Enlarge image

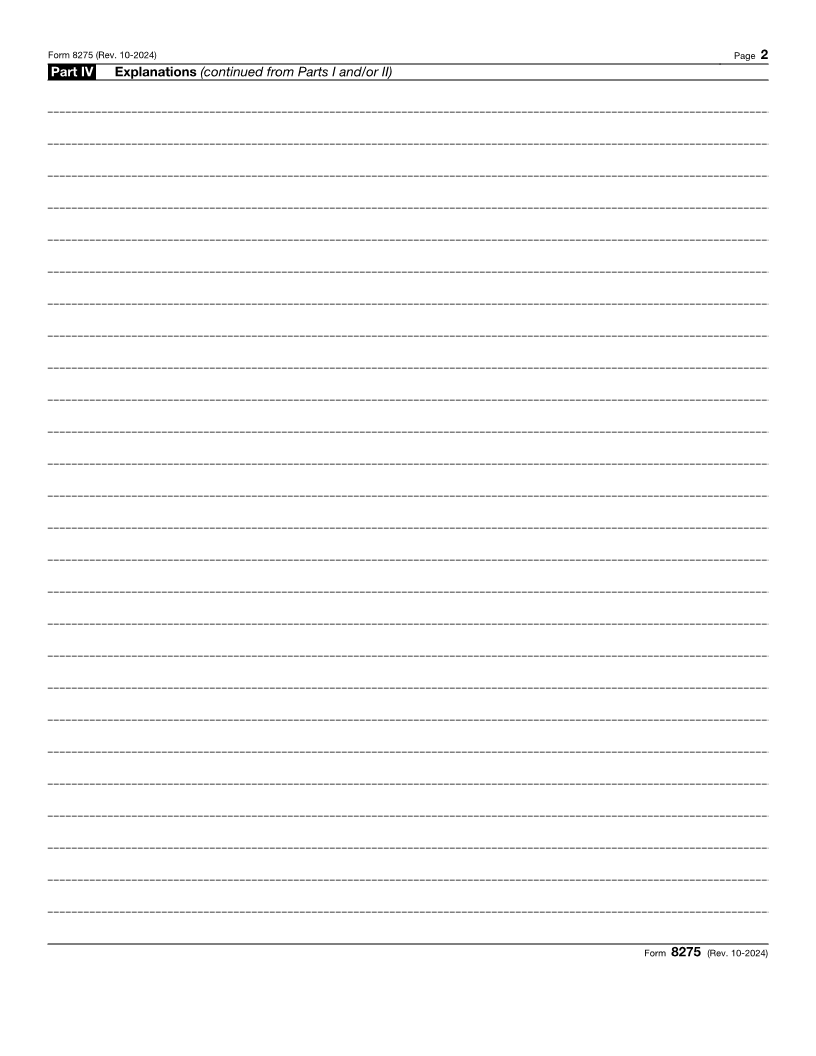

Disclosure Statement OMB No. 1545-0889

Form 8275 Don’t use this form to disclose items or positions that are contrary to Treasury

(Rev. October 2024) regulations. Instead, use Form 8275-R, Regulation Disclosure Statement. Attachment

Department of the Treasury Attach to your tax return. Sequence No. 92

Internal Revenue Service Go to www.irs.gov/Form8275 for instructions and the latest information.

Name(s) shown on return Identifying number shown on return

If Form 8275 relates to an information return for a foreign entity (for example, Form 5471), enter:

Name of foreign entity

Employer identification number, if any

Reference ID number (see instructions)

Part I General Information (see instructions)

(a) (b) (c) (d) (e) (f)

Rev. Rul., Rev. Proc., etc. Item or Group Detailed Description Form or Line Amount

of Items of Items Schedule No.

1

2

3

4

5

6

Part II Detailed Explanation (see instructions)

1

2

3

4

5

6

Part III Information About Pass-Through Entity. To be completed by partners, shareholders, beneficiaries, or

residual interest holders.

Complete this part only if you are making adequate disclosure for a pass-through item.

Note: A pass-through entity is a partnership, S corporation, estate, trust, regulated investment company (RIC), real estate investment

trust (REIT), or real estate mortgage investment conduit (REMIC).

1 Name, address, and ZIP code of pass-through entity 2 Identifying number of pass-through entity

3 Tax year of pass-through entity

/ / to / /

4 Internal Revenue Service Center where the pass-through entity filed

its return

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 61935M Form 8275 (Rev. 10-2024)