Enlarge image

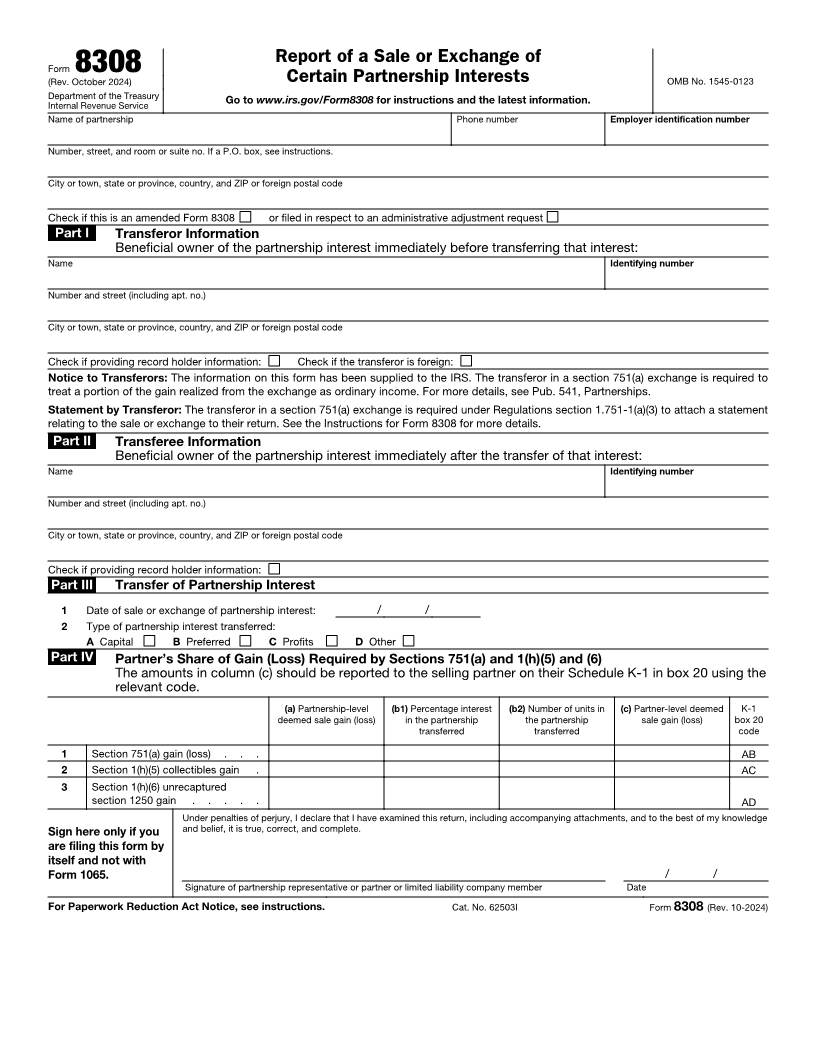

Report of a Sale or Exchange of

Form 8308

(Rev. October 2024) Certain Partnership Interests OMB No. 1545-0123

Department of the Treasury Go to www.irs.gov/Form8308 for instructions and the latest information.

Internal Revenue Service

Name of partnership Phone number Employer identification number

Number, street, and room or suite no. If a P.O. box, see instructions.

City or town, state or province, country, and ZIP or foreign postal code

Check if this is an amended Form 8308 or filed in respect to an administrative adjustment request

Part I Transferor Information

Beneficial owner of the partnership interest immediately before transferring that interest:

Name Identifying number

Number and street (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Check if providing record holder information: Check if the transferor is foreign:

Notice to Transferors: The information on this form has been supplied to the IRS. The transferor in a section 751(a) exchange is required to

treat a portion of the gain realized from the exchange as ordinary income. For more details, see Pub. 541, Partnerships.

Statement by Transferor: The transferor in a section 751(a) exchange is required under Regulations section 1.751-1(a)(3) to attach a statement

relating to the sale or exchange to their return. See the Instructions for Form 8308 for more details.

Part II Transferee Information

Beneficial owner of the partnership interest immediately after the transfer of that interest:

Name Identifying number

Number and street (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code

Check if providing record holder information:

Part III Transfer of Partnership Interest

1 Date of sale or exchange of partnership interest: / /

2 Type of partnership interest transferred:

A Capital B Preferred C Profits D Other

Part IV Partner’s Share of Gain (Loss) Required by Sections 751(a) and 1(h)(5) and (6)

The amounts in column (c) should be reported to the selling partner on their Schedule K-1 in box 20 using the

relevant code.

(a) Partnership-level (b1) Percentage interest (b2) Number of units in (c) Partner-level deemed K-1

deemed sale gain (loss) in the partnership the partnership sale gain (loss) box 20

transferred transferred code

1 Section 751(a) gain (loss) . . . AB

2 Section 1(h)(5) collectibles gain . AC

3 Section 1(h)(6) unrecaptured

section 1250 gain . . . . . AD

Under penalties of perjury, I declare that I have examined this return, including accompanying attachments, and to the best of my knowledge

Sign here only if you and belief, it is true, correct, and complete.

are filing this form by

itself and not with

Form 1065. / /

Signature of partnership representative or partner or limited liability company member Date

For Paperwork Reduction Act Notice, see instructions. Cat. No. 62503I Form 8308 (Rev. 10-2024)