . . . 23

24 Penalty on early withdrawal of savings . . . . . . . . . . . . . 24

25 IRA deduction . . . . . . . . . . . . . . . . . . . . . 25

26 Student loan interest deduction . . . . . . . . . . . . . . . 26

27 Reserved for future use . . . . . . . . . . . . . . . . . . 27

28 Reserved for future use . . . . . . . . . . . . . . . . . . 28

29 Add lines 17 through 28 . . . . . . . . . . . . . . . . . . . . . . . . . . 29

30 Subtract line 29 from line 16. This is your USVI adjusted gross income . . . . . . . . . . 30

Part III Allocation of Tax to the USVI

31 Enter the amount from the total tax line on your tax return . . . . . . . . . . . . . . 31

32 Enter total of certain amounts from your tax return. See instructions on page 4 for amount to enter . . . 32

33 Subtract line 32 from line 31 . . . . . . . . . . . . . . . . . . . . . . . . 33

34 Enter the amount from the adjusted gross income line on your tax return . 34

35 Divide line 30 above by line 34. Enter the result as a decimal (rounded to at least 3 places). Do not

enter more than 1.000 . . . . . . . . . . . . . . . . . . . . . . . . . . 35 .

36 Multiply line 33 by line 35. This is your tax allocated to the USVI . . . . . . . . . . . . 36

Part IV Payments of Income Tax to the USVI

37 Income tax withheld by the USVI . . . . . . . . . . . . . . . 37

38 2024 estimated tax payments and amount applied from 2023 return . . . 38

39 Amount paid with Form 4868 (extension request) . . . . . . . . . . 39

40 Add lines 37 through 39. These are your total payments to the USVI . . . . . . . . . . . 40

41 Enter the smaller of line 36 or line 40. Add this amount to the other refundable credits line on

Schedule 3 (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . . 41

42 Overpayment to the USVI. If line 40 is more than line 36, subtract line 36 from line 40 . . . . . 42

43 Amount of line 42 you want refunded to you . . . . . . . . . . . . . . . . . . . 43

44 Amount of line 42 you want applied to your 2025 estimated tax . . . . 44

45 Amount you owe to the USVI. If line 40 is less than line 36, subtract line 40 from line 36 . . . . . 45

46 Enter the amount from line 45 that you will pay when you file your income tax return. Add this amount

to the other refundable credits line on Schedule 3 (Form 1040) . . . . . . . . . . . . . 46

For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 64603D Form 8689 (2024)