Enlarge image

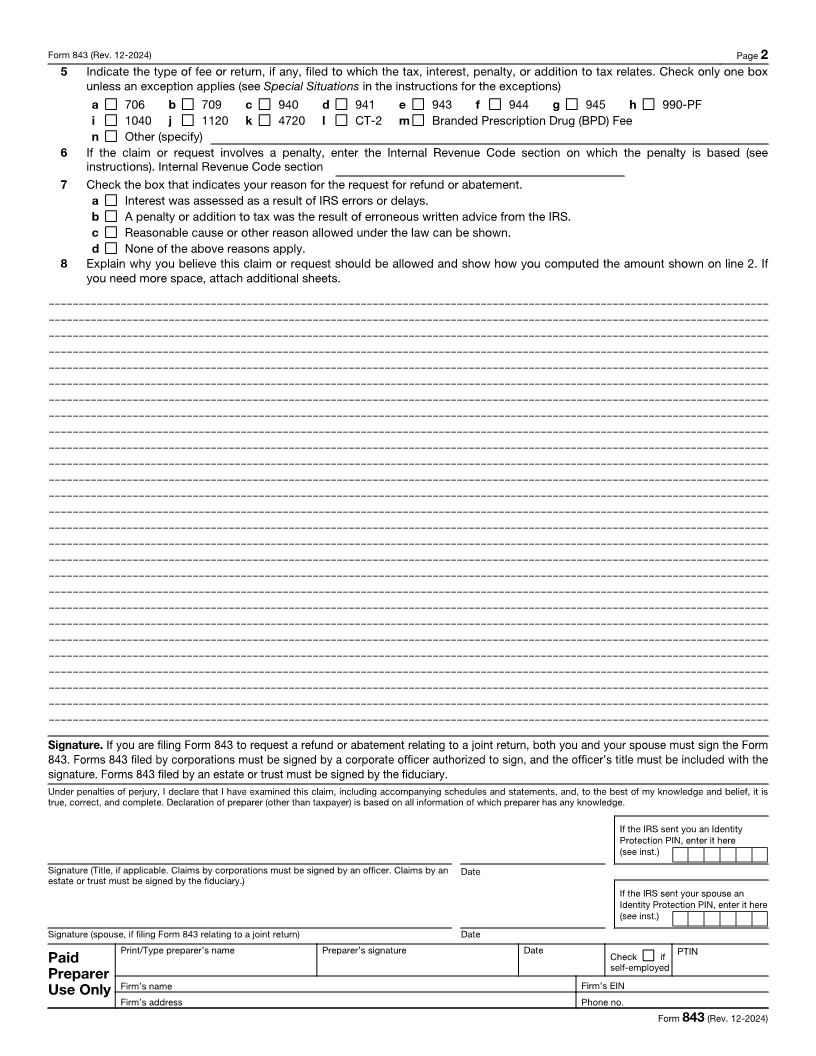

Form 843 Claim for Refund and Request for Abatement

(Rev. December 2024) OMB No. 1545-0024

Department of the Treasury Go to www.irs.gov/Form843 for instructions and the latest information.

Internal Revenue Service

Check the box below that indicates your reason for filing Form 843.

Tax

Abatement or refund of tax other than income, estate, or gift tax

Abatement or refund of tax that can’t be claimed on any form except Form 843

Refund to employee of excess social security, Medicare, or RRTA tax withheld by any one employer, but only if your employer will

not adjust the overcollection

Refund to employee of excess tier 2 RRTA tax when, for the year, you had more than one railroad employer and your total tier 2

RRTA tax withheld or paid exceeds the tier 2 limit

Refund to employee of social security, Medicare, or RRTA tax withheld in error, but only if your employer will not adjust the

overcollection

Abatement or refund of tier 1 RRTA tax for an employee representative

Penalty

Abatement or refund of a penalty or addition to tax due to reasonable cause or other reason allowed under the law

Abatement or refund of penalty imposed under section 6672 for failure to collect and pay over tax, or attempt to evade or defeat

tax (Trust Fund Recovery Penalty)

Refund of penalty imposed under section 6695A for misstatements due to incorrect appraisals

Refund of penalty imposed under section 6715 for misuse of dyed fuel

Abatement or refund under section 6404(f) of a penalty or addition to tax attributable to erroneous written advice by the IRS

Interest

Abatement or refund of interest due to IRS error or delay under section 6404(e)(1)

Request for net interest rate of zero under Rev. Proc. 2000-26

Other

Abatement or refund of assessed penalties, interest, or additions to tax because you were unable to read and timely respond to a

standard print notice from the IRS

Refund of branded prescription drug fee

Refund of annual fee on health insurance providers

Other (specify)

CAUTION: Do not use Form 843 when you must use a different tax form. For example, do not use Form 843 to claim a refund or

abatement of an overpayment of income taxes or an employer’s claim for FICA tax, RRTA tax, or income tax withholding; a refund of

excise taxes based on the nontaxable use or sale of fuels; or an overpayment of excise taxes reported on Form(s) 11-C, 720, 730, or

2290. Also, do not use Form 843 to claim a refund of tax return preparer or promoter penalties. See instructions for the forms to use.

Name of person requesting the refund or abatement (see instructions) Social security number (SSN)

Name of spouse if filing Form 843 relating to a joint return (see instructions) Spouse’s social security number (SSN)

Address (number and street or P.O. box if mail is not delivered to street address) Apt., room, or suite no.

City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code Employer ID number (EIN)

Foreign country name Foreign province/state/county Foreign postal code

Name and address shown on return if different from above Daytime telephone number

1 Enter the tax period or fee year. Prepare a separate Form 843 for each tax period or fee year.

Beginning date (MM/DD/YYYY) Ending date (MM/DD/YYYY)

2 Amount to be refunded or abated. $

3 Date(s) of payment(s) for which you are requesting a refund (MM/DD/YYYY). If you need more space, attach additional sheets.

a b c d e f

g h i j k l

4 Check the box(es) with the type of tax or fee for which you are asking a refund or abatement. Or check the box(es) with the

type of tax or fee to which the interest, penalty, or addition to tax is related. Check only one box unless an exception applies

(see Special Situations in the instructions for the exceptions).

a Employment b Estate c Gift d Excise e Income f Fee g Civil penalty

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 10180R Form 843 (Rev. 12-2024)