Enlarge image

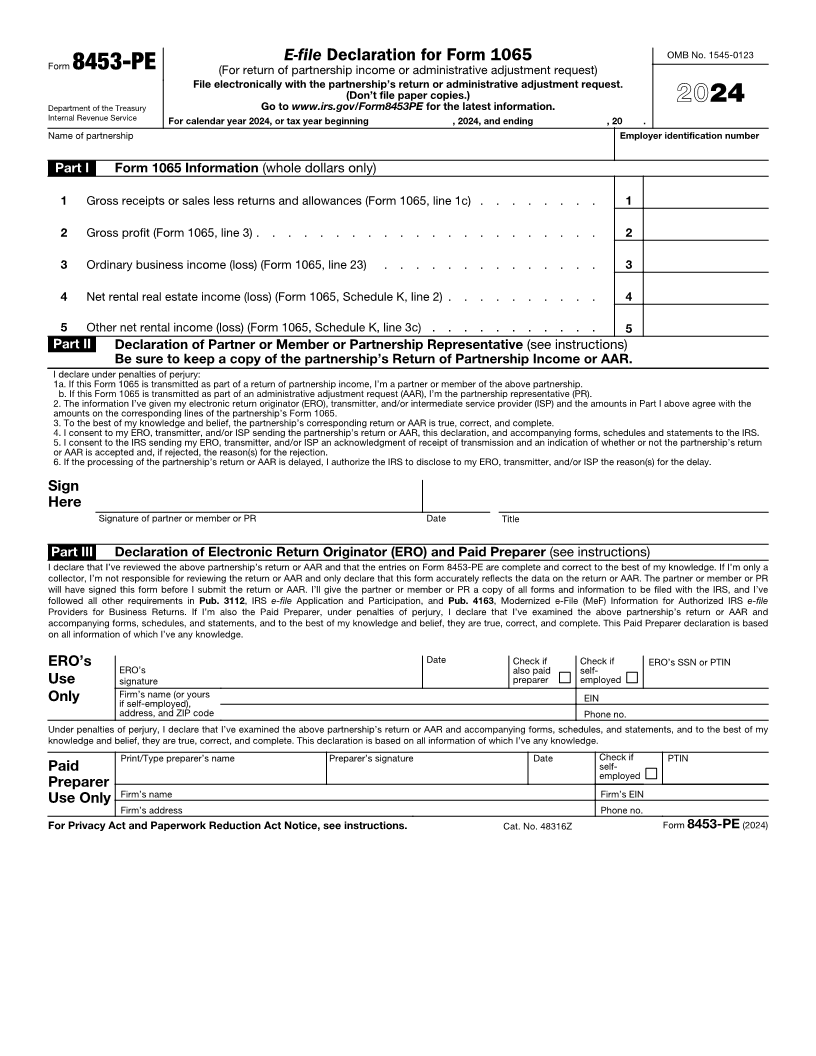

E-file Declaration for Form 1065 OMB No. 1545-0123

Form 8453-PE (For return of partnership income or administrative adjustment request)

File electronically with the partnership’s return or administrative adjustment request.

(Don’t file paper copies.)

Department of the Treasury Go to www.irs.gov/Form8453PE for the latest information. 2024

Internal Revenue Service For calendar year 2024, or tax year beginning , 2024, and ending , 20 .

Name of partnership Employer identification number

Part I Form 1065 Information (whole dollars only)

1 Gross receipts or sales less returns and allowances (Form 1065, line 1c) . . . . . . . . 1

2 Gross profit (Form 1065, line 3) . . . . . . . . . . . . . . . . . . . . . . 2

3 Ordinary business income (loss) (Form 1065, line 23) . . . . . . . . . . . . . . 3

4 Net rental real estate income (loss) (Form 1065, Schedule K, line 2) . . . . . . . . . . 4

5 Other net rental income (loss) (Form 1065, Schedule K, line 3c) . . . . . . . . . . . 5

Part II Declaration of Partner or Member or Partnership Representative (see instructions)

Be sure to keep a copy of the partnership’s Return of Partnership Income or AAR.

I declare under penalties of perjury:

1a. If this Form 1065 is transmitted as part of a return of partnership income, I’m a partner or member of the above partnership.

b. If this Form 1065 is transmitted as part of an administrative adjustment request (AAR), I’m the partnership representative (PR).

2. The information I’ve given my electronic return originator (ERO), transmitter, and/or intermediate service provider (ISP) and the amounts in Part I above agree with the

amounts on the corresponding lines of the partnership’s Form 1065.

3. To the best of my knowledge and belief, the partnership’s corresponding return or AAR is true, correct, and complete.

4. I consent to my ERO, transmitter, and/or ISP sending the partnership’s return or AAR, this declaration, and accompanying forms, schedules and statements to the IRS.

5. I consent to the IRS sending my ERO, transmitter, and/or ISP an acknowledgment of receipt of transmission and an indication of whether or not the partnership’s return

or AAR is accepted and, if rejected, the reason(s) for the rejection.

6. If the processing of the partnership’s return or AAR is delayed, I authorize the IRS to disclose to my ERO, transmitter, and/or ISP the reason(s) for the delay.

Sign

Here

Signature of partner or member or PR Date Title

Part III Declaration of Electronic Return Originator (ERO) and Paid Preparer (see instructions)

I declare that I’ve reviewed the above partnership’s return or AAR and that the entries on Form 8453-PE are complete and correct to the best of my knowledge. If I’m only a

collector, I’m not responsible for reviewing the return or AAR and only declare that this form accurately reflects the data on the return or AAR. The partner or member or PR

will have signed this form before I submit the return or AAR. I’ll give the partner or member or PR a copy of all forms and information to be filed with the IRS, and I’ve

followed all other requirements in Pub. 3112, IRS e-file Application and Participation, and Pub. 4163, Modernized e-File (MeF) Information for Authorized IRS e-file

Providers for Business Returns. If I’m also the Paid Preparer, under penalties of perjury, I declare that I’ve examined the above partnership’s return or AAR and

accompanying forms, schedules, and statements, and to the best of my knowledge and belief, they are true, correct, and complete. This Paid Preparer declaration is based

on all information of which I’ve any knowledge.

Date Check if Check if ERO’s SSN or PTIN

ERO’s ERO’s also paid self-

Use signature preparer employed

Only Firm’s name (or yours EIN

if self-employed),

address, and ZIP code Phone no.

Under penalties of perjury, I declare that I’ve examined the above partnership’s return or AAR and accompanying forms, schedules, and statements, and to the best of my

knowledge and belief, they are true, correct, and complete. This declaration is based on all information of which I’ve any knowledge.

Print/Type preparer’s name Preparer’s signature Date Check if PTIN

Paid self-

employed

Preparer

Use Only Firm’s name Firm’s EIN

Firm’s address Phone no.

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 48316Z Form 8453-PE (2024)