Enlarge image

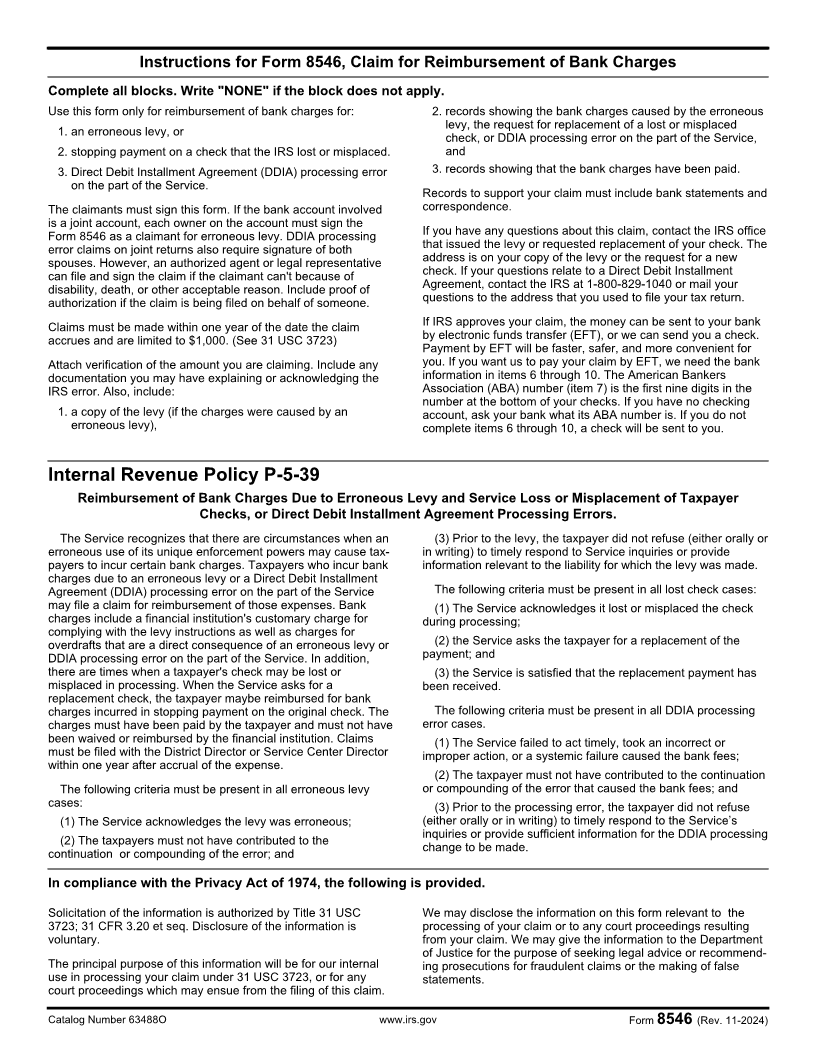

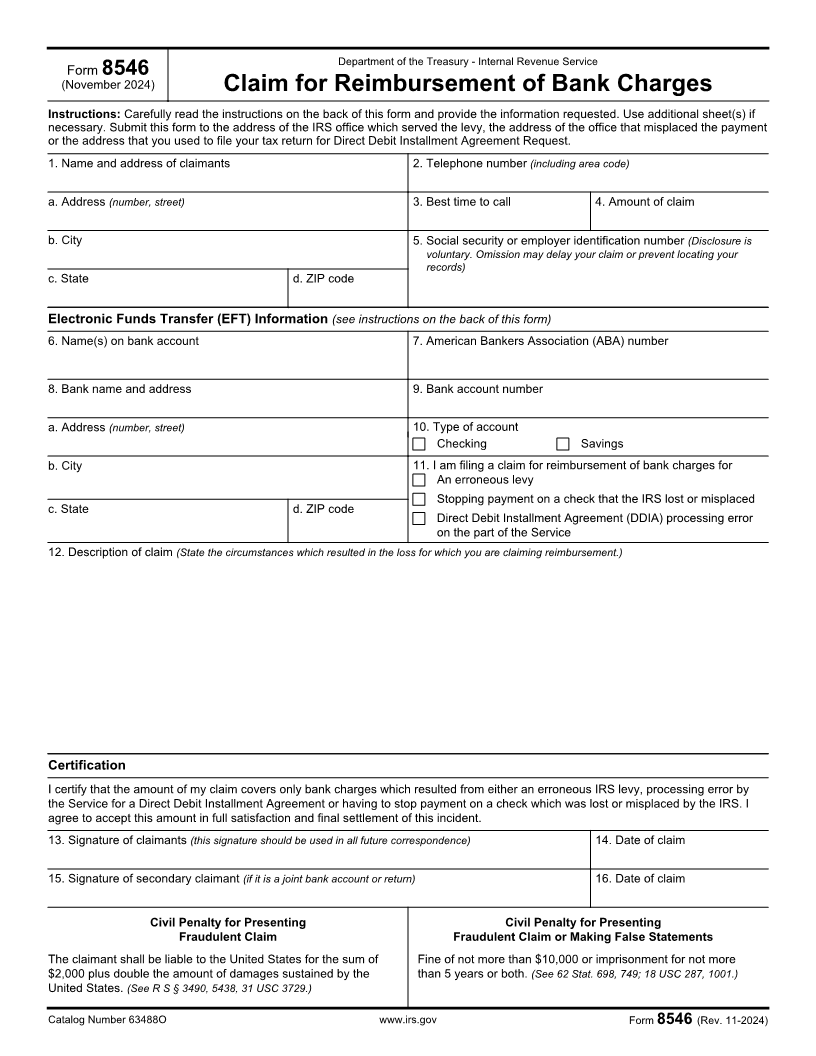

Department of the Treasury - Internal Revenue Service

Form 8546

(November 2024)

Claim for Reimbursement of Bank Charges

Instructions: Carefully read the instructions on the back of this form and provide the information requested. Use additional sheet(s) if

necessary. Submit this form to the address of the IRS office which served the levy, the address of the office that misplaced the payment

or the address that you used to file your tax return for Direct Debit Installment Agreement Request.

1. Name and address of claimants 2. Telephone number (including area code)

a. Address (number, street) 3. Best time to call 4. Amount of claim

b. City 5. Social security or employer identification number (Disclosure is

voluntary. Omission may delay your claim or prevent locating your

records)

c. State d. ZIP code

Electronic Funds Transfer (EFT) Information (see instructions on the back of this form)

6. Name(s) on bank account 7. American Bankers Association (ABA) number

8. Bank name and address 9. Bank account number

a. Address (number, street) 10. Type of account

Checking Savings

b. City 11. I am filing a claim for reimbursement of bank charges for

An erroneous levy

Stopping payment on a check that the IRS lost or misplaced

c. State d. ZIP code

Direct Debit Installment Agreement (DDIA) processing error

on the part of the Service

12. Description of claim (State the circumstances which resulted in the loss for which you are claiming reimbursement.)

Certification

I certify that the amount of my claim covers only bank charges which resulted from either an erroneous IRS levy, processing error by

the Service for a Direct Debit Installment Agreement or having to stop payment on a check which was lost or misplaced by the IRS. I

agree to accept this amount in full satisfaction and final settlement of this incident.

13. Signature of claimants (this signature should be used in all future correspondence) 14. Date of claim

15. Signature of secondary claimant (if it is a joint bank account or return) 16. Date of claim

Civil Penalty for Presenting Civil Penalty for Presenting

Fraudulent Claim Fraudulent Claim or Making False Statements

The claimant shall be liable to the United States for the sum of Fine of not more than $10,000 or imprisonment for not more

$2,000 plus double the amount of damages sustained by the than 5 years or both. (See 62 Stat. 698, 749; 18 USC 287, 1001.)

United States. (See R S § 3490, 5438, 31 USC 3729.)

Catalog Number 63488O www.irs.gov Form 8546 (Rev. 11-2024)